Real Asset-Backed Silver Crypto Token Recommendations

2026-01-30

Bittime - Interest in silver crypto has been growing again, amid the recent rise in silver prices. While pure crypto volatility is difficult to predict, silver-based crypto offers a different approach, backed by physical silver as underlying asset.

This model allows investors to gain exposure to precious metals without having to hold silver directly.

Searches for recommendations for silver crypto tokens are also increasing as more and more projects claim to besilver backed crypto tokenHowever, not all of them have clear reserve structures, adequate liquidity, or verifiable transparency.

This article summarizes the most well-known, actively traded, and relatively well-established reserve approach crypto silver tokens.

Key Takeaways

- Silver crypto combines the exposure of precious metals with the flexibility of digital assets.

- Not all silver tokens have the same physical reserves and transparency.

- Liquidity, custody models, and audit mechanisms are the main differentiating factors.

What Is Silver Crypto and How Does It Work?

Silver crypto is a digital token whose value is tied to the price of silver. In the most common model, each token represents a certain amount of physical silver held by a custodian. This concept often positions silver crypto as a bridge between the commodities market and the blockchain.

Unlike fiat-based stablecoins,crypto berbasis silverIt moves in line with global precious metal prices. When silver prices rise, the token's value also rises.

Conversely, when commodity markets weaken, tokens also experience corrections. This mechanism makes silver-backed crypto tokens more suitable as a hedge than a short-term speculative instrument.

However, it's important to understand that the quality of a project depends heavily on how the silver reserves are managed, recorded, and audited. Without transparency, claims of silver backing become mere empty narratives.

Read Also: How AMMs Work on Solana DEX: Why Low Liquidity Can Be Dangerous

The Most Popular Crypto Silver Token Recommendations

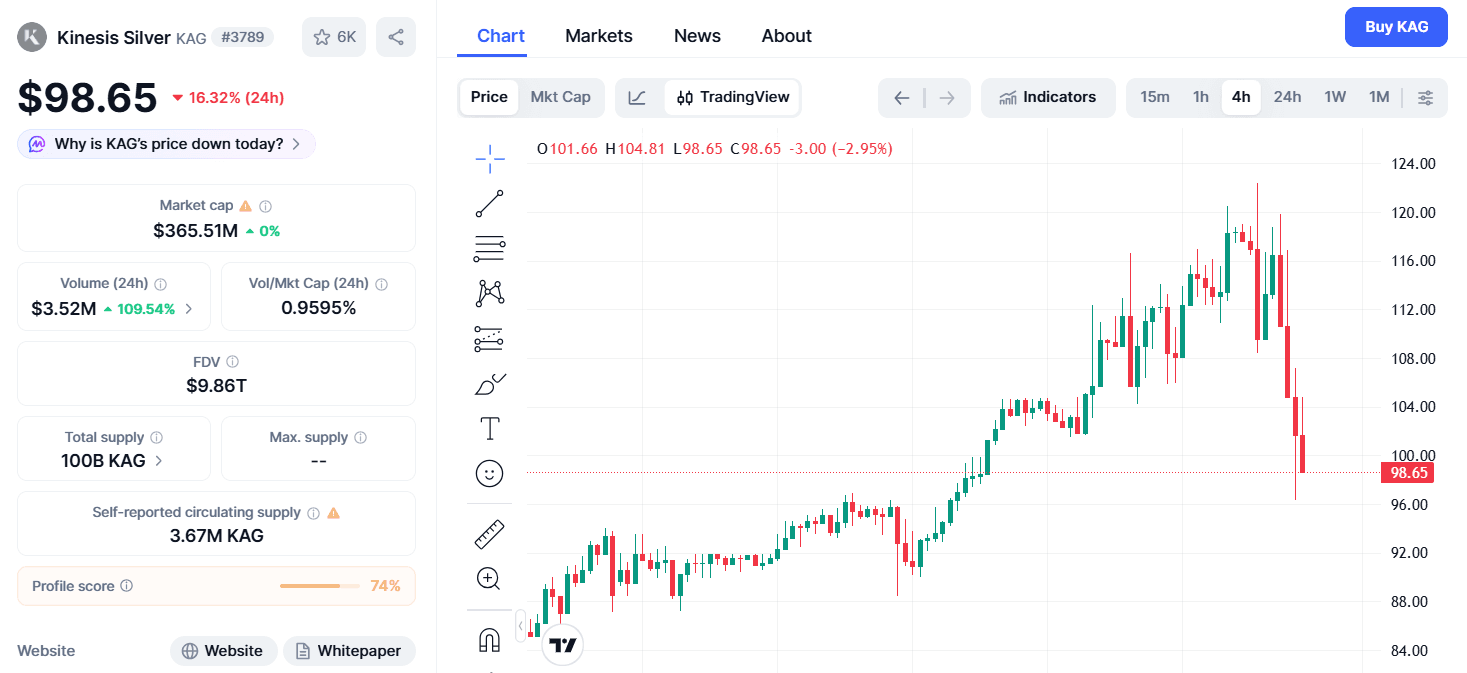

1. Kinesis Silver (KAG)

Kinesis Silver, or KAG, is known as one of the most capitalized and liquid silver cryptocurrencies. Each KAG token represents physical silver stored in Kinesis's vault network.

Ownership is recorded digitally and can be verified through their internal systems. KAG is often chosen by investors seeking silver exposure with relatively stable trading volume and a clear reserve structure.

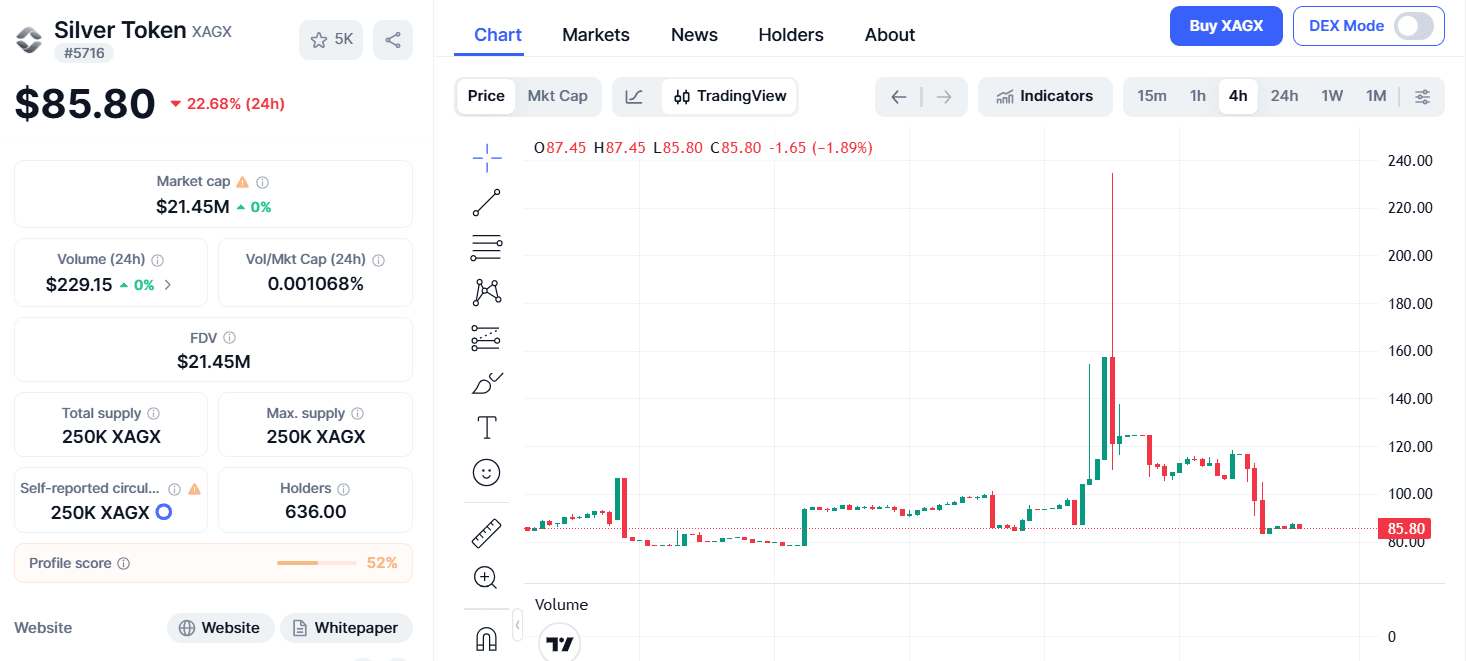

2. XAGX Silver Token

XAGX is a silver-backed crypto token that claims the backing of silver bullion as the underlying asset.

This token is widely used as a means of digital exposure to silver prices, especially for investors who want to remain in the crypto ecosystem without touching pure derivatives.

XAGX is known for its backup documentation approach which is the main focus of user trust.

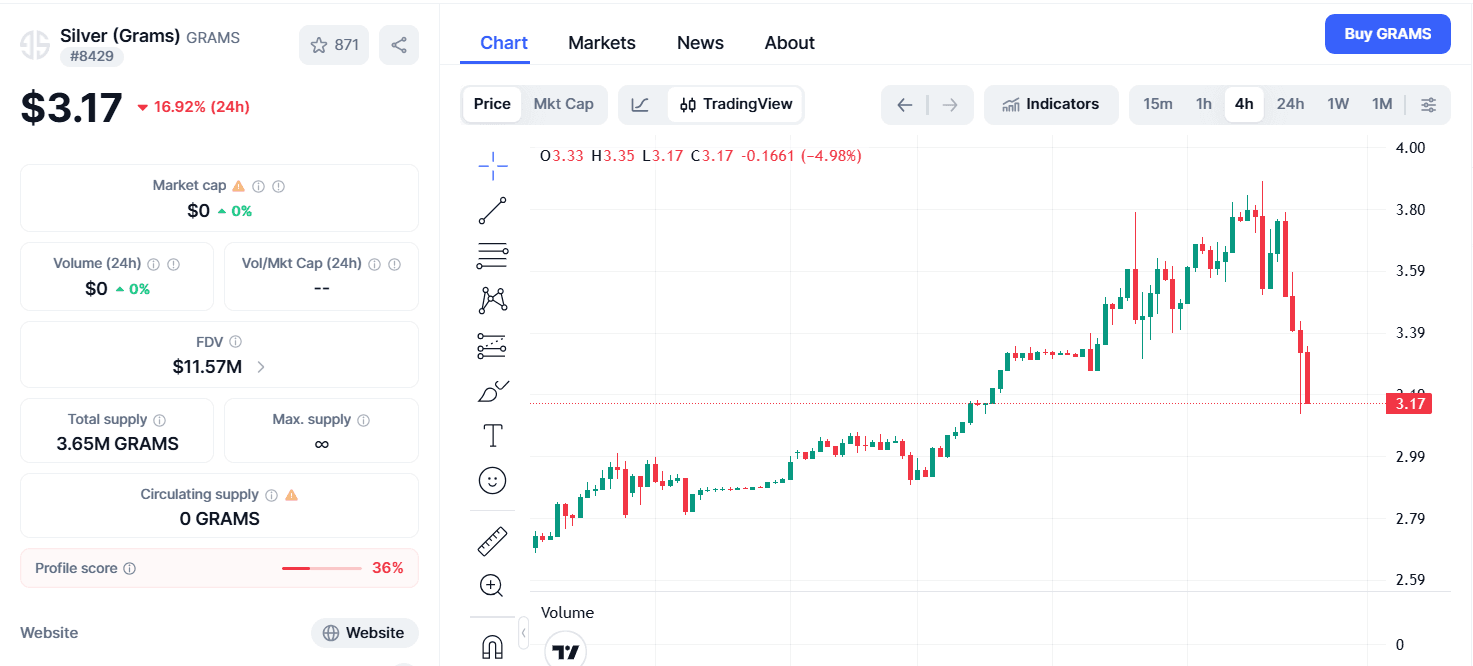

3. Silver Grams (GRAMS)

Silver Grams offers an easy-to-understand concept: one token equals one gram of silver. This model allows retail investors to calculate the value of their holdings without complex conversions.

GRAMS is often positioned as a practical alternative for users who want to start investing in silver-based crypto with small nominal amounts and a simple structure.

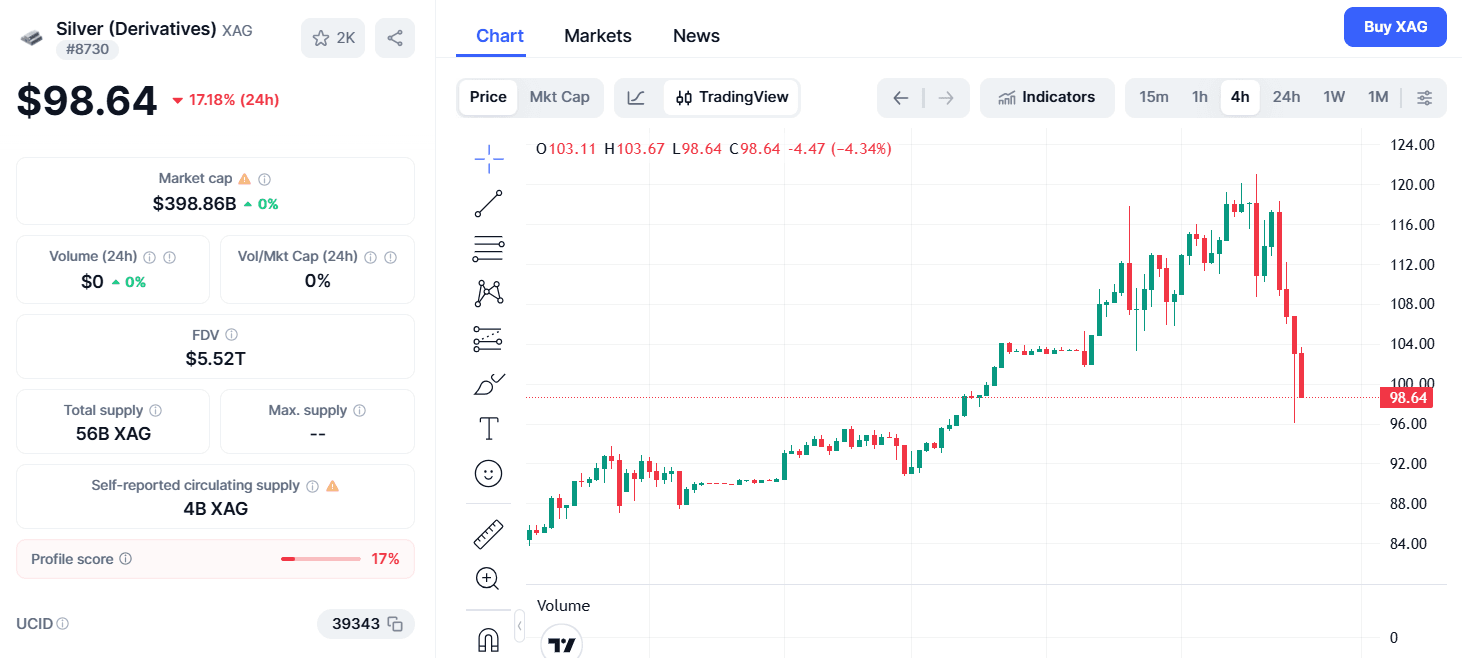

4. XAG Silver (Derivatives)

Unlike other tokens that focus on physical ownership, XAG Silver is more often used as a representation of the price of silver in derivatives systems and certain markets. This token is widely used for trading and price tracking, rather than as a long-term store of value based on physical reserves.

Register at Bittime now and start trading crypto with a fast, secure, and easy process directly from one application.

Things to Consider Before Buying Silver Tokens

Before purchasing silver-backed crypto tokens, there are several crucial factors that should not be overlooked. First, physical reserves. Investors need to ensure the silver actually exists and is held by a reputable custodian.

Second, audit mechanisms. Credible projects typically provide regular reports on token reserves and circulation.

Liquidity is also crucial. Tokens with low volume risk being difficult to sell when market conditions change. Furthermore, consider the project's legal jurisdiction, as the storage of physical commodities is highly regulated.

Finally, silver crypto still carries market risks. While more stable than pure crypto, its value can still fluctuate depending on global silver prices and macroeconomic conditions.

Read Also:RWA Crypto is Gaining Strength, These 7 Projects Are Preparing to Release Tokens in 2026

Conclusion

The recommendation of the silver crypto token cannot be separated from the quality of the reserves andProject transparency. Silver crypto offers an alternative for investors who want exposure to precious metals without the hassle of physical storage, but still requires extra caution.

Tokens like KAG, XAGX, GRAMS, and XAG are examples of howSilver-based crypto is developing with a different approach. For investors, understandingReserve structure and liquidity are far more important than simply following trends. Silver-backed crypto tokens can be a valuable addition to a portfolio, as long as they are used with realistic expectations.

Read Also:How to Buy Bitcoin for Beginners

FAQ

What is silver crypto?

Silver crypto is a digital asset whose value is linked to physical silver as the underlying asset.

Are silver backed crypto tokens safe?

Its security depends on the transparency of reserves, audits, and the reputation of the token manager.

What is the difference between silver crypto and stablecoin?

Stablecoins are usually based on fiat currencies, while silver crypto follows the price of silver.

Is silver crypto suitable for long-term investment?

Silver crypto is more suitable as a hedging and diversification tool than a speculative instrument.

Where are crypto silver tokens traded?

Most of them are traded on certain crypto exchanges and dedicated asset tokenization platforms.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.