US Dollar Price Prediction against Rupiah in December 2025

2025-12-02

Bittime - The prediction of the US Dollar price against the Rupiah in December 2025 has become a major market concern as exchange rate movements become increasingly sensitive to global monetary policy.

The US dollar price affects import costs, purchasing power, and investment strategies, so the exchange rate outlook towards the end of the year is crucial for planning.

This analysis combines technical indicators, exchange rate model projections, and domestic policy developments to provide readers with a comprehensive view of potential opportunities and risks.

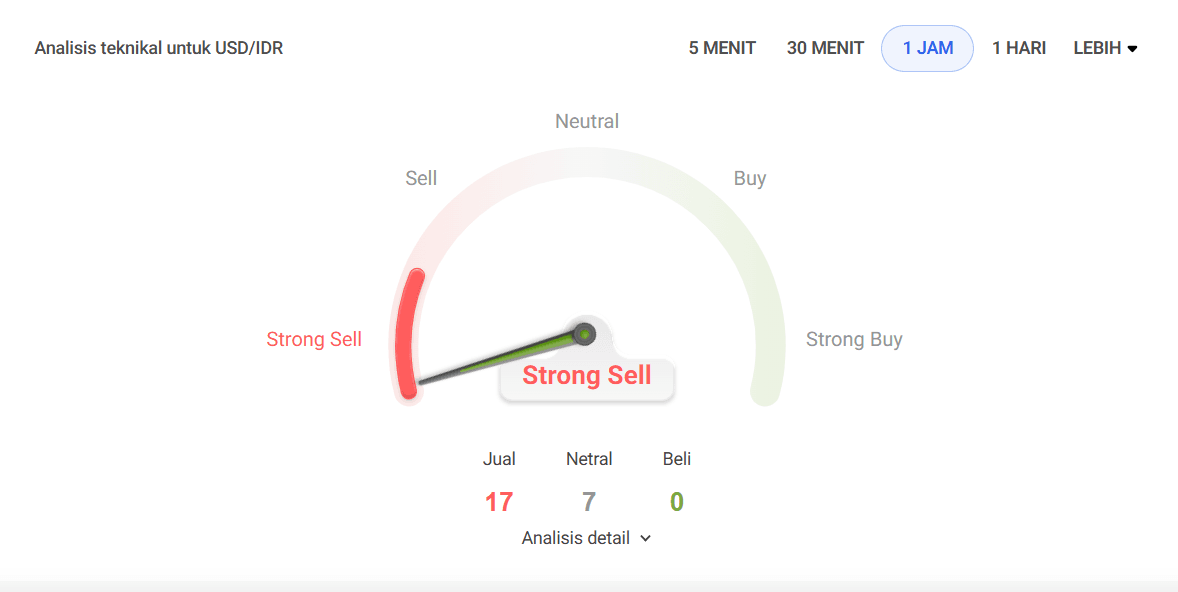

“Strong Sell” signal overview on USD/IDR

The one-hour timeframe technical indicator shows a “Strong Sell” status with 17 sell signals, 7 neutral signals, and no buy signals.

This reading typically occurs when dollar selling pressure strengthens in the very short term, either due to the market's response to the latest economic data or a knee-jerk reaction to global news.

However, intraday indicators cannot be used solely to predict the direction of exchange rates over the course of a full month. Central bank policies, foreign exchange intervention, and global risk sentiment can shift trends quickly.

Thus, this signal is more appropriately used as a short-term momentum guide, rather than a medium-term strategic reference.

December 2025 exchange rate projections based on models and official statements

Several forecast models place the exchange rate within a range close to current levels, with movements dependent on global pressures. The monetary authority's official statement stated that the rupiah's stabilization target is around 16,400 to 16,500 per dollar in the medium term.

Various independent projection models suggest a December 2025 range of 16,600 to 17,000 as a baseline.

This prediction reflects the balance between the potential for global dollar strengthening and domestic intervention capabilities.

Projections are not exact numbers, but they help market participants and corporations prepare more realistic plans.

Rupiah exchange rate scenarios for December 2025 and their implications

Three main scenarios can be used to map the risks. The conservative scenario places the rupiah in the range of 16,300 to 16,700 if monetary stabilization is effective.

The moderate scenario places the range at 16,700 to 17,200 if capital flows fluctuate or global dollar pressures increase. The aggressive scenario predicts a possible weakening to 17,200 to 17,800 if there is a global economic shock or a sharp decline in capital inflows.

The impact is multi-layered: importers face increased costs, exporters benefit from exchange rate differences, and investors need to adjust their exposure to exchange rate risk. These three scenarios can form the basis for budgeting and hedging strategies.

Factors determining the direction of the exchange rate and signals that need to be monitored

The direction of the USD/IDR is heavily influenced by the Fed's interest rate decisions, the strength of portfolio capital flows, Indonesia's trade balance, and the government's fiscal policy.

The movement of foreign exchange reserves and market intervention by central banks are key signals about the ability to protect against volatility.

In addition to fundamental indicators, market participants can use multi-timeframe technical indicators to assess the strength of short-term trends.

Daily monitoring of official exchange rate data, economic releases, and global sentiment will help determine whether exchange rate movements are temporary or have the potential to form a new trend.

Risk management recommendations for corporate and retail investors

For corporations, using a phased hedging strategy through forward contracts, options, or a combination of both can help lock in import costs.

The cash flow calendar should be adjusted to accommodate potential aggressive exchange rate scenarios to ensure the company has sufficient liquidity space.

Retail investors are advised to avoid high leverage during periods of volatility and consider asset diversification to reduce direct exposure to exchange rate fluctuations. Medium-term financial planning can be strengthened by using multiple exchange rate assumptions as stress tests.

Conclusion

The predicted US Dollar price against the Rupiah in December 2025 depends on a combination of central bank policies, global pressures, and domestic market responses.

Short-term technical signals point to intraday selling pressure, while model projections place the year-end range at 16,400 to 17,200 in a normal scenario.

By combining fundamental and technical analysis, market players can develop strategies that are more adaptive to uncertainty.

FAQ

What is the most likely USD/IDR exchange rate range for December 2025?

The range considered realistic is between 16,300 and 17,200, depending on capital flows and monetary policy.

Does the “Strong Sell” signal mean the rupiah will strengthen significantly?

Not necessarily. These signals only reflect short-term momentum and don't necessarily translate into monthly trends.

What data needs to be monitored to monitor the direction of the exchange rate?

Monitoring official exchange rate data, foreign exchange reserves, interest rate decisions, trade balances, and global sentiment developments is very helpful.

How to reduce exchange rate risk for importers?

Importers can use forward contracts or options, arrange payment schedules, and provide additional liquidity reserves to face aggressive scenarios.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.