HUMA Price Prediction: Between Visa Optimism and Token Unlock Pressure

2025-10-17

Bittime - Huma Finance (HUMA) is back in the spotlight after its token price fell 3.33% in the last 24 hours to $0.0286, underperforming the weakening crypto market which dropped 2.49%.

Still, a recent Visa report positions Huma as a pioneer in on-chain financing based on stablecoins, offering hope for a price recovery in the medium term.

HUMA’s price decline was triggered by a combination of supply pressure from a large token unlock, bearish altcoin sentiment, and technical weakness.

This article delves into HUMA’s price outlook, the driving factors, and potential future price directions.

Technical Condition: Bearish Signals Still Dominate

HUMA is currently trading around $0.0286, below the 7-day SMA ($0.0288) and the 30-day SMA ($0.0322), indicating weak short-term momentum.

The MACD (-0.00083) and RSI (41.81) suggest mild oversold conditions, but not enough yet to trigger a significant rebound.

Price is also held below the 38.2% Fibonacci level at $0.02909 and failed to break the minor resistance at $0.03. If the price falls below $0.028, a drop toward the strong support area of $0.0254 (August low) becomes likely.

Conversely, if HUMA can break above the 7-day SMA and the $0.03 resistance, this could be an initial technical signal of a reversal toward $0.033–$0.035.

Read also: Huma Finance Price Today | HUMA/IDR Price

Token Unlock Pressure: Root of Negative Sentiment

On August 26, 2025, Huma Finance unlocked 378 million HUMA tokens — about 23% of the circulating supply, with a valuation of roughly $10.8 million at current prices.

Most of these tokens were allocated to early contributors and liquidity providers, two groups that tend to sell when prices weaken.

As a result, although HUMA recorded an 8% gain in the past 30 days, the token remains 80% below its May 2025 peak of $0.12.

Selling pressure from this unlock prolongs the correction phase and suppresses buying volume in the secondary market.

This condition is expected to persist through the end of 2025 because HUMA still follows a quarterly linear vesting schedule, which may add supply pressure in the short term.

Visa Integration: Long-Term Fundamental Catalyst

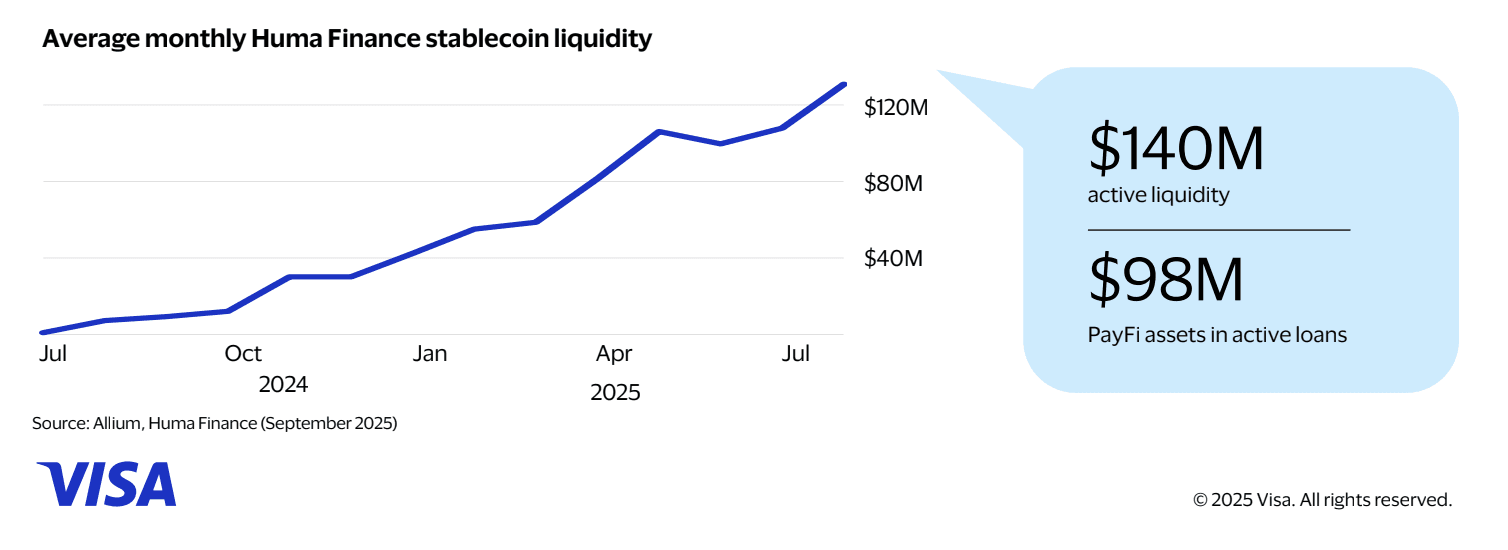

A Visa report dated October 16, 2025, cites Huma Finance as a key part of the “$40 Trillion Credit Shift,” a global credit movement toward blockchain infrastructure.

Visa noted that Huma has processed over $500 million in on-chain loan transactions and has an active portfolio valued at $98 million.

This partnership with Visa opens significant opportunities for institutional adoption, as HUMA becomes one of the protocols leveraging programmable credit and receivables-backed loans, enabling cross-border lending with efficient and transparent costs.

For long-term investors, this collaboration forms the basis of optimism because Huma is now viewed as a project with real utility in the decentralized finance (DeFi) lending sector.

Read also: Buy & Trade HUMA/IDR

Altcoin Market Sentiment: Risks Remain High

Bitcoin dominance now stands at 58.9%, indicating capital flows back to the primary asset. Meanwhile, the Altcoin Season Index fell 63% in a month, and the Fear & Greed Index is at 28 (Fear zone).

This situation dampens demand for altcoins, including HUMA, even though the project has strong fundamental potential.

In the short term, HUMA’s price movement will be heavily influenced by Bitcoin’s direction. If BTC can break $115,000, altcoins including HUMA could strengthen again.

Read also: Altcoin Season Index: A Cheerful Guide to Welcoming Altseason 2025

Conclusion

HUMA’s price forecast for the end of 2025 is still neutral to bearish in the short term, with a trading range between $0.025–$0.035.

However, the medium-term outlook remains positive if the Visa collaboration successfully expands HUMA token usage within the global digital payments ecosystem.

Investors are advised to wait for technical confirmation above $0.03 before re-entering, while monitoring further developments from Visa’s PayFi initiative and the schedule of future token unlocks.

How to Buy Crypto on Bittime

Want to trade or buy buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then make a minimum deposit of Rp10,000. After that, you can immediately buy your favorite digital assets!

Check exchange rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to learn about crypto market trends in real-time on Bittime.

Also visit Bittime Blog for interesting updates and educational information about crypto. Find trusted articles about Web3, blockchain technology, and crypto investment tips designed to enrich your knowledge in the crypto world.

FAQ

What is Huma Finance (HUMA)?

Huma Finance is a decentralized finance (DeFi) protocol focused on stablecoin-based lending and receivables financing. The HUMA token serves governance and utility roles within its ecosystem.

Why did HUMA’s price drop recently?

The decline was caused by selling pressure following the unlock of 378 million tokens and a weakening global altcoin market due to rising Bitcoin dominance.

Is HUMA’s partnership with Visa positive?

Yes. Visa officially highlights Huma as a pioneer in cross-border stablecoin financing. This strengthens the credibility and long-term adoption potential of the HUMA token.

What is the near-term price target for HUMA?

If it breaks the $0.03 resistance, the price could move toward $0.033–$0.035. However, if it fails to hold $0.028, the risk of a drop to $0.025 emerges.

Is HUMA suitable for long-term investment?

For high-risk-profile investors, HUMA may be attractive due to Visa adoption. However, volatility and the token unlock schedule should be considered before taking large positions.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.