Litecoin (LTC) Price Prediction for October 2025: ETF Momentum and Institutional Adoption

2025-10-10

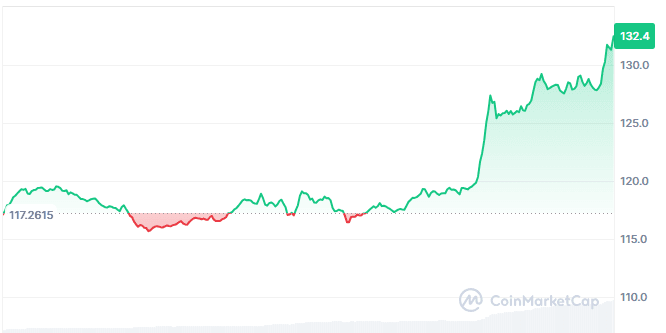

Bittime - Litecoin (LTC) has once again drawn investor attention after surging more than 11% in the last 24 hours, outpacing the crypto market’s average weekly gain of just 0.21%.

This sharp rise was driven by a combination of ETF optimism, bullish technical signals, and increased institutional adoption.

With the current price around $132, the market is watching whether Litecoin can break the psychological resistance at $140 and continue its rally to higher areas.

ETF Approval Momentum

The primary catalyst for Litecoin’s rally comes from optimism over a spot ETF approval.

The U.S. SEC missed the October 2, 2025 deadline for Canary Capital’s Litecoin ETF proposal due to the U.S. government shutdown.

However, Bloomberg analysts such as Eric Balchunas estimate the approval odds at around 95% once regulatory activity resumes.

A Litecoin-based ETF would open broad institutional capital access, similar to Bitcoin’s price surge after its ETF approval in 2024.

The “buy the rumor” effect now dominates the market, with traders speculating ahead of official news.

An important date to watch next is October 10, when a new deadline from Grayscale is expected to become a confirmation moment for other crypto ETFs, including Litecoin.

Read Also: How to Get Litecoin (LTC) for Free: Complete Guide for Beginners

Technical Analysis: Strong Breakout and Continued Momentum

On the technical side, Litecoin has broken the crucial resistance at $127.45, indicating a short-term trend shift to bullish. Technical indicators show:

- 7-day SMA: $119.97 (LTC is trading well above it)

- Fibonacci 23.6% retracement: $121.16 (now acting as new support)

- RSI (14): 68.09 → still in the neutral-bullish zone

- MACD histogram: +1.46 → confirming upward momentum

The next short-term targets are $134.69 (Fibonacci 127.2%) and if this level is breached, LTC could continue its rally toward $143.91 (Fib 161.8%).

However, rejection around the $140 area could trigger a short-term correction to the $121–$124 zone.

Institutional Adoption: MEI Pharma and Luxxfolio Push the “Digital Silver” Narrative

Beyond the ETF factor, institutional adoption is a fundamental catalyst that strengthens Litecoin’s long-term outlook.

Public company MEI Pharma announced a $100 million investment in Litecoin as part of its reserve asset strategy, mirroring MicroStrategy’s move with Bitcoin.

Meanwhile, Luxxfolio is also targeting ownership of 1 million LTC by 2026, underscoring corporate confidence in Litecoin’s stability.

Both moves not only reduce circulating supply but also reinforce the narrative of “Litecoin as digital silver,” with Bitcoin viewed as digital gold.

Direct backing from Charlie Lee, Litecoin’s creator who now sits on MEI Pharma’s board, further adds credibility to these steps.

Read Also: How to Buy Litecoin (LTC)

Overbought and Regulatory Uncertainty

Although the medium-term outlook looks positive, several indicators point to potential short-term corrections:

- 7-day RSI at 79.47, indicating an extreme overbought condition.

- Litecoin is now 32% above the 200-day EMA ($105.61), indicating a wide gap from the long-term trend average.

- Strong resistance in the $135–$140 range has repeatedly stalled rallies since December 2024.

If price is rejected in this zone, LTC could correct to $114–$121, the accumulation area that previously supported rallies.

Read Also: Litecoin ETF: Potentially Approved by US Regulators

Conclusion

Litecoin’s rally reflects a mix of ETF optimism, technical momentum, and institutional validation.

As long as price holds above $127 and volume remains elevated, the medium-term trend remains bullish with potential upside to $150–$170 if an ETF is indeed approved after the U.S. government reopens.

However, traders should be wary of potential profit-taking around $140, especially if ETF news is delayed again.

In a worst-case scenario, ETF rejection could drag LTC back below $110, while official approval could spark a parabolic rally to new annual highs.

How to Buy Crypto on Bittime

Want to trade or sell buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of Rp10,000. After that, you can immediately buy your favorite digital assets!

Check the rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today’s crypto market trends in real-time on Bittime.

Also, visit Bittime Blog for various interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the crypto space.

FAQ

What are the main factors driving Litecoin's price increase right now?

The rise is driven by optimism over ETF approval, bullish technical signals, and large institutional investments from MEI Pharma and Luxxfolio.

Will the Litecoin ETF really be approved?

Bloomberg analysts estimate the odds above 90%, but certainty will only come once SEC activity returns to normal after the U.S. government reopens.

What are the short-term price targets for Litecoin?

Short-term targets are $134–$143, with the potential for a mild correction before resuming the uptrend toward $150.

Is Litecoin still worth buying now?

Litecoin still has medium-term upside potential, but overbought conditions signal short-term correction risks. The best strategy is to accumulate gradually below $125.

What is the relationship between ETFs and Litecoin's price?

ETFs allow large institutions to buy Litecoin through regulated financial products, increasing demand and exerting downward pressure on circulating supply — ultimately pushing prices higher.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.