Clovis (CLO) Price Prediction 2026-2030: Long-Term Outlook

2026-01-27

Clovis (CLO) from Yei Finance has become one of the most interesting DeFi projects due to its cross-chain liquidity abstraction layer concept.

So, how is the price prediction for Clovis (CLO) for 2026–2030, and does this token still have long-term potential? Read this article to find out more!

Key Takeaways

- Clovis (CLO) is a cross-chain DeFi solution focused on aggregating global liquidity.

- CLO prices are being pressured due to technical factors and altcoin market sentiment.

- The long-term potential of CLOs depends on ecosystem adoption and crypto market recovery.

What is Clovis (CLO)?

Image Source: Yei Finance

Clovis (CLO) is a project developed by Yei Finance with the aim of unifying fragmented DeFi liquidity across multiple blockchains.

Instead of constantly moving assets between chains, Clovis leverages a global Clearing Layer combined with lightweight vaults on each chain.

This approach allows a single pool of liquidity to be used for multiple purposes simultaneously, such as lending and borrowing, asset swaps, and cross-chain transfers (bridges).

Interestingly, this liquidity can still generate stacked yields from various sources, making capital efficiency much more optimal.

Read Also: Bounce Token (AUCTION) Price Prediction 2026-2030: Latest Chart Analysis

CLO Price Performance Today

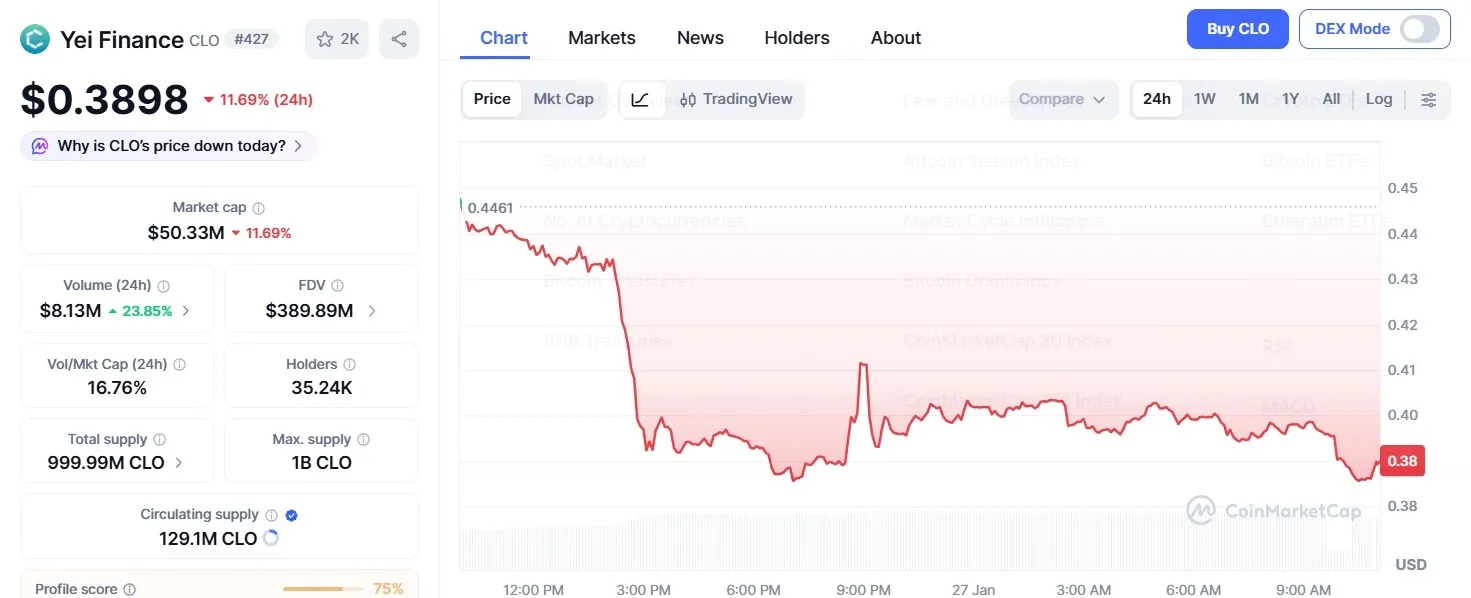

Image Source: Coinmarketcap

Based on the latest chart, CLO price is trading in the range of $0.38-0.39 today, down about 11% in the last 24 hours.

Over the past 7 days period, CLO has weakened by about 36.40%, underperforming the global crypto market.

Historically, CLO reached an All-Time High (ATH) of $0.9101 and an All-Time Low (ATL) of $0.1363. This means that the current CLO price is still about 57% below the ATH, but has risen over 180% from the ATL, indicating significant volatility.

Read Also: Oasis (ROSE) Price Prediction 2026: The Potential of a Privacy & AI Token

Analysis of the Causes of the Decline in CLO Prices

There are several main factors that suppress CLO prices in the short term, which as follows:

1. Technical Analysis Pressure

Technically, CLO has broken below the 7-day and 30-day SMAs, which are usually bearish signals.

The RSI indicator is in the oversold area, while the MACD indicator still shows negative momentum. This situation has prompted many short-term traders to exit the market.

A key support area currently sits around $0.38-0.40. If this level fails to hold, further downside is still possible.

2. Altcoin Sentiment Shift

The overall sentiment in the crypto market is also not favorable for altcoins. The Fear & Greed Index remains in the Fear zone, while Bitcoin's dominance is increasing.

This situation often causes investors to shift funds from high-risk altcoins to assets that are considered safer.

3. Pressure from the Sei Ecosystem

As part of the Sei Network ecosystem, CLO price movements are also influenced by the performance of the SEI token.

The recent weakening of the SEI price has put pressure on tokens within the ecosystem, including the CLO token, even though Yei Finance's on-chain activity continues to show growth.

Read Also: Dusk (DUSK) Price Prediction 2026: RWA Token Opportunity Analysis

Clovis (CLO) Price Prediction 2026-2030

Based on technical conditions, project fundamentals, and long-term adoption potential, the following is a moderate to optimistic 2026-2030 Clovis (CLO) price prediction.

2026

If the crypto market begins to recover and Clovis is successful in expanding adoption, CLO prices could potentially return to the $0,60-0,85 area. This level is still realistic because it is close to the previous ATH.

2027

Assuming consistent product development and increasing demand for cross-chain liquidity, CLOs could move in the range $0,90-1,20. At this stage, CLOs have the potential to achieve a new ATH if market sentiment is favorable.

2028

This year, the market focus will typically shift to utility and revenue protocols. If Clovis is successful,monetizeecosystem well, CLO prices could be in the range $1,30-1,80.

2029

As the cross-chain DeFi sector matures, CLOs have the potential to trade in the range $1,90-2,50, especially if the protocol's volume and TVL continue to increase.

2030

In a long-term optimistic scenario, Clovis could become a major cross-chain DeFi infrastructure. The price of CLO could potentially reach $2,80-3,50, although it remains dependent on global crypto market conditions and industry competition.

Read Also: Manta Network (MANTA) Price Prediction 2026: Latest Analysis

Conclusion

The Clovis (CLO) price prediction for 2026-2030 shows attractive growth potential, although the price is currently still under pressure.

CLOs are not just speculative tokens, but part of a cross-chain DeFi infrastructure solution that is quite relevant to future needs.

However, as with any crypto investment, the risk of volatility remains high and needs to be balanced with careful research and risk management.

Read Also: RAI Token (RAI) Price Prediction 2026: Latest Chart Analysis

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Clovis (CLO)?

Clovis is a DeFi project from Yei Finance that serves as a cross-chain liquidity layer for lending, swaps, and bridging.

Why has the price of CLO fallen recently?

The decline was triggered by technical pressure, negative altcoin sentiment, and the weakening of the related ecosystem.

Are CLOs still worth investing in for the long term?

CLOs are attractive from a technological perspective, but still carry high risks due to the volatility of the crypto market.

What is the potential price of CLO in 2030?

In an optimistic scenario, the CLO price could potentially be in the range of USD 2.8 to USD 3.5.

Does Clovis depend on the Sei ecosystem?

Yes, CLO performance is still quite influenced by developments and sentiment in the Sei Network ecosystem.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.