STABLE Listing and Its Impact on STABLE Price

2025-11-25

Bittime - Token STABLE returned to the market's attention after the announcement of the opening of the initial minting phase and preparations for the official listing.

This minting program allows users to acquire STABLE tokens early before public trading opens.

This movement is considered to have a direct impact on the price of STABLE and market sentiment, especially since the project is under the Stablechain network, a Layer 1 that focuses on stablecoin-based payments.

Early Minting Phase and Market Response

The initial minting phase of STABLE was launched to give the public the opportunity to earn tokens through USDT staking. Such programs typically occur before a token is freely traded on the spot market.

STABLE minting enthusiasts view this early phase as an opportunity to obtain more competitive pricing before the influx of large amounts of liquidity.

Read also:What is Minting in Cryptocurrency?

Response in the crypto community suggests that STABLE's minting momentum is generating optimism about the initial price direction, although some analysts caution that volatility is still possible.

Early minting allows participants to gauge market interest before the token is officially released to the public.

Read also:How to Buy and Transfer USDT

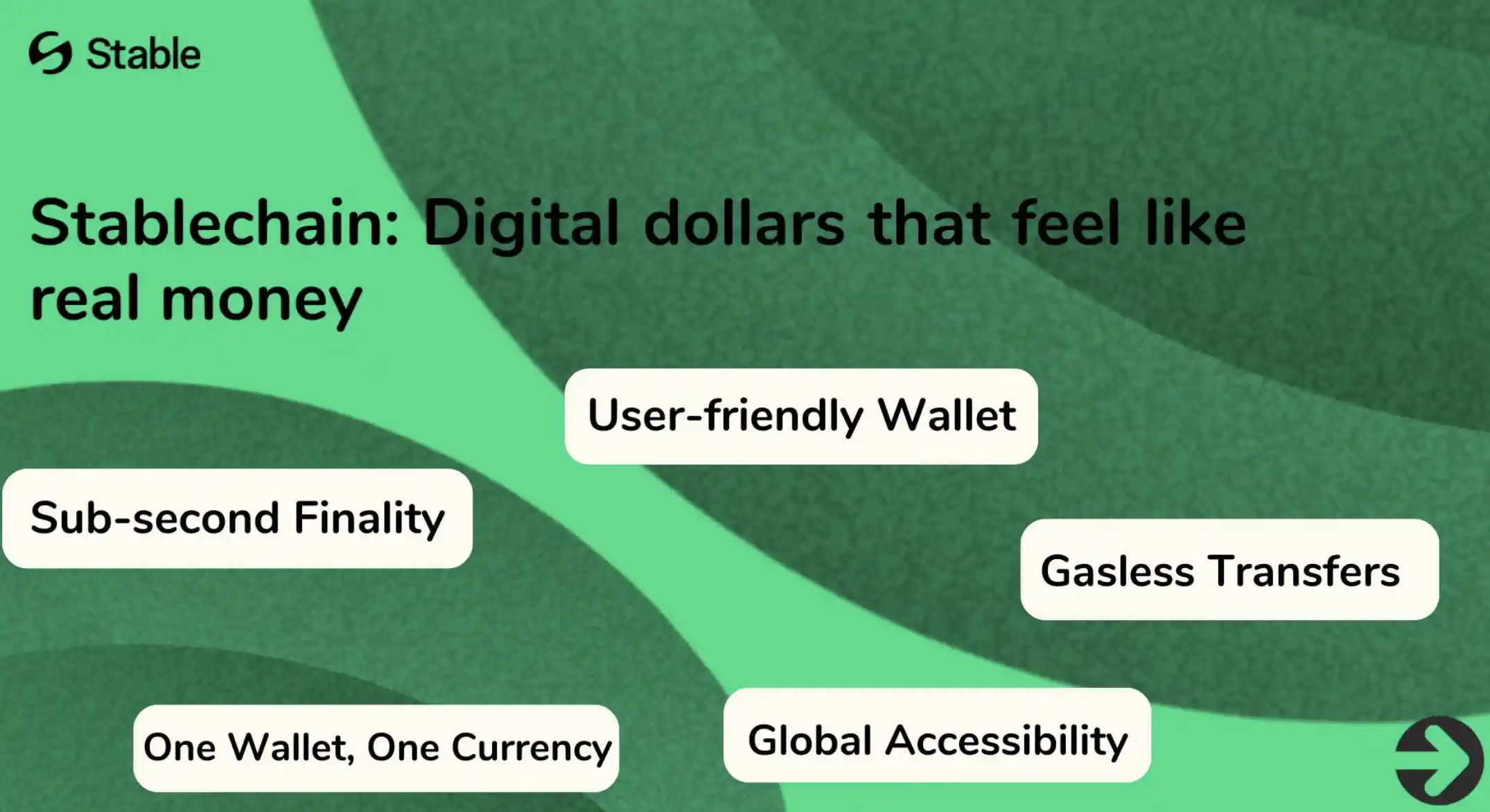

What is a Stablechain and Why is it Considered Important?

A stablechain is a Layer 1 blockchain specifically designed for payment transactions using stablecoins. On this network, stablecoins like USDT are used for gas fees and transaction settlement.

This approach aims to create a payment system that is stable, fast, and easy to adopt by both businesses and general users.

The STABLE token itself acts as a native token and a supporting asset for the ecosystem, including for certain governance and utility functions.

With the increasing need for stable crypto-based payment networks, the concept of Stablechain is considered relevant to the direction of development of the Web3 industry.

Read Also: Crypto Trading Strategies for Beginners: Don't Do This!

Minting Mechanism: How It Works and What to Look Out For

The STABLE minting phase uses a staking model, where participants exchange USDT to obtain STABLE PreTokens which will be converted into final tokens when the official listing opens.

The value of PreTokens often does not reflect the official price because there is no full liquidity and price discovery has not occurred in the market.

Traders typically view minting as an opportunity to gain an early position, but risks remain, such as the potential for price drops after listing or volume uncertainty.

The pre-listing process also does not guarantee profits because the token value tends to fluctuate in the initial period.

Read also:USD/US Dollar Price Prediction for December 2026

Factors Affecting the Price of STABLE When Listing

STABLE price when listing is influenced by several factors:

1. Minting participation volume

The larger the funds raised, the higher the potential volatility at listing.

2. Early adoption of Stablechain

If this payment network is able to attract users, then demand for STABLE could increase.

3. Initial liquidity

Low liquidity can lead to extreme price movements.

4. Community expectations

Hype in the crypto community often has a significant impact on the initial candle.

5. Roadmap announcement

The clearer the Stablechain development plan, the stronger the fundamentals.

In many new tokens, the first day of listing often displays aggressive movement in both directions before the market finds equilibrium. Traders need to understand these dynamics before making decisions.

Read also:Buy USDT with Rupiah: Easy, Cheap, and Fast

A Quick Guide to Buying STABLE After Listing

Once the token is officially traded, new buyers can acquire STABLE through the spot market on various crypto exchanges that support it.

The initial step usually involves first purchasing USDT through a licensed local platform, then exchanging it for STABLE on a global exchange that offers that trading pair.

A common strategy used by traders is to wait for the first candle to stabilize, or to buy gradually using a dollar-cost averaging strategy to reduce the risk of entering too high.

Risks and Survival Strategies in Early Listing Conditions

Listing a new token is a highly speculative phase. Some key risks to consider include:

- High volatility in the early minutes

- Large spread due to unstable liquidity

- Potential dump from early minting participants

- Uncertainty about short-term price direction

To mitigate risk, traders can manage position sizes proportionally, set realistic targets, and monitor official updates regarding tokenomics, vesting, and the project roadmap.

Conclusion

The listing of STABLE is expected to have a significant impact on the trading dynamics of this asset, especially since the project is in a growing sector, namely stablecoin-based payment blockchains.

Early minting provides an opportunity for users who want to get in early, but still carries the typical risks of the pre-listing phase.

STABLE's long-term success will depend on stablechain adoption, a clear roadmap, and its ability to attract an application ecosystem that requires fast and stable transactions. Traders and investors are advised to always conduct additional analysis before making any decisions during the initial listing phase.

FAQ

What is STABLE?

STABLE is the main token in the Stablechain ecosystem, a Layer 1 network designed specifically for stablecoin-based payments.

When will STABLE start trading?

STABLE will be traded after the initial minting phase is completed and the official listing is opened by the exchanges that support it.

What are the benefits of STABLE early minting?

Early minting provides an opportunity to acquire tokens before the spot market opens, but still carries the risk of volatility.

What affects the price of STABLE at listing?

Price is influenced by liquidity, minting volume, community sentiment, Stablechain adoption, and project roadmap.

Is STABLE suitable for the long term?

The long-term potential depends on the adoption of Stablechain as a stablecoin-based payment network and the development of its application ecosystem.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.