DeFi Opportunities and Risks in Indonesia: What Users and Developers Should Be Aware of

2025-10-13

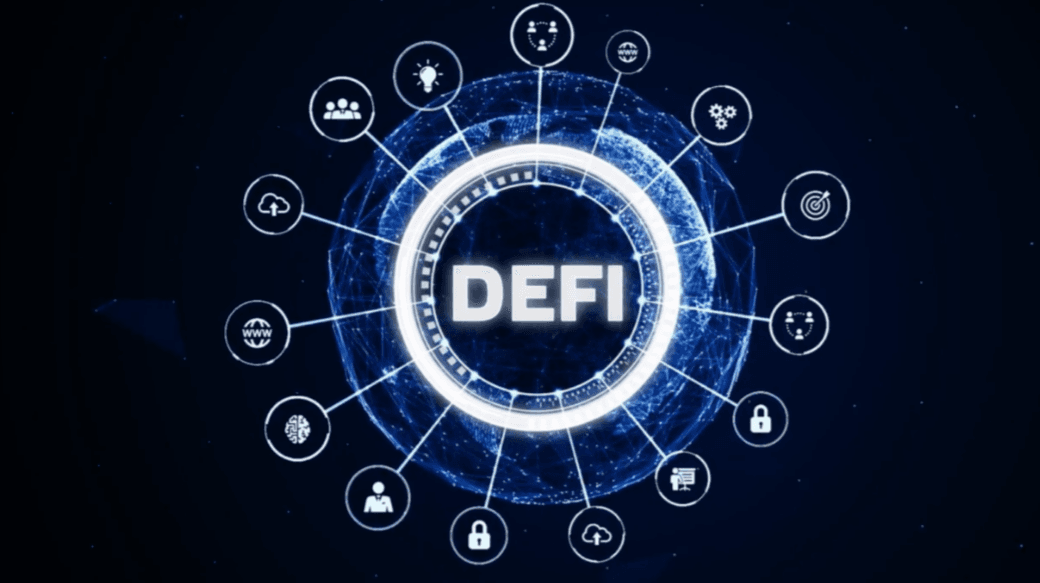

Bittime - DeFi is a breakthrough in digital finance that eliminates traditional intermediaries, and interest in DeFi in Indonesia appears to be growing. However, as opportunities grow, risks also lurk—from smart contract vulnerabilities to regulatory uncertainty.

Understanding the opportunities and risks of DeFi in Indonesia is crucial for users and developers to take cautious and strategic steps.

DeFi Opportunities in Indonesia — Financial Inclusion and Innovation

One of DeFi's strengths is its potential to expand access to financial services for unbanked communities. Decentralized lending platforms can reach remote areas via internet connections without the need for physical branches.

On the innovation side, DeFi opens up opportunities for yield farming, cross-asset staking, and the tokenization of local assets such as agriculture, seafood, or real estate. Local projects leveraging DeFi can attract domestic capital and strengthen the digital financial ecosystem.

Several Indonesian blockchain startups are exploring DeFi integration with microfinance applications, token-based supply chain financing, and creative financing protocols within the Web3 ecosystem. If regulations are supportive, DeFi could become a funding alternative for MSMEs.

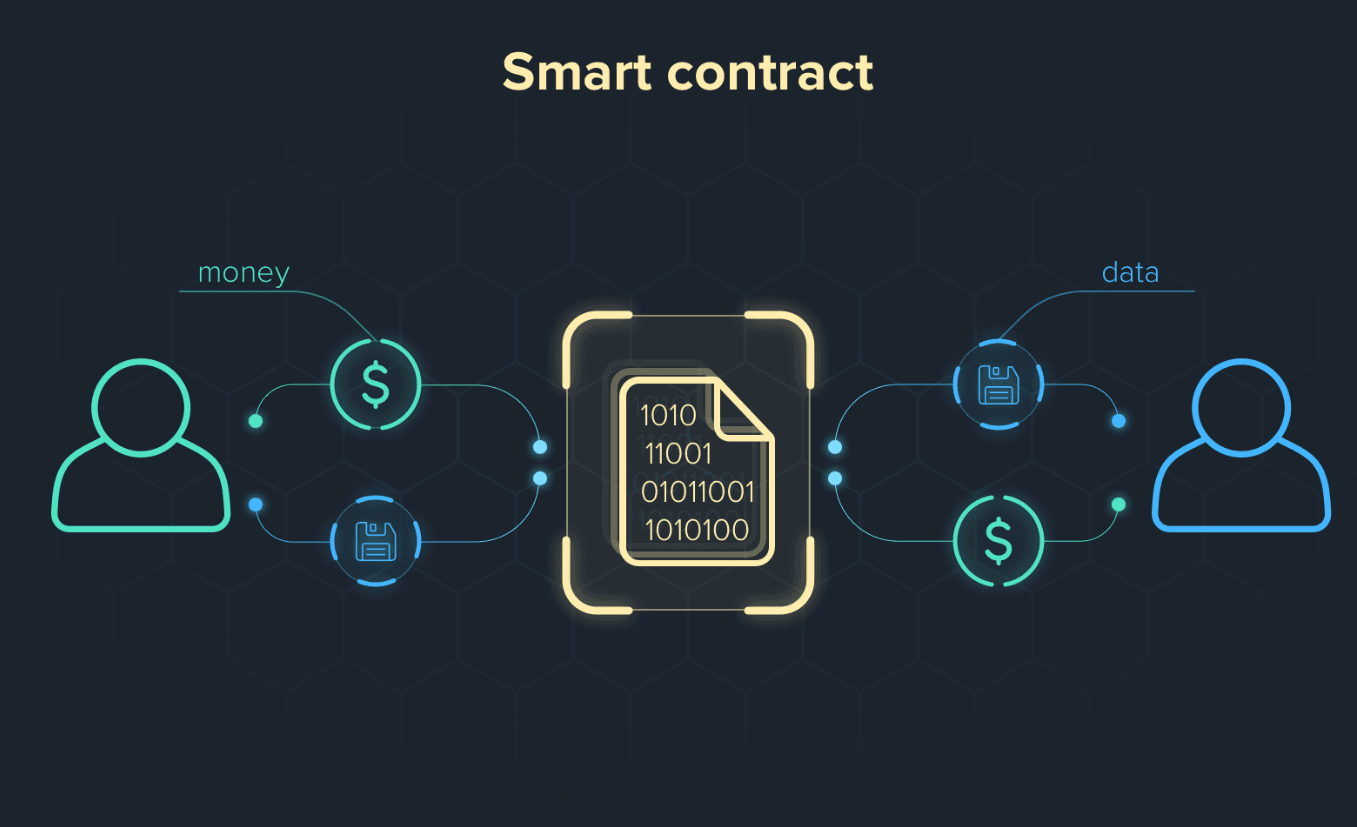

Smart contract risks and protocol security

The main risk of DeFi is bugs and vulnerabilities in smart contracts. Small code errors can be exploited to compromise or exploit user funds. Indonesia has witnessed cases of hacks of local protocols that resulted in significant losses.

Additionally, the concept of fragmented liquidity causes capital to be spread across multiple L2 protocols or sidechains, so that when the market is stressed, liquidity can suddenly dry up.

The risks of slippage, rug pulls (developers suddenly withdrawing funds), and price manipulation through decentralized exchanges are also real.

Users should check independent audits, the development team's track record, and fallback mechanisms (e.g., emergency stop) before using a DeFi platform.

Regulatory challenges and legal certainty

Regulation is a major challenge for DeFi in Indonesia. To date, there are no specific regulations governing decentralized finance protocols.

Financial authorities (such as the Financial Services Authority) and commodity market authorities (such as Bappebti) still treat crypto assets and tokens as commodities or financial instruments.

Regulatory uncertainty leaves DeFi projects in a legal gray area: do DeFi protocols need a license to operate as financial providers? What is the liability for losses caused by bugs?

Anti-money laundering (AML) and user identification (KYC) regulations are also difficult to implement in a decentralized manner without violating privacy principles.

According to Chambers' practice guide for Indonesia, Indonesian blockchain regulation is still fragmented and many new aspects such as DeFi are not yet explicitly covered as reported byPractice Guides Indonesia.

Adoption, interoperability, and user education

Adoption barriers are a real obstacle. Many potential users don't understand DeFi mechanisms such as impermanent loss, asset ownership, or liquidity risk. Digital financial literacy levels still vary in Indonesia.

Interoperability between DeFi protocols and across networks (Ethereum, Solana, Binance Smart Chain) is also a technical challenge. To prevent capital from being trapped in silos, secure and efficient bridges are needed.

Local platforms must promote education, simple UI/UX, and transparency to allow novice users to enter DeFi with minimal risk. Collaborating with community initiatives, academics, and regulators can create a healthier DeFi ecosystem.

Conclusion

DeFi in Indonesia holds numerous opportunities: expanding financial inclusion, supporting local financial innovation, and opening new funding channels. However, smart contract security risks, fragmented liquidity, and unclear regulations are major stumbling blocks.

Developers and users must be selective: use audited protocols, understand their operational mechanisms, and pay attention to regulatory status. If the DeFi ecosystem can grow at a controlled pace, Indonesia could become a hub for DeFi innovation in Southeast Asia.

FAQ

What is DeFi and why is it important in Indonesia?

DeFi (decentralized finance) is a financial system that runs on the blockchain without traditional intermediaries. It's important because it can reach the underbanked and offer new financial instruments.

Is DeFi legal in Indonesia?

There is no specific regulation for DeFi, leaving protocols in a legal gray area. DeFi projects need to consider licensing, responsibilities, and potential legal liabilities.

How to reduce risks when using DeFi?

Use audited protocols, diversify your capital, understand fees, and don't invest large amounts in a single protocol without testing it first.

Which DeFi protocol is suitable for Indonesian users?

Protocols that support popular networks in Indonesia (such as Ethereum, BSC) and have high liquidity and a transparent team can be a safer choice.

What can regulators do to support DeFi?

Regulators can establish a clear legal framework for DeFi protocols, regulate appropriate KYC/AML aspects without compromising privacy, and encourage pilot projects with government sectors for education and oversight.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.