AMD (AMDON) Price Prediction 2026-2030: Tokenized Stock Outlook

2026-02-09

AMD (AMDON) is a tokenized version of Advanced Micro Devices (AMD) stock. So, how is the AMDON price prediction for 2026-2030?

This article will discuss what AMDON is, its current price conditions, factors influencing its movement, and potential price predictions for the next few years based on fundamental analysis and market sentiment.

Key Takeaways

- AMDON is a tokenized stock that provides economic exposure to AMD shares through the blockchain.

- AMDON's price is heavily influenced by AMD stock performance, crypto market sentiment, and tokenized asset regulations.

- Long-term prospects depend on the growth of the semiconductor industry and the adoption of tokenized securities.

What is AMDON?

AMDON is a tokenized version of AMD shares issued through the Ondo Finance platform.

This token allows global investors, including those outside the United States, to gain economic exposure similar to holding AMD shares directly, including the benefit of potential price growth and dividend reinvestment.

Through a tokenized stock system, investors can mint and redeem assets with access to traditional market liquidity, while still gaining the trading flexibility of the blockchain ecosystem.

Trading can be done almost around the clock, providing an advantage over conventional stock markets which have limited operating hours.

Read Also: IEFAON Price Prediction 2026-2030: Prospects for Tokenized ETFs

AMDON Price Today

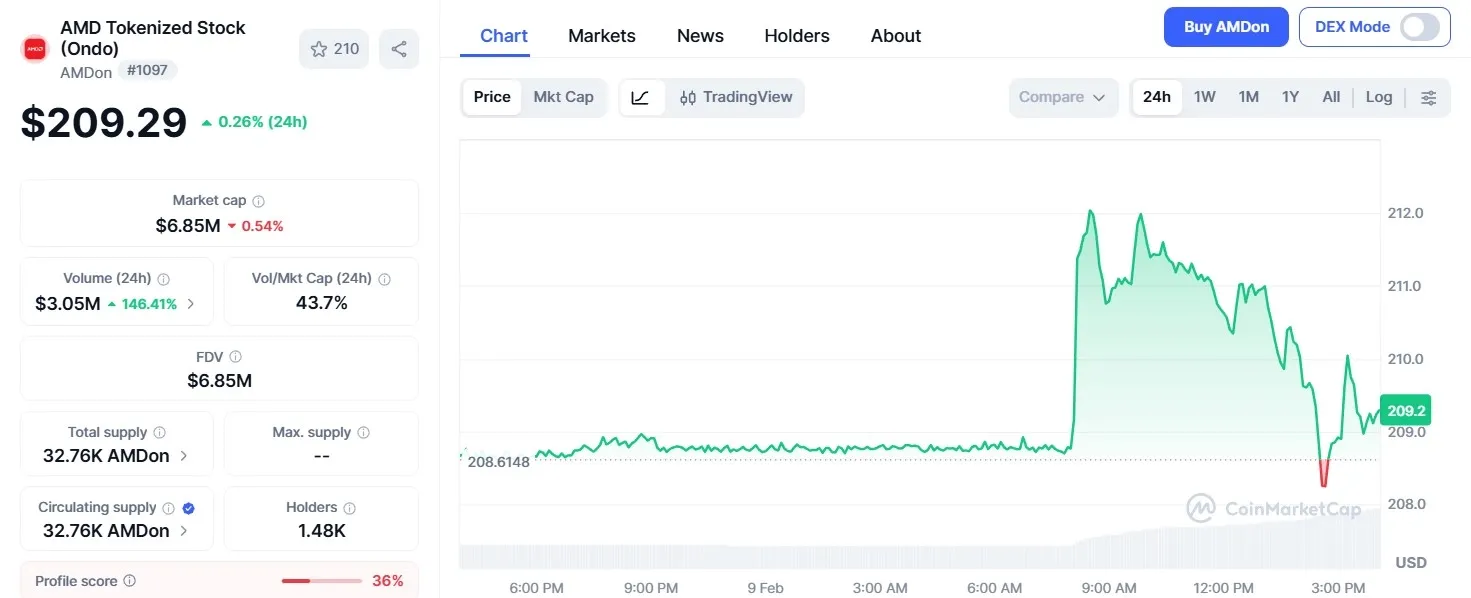

Image Source: Coinmarketcap

Based on the latest chart, AMDON price today is trading around $209, with relatively stable movement after experiencing intraday volatility.

In the last seven days, the price of AMDON has decreased by around 9.70%, but this is still better than the decline in the global crypto market during the same period.

AMDON previously reached an all-time high of $571.96 and a low of around $149.82. Currently, the price remains well below its peak, but has rebounded significantly from its low, indicating a recovery phase.

Read Also: Microsoft (MSFTON) Price Prediction 2026-2030

AMDON Price Analysis

Here are some factors that can influence the price of AMDON today:

1. AMD Stock Performance as a Key Factor

Because AMDON represents AMD stock, the most important factor that influences price is the performance of the company itself.

Financial reports, semiconductor business growth, AI technology developments, and competition with other chip companies are the main variables.

If AMD manages to increase its market share or demonstrates strong growth in the AI and data center sectors, the price of AMDON could potentially be pushed up.

Conversely, pressure on the technology sector or a decline in company performance will have a direct impact on this token.

2. Crypto Market Demand for Tokenized Assets

In addition to stock factors, AMDON is also influenced by overall crypto market conditions. When the market is in a bullish phase with high liquidity, tokenized stocks often gain more attention because they offer easy access to global stocks.

However, in risk-off market conditions, such as when Bitcoin's dominance increases, capital flows typically shift away from niche assets, including tokenized stocks. This can cause prices to slow down or even fall below their original value.

3. Clarity of Tokenized Securities Regulations

Regulation is a crucial factor that is still evolving. If regulations in various countries begin to provide legal certainty for tokenized securities, institutional adoption could increase significantly.

Conversely, overly stringent regulations could restrict trading access or even impact market liquidity. This presents both a significant risk and opportunity for AMDON in the long term.

Read Also: JPMorgan Chase (JPMON) Price Prediction 2026-2030

AMDON Price Prediction 2026-2030

Considering the current price conditions, AMD's fundamentals as a technology company, and the development of the RWA sector, the AMDON price prediction tends to follow the direction of AMD shares with the additional influence of crypto market sentiment.

Here are the AMDON price prediction for 2026-2030:

2026: Potentially in the range $240-$280 if the AI and semiconductor sectors continue to grow strongly.

2027: Can go up to the area of $280-$330 as the adoption of tokenized stocks increases.

2028: In a bullish scenario, the price has the potential to reach $330-$400 if AMD maintains growth momentum.

2029: Potential to move in the range $400-$470 if regulations become clearer and liquidity increases.

2030: If the trend of AI and computing technology continues, AMDON has the potential to reach $470-$550 in the long term.

It should be noted that these predictions are estimates and remain dependent on global market conditions and developments in the technology industry.

Read Also: McDonald's xStock (MCDX) Price Prediction 2026-2030

Conclusion

AMDON offers a new way to access technology stocks through blockchain. As a tokenized stock, this asset has unique characteristics because it is influenced by both the traditional stock market and the crypto market.

AMDON's long-term prospects are quite attractive, especially if AMD continues to expand in the AI and semiconductor sectors and the adoption of tokenized assets increases. However, investors should remain mindful of liquidity risks and evolving regulations.

Read Also: CLAWNCH Price Prediction and How to Buy on Exchange

FAQ

What is AMDON?

AMDON is a tokenized stock that represents AMD shares on the blockchain through the Ondo Finance platform.

Is AMDON price the same as AMD stock?

It's not always exactly the same, but its movement is heavily influenced by the price of AMD stock as its underlying asset.

What are the main factors that influence the price of AMDON?

AMD stock performance, crypto market sentiment, trading liquidity, and regulatory developments.

Is AMDON suitable for long-term investment?

It could be an option for investors who want exposure to technology stocks through blockchain, but still have market risk.

Is the AMDON price prediction for 2026-2030 accurate?

No. Price predictions are based solely on current market conditions and may change depending on global market and economic developments.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.