Rupiah Weakens Amid Strengthening US Dollar and Global Pressure

2026-01-19

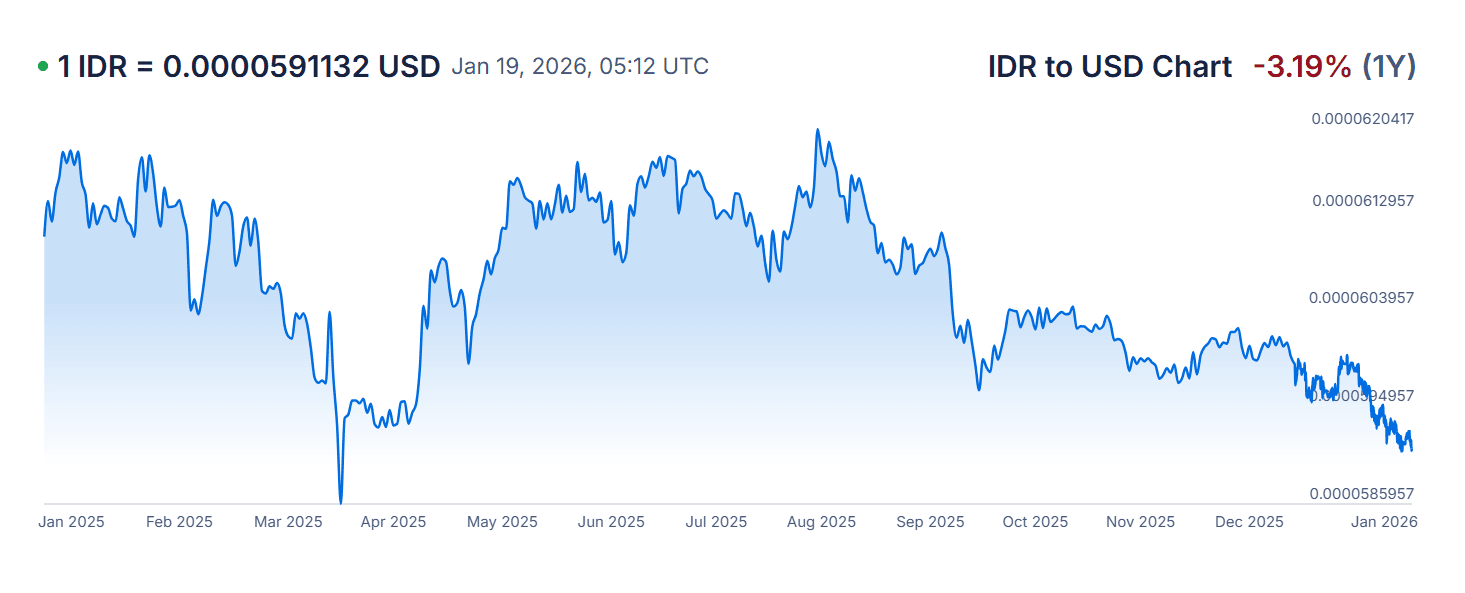

Bittime - The rupiah's exchange rate has weakened against the US dollar in recent weeks and has once again become a market concern. Today's rupiah exchange rate movement indicates that pressure has not yet fully subsided, as the US dollar strengthens on global markets.

The issue of the weakening rupiah is no longer just a daily fluctuation, but rather a reflection of global sentiment that is changing direction.In the context of the rupiah versus the dollar, the US currency's dominance remains strong. Demand for the dollar increased as global market participants became more cautious about risky assets.

This situation has led to a tendency for capital to flow out of emerging markets, including Indonesia. Consequently, the rupiah exchange rate has struggled to strengthen, despite relatively stable domestic indicators.This pressure has also revived old concerns, including the narrative that the rupiah is the weakest in the world, although structurally the situation is not that simple.

To fully understand this situation, it is important to look at the causes of the rupiah's decline from various perspectives, not just the movement of the numbers alone.

Read Also:2026 Gold Installment Simulation: Example Calculations & Tips Before You Start

Key Points

• The rupiah exchange rate today weakened against the US dollar

• The strengthening of the global dollar is the main factor putting pressure on the rupiah.

• Foreign capital flows and risk sentiment influence exchange rates

• Investors need a strategy to deal with fluctuations in the rupiah vs. dollar

What's Depressing the Latest Rupiah Exchange Rate?

The rupiah's depreciation against the US dollar did not occur in a vacuum. The main pressure comes from abroad, particularly the United States' continued tight monetary policy. The US central bank's tendency to maintain high interest rates keeps the dollar attractive to global investors.

Furthermore, geopolitical conditions and global economic uncertainty are driving market participants to seek safe-haven assets. The US dollar has once again become the preferred currency, leading to increased demand. At the same time, emerging market currencies, including the rupiah, are facing selling pressure.

Domestically, fiscal factors and monetary policy expectations also influence market perceptions. Speculation about the possibility of interest rate cuts to maintain economic growth is often negatively perceived by foreign exchange investors. This combination of global and domestic factors has put the rupiah on the defensive.

Read Also:Venezuela Has $1,000 Trillion in Bitcoin Reserves: Potential Impact on the Global Crypto Market

How to Interpret the Movement of the Rupiah vs. the Dollar

Rupiah exchange rate movements cannot be interpreted as a single indicator of national economic conditions. In many cases, rupiah depreciation reflects shifts in global capital flows rather than domestic structural issues.

As global investors reduced exposure to risky assets, the rupiah came under pressure, even though the trade balance remained in surplus. This suggests that sentiment and risk perception play a significant role in shaping the exchange rate.

Bank Indonesia is focused on maintaining stability, not holding the exchange rate at a specific level. Market interventions and monetary policy are aimed at reducing excessive volatility, not completely opposing market trends.

Therefore, fluctuations in the rupiah against the dollar should be understood as an adjustment process, not an anomaly.

Read Also:Timothy Ronald's Case Is Trending, Here's What You Need to Know

Factors Affecting the Rupiah Exchange Rate Against the USD

There are several main factors that influence the rupiah exchange rate against the US dollar.

First, global monetary policy, particularly the direction of US interest rates. When dollar yields are high, capital flows tend to shift to USD-denominated assets.

Second, demand for dollars for trade and hedging purposes. Import activity, foreign debt payments, and corporate demand for foreign currency also put pressure on the rupiah.

Third, foreign capital flows into the stock and bond markets. The outflow of foreign funds increases demand for dollars in the domestic market.

Fourth, fiscal conditions and national economic stability. Perceptions of the budget deficit and policy continuity are important considerations for global investors.

Read Also:5 Viral Chinese Coin Memes on BSC That Must Be on Trader's Radar

Investor Strategies for Dealing with Rupiah vs. Dollar Fluctuations

For investors, the weakening rupiah is not only a risk but also a signal to adjust their strategy. Asset diversification is a fundamental step to mitigate the impact of exchange rate fluctuations. Having exposure to dollar-denominated assets can help balance a portfolio.

Furthermore, understanding the factors influencing the rupiah exchange rate against the USD helps investors interpret market movements more rationally. A medium-term approach and disciplined risk management are often more effective than impulsive reactions to daily fluctuations.

For businesses, managing exchange rate risk through hedging instruments can be an option. Meanwhile, monitoring Bank Indonesia's policy direction remains crucial, as the monetary authority's response often signals market stabilization.

Conclusion

The rupiah weakened in early 2026 in response to a combination of global pressures and domestic dynamics. The strengthening of the US dollar, shifting risk sentiment, and international capital flows were the main factors influencing the rupiah's exchange rate.

Understanding the causes of the rupiah's decline and how to interpret exchange rate movements helps market participants make more informed decisions. In uncertain market conditions, adaptive strategies and risk management are key to navigating rupiah-dollar fluctuations.

FAQ

What is the main cause of the rupiah weakening?

The strengthening of the US dollar, tighter global monetary policy, and changes in capital flows are the main factors behind the weakening of the rupiah.

Does the world's weakest rupiah reflect Indonesia's economic condition?

Not always. These nicknames often arise from short-term comparisons and don't always reflect overall economic fundamentals.

How do investors respond to rupiah fluctuations?

Asset diversification, risk management, and understanding global factors can help investors deal with exchange rate volatility.

Will the rupiah's weakening last long?

The duration of the weakening depends heavily on global conditions and domestic policy responses, particularly the direction of interest rates and market stability.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.