Allora Price Prediction 2025–2030

2025-12-11

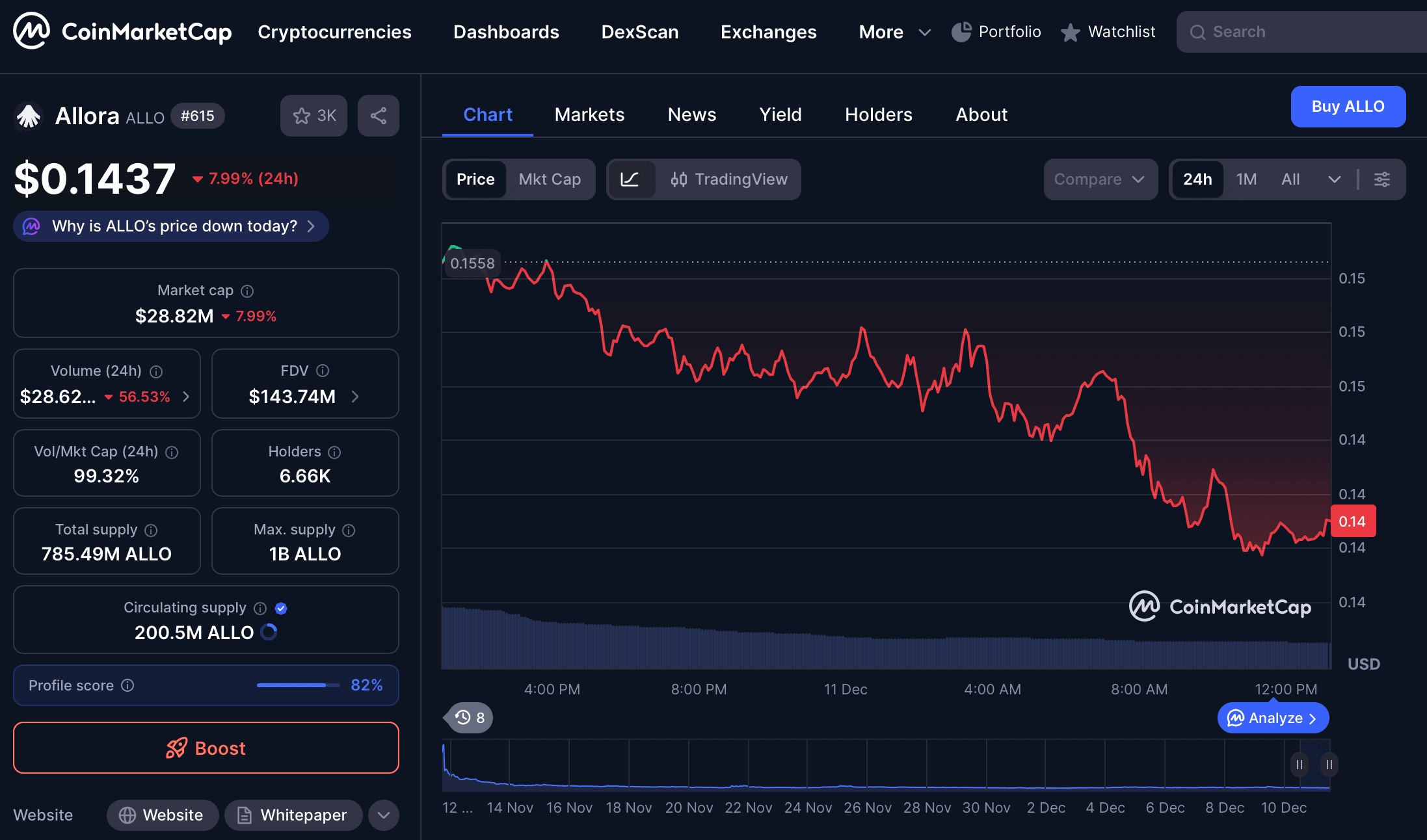

Allora has drawn attention from many traders after its price fell sharply in December 2025. Many are wondering whether this drop is just a routine correction or an early sign of a longer-term trend.

To answer that question, this article examines Allora price forecasts from 2025 to 2030 by looking at three main factors: fundamentals, staking, and market conditions. The content is written in a light, easy-to-read style so you can follow the analysis without excessive scrolling.

Network Adoption and Allora Partnerships (2025–2030)

One of the biggest influences on Allora's price is how quickly its technology is adopted within the blockchain ecosystem. At the end of 2025, Allora announced integration with TRON. This move drew attention because TRON has a large amount of value locked and typically adopts new features quickly to support DeFi applications.

This integration gives Allora the chance to offer services like volatility forecasts, risk models, and AI-driven data that can be used by TRON protocol. If this usage grows organically, demand for Allora tokens could rise as more applications require AI inference.

However, the road is not that easy. Allora competes with large data providers like Chainlink and Pyth, which already have strong reputations. Developers tend to choose proven solutions, so Allora must offer tangible advantages.

Read also: Bitcoin Price Forecast (BTC): A Comprehensive Analysis

The crypto AI sector is also under pressure, with market capitalization down more than ten percent in one month. This means new adoption needs to be stronger to counter negative sentiment.

In the 2025–2027 period, growth in Allora usage will be a key indicator. If network activity increases, especially in DeFi applications, the chances of price appreciation are higher. But if adoption remains limited to trials, the impact may be insignificant.

If you're interested in learning about crypto assets like Allora, creating an account onBittime.com can be a good first step because the platform is easy to use and suitable for beginners.

Impact of Staking and Tokenomics on Allora Price Movement

Besides network adoption, staking is an important aspect investors watch. Allora's staking program currently offers yields of around twelve percent per year, which can attract users who want to hold tokens mid term.

Currently, about twenty eight percent of the circulating supply is staked. This indicates that a sizable portion of tokens is not available on the market, which reduces selling pressure. The higher the staking rate, the more stable price movements tend to be.

However, Allora's tokenomics present a significant challenge. Eighty percent of the token supply is still locked and will be unlocked gradually toward 2026. When those tokens are released, the supply entering the market could increase and pressure the price if not matched by rising demand or staking interest.

Read also: SOON Price Forecast (SOON) 2025–2030

Staking will be an important support during that period. If staking participation increases, selling pressure from token unlocks can be reduced. But if yields fall and many stakers exit, price volatility may rise.

From a technical perspective, Allora's RSI was once in a heavily oversold zone. This condition often allows for a potential rebound, but without fundamental support, any rebound may not last long.

If you want to learn more about how staking and tokenomics work in the crypto ecosystem, you can study them directly through Bittime.com, which provides educational guides in simple language.

Market Sentiment and Long Term Technical Analysis for Allora

Overall crypto market conditions also heavily influence Allora's price. This December, the market fear index stood at twenty nine out of one hundred, indicating that investors are cautious. Such a situation usually makes it harder for altcoins to move as capital tends to flow to Bitcoin.

Bitcoin dominance remaining above fifty five percent adds pressure because altcoins usually need a decline in BTC dominance to start rising. As long as this condition persists, Allora's upside may be limited.

Technically, a key resistance area is around $0.15. The price has attempted to break it several times but failed. If this level is eventually breached with strong buying volume, the short term trend could turn more positive.

For nearby support, the $0.13 level is being watched by many traders. If it is broken, selling pressure could increase.

Read also: Long Term Price Forecast for SpaceN Token (SN)

Looking ahead to 2030, Allora needs to prove that the decentralized AI technology it develops is truly used in real world applications. If the crypto AI sector sees a recovery and Allora manages to build a solid user base, its prospects could be promising.

But if competition intensifies or adoption remains slow, Allora could enter a prolonged consolidation phase in which the price moves sideways while waiting for the next major catalyst.

Conclusion

Allora price forecasts for 2025–2030 are heavily influenced by three factors: network adoption, staking strength, and global market conditions. Integration with TRON offers positive potential, but the crypto AI sector is under pressure so adoption must grow significantly to affect the price.

If Allora succeeds in attracting more developers and maintaining staking interest, its long-term trend could be more stable. You can monitor indicators such as network activity, application growth, and Bitcoin dominance to understand where the price may be headed.

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures transactions are safe and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check exchange rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see real-time crypto market trends on Bittime.

Also visit Bittime Blog to get more updates and educational information about crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

Does Allora have a chance to rise in the future?

There is potential if network adoption grows and market sentiment is supportive.

Does Allora staking affect the price?

Yes, staking helps reduce circulating supply, which can stabilize price.

Is the TRON integration important for Allora?

It is fairly important, but the impact depends on how many applications actually use Allora's technology.

Could the 2026 token unlock pressure the price?

Yes, especially if token holders choose to sell in large quantities.

What indicators should Allora traders monitor?

Technical resistance, network activity, and trends in the crypto AI sector.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.