JPMorgan Chase (JPMON) Price Prediction 2026-2030

2026-02-09

The growth of Real World Assets (RWA) has led many investors to consider tokenized stocks as a new investment alternative in the crypto world. One that has attracted considerable attention is JPMorgan Chase (JPMON).

So, how is the JPMON price prediction for 2026-2030? This article will provide a comprehensive discussion, from the latest price analysis to projected movements over the next few years.

Key Takeaways

- JPMorgan Chase (JPMON) is a tokenized stock that provides economic exposure to JPMorgan Chase shares via the blockchain.

- JPMON's price is influenced by regulations, the growth of the RWA sector, and the conditions of the stock and crypto markets simultaneously.

- JPMON's price prediction for 2026–2030 is likely to move steadily with potential for growth following JPMorgan's stock performance and the adoption of tokenized assets.

What is JPMorgan Chase (JPMon)?

JPMorgan Chase (JPMON) is a tokenized version of JPMorgan Chase shares issued through the Ondo Finance ecosystem.

These tokens allow holders to gain economic exposure similar to JPM stock ownership, including the benefit of dividend reinvestment, but in the form of digital assets on the blockchain.

This tokenized stock concept allows global investors, particularly those outside the United States, to access US stock price movements more flexibly.

Tokens can be minted or redeemed at almost any trading time, while remaining connected to traditional market liquidity.

Meanwhile, JPMorgan is one of the largest financial institutions in the world, so JP Morgan is often considered an asset with a lower risk profile than speculative altcoins.

Read Also: McDonald's xStock (MCDX) Price Prediction 2026-2030

JPMON Price Today

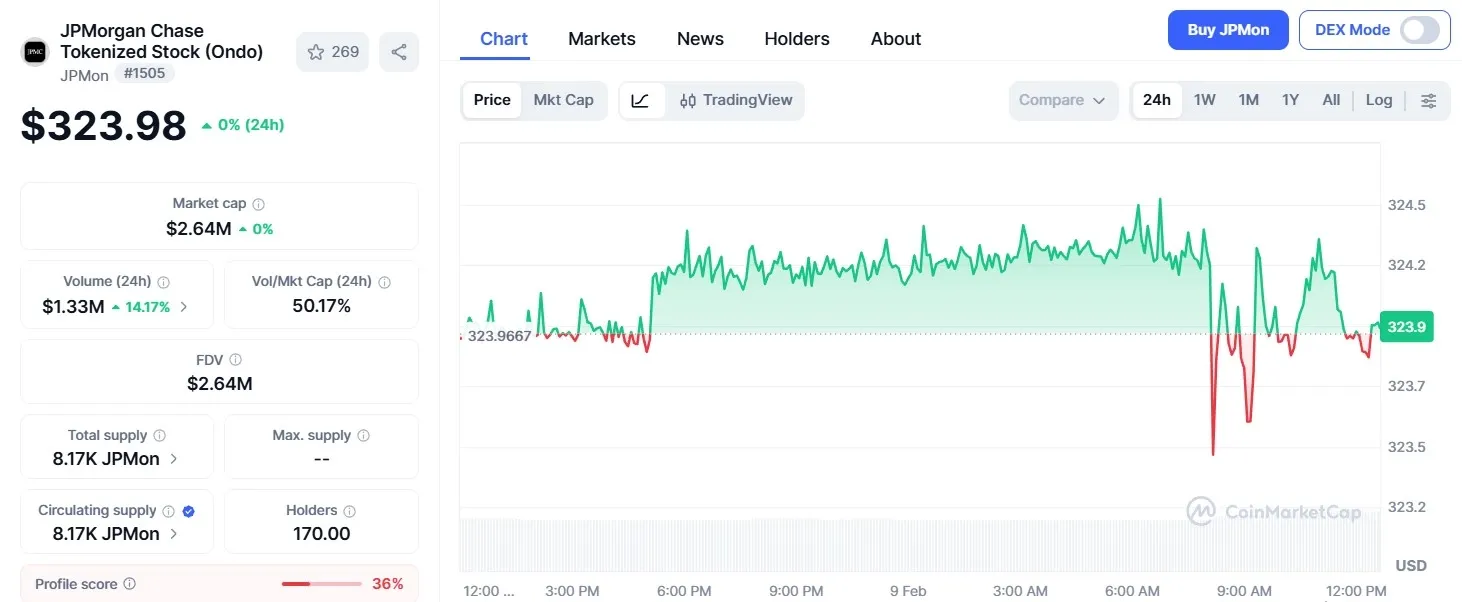

Image Source: Coinmarketcap

Based on the latest chart, JPMON price today is trading around $323, with relatively stable movement in the last 24 hours.

In a 7-day period, the price recorded an increase of around 6.20%, outperforming the global crypto market which was experiencing a decline.

Historically, JPMON has reached a high of around $338.05 and a low of $291.63. The current price remains relatively close to that high, indicating a relatively healthy trend despite the current cautious crypto market.

Read Also: CLAWNCH Price Prediction and How to Buy on Exchange

JPMON Price Analysis Today

Here are some factors that could influence the future price of JPMON:

1. Influence of Regulation and Clarity of Rules

As a tokenized stock, JPMON is in a regulatory environment that is still evolving. Providing a clear legal framework could potentially boost institutional investor confidence and encourage wider adoption.

Conversely, overly restrictive policies can limit market access and suppress growth. Therefore, regulatory factors are an important catalyst for JPMON's price in the medium term.

2. Growth of the RWA Sector and Ondo Ecosystem

The value of JPMON also heavily depends on the development of the rapidly growing RWA sector. Currently, the tokenization of real-world assets has surpassed billions of dollars and continues to grow as more companies enter this sector.

Ondo Finance's expansion by offering more tokenized stocks across various platforms has also boosted confidence in this business model. Increased liquidity and exchange access could help maintain JPMON's long-term bullish trend.

3. Double Exposure: Stock Market and Crypto

JPMON has a unique character because it is influenced by two markets simultaneously. On the one hand, its price follows the performance of JPMorgan Chase shares. On the other hand, crypto market sentiment also influences its price movements.

This creates both opportunities and risks. If JPMorgan's stock performs well, the price could remain strong even if the crypto market weakens. However, when both markets experience pressure simultaneously, volatility could increase more rapidly.

Read Also: Moonbirds (BIRB) Price Prediction 2026: Its Prospects in the Solana Ecosystem

JPMON Price Prediction 2026-2030

Looking at fundamental factors and the adoption trend of tokenized assets, JPMON's movement is likely to follow JPMorgan's share growth, with additional potential from the RWA sector.

Here is the JPMorgan Chase (JPMON) price prediction for 2026-2030:

2026

If regulations become clearer and adoption of tokenized stocks increases, JPMON could potentially move in the range of $340-$380. The increase is expected to come from increased investor confidence in RWA assets.

2027-2028

Assuming the RWA sector matures and liquidity increases, prices could be in the range area of $380-$420, following the growth of the global financial sector and the performance of JPMorgan.

2029-2030

In an optimistic scenario, widespread adoption of tokenized stocks could push prices towards $420-$500, especially if JPMorgan maintains solid business performance in global markets.

However, this projection remains influenced by macroeconomic conditions, interest rate policies, and digital asset regulations in various countries.

Read Also: Brevis (BREV) Price Prediction 2026-2030: Latest Analysis

Conclusion

JPMorgan Chase (JPMON) serves as an example of how the traditional financial world is beginning to integrate with blockchain technology.

Compared to many other crypto assets, JPMON's price movements tend to be more stable because they follow the stocks of large companies.

Meanwhile, JPMON's price predictions for 2026-2030 show potential for gradual growth, rather than extreme spikes.

Investors interested in this asset should pay attention to regulatory developments, the growth of the RWA sector, and JPMorgan's stock performance as key factors influencing the price.

Read Also: Clovis (CLO) Price Forecast 2026-2030: Long-Term Outlook

FAQ

What is JPMon?

JPMon is a tokenized stock that provides exposure to JPMorgan Chase's stock price through blockchain technology.

What influences the price of JPMon?

Prices are influenced by JPMorgan's stock performance, tokenized asset regulations, developments in the RWA sector, and crypto market sentiment.

Is JPMon the same as buying JPMorgan stock?

No. JPMon only provides economic exposure to stock prices, not direct stock ownership.

Is JPMon suitable for long-term investment?

It could be an option for investors who want global stock exposure with the flexibility of crypto assets.

Can JPMon rise drastically like altcoins?

The likelihood is smaller because the price follows JPMorgan's stock which tends to move more steadily.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.