5 Crypto Neobanks That Will Be Hot in 2026 — A Complete Analysis

2025-12-05

Bittime - Crypto neobanks are increasingly emerging as a bridge between modern banking services and digital asset capabilities.

In this article, we review five projects that demonstrate the combination of product, liquidity, and adoption that has the potential to drive momentum in 2026.

We present key keywords such as crypto neobanks and best crypto neobanks from the start to help readers find quick and relevant context.

1. ether.fi — The Restaking Model That Becomes a Liquidity Engine

ether.fi started as a liquid restaking protocol but strategically developed features similar to banking products: liquidity from staking, yield that can be used as collateral, and an interface that makes it easy for users to earn income while still being able to spend their assets.

The shift from a yield protocol to a bank-style product comes as ether.fi has expressed its ambition to become a “save, grow, spend” platform, offering an account-like facility that offers interest and payment capabilities.

For readers assessing risk, the restaking model increases TVL and provides utility but also adds technical complexity and smart contract risk—so keep an eye on audits, insurance, and regulatory support.

Sign up now on Bittime and start trading crypto assets today. The process is fast, secure, and you can immediately purchase your favorite tokens!

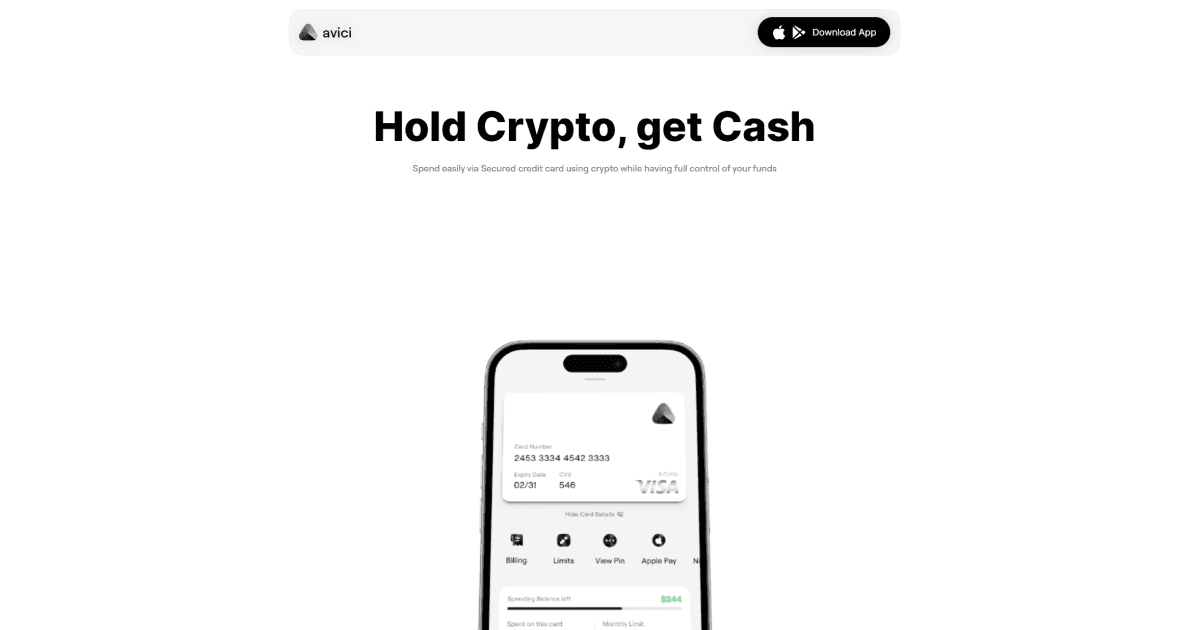

2. Avici — Ready-to-Use Retail Cards and Access

Avici stands out for its highly focused approach to user experience: mobile apps, Visa card issuance, and fiat onramps that simplify everyday use.

Avici's crypto-to-fiat card product has entered public beta, boasting initial transaction volumes and easy card signup. This model positions Avici as a convenient neobank targeting users who want to spend crypto directly at traditional merchants.

Success factors will depend on compliance with KYC regulations and regional banking regulations, a reliable card network, and competitive conversion fees. If Avici maintains its volume growth and service expansion, its popularity could surge by 2026.

3. Mantle — Foundation for On-Chain Banking

Mantle has moved from being a mere Layer-2 to a platform that positions itself as on-chain banking infrastructure.

The team is launching features geared towards payments, cards, and cross-asset liquidity, making the concept of “on-chain banking” no longer just a buzzword but a product being tested in the market.

Indicators to watch include infrastructure partnerships, the adoption of protocols for fiat-to-stablecoin conversion, and the launch of Mantle Banking, or UR, services aimed at retail and institutional users.

If the technical roadmap and payment card integrations continue as per the beta announcement, Mantle has the potential to become one of the most publicly known crypto neobanks by 2026.

4. THORWallet — A Functional Multichain Non-Custodial Neobank

THORWallet comes from the THORChain ecosystem with the advantages of cross-chain exchange and non-custodial features.

Its shift to a consumer product offering swaps, storage, and a utility token makes it attractive as a “neobank” that prioritizes user control over assets while providing access to financial services.

THORWallet also launched the TITN token and expanded its listings on multiple exchanges, moves that typically increase product liquidity and visibility.

The challenges include ensuring ease of use for the non-technical segment and ensuring stable liquidity when users use the payment feature.

If the user experience and card or payment gateway integration are improved, THORWallet could be a hot multichain neobank option by 2026.

5. VPay — OmniBank AI Concept for Web3 Users

VPay is building a different narrative: combining fiat account functions like USD accounts and card issuance with an AI assistant to manage portfolios of fiat, crypto, and synthetic instruments.

This approach targets users who want a single interface for all their modern financial needs. VPay's roadmap focuses on merchant integration, card services, and AI features that simplify asset management.

The success of this model is closely tied to regulation, banking partnerships for fiat onramps/offramps, and the reliability of AI in managing decisions involving real money. With a robust ecosystem and the appropriate operating permits, VPay has a strong chance of becoming a global leader in 2026.

Conclusion

The five projects discussed demonstrate different paths to crypto neobank status: Mantle's infrastructure, ether.fi's liquidity staking, Avici's focus on cards and retail, THORWallet's multichain non-custodial approach, and VPay's combination of fiat, crypto, and AI.

Each has its own growth drivers and technical and regulatory risks. For readers following the market, it's important to separate hype from real adoption by assessing product launches, evidence of transaction volume, and regulatory compliance.

FAQ

What is a crypto neobank?

A crypto neobank is a digital financial service that provides bank-like features such as accounts, cards, and payments, but is designed to manage crypto assets and integrate fiat onramps and offramps.

How do crypto neobanks generate revenue?

Common revenue models include fiat conversion fees, spreads on crypto conversions, card issuance fees, and revenue from yield or liquidity provisioning services.

Are crypto neobanks safe to store assets?

Security depends on the architecture: custodial services store assets centrally, while non-custodial options place the keys in the hands of users. Always check smart contract audits, KYC practices, and insurance, if available.

How to choose the best crypto neobank for me?

Consider the products you need — card payments, yield access, or non-custodial control — and then check for proof of volume, product roadmaps, security audits, and regulatory compliance in your region.

Will regulations limit crypto neobanks?

Regulation is indeed a determining factor. Neobanks' strength lies in their ability to combine compliance with product innovation. Regulatory changes in each country will impact service availability and business models.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.