Bitcoin Price Prediction February 10, 2025: Forecast and Trends

2025-02-09

Bittime - Bitcoin continues to be a digital asset that attracts attention with its dynamic price movements every day. Today's Bitcoin price analysis and predictions provide important insights for investors to understand the latest market trends.

Influenced by market sentiment, global news, and technical indicators, Bitcoin offers both great opportunities and challenges for those immersed in the world of crypto.

In this article, we will review the latest predictions, technical analysis, and factors that influence Bitcoin prices, so you can always be ready to face market changes.

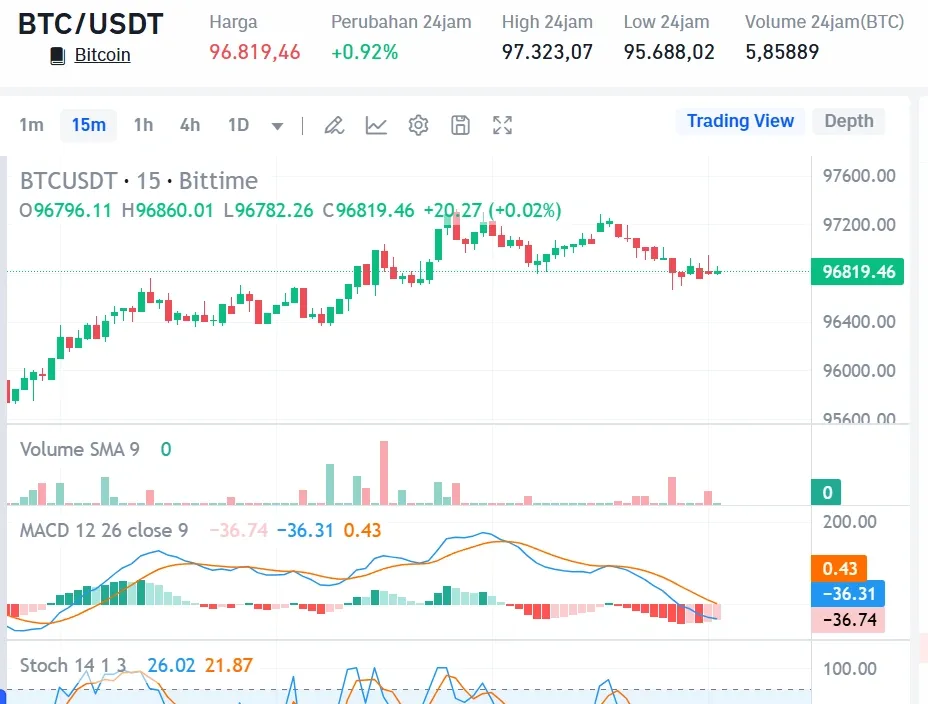

Bitcoin Price Performance Today

On February 9, 2025, Bitcoin price is trading in a range $96,819,46 take notes 0.92% increase in Last 24 hours. The market is showing volatility with daily lows at $95,688.02 and highest in $97,323,07. Bitcoin's total market capitalization stands at approx $1,918,474,500,713.83, reflecting strong investor interest despite recent price fluctuations.

Price BTC to USDT via Market Endtime

Historical Bitcoin Price Movements

Bitcoin has experienced significant growth over the past year, with a notable increase of approx 141,83% since January 2024, when the price is approx $42.461. This cryptocurrency hit an all-time high in $109.588 before Donald Trump's inauguration on January 20, 2025. This surge reflects bullish market sentiment, driven by expectations of pro-crypto policies from the new administration.

Currently, Bitcoin price is in a range $96,819,46, after experiencing 0.92% increase in the last 24 hours. Despite recent price fluctuations, Bitcoin's total market capitalization stands at approx $1,918,474,500,713.83, indicating investor interest remains strong amidst market volatility.

Read too Bitcoin (BTC) Price Prediction: Comprehensive Analysis

Factors Affecting Bitcoin Prices

Supply and Demand

- Supply Reduction (Halving) The reduction in Bitcoin supply through the halving process reduces rewards for miners, creating a supply shortage that triggers buying pressure.

- Supply and Demand Bitcoin Price greatly influenced by supply and demand. When many people want to buy Bitcoin and only a few sell it, the price will rise. Conversely, when many sell and few buy, prices will fall.

Market Sentiment and News

- News and Market Sentiment News and market sentiment plays a big role in Bitcoin price movements. For example, the announcement of a large company accepting Bitcoin as payment could increase public trust and interest.

- Adoption by Institutions and Companies The adoption of Bitcoin by financial institutions and large corporations has a significant impact on its price. When large companies start accepting Bitcoin or offering Bitcoin-related services, demand increases and drives the price up.

Government Regulations and Policies

- Regulatory Changes Government regulations greatly influence the price of Bitcoin. Regulations that support the use of Bitcoin can increase investor confidence, while regulations that limit or prohibit use can reduce prices.

- The Impact of Donald Trump's Policies The election of Donald Trump as US President and the appointment of prominent crypto advocates could provide a positive signal for the crypto industry, reducing uncertainty and encouraging more investors to get involved.

Global Economic Conditions

- Global Economic Conditions Economic uncertainty or high inflation drives investors to seek assets that are considered safe, which can increase demand for Bitcoin.

Other Factors

- Transaction Volume Transaction volume affects the price of Bitcoin.

- Profit Taking Action) After reaching record levels, investors often sell their Bitcoin holdings to take profits, causing selling pressure and falling prices.

- AI Technology Development: AI models like DeepSeek R1 can influence the crypto market. This open source AI model is considered a major achievement in technology. The main advantage of DeepSeek R1 lies in its efficiency. The breakthrough has shaken markets, triggering a decline in the value of AI-related cryptocurrencies as investors reconsider the value of tokens that rely on GPU-based operations.

Conclusion

HBitcoin's price is the result of dynamic and complex interactions between various factors that influence each other. Supply and demand, particularly through a halving event that reduces new supply, creates the potential for a price increase on February 10, 2025. Market sentiment, driven by news, institutional adoption, and technological developments, plays an important role in shaping investor confidence and, consequently, the value of Bitcoin.

Government regulation is a crucial factor, with policies that support crypto adoption increasing market confidence, while restrictive or prohibitive policies can depress prices. In addition, global economic conditions, including inflation and economic uncertainty, encourage investors to look for alternative assets such as Bitcoin.

Read too Everything Happening to Bitcoin Through 2024: BTC ETFs, Trump, and the All-Time High

Furthermore, factors such as transaction volume, profit-taking by investors, and even developments in the field of artificial intelligence (AI) can have a significant impact on the price of Bitcoin. AI developments, such as the launch of the DeepSeek R1 model, may impact the value of AI-related cryptocurrencies, indicating that new technological factors may lead to changes in the crypto landscape.

A comprehensive understanding of all these factors is essential for investors and market observers to navigate the ever-evolving complexity of the cryptocurrency market. By considering the interaction between supply, sentiment, regulation, global economic conditions, and new factors such as AI, investors can make more informed decisions in the dynamic Bitcoin market.

Support and Resistance Levels

Nearest Support Level:

$97,258

If this level is broken, there is a possibility of testing the $96,000 level and then $92,000. Another analyst mentioned $93,500 as a support level.

Key Resistance Levels:

$99,000 - $100,000

A break of this level with strong volume can pave the way for a bullish trend. Other resistance is at $103,500 and $110,000.

Relative Strength Index (RSI)

Currently the RSI is at 69, indicating positive momentum and supporting the potential for further increases9.

Analysis of Bitcoin Predictions for February 10, 2025

Bitcoin is expected to experience significant movement after a period of volatility that occurred at the end of January. Some factors that influence this analysis include:

Bullish Scenario

Condition: JIf Bitcoin manages to break the resistance level at $100,000 and maintain momentum above $99,000.

Support: Driven by continued increasing institutional interest and positive sentiment from the market.

Potential Surge: There is potential for price spikes. Bullish targets are at $103,500 and $110,000.

Bearish Scenario

Condition: If Bitcoin falls below the support level of $97,258.

Impact: This could trigger profit-taking, with support targets around $96,000 and $92,000.

Further Decline: Could lead to a test of the psychological level at $95,000.

Consolidation Scenario

Condition: Bitcoin may move sideways between $97.258 and $100,000.

Evaluation: Investors will evaluate the impact of the latest economic news and monetary policy.

Bitcoin Price Prediction for February 10, 2025

The Bitcoin price prediction shows the potential for an interesting move with the price expected to be around $103,500 And $110,000 depending on the ability to break through major resistance. Mixed market sentiment and recent liquidation action are key factors in this projection. Investors are advised to remain alert to market developments and news that may affect prices.

Overall, current market conditions show uncertainty with selling pressure still existing. However, there are also positive signals of increased institutional interest. Therefore, monitoring price developments in the next few days is very important to determine the right trading strategy.

Read too How to Buy Bitcoin (BTC)

Conclusion

Comprehensively, Bitcoin market conditions on February 9 2025 represent a crucial period that requires close monitoring by investors. Traded around $96,655.9, Bitcoin is facing a crucial point where its next price movement depends heavily on its ability to navigate clear support and resistance levels.

The nearest support level is at $97,258 become an important bulwark to prevent further decline. If this level is broken, the price has the potential to test the $96,000 level and even $92,000, which could trigger further selling and push the price down towards the psychological level at $95,000.

Instead, the main resistance levels are in between $99,000 And $100,000 serves as a significant obstacle to the bullish trend. Successfully breaking through this resistance with strong trading volume could pave the way for positive price movement, with a potential target at $103,500 And $110,000 on February 10, 2025.

Technical indicators such as the Relative Strength Index (RSI) are currently at 69, indicating positive momentum that could support potential further upside. Chart pattern bull flag on the weekly chart also gives hope for a bullish movement if the key resistance level is broken.

However, mixed market sentiment and economic uncertainty warrant a cautious approach. Factors such as tariff policy, US economic data and Fed policy expectations continue to influence investor sentiment. While increased institutional interest and positive market sentiment may push prices higher, selling pressure and risk of profit-taking limit the potential for significant upside.

Therefore, investors should maintain a balanced outlook by monitoring price developments closely and staying abreast of the latest economic and policy news. Adapting trading strategies based on changing market dynamics will be critical to success in the dynamic Bitcoin market. Staying alert and ready to respond to unexpected market movements will be key to navigating this complex crypto landscape

FAQ

1. How high is Bitcoin expected to rise on February 10, 2025?

Predictions vary, but many analysts expect momentum bullish. More realistic targets are $103,500 and $110,000 if it can break the main hurdle. Other analysts are targeting $120,000 and $150,000 in 2025.

2. What factors can influence the price of Bitcoin on that date?

Key factors include interest from institutional investors, market sentiment, regulation, and global economic news. Potential support from the Donald Trump administration is also a factor to watch.

3. Is there a risk of Bitcoin price dropping on February 10, 2025?

Yes, although there is potential bullish, the crypto market remains volatile. Investors should be aware of potential sell-offs, negative regulatory developments, and economic uncertainty that could cause prices to fall.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.