Obol (OBOL) Price Prediction: Short, Medium, and Long Term Outlook

2026-01-07

Many investors are now looking for Obol (OBOL) price prediction to understand the future potential of this asset, will OBOL simply move sideways, or does it have the potential for significant upside with the adoption of Distributed Validator technology?

In this article, we will briefly discuss Obol, the current price conditions of OBOL, the factors that influence price movements, and Obol (OBOL) price predictions for the short, medium, and long term.

What is Obol (OBOL)?

Obol (OBOL) is a project focused on developing critical technologies to keep Ethereum decentralized and secure.

The core of this project's innovation lies in the Distributed Validators (DV) system, which is a method of running Ethereum validators in a distributed manner to reduce the risk of single failures and improve performance.

DV technology has been used to secure billions of dollars worth of staked Ethereum (ETH). Compared to traditional staking setups, Obol's Distributed Validators offer greater stability and lower risk, especially for institutions.

Meanwhile, OBOL tokens serve as utility tokens in Obol Collective, a large ecosystem involving node operators, financial institutions, staking providers, and the global developer community.

Read Also: Maduro Memes (MADURO) Price Prediction: Chart Analysis and Potential

OBOL Price Today

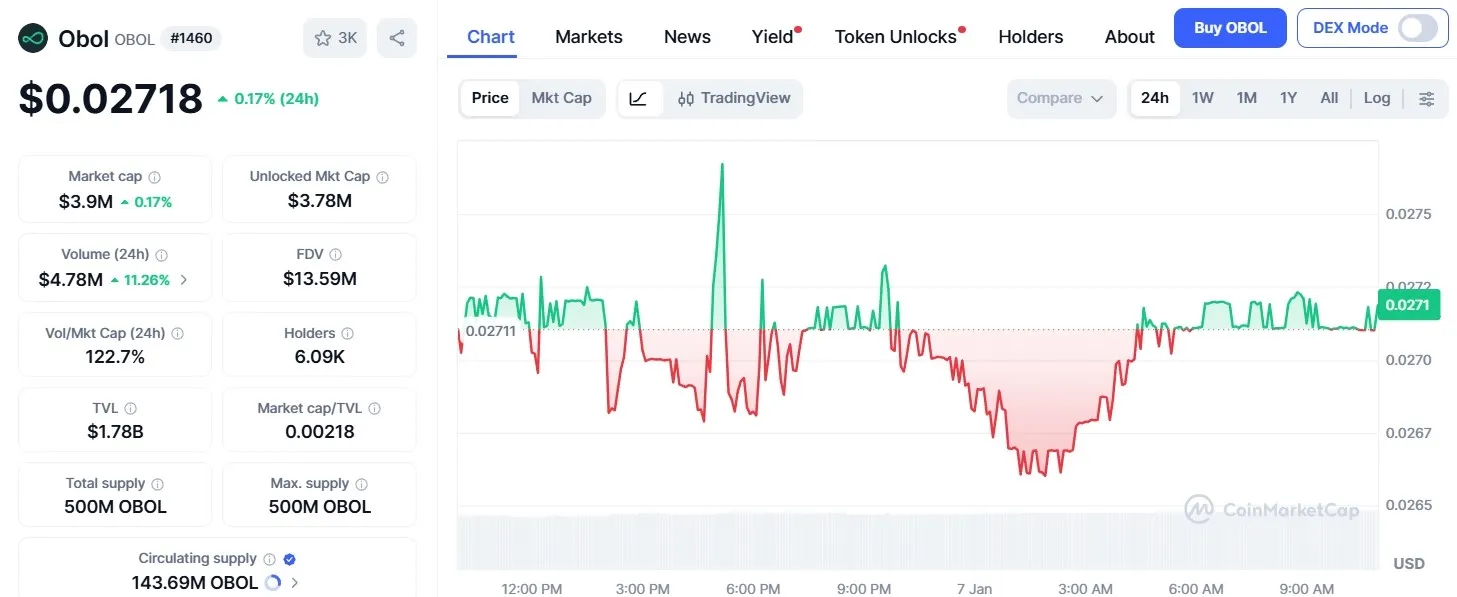

Based on the latest chart, OBOL price today is in the range $0.027, with:

All-time high (ATH): $0,3801

All-time low (ATL): $0,0202

Thus, the current price of OBOL is still around92% below its highest price, but already about 33% above its lowest priceThis indicates that OBOL is in the early stages of recovery after a long correction.

Read Also: Ethereum (ETH) Price Prediction 2026: Long-Term Outlook

Obol (OBOL) Price Analysis

Before knowing the Obol (OBOL) price prediction, it is important to look at the fundamental factors that can drive or restrain future price movements.

Here are things that could affect the next OBOL price:

1. DVT Adoption on the Rise (Bullish Impact)

The Ethereum Pectra upgrade (EIP-7251) allows validator consolidation from 32 ETH to 2048 ETH. This could reduce infrastructure costs by up to 80% for large institutions.

Obol's DV technology is already integrated with Lido's Simple DVT module and major custodians like Bitcoin Suisse, with a total of over $1 billion in ETH secured.

If this adoption becomes widespread, particularly from institutions seeking a tamper-resistant staking solution, demand for Obol infrastructure could potentially increase.

Historically, the number of Lido operators has increased dramatically after the integration of Obol, which shows a real impact on the growth of the ecosystem.

2. Regulatory and Legitimacy Risks (Mixed Impact)

Regulations like the GENIUS Act and MiCA present both challenges and opportunities. On the one hand, compliance costs increase and could suppress short-term growth, but clear regulations can actually attract more conservative institutional capital.

For OBOL, the short-term effects could be neutral to slightly negative, but in the long run, projects that are technologically and governance-ready could actually benefit.

3. Token Governance and Incentives (Bullish Impact)

The launch of Delegate Reputation Score (DRS) makes OBOL staking and governance more attractive to long-term holders. This mechanism encourages active participation and has the potential to reduce selling pressure.

Furthermore, incentives flowing into staker vaults create new demand for OBOL. In many cases in the DeFi world, increased token utility is often the catalyst before a price revaluation occurs.

Read Also: Top 10 Clash Royale Decks 2026 That You Must Upgrade

Obol (OBOL) Price Prediction

Based on the current price chart and fundamental analysis above, here’s an overview of Obol (OBOL) price prediction:

Short Term Price Prediction

In the short term, OBOL token is likely to continue consolidating. As long as there's no major catalyst, prices have the potential to move within the range $0,025-$0,035. Volatility remains, but the trend is likely sideways.

Medium Term Price Prediction

If the adoption of Distributed Validators continues to increase and Ethereum staking becomes more popular and institutionalized, OBOL has the opportunity to rise to $0,06-$0,10. This level is still considered realistic considering its distance from the ATH.

Long Term Price Prediction

In a long-term bullish scenario, when OBOL becomes the gold standard for distributed validators on Ethereum, OBOL price could potentially retest the area $0,20-$0,30.

Even approaching ATH is not impossible, although it still depends on the overall crypto market conditions.

Read Also: Dragon City Events January 2026: Check Out the Complete Schedule Here!

Conclusion

Obol (OBOL) price predictions are heavily influenced by the adoption of Distributed Validators technology, regulatory developments, and the strength of the Ethereum ecosystem itself.

Currently, OBOL is still well below its peak price, but the project's fundamentals show quite solid long-term potential.

However, OBOL remains a risky asset, especially in the short term. For investors who believe in the future of decentralized staking and Ethereum's infrastructure, OBOL could be an interesting asset to monitor closely.

Read Also: How to Get Free Robux Legally and Safely, Must Know!

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

Apa itu Obol (OBOL)?

Obol is an Ethereum infrastructure project developing Distributed Validators technology for more secure and decentralized staking.

Why is OBOL price still far from ATH?

OBOL is still in the recovery phase after a long crypto market correction and gradual technology adoption.

Is OBOL suitable for long-term investment?

OBOL has strong fundamentals, but remains dependent on adoption and the general state of the crypto market.

What factors most influence OBOL prices?

DVT adoption, staking regulations, and token utility within the Obol Collective ecosystem.

Does OBOL have the potential to rise significantly?

If Obol technology becomes the standard for Ethereum staking in the future, the potential for price increases remains open, although it is not without risks.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.