Gold Price Prediction and XAUT/IDR Price: Outlook for January to 2026

2026-01-27

Introduction: If you routinely track today’s gold price, it’s natural for the next question to pop up: will tomorrow’s gold price forecast keep rising, or take a breather first? On the other hand, many people also compare physical gold with digital gold such as XAUT, so the XAUT/IDR price is also in the spotlight.

To keep things simple, we’ll use an easy approach: review the latest price, read the short-term trend direction, then build AI-based forecast scenarios.

The result isn’t certainty, but a map that helps you make calmer decisions, especially when gold prices are rising and the market starts heating up.

Key Takeaways:

- The AI forecast is derived from the physical gold price snapshot and the XAUT/IDR chart.

- It focuses on three horizons: tomorrow, the rest of January, and a 2026 outlook.

- It includes simple support and resistance levels so you can spot “reversal risk” zones and “continuation” areas.

Current Gold Price and XAUT/IDR Price Snapshot

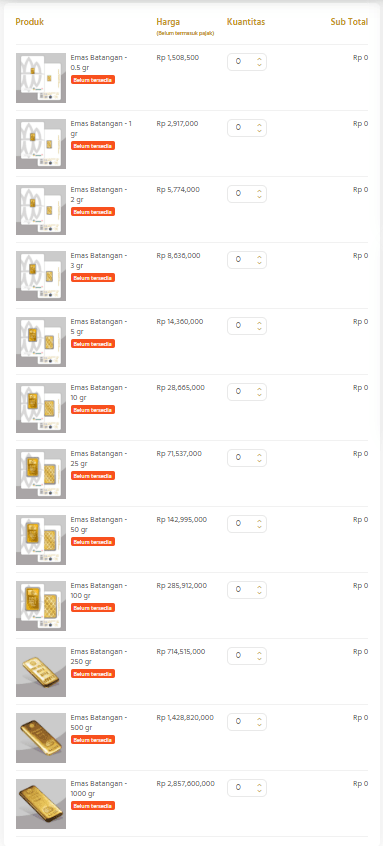

From the price list, ANTAM gold bars (LM) are available from 0.5 grams up to 1,000 grams, and you can see a common pattern: the smaller the denomination, the higher the per-gram price tends to be due to minting and distribution costs.

That matters because many people are surprised when comparing 1 gram vs 100 grams and think, “Why is it different?” In reality, the difference often comes from the denomination premium, not because the gold itself is different.

Read Also: Beginner Crypto Trading Strategies: Don’t Do This!

Current gold price on January 26, 2026

- 0.5 g: Rp1,508,500

- 1 g: Rp2,917,000

- 2 g: Rp5,774,000

- 3 g: Rp8,636,000

- 5 g: Rp14,360,000

- 10 g: Rp28,605,000

- 25 g: Rp71,537,000

- 50 g: Rp142,995,000

- 100 g: Rp285,912,000

- 250 g: Rp714,515,000

- 500 g: Rp1,428,820,000

- 1,000 g: Rp2,857,600,000

- Note: the display states “excluding tax.”

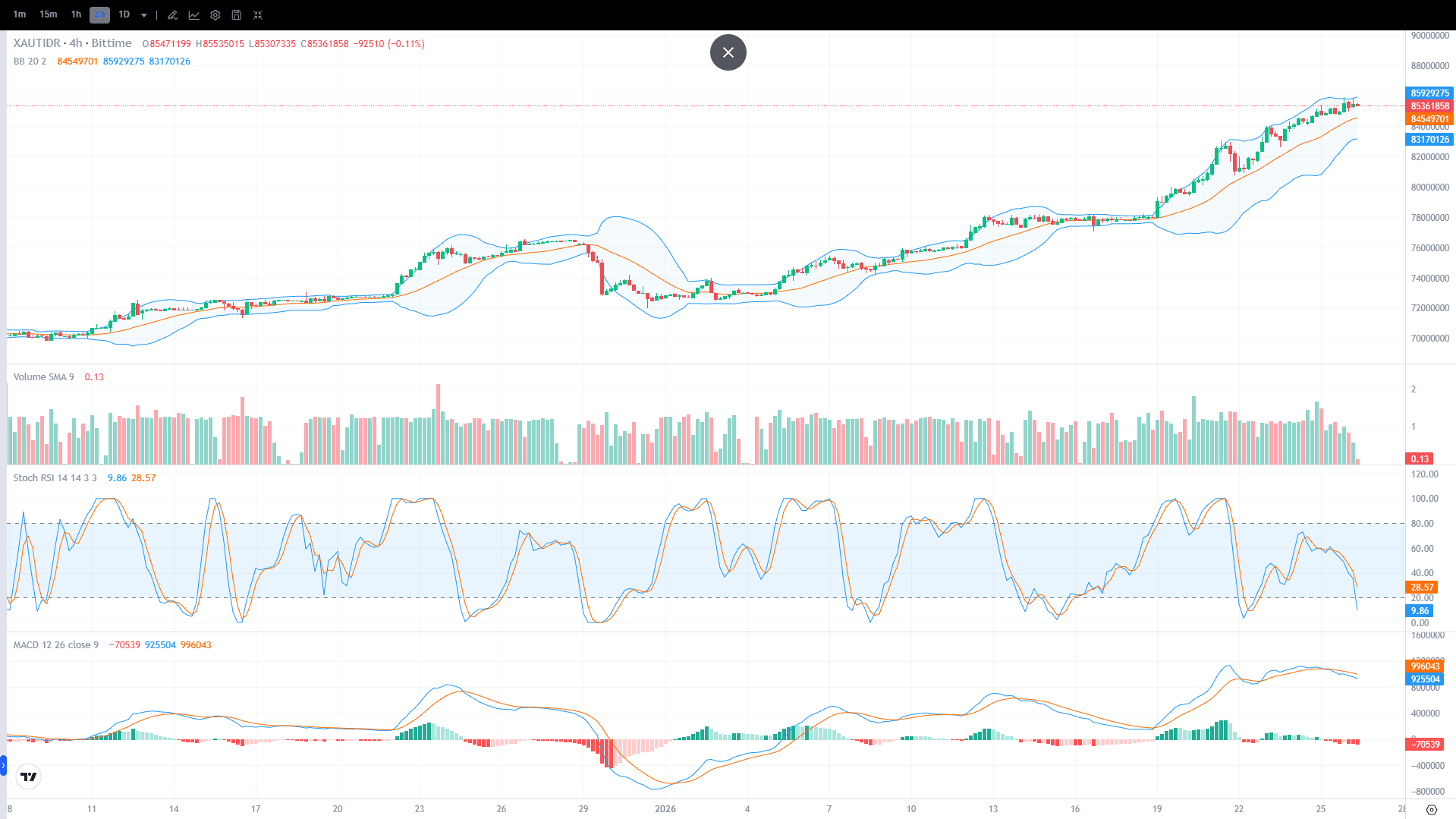

Current XAUT/IDR price

- Last close: 85,361,858

- High: 85,535,015

- Low: 85,307,335

- Bollinger Bands (approx. from the display): upper 85,929,275, mid 84,549,701, lower 83,170,126

Read Also: 7 Effective Ways to Trade Crypto for Beginners, Complete with Tips and Tricks

Tomorrow’s Gold Price Forecast and Tomorrow’s XAUT/IDR Forecast

The forecast below is an AI simulation based on an uptrend that is still intact, but with weakening short-term momentum. The most reasonable “tomorrow” scenario is typically sideways action or a shallow pullback before the trend continues. If you want to buy digital gold, you can use the Bittime platform by registering first.

Tomorrow’s gold price forecast (physical gold, using 1 gram as the reference)

- Neutral scenario: a small move in the Rp2,900,000 to Rp2,940,000 range per 1 gram

- Bullish scenario: if market sentiment supports it, it may test Rp2,950,000 per 1 gram

- Pullback scenario: if a daily correction occurs, it may return to the Rp2,880,000 to Rp2,895,000 area per 1 gram

Tomorrow’s XAUT/IDR price forecast

- XAUT price forecast main range: 85,000,000 to 85,900,000

- Key support areas to watch: 85,300,000, then 84,550,000

- Nearest resistance area: 85,930,000 to 86,000,000

January Gold Price Forecast and 2026 Gold Price Outlook

For a longer horizon, don’t fixate on a single number. What’s more useful is a range and the triggers. Gold can rise due to a combination of global risk sentiment, exchange rates, and safe-haven demand. However, upswings are often interrupted by pauses.

January gold price forecast (rest of the month, using 1 gram as the reference)

- Realistic range: Rp2,850,000 to Rp2,980,000

- The bullish bias holds if daily dips don’t stay below the lower end of the range for too long

- The bias weakens if there’s a string of declines and price fails to reclaim the mid-range area

2026 gold price outlook (big picture, using 1 gram as the reference)

- Moderate scenario: Rp2,750,000 to Rp3,200,000

- Bullish scenario: Rp3,200,000 to Rp3,500,000 if the uptrend remains strong throughout the year

- Defensive scenario: Rp2,500,000 to Rp2,750,000 if there’s a prolonged risk-on phase and the rupiah strengthens significantly

XAUT/IDR 2026 outlook (range per XAUT)

- Moderate scenario: 82,000,000 to 92,000,000

- Bullish scenario: 92,000,000 to 105,000,000

- Defensive scenario: 75,000,000 to 82,000,000

Conclusion

Based on the current gold price snapshot and the XAUT/IDR movement, the most reasonable AI view is that the bigger trend is still upward, but there’s a chance of a pause or a mild correction in the very short term.

If your goal is investing, the key isn’t calling the exact top, but managing risk through staggered buying and understanding the denomination premium in physical gold. If you want a more flexible alternative, you can consider digital gold XAUT and track its movement directly here.

While tracking gold, you can also explore other opportunities: try trading on Bittime Exchange or read the latest crypto updates on Bittime Blog.

FAQ

Can tomorrow’s gold price forecast be accurate?

Forecasts help you evaluate scenarios, but they still can’t guarantee outcomes. Use them as guidance, not certainty.

Why can gold prices rise so quickly?

It’s usually driven by a combination of market sentiment, safe-haven demand, and exchange-rate moves.

What’s the difference between physical gold and XAUT?

Physical gold comes in bar form with denomination premiums, while XAUT is a digital asset that tracks gold’s value and is traded like crypto.

Why is the per-gram price higher for smaller denominations?

Because there’s a premium such as minting costs, distribution, and stock availability that raises the per-gram price.

Is it better to buy physical gold or XAUT?

It depends on your goal. Physical gold is suitable for long-term holding, while XAUT is better for transaction flexibility and fast price monitoring.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.