Understanding the Long Short Ratio: Calculation and Examples

2025-10-26

Bittime - Long/short ratio plays a crucial role in crypto asset trading. By understanding this ratio, you can get a general idea of what market participants are thinking and doing.

This ratio tells you whether the majority is preparing positions for a price rise or waiting for a price fall. This simple knowledge can help you make wiser decisions and avoid simply following the crowd.

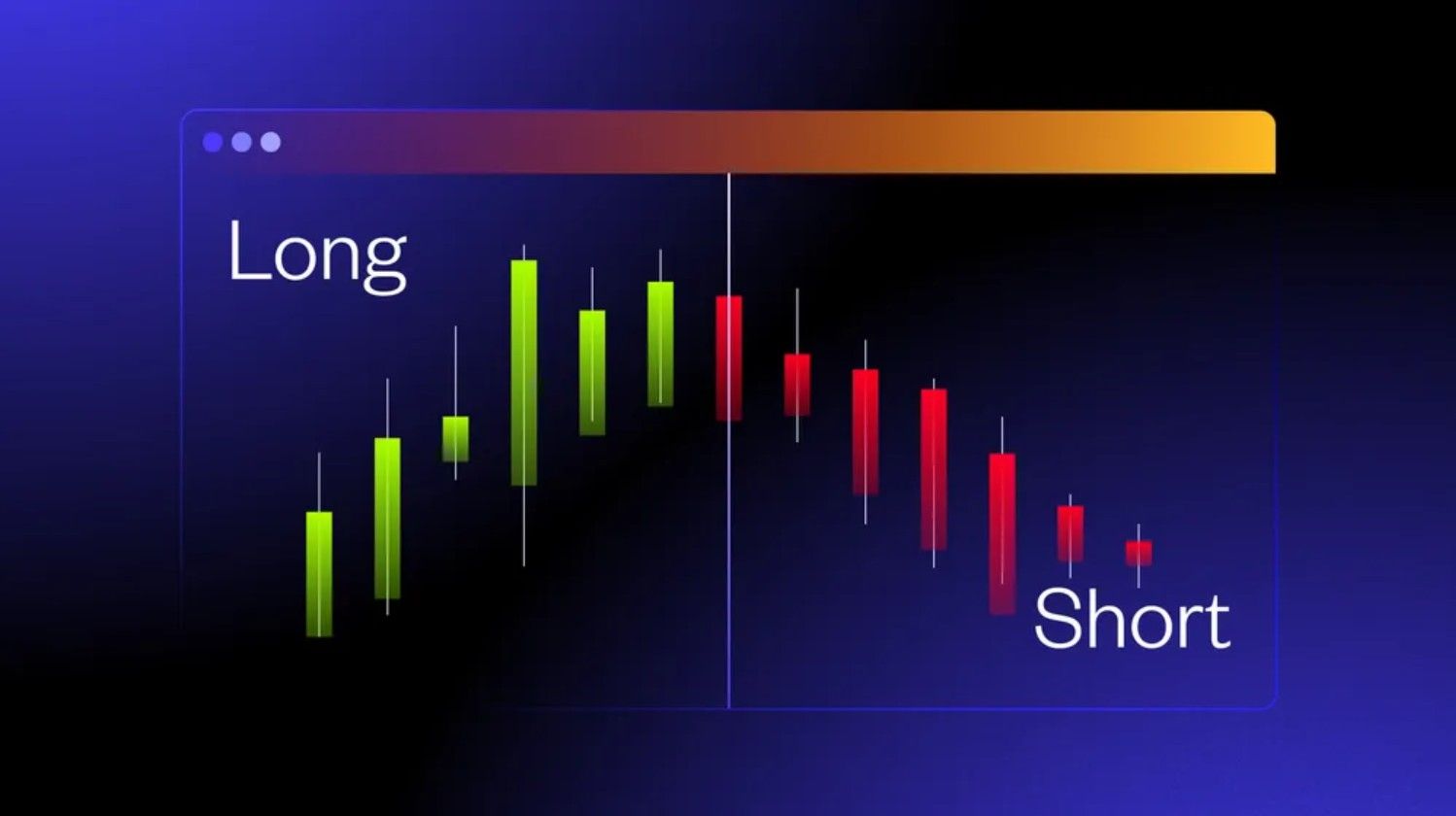

Long and Short Positions Explained in Crypto Trading

Before discussing the long short ratio further, we need to know what a position is.long And shortThese two terms are fundamental in crypto futures trading.

Long position placed when a trader expects the price to rise in the future. Similar to buying an asset, with futures, you don't actually own the asset.

Short position placed when a trader predicts a price decline. The goal is to profit from the price decline.

When the market is optimistic and many believe prices will rise, long positions are usually more numerous. However, when the market is full of anxiety, short positions can dominate.

Read also: What Is the Barron Trump Memecoin? A New Crypto Trend Based on Political Humor

What is the Long Short Ratio?

Long short ratio is a market sentiment indicator that compares the number of long positions to the number of short positions in crypto futures. This ratio helps determine whether the market is more confident about rising or falling prices.

If the ratio is high means there are more long positions and sentiment tends to be bullish.

If the ratio is low means there are more short positions and sentiment tends to be bearish.

By looking at this indicator, traders can get an initial idea of the market mood towards a particular asset such as Bitcoin or Ethereum.

Long Short Ratio Calculation

The way to calculate the long short ratio is quite simple:

Formula

Number of long positions ÷ number of short positions

Simple example:

Long position: 80

Short position: 40

So the calculation is:

80 ÷ 40 = 2

This means that long positions are twice as numerous as short positions, so the market tends to be optimistic about price increases.

Read also: Complete Guide to Buying Echo Crypto (ECHO): Price, Project, and Safe Steps for Beginners

The Meaning of Long Short Ratio in Market Analysis

When long short ratio more than 1Traders see an opportunity for price increases. The market is confident, and demand for long positions is strong.

On the other hand, when long short ratio is less than 1 the market is showing signs of anxiety. More traders anticipate a price decline, leading to a predominance of short positions.

However, it's important to remember that the long-short ratio only reflects sentiment. Markets can change at any time, and the majority sentiment isn't always correct.

Example of Using Long Short Ratio in Trading

Long-short ratio data can be found on various futures platforms, such as Binance Futures. There, you can view ratio charts for various assets over the past 30 days.

Real example:

On March 21, 2023

BTC/USDT long short ratio is at0.77

Around 56.46% account takes a short position

Temporary 43.54% choose a long position

The interpretation is that the market at that time was more predicting that the BTC price would fall.

By monitoring this ratio regularly, traders can see changes in market sentiment over time and consider their next steps more carefully.

Read also: What is Velo (VELO)? Roadmap, Tokenomics, and Pricing

Conclusion

The long-short ratio is a simple but quite helpful tool for assessing the direction of the crypto market. This ratio indicates whether more people believe the price will rise or fall. Traders can use this information as a baseline before making decisions.

While useful, the long-short ratio shouldn't be the sole basis for trading. It's best to combine it with other analysis, such as technical and fundamental analysis, for more informed decision-making.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the ratiolong-short?

Ratiolong-short(*long-short ratio*) shows the comparison between the amount of an asset available for short sale (short selling) compared to the amount actually borrowed and sold. A high ratio indicates positive expectations from investors.

Why is it necessary to track the ratio?long/short BTC?

Looking at the ratioLong ShortBitcoin can provide important insights. The significant increase in the ratio, accompanied by high trading volume and a steady rise in Bitcoin's price, suggestssentimentbullishstrong in the market.

How to read a ratio chartlong-short?

In the graphic:

Part redshow positionshort(short sell).

Part greenshow positionlong(buy).

The white curved line between the two parts is ratio value long/short on that day.

For example, a ratio of 1.31 is high, indicating that the market trend is likely to bebullish(experienced an increase).

How reliable is the long/short ratio?

Ratiolong/short most reliablewhen interpretedalong with other market metrics. Combining these ratios with technical and market data can turn raw sentiment into actionable insights.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.