Getting to Know Morpho (MORPHO): How It Works, Tokenomics, and How to Use It

2025-10-06

Bittime - In the DeFi world, Morpho stands out as a lending protocol known for an efficient, permissionless “lending primitive” approach.

Not just an interface—Morpho is designed as an infrastructure layer that enables anyone to open decentralized lending markets with low cost and high throughput.

This article explains Morpho’s core concepts, the MORPHO token, risks, and how ordinary users can start interacting with the protocol.

What is Morpho?

Morpho is a decentralized lending protocol operating in EVM environments that focuses on over-collateralized markets (loans backed by collateral greater than the loan value).

The core idea is simple: build lending markets more efficiently than traditional models by using immutable smart contracts as the base layer—allowing lenders, borrowers, and other apps to interact trustlessly.

Morpho is more than a single app; it’s an ecosystem: the core protocol, several user interfaces, a supporting association, and governance mechanisms via the MORPHO token.

Read also:What Is Morpho (MORPHO)?

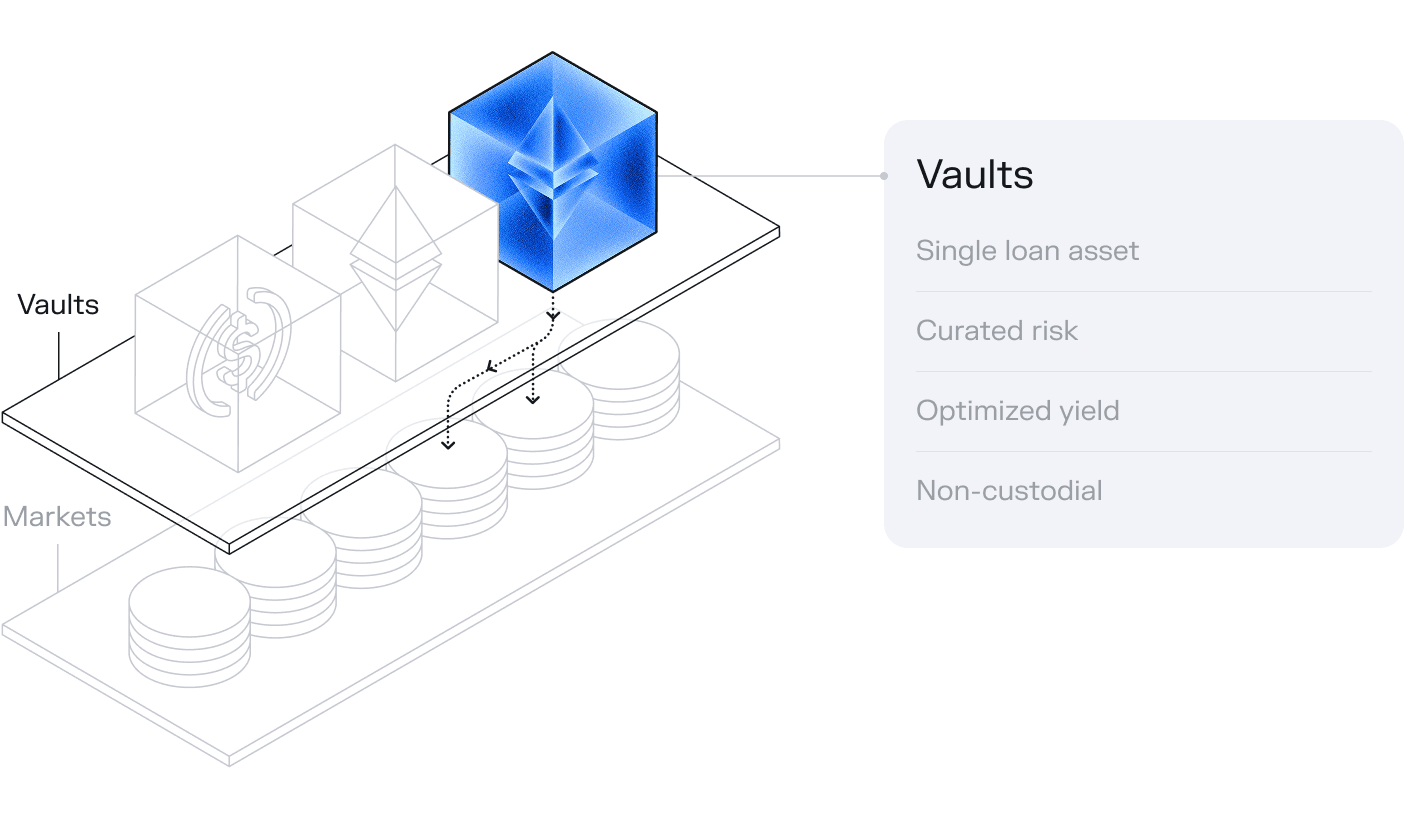

How Morpho Works

Imagine visiting an on-chain lending marketplace: there are shelves of markets for various ERC20s and ERC4626s.

On Morpho, each market is guarded by contracts that run logic for dynamic interest calculation based on supply-demand, as well as liquidation rules (LLTV) to keep the protocol healthy.

Users who want to “park” assets (lenders) deposit into Morpho vaults or markets—but retain full control of their assets because Morpho is non-custodial.

On the borrower side, borrowers post collateral greater than the loan value (over-collateralized); if collateral falls below the LLTV threshold, protection mechanisms trigger liquidation to protect the protocol.

All of this occurs permissionlessly, enabling developers to build UIs, vaults, or complementary services on top.

MORPHO Token & Tokenomics

The MORPHO token is not just a medium of exchange—it is the backbone of governance and incentives in the Morpho ecosystem.

The token is designed to facilitate community voice in DAO decision-making, incentivize users and contributors, and support reward distribution mechanisms that help the protocol grow sustainably.

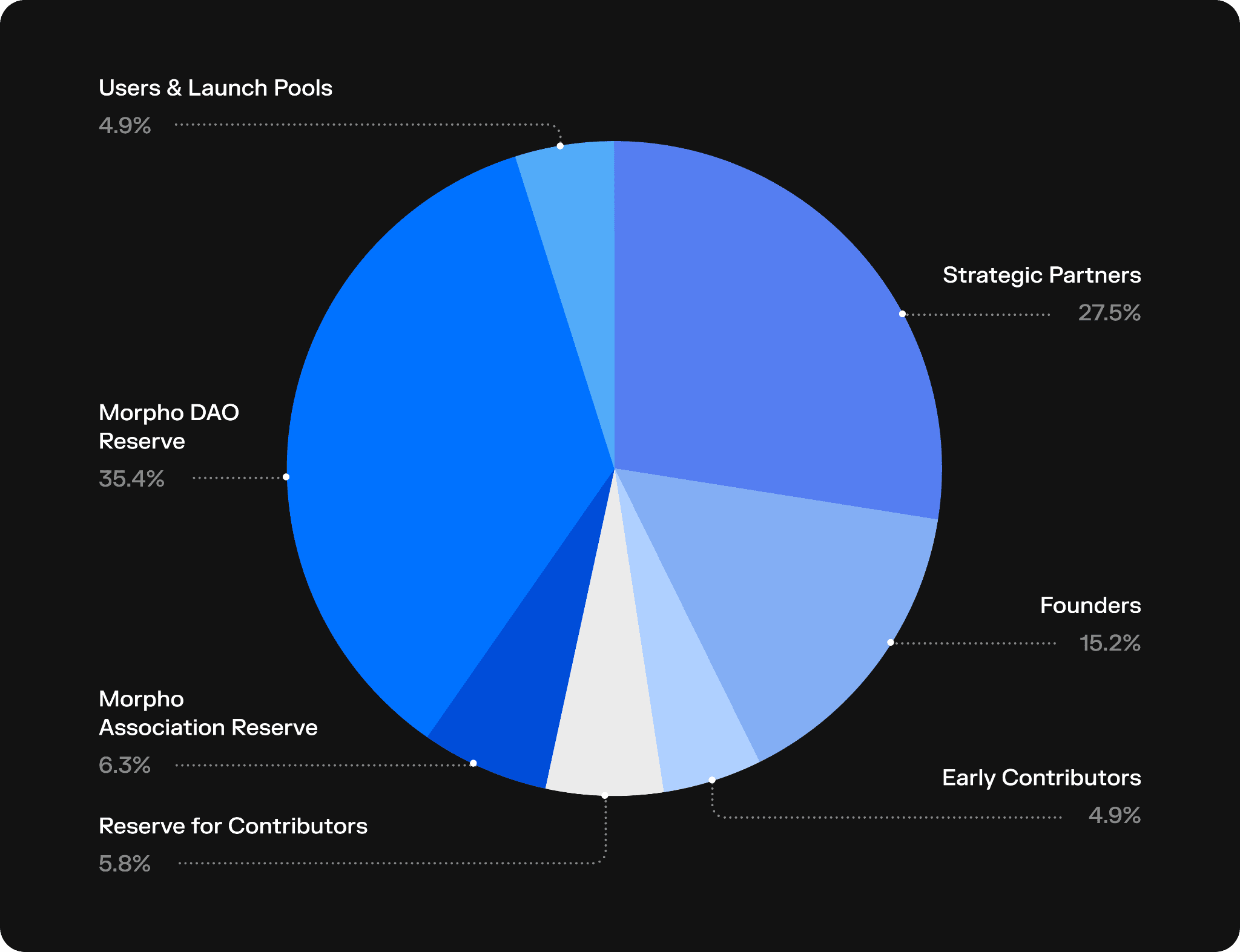

MORPHO Tokenomics

- Maximum total supply: 1,000,000,000 MORPHO.

- Initial circulating supply (estimated at transferability): ≈ 11.2% of total supply.

- Main allocations:

- Morpho DAO: ≈35.4% (used for community funds, grants, etc.)

- Strategic Partners: ≈27.5% (with several cohorts of different vesting)

- Founders: ≈15.2% (medium-term vesting schedule)

- Contributors & Reserve: ≈5.8% – 6.3% (rewards for developers/contributors)

- Users & Launch Pools + Early Contributors: ±4.9% allocated for community distribution.

- Morpho DAO: ≈35.4% (used for community funds, grants, etc.)

- Vesting & lockup: many strategic/founders/contributors allocations have staged vesting schedules (2024–2028 across tranches)—this is important because large unlocks can affect selling pressure.

- Wrapped vs Legacy: legacy MORPHO can be wrapped 1:1 into wrapped MORPHO to enable on-chain voting and cross-chain transfers; exchanges & public liquidity typically support wrapped tokens.

- Token functions: governance (voting & proposals), staking/rewards, access to premium ecosystem features, and potential buyback/usage-driven value accrual mechanisms.

Read also:Morpho Price Today | MORPHO/IDR Price

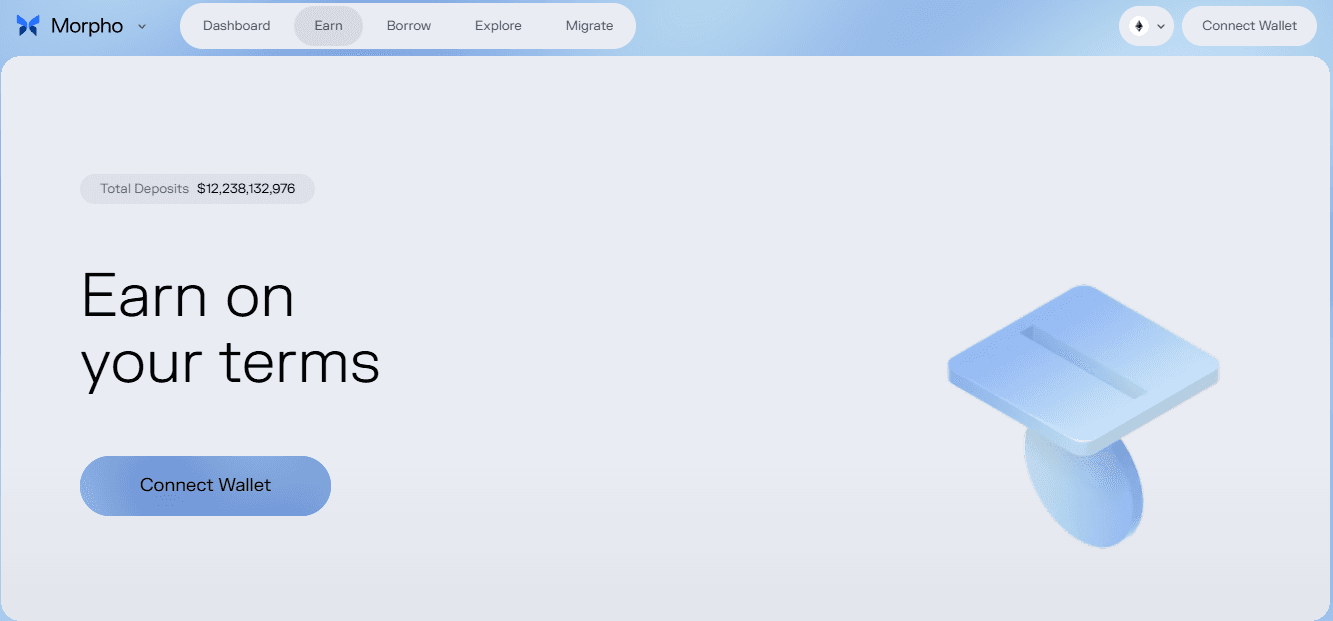

How to Use Morpho — Step by step

- Open the official interface: visit app.morpho.org (or an official partner app) and make sure the URL is correct to avoid phishing.

- Connect your wallet: click “Connect Wallet” and choose your web3 wallet (MetaMask, WalletConnect, etc.). Ensure you are on a supported network (Ethereum, Base, Arbitrum, or the market-specific network).

- (If needed) Wrap legacy MORPHO: if you hold legacy MORPHO, click the Wrap banner on the dashboard → approve the transaction to grant permission → confirm the wrap to swap 1:1 into wrapped MORPHO.

- Choose a market or vault: on the Markets/Vaults page, pick the asset you want to deposit (e.g., USDC, ETH) or the market you want to use for borrowing.

- Deposit (become a lender / liquidity provider): click Deposit / Supply, enter the amount → approve the token (1 tx) → confirm deposit (2nd tx). Once on-chain, your balance will start earning yield from borrowers.

- Set up collateral & borrow (for borrowers): ensure you have deposited sufficient collateral. Go to the Borrow page, choose the target asset, check LLTV / remaining borrow limit → enter the amount to borrow and confirm (leave safety margin to avoid liquidation).

- Check position health: monitor the Health Factor / utilization rate and collateral prices on the dashboard. If health factor approaches the threshold, add collateral or perform a partial repay.

- Withdraw / Repay: to withdraw funds, choose Withdraw on the relevant market and confirm; to close a loan, choose Repay and confirm the transaction. Be aware of gas fees.

- Claim rewards: if you participate in rewards or launch pools, open the Rewards tab → claim periodically (usually cycle-based; check the UI for frequency).

- Use monitoring & safety tools: enable notifications, use price oracle references, and set automatic limits if available in the UI to minimize liquidation risk.

- Developer / advanced integration: developers can use the official SDK/API to build vaults or integrations; follow the GitHub documentation if you want to run an integrator or node.

- Transaction security: always verify contracts on explorers (Etherscan/Base/Arbitrum), avoid entering private keys, and use a hardware wallet for large allocations.

By following the steps above you can start lending, borrowing, claiming rewards, or managing MORPHO tokens safely.

Always perform Do Your Own Research (DYOR) and consider vesting/unlock risk before committing large capital.

Wrapped vs Legacy MORPHO — Transferability

To address technical limitations of the original token, Morpho introduced a wrapping mechanism: legacy MORPHO can be exchanged 1:1 for wrapped MORPHO so the token supports on-chain vote accounting and cross-chain interoperability.

Token transferability was enabled by the DAO and executed in November 2024, so legacy token holders were given the option to wrap their tokens via the official app before tokens became tradable on exchanges.

Read also:Is Morpho (MORPHO) Safe? Benefits and Advantages

Security & Audits

Security is a primary focus for Morpho: the project implements multiple practices—formal verification, fuzzing, unit testing, peer review—and has been audited by several independent firms.

Additionally, Morpho runs substantial bug bounty programs (e.g., Immunefi / Cantina) to encourage vulnerability discovery before exploitation.

That said, documentation emphasizes there is no risk-free system: users must understand smart contract risk, liquidity risk, and potential governance changes.

Risks to Consider

Morpho offers efficiency but not without hazards. Main risks include smart contract bugs, collateral asset volatility that can trigger liquidation, and selling pressure when locked token allocations vest and become unlocked.

Always perform research (DYOR) and consider position sizing and risk management before interacting.

Read also:Buy & Trade MORPHO/IDR

Conclusion

Morpho is a mature DeFi lending infrastructure layer—combining technical efficiency, DAO-based governance, and a security focus.

For users who want on-chain lending/borrowing or developers building decentralized credit services, Morpho provides a strong foundation. However, understand the tokenomics and unlock schedules before making investment decisions.

How to Buy Crypto on Bittime

Want to trade or buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then deposit a minimum of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check rates for BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to follow real-time market trends on Bittime.

Also visit the Bittime Blog for updates and educational content about crypto. Find trusted articles on Web3, blockchain technology, and investment tips designed to enhance your crypto knowledge.

FAQ

What is Morpho?

Morpho is a decentralized lending protocol for EVMs that enables over-collateralized markets and permissionless lending applications.

How can I obtain MORPHO?

MORPHO can be obtained via reward programs in the Morpho App, swaps on exchanges that support wrapped MORPHO, or by wrapping legacy tokens through the Morpho App.

Is Morpho safe?

Morpho performs many audits, formal verification, and runs large bug bounty programs, but smart contract and liquidity risks remain. Do your own research (DYOR).

What is the total supply of MORPHO?

Maximum total supply is 1,000,000,000 MORPHO, with distribution for the DAO, strategic partners, founders, and others as detailed in official documentation.

Where can I buy MORPHO?

Wrapped MORPHO is listed on several major exchanges and also available in Uniswap V3 pools on networks like Base and Ethereum—check official docs or a trusted CEX for availability.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.