Latest Bitcoin Price Prediction for 21 January 2026

2026-01-20

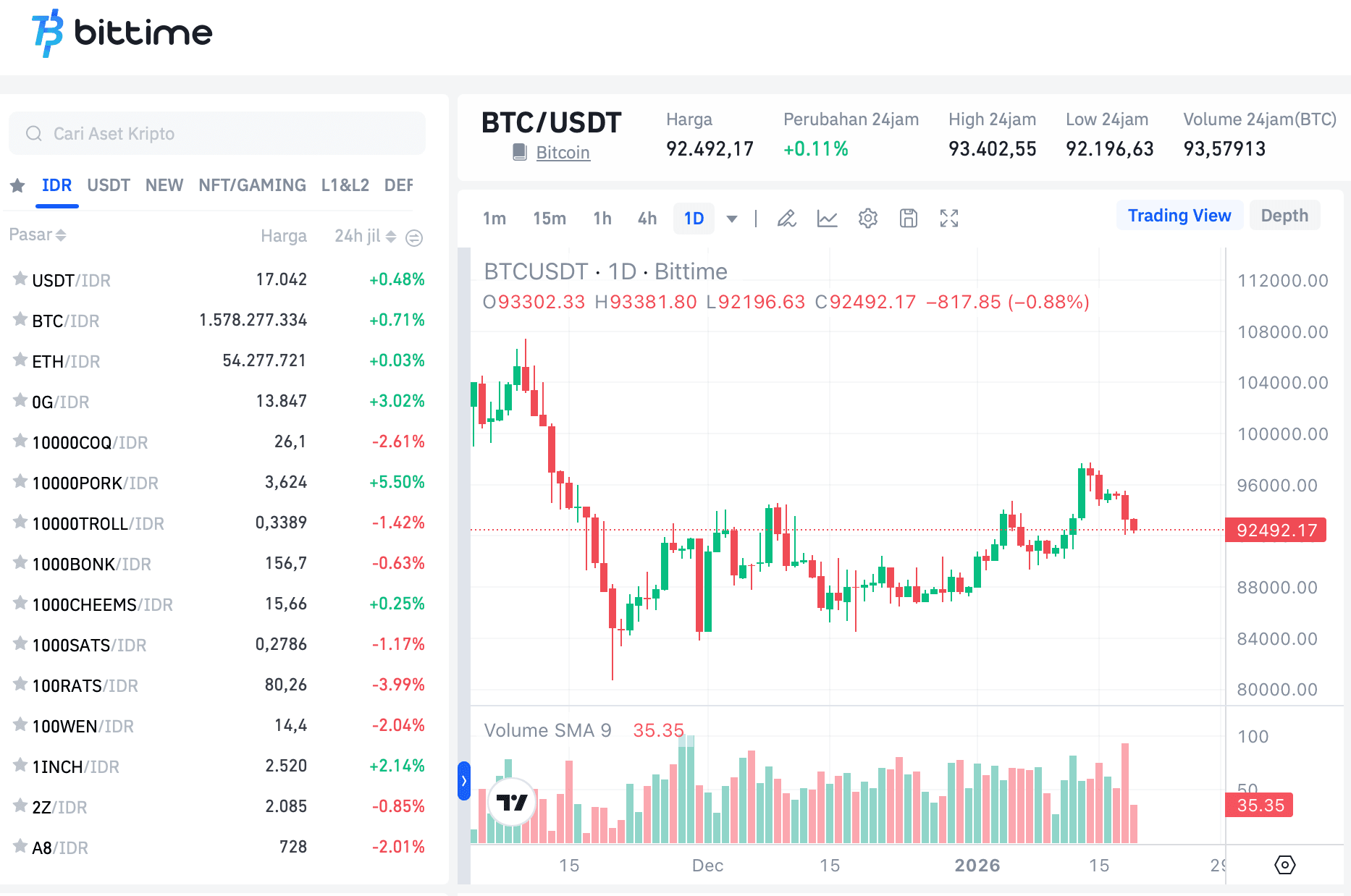

Bitcoin (BTC) is once again showing interesting price movements as mid-January 2026 approaches. As the largest-market-cap cryptocurrency, Bitcoin’s moves remain a primary focus for investors and traders in Indonesia.

Daily price analysis is important for reading short-term trend direction, especially amid a consolidation phase that appears to be ending. With volatility remaining present, understanding market conditions is key to decision making.

In this article, we review the latest Bitcoin price performance, technical analysis, and a price prediction for 21 January 2026 based on market data from Bittime.

Key Takeaways

- Bitcoin (BTC/IDR) is trading today around IDR 1.58 billion with an increase of about 0.71%

- Price structure shows a consolidation phase with a tendency to strengthen after rebounding from lower areas

- Main support is in the IDR 1.55–1.56 billion area, while a crucial resistance is around IDR 1.60–1.63 billion

Monitor the latest Bitcoin price and start trading BTC/IDR easily via the Bittime now.

Bitcoin Price Performance Today

Based on the latest data from Bittime, the price of Bitcoin (BTC/IDR) on 20 January 2026 was around IDR 1,578,277,334, recording an increase of about 0.71% in the last 24 hours.

Daily price movement shows relatively stable market activity with the following details:

- Last price: ± IDR 1.58 billion

- 24h high: ± IDR 1.60 billion

- 24h low: ± IDR 1.55 billion

- 24h volume: approximately 93.58 BTC

Read also:Dolomite (DOLO) Price Prediction: Trend & Sentiment Analysis

This condition indicates that trading interest remains intact although the market has not yet shown a strong breakout momentum.

Historical Price Movement of Bitcoin

The daily chart of BTC/IDR on Bittime shows that Bitcoin experienced selling pressure since late 2025, before forming a relatively solid base.

Read also:Polyhedra Network (ZKJ) Price Prediction: Short to Long Term

In recent sessions, price action has begun forming a higher-low pattern, a technical signal often associated with the initial stages of a gradual trend reversal. Selling pressure appears to be easing while buyers are re-entering at support areas.

Bitcoin Price Analysis Today – 20 January 2026

From a technical perspective, Bitcoin is currently in a phase of healthy consolidation. The price is relatively stable above key support areas, while trading volume remains at moderate levels.

As long as the price can hold above IDR 1.55 billion, the potential for further strength remains. However, if the price fails to break the nearest resistance, Bitcoin may move sideways in the short term.

Bitcoin Price Prediction 21 January 2026

On 21 January 2026, Bitcoin is expected to trade sideways with a bullish bias. Stable trading volumes and improving price structure are supporting factors for this outlook.

Read also: Obol (OBOL) Price Prediction: Short, Medium, and Long Term

With the current price around IDR 1.58 billion, Bitcoin could test resistance areas if buying volume increases. Nevertheless, volatility should still be anticipated given that the crypto market remains sensitive to shifts in sentiment.

Factors Affecting Bitcoin's Price

Market Sentiment

Short-term optimism remains intact alongside price gains and relatively stable trading activity.

Technical Indicators

The price structure starting to form higher lows opens up the possibility of testing resistance in the near term.

Read also: Maduro Memes (MADURO) Price Prediction: Chart Analysis and Potential

Global Market Conditions

Movements in the global crypto market and other risk assets remain external factors that influence Bitcoin’s direction.

Potential Scenarios

Bullish Scenario

If the price can break through the IDR 1.60 billion area, Bitcoin could continue rising toward around IDR 1.63 billion.

Bearish Scenario

If selling pressure increases again, the price could correct toward the IDR 1.55–1.56 billion area as the nearest support.

Conclusion

Considering the current price structure and market sentiment, Bitcoin on 21 January 2026 is expected to trade within the range of IDR 1.55 billion to IDR 1.63 billion.

Investors and traders are advised to keep monitoring price movements and trading volume, focusing on key support and resistance areas as the basis for decision making.

How to Buy Crypto on Bittime

Want to trade and buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favourite digital assets!

Check the rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see crypto market trends in real-time on Bittime.

Also, visit Bittime Blog for a variety of interesting updates and educational information about the crypto world. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to deepen your crypto knowledge.

FAQ

What is Bitcoin's price today on Bittime?

The price of Bitcoin (BTC/IDR) on 20 January 2026 was around IDR 1.58 billion, up about 0.71% in the last 24 hours.

What is the predicted price of Bitcoin for 21 January 2026?

Bitcoin is expected to trade in the range of IDR 1.55 billion to IDR 1.63 billion, depending on market sentiment and trading volume.

Does Bitcoin still have potential to rise in the near future?

As long as the price holds above support areas and buying pressure remains dominant, the potential for further upside remains open.

Where are Bitcoin's current support and resistance levels?

Support is around IDR 1.55–1.56 billion, while the nearest resistance is around IDR 1.60–1.63 billion.

Is this Bitcoin price prediction certain?

No. Price predictions are estimates based on technical analysis and market conditions. High volatility means price movements can change at any time.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.