Microsoft Tokenized Stock (MSFTON) Price Prediction 2026-2030

2026-02-09

Microsoft Tokenized Stock (MSFTON) is a tokenized version of Microsoft stock issued through the Ondo ecosystem. So, how is the MSFTON price prediction 2026-2030?

This article will discuss what Microsoft Tokenized Stock (MSFTON) is, its current price conditions, price movement analysis, and projections for future movements.

Key Takeaways

- Microsoft Tokenized Stock (MSFTON) provides economic exposure to Microsoft shares through blockchain technology.

- Price movements are influenced by crypto market sentiment, trading volume, and Microsoft stock performance.

- MSFTON price prediction 2026-2030 shows potential for gradual increase along with the adoption of tokenized assets and the growth of the technology sector.

What is Microsoft Tokenized Stock (MSFTON)?

MSFTON is tokenized stock that represents Microsoft stock price movements in the form of digital assets.

This token allows investors to gain economic exposure similar to owning Microsoft stock, including the benefit of dividend reinvestment, but with the flexibility of blockchain-based transactions.

Through the Ondo platform, tokenized stocks like MSFTON allow global users, particularly those outside the United States, to access US stocks more easily.

Tokens can be minted or redeemed at almost any trading time and remain connected to traditional market liquidity.

Read Also: JPMorgan Chase (JPMON) Price Prediction 2026-2030

MSFTON Price Today

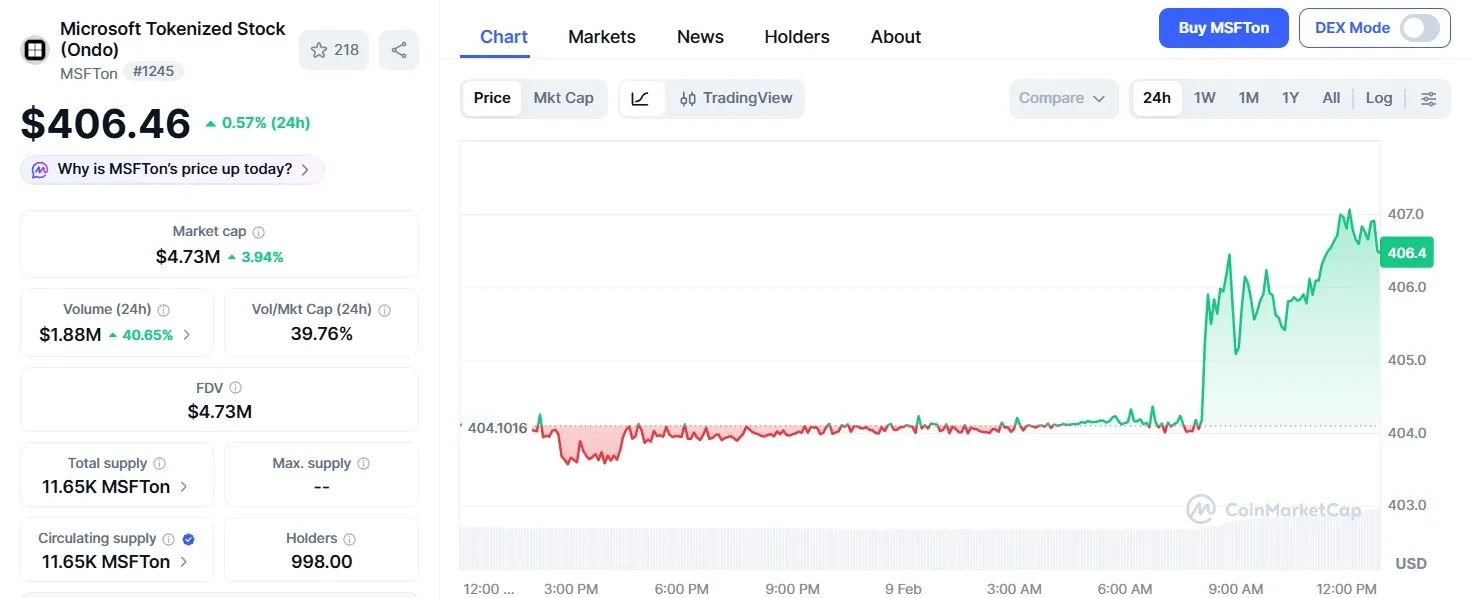

Image Source: Coinmarketcap

Based on the latest chart, MSFTON price today is trading around $406, with a slight increase in the last 24 hours.

In the past seven days, the price has indeed corrected by around 4.20%, but it still shows better performance compared to the global crypto market, which has experienced a deeper decline.

Historically, MSFTON has reached a high of around $551.18 and a low of $391.37. Currently, the price is still about 26% below its peak but remains slightly above its historical low.

Read Also: McDonald's xStock (MCDX) Price Prediction 2026-2030

Today’s MSFTON Price Analysis

Here are some of the catalysts that caused the price of MSFTON to rise today:

1. Beta-Driven Market Lift

Today's price increase in MSFTON is largely influenced by the overall movement in the crypto market. When the total crypto market capitalization increases, tokenized stocks like MSFTON typically follow suit, although the movements aren't as significant as those of altcoins.

This means the increase wasn't driven by specific Microsoft-related news, but rather by slightly improved market sentiment. Global crypto market cap movements are an important indicator of short-term price direction.

2. Volume Spikes in a Thin Market

MSFTON's trading volume has increased significantly in the past 24 hours. With a relatively small market capitalization, a modest influx of funds is enough to move the price rapidly.

This surge in volume indicates market participation, but it doesn't necessarily reflect a fundamental change. In assets with limited liquidity, volatility can increase due to the impact of large transactions by a few market participants.

3. Short-Term Market Outlook

Technically, MSFTON remains in a medium-term downtrend after experiencing a decline of around 15% in the past 30 days. The psychological level around $400 serves as a key support area.

If the price can hold above that level, there's still a chance for an increase towards the $410-$415 area. However, if price rejection occurs, the possibility of a correction back to the $395 area remains a concern.

Furthermore, the current fear-driven sentiment in the crypto market is also a factor that could trigger volatility.

Read Also: CLAWNCH Price Prediction and How to Buy on Exchange

MSFTON Price Prediction 2026-2030

Given Microsoft's strong fundamentals and the growth of the RWA sector, MSFTON's price projections are likely to follow Microsoft's stock trend with the added potential of tokenized asset adoption.

Here are the Microsoft Tokenized Stock (MSFTON) price predictions for 2026-2030:

2026

If the tech market continues to grow and tokenized stock regulations become clearer, MSFTON has the potential to be in the range $430-$480.

2027-2028

Assuming Microsoft's business expansion in the AI and cloud sectors continues to grow, prices have the potential to rise to the area of $480-$520 as investor interest in technology-based assets increases.

2029-2030

In an optimistic scenario, wider adoption of RWA could push prices towards $520-$600, especially if Microsoft shares reach new record prices in traditional markets.

However, macro factors such as interest rates, global economic conditions, and crypto market sentiment remain important variables influencing price movements.

Read Also: Moonbirds (BIRB) Price Prediction 2026: Its Prospects in the Solana Ecosystem

Conclusion

Microsoft Tokenized Stock (MSFTON) offers a new approach to investing in technology stocks through blockchain.

Compared to speculative crypto assets, their price movements are relatively more stable because they track the performance of major companies like Microsoft.

Meanwhile, MSFTON price predictions for 2026-2030 show potential for gradual increases, not extreme spikes.

Interested investors should continue to monitor developments in the technology stock market, global crypto sentiment, and the growth of the tokenized asset sector as key factors determining price direction.

Read Also: Brevis (BREV) Price Prediction 2026-2030: Latest Analysis

FAQ

What is MSFTON?

MSFTON is a tokenized stock that provides exposure to Microsoft's stock price through blockchain technology.

What affects the price of MSFTON?

Prices are influenced by Microsoft stock performance, crypto market sentiment, trading volume, and developments in the RWA sector.

Is MSFTON the same as buying Microsoft shares?

No. MSFTON only provides economic exposure to stock prices, not direct stock ownership.

Is MSFTON suitable for long-term investment?

It could be an option for investors who want exposure to technology stocks with the flexibility of digital assets.

Can MSFTON price rise drastically like altcoins?

The likelihood is less because price movements tend to follow Microsoft's relatively stable stock compared to altcoins.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.