ASTER Price Prediction for October 2025: Correction or Rebound?

2025-09-30

Bittime - ASTER (ASTER token) attracted public attention after a rapid rally in late September 2025, with a surge of more than 350% in a few days.

However, the rally wasn't without challenges: ASTER subsequently experienced a sharp correction, falling more than 30% from its peak to around $1.70.

Now, as October approaches, investors are wondering: will ASTER recover, or is the correction still far from over?

This article examines the fundamentals underlying ASTER demand, technical analysis within the narrative, and scenarios – from bullish to bearish – that may occur in October 2025.

Fundamental ASTER

Before diving into predictions, it's important to understand a little background on ASTER. ASTER is a decentralized DEX offering spot and perpetual trading, with high leverage and a "trade & earn" mechanism—where the capital used for trading can also generate passive returns.

In its latest rally, ASTER received strong support from whale demand (large holders) and a surge in TVL (Total Value Locked) on its protocol.

Whale demand and the increase in TVL were among the driving forces behind ASTER's rise during that rally.

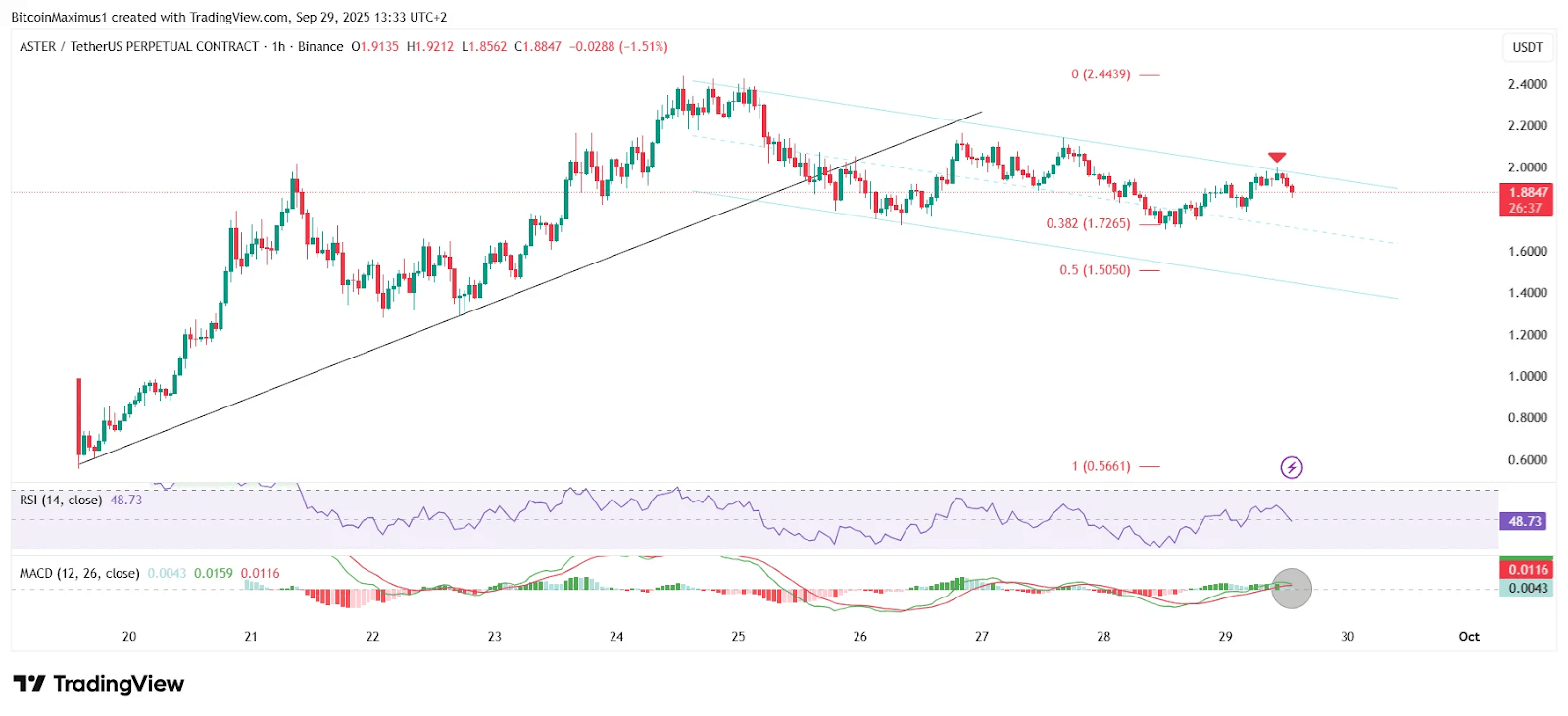

However, the rapid rally also carries the risk of overextension: ASTER finally “broke down” from the ascending trendline, entering a short-term descending channel pattern, and technical indicators such as the RSI and MACD show uncertainty.

With this in mind, let's take a look at the ASTER price prediction for October 2025.

Read Also: What is Aster (ASTER)? Tokenomics and Price Prediction

Technical Analysis of Narratives: Patterns, Stresses, and Points of Interest

Currently, the price movement of ASTER looks like it is in ashort-term descending channel: the price moves up and down between the ceiling and bottom of the channel.

After rallying to a peak of $2.43 (on September 24), the price failed to maintain momentum and broke through the previous uptrend line, proving that a correction had begun.

The correction brought ASTER to a low price of around $1,70on September 28. Despite recovery efforts, ASTER has not been able to break through the upper boundary of its channel, indicating that resistance pressure remains strong.

On the technical side, indicators such as the RSI have already fallen below 50 — a signal that bull momentum is starting to weaken — while the MACD has formed a bearish cross which indicates the potential for further selling pressure.

In the wave count framework, there are indications that ASTER has completed the lateral wave (B) and may be entering wave C.down.

If waves A and C are balanced, the basic target of the correction could be in the range$1,29– levels that also relate to Fibonacci retracements and the lower channel support line.

However, there are optimistic signals too: some analysts say ASTER has formed a bullish pattern.bullish flag in the medium-term technical framework, which if an upward breakout occurs, could push the price to $3 or more.

So the narrative is: ASTER is in a tense consolidation phase between downward pressure from a correction and a potential rebound if a breakout occurs.

The price will attempt to test the upper channel boundary (resistance) and the lower boundary as support.

Read Also: How to Buy ASTER on DEX: A Complete Beginner's Guide & Safety Tips

ASTER Price Prediction October 2025

Based on technical modeling and fundamental conditions, the following are possible scenarios:

- Bearish Scenario (More likely in the short term):The correction continues and ASTER could drop to $1,29 as the base of wave C. If this support fails to hold, the risk of further decline remains.

- Consolidation Scenario:Prices fluctuate within a range $1,40 – $2,10, forming a sideways pattern waiting for a major catalyst (listing, adoption, technology announcement).

- Skenario Bullish (Breakout):If ASTER is able to break through the upper boundary of the channel with strong volume — especially with the help of positive news of a major listing or partnership — the price could break into the region $2,50 – $3,00 in the medium term.

Some prediction estimates also say that the average price of ASTER for 2025 could be around$1,383, with the potential for a bullish peak of up to$2,074if adoption increases.

Read Also: Aster Price Today | ASTER/IDR

Risks to Watch Out For

- If ASTER continues to fail to break through the channel resistance, selling pressure could become dominant.

- High liquidity/volatility due to large leverage makes ASTER vulnerable to mass liquidations.

- Negative news, exchange listing delays, or technical failures can damage trust.

- If the crypto market macro declines, ASTER as an altcoin token could be hit hard.

Read Also: How to Buy and Sell Crypto on Aster DEX: The Complete Guide

Conclusion

The ASTER price prediction for October 2025 is more bearish and consolidative in the short term. The correction from the $2.43 peak may not be complete, with a potential bottom towards $1.29 if further pressure occurs.

However, bullish opportunities remain if the price manages to break through the channel resistance, supported by volume and positive news (listings, adoptions). In such a scenario, ASTER could surge to $2.50 or even $3.00.

Investors are advised to be patient, pay attention to key technical levels, and be careful with high leverage and speculation.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

Is the ASTER correction complete?

Not yet. Wave analysis and technical indicators suggest there's still potential for further downside towards $1.29, the base target of wave C.

What is a realistic ASTER price target in October 2025?

In a bullish scenario: $2.50 – $3.00; in a moderate/consolidation scenario: $1.40 – $2.10; in a bearish scenario: down to $1.29.

What are the main factors that could trigger an ASTER breakout?

These factors include listing on major exchanges, strategic partnerships, increasing demand, and wild adoption in the ASTER ecosystem.

Is ASTER safe for leverage traders?

High leverage (up to 1001x in the ASTER platform) carries the risk of rapid liquidation, especially if the price moves even slightly against the position.

Should I buy ASTER now?

If you're prepared for high risk and have an exit plan, entering at the bottom of the channel (avoiding resistance) might be worth considering. However, if you're not comfortable with volatility, waiting for confirmation of a breakout is a safer strategy.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.