Understanding the Concept of Smart Money According to the Crypto Academy: Strategies of Large Institutions

2025-10-07

Bittime - This time we discuss a topic commonly talked about among crypto traders: Smart Money.

If until now we’ve mostly learned trading with supports, resistances, patterns, and indicators, the Smart Money concept offers a different perspective — namely following the steps of large institutions that have access to liquidity and broader information.

Akademi Crypto itself raises this concept as an important module in their crypto trading education.

In this article we will cover: definition of Smart Money, its key elements, strategies to apply it in crypto markets, benefits & challenges, and simple examples so you can start applying it.

What Is Smart Money in the Crypto World?

Smart Money refers to capital or fund flows controlled by large institutions, professional traders, whales, or players with access to information, large capital, and complex strategies.

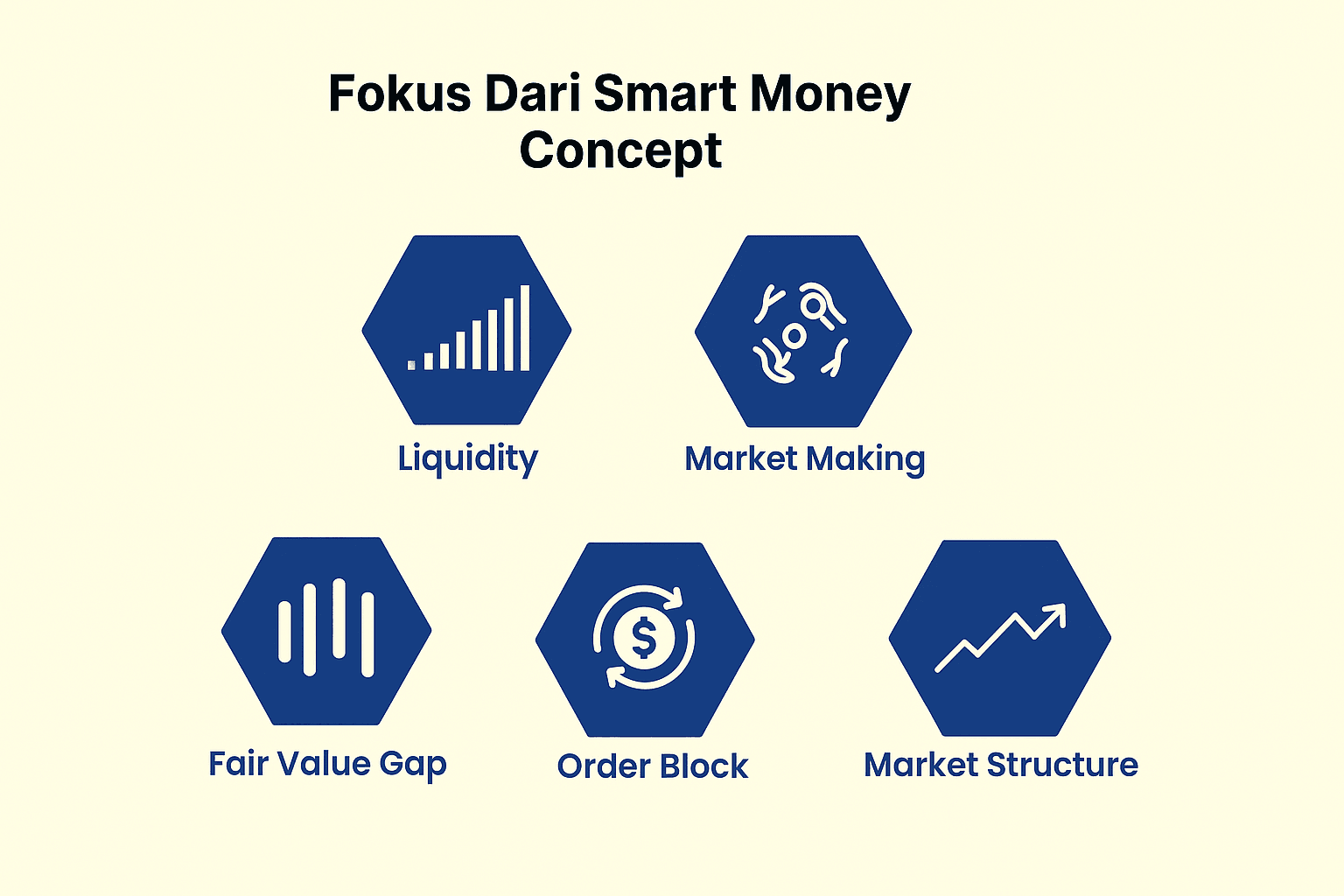

In the context of Akademi Crypto, the Smart Money Concept (SMC) is considered a new paradigm in trading — focusing on liquidity and market structure more than common technical patterns.

Practically, Smart Money looks for:

- Where large liquidity accumulates (stop losses, large orders)

- Market structure: reversal points, break of structure (BOS), change of character (CHoCH)

- “Order block” and “fair value gap” areas where institutions position themselves

By understanding how they think, retail traders can “follow the flow” without fighting it.

Read also:Akademi Crypto: Getting to Know the Crypto Education Platform

Key Elements in the Smart Money Concept (SMC)

Here are main components often discussed in Akademi Crypto’s Smart Money module:

Liquidity

This is the core of Smart Money: markets move because of liquidity. Smart Money will “target” liquidity areas — where many stop losses are left at support/resistance.

There are two sides of liquidity:

- Buy Side Liquidity (BSL): liquidity positions taken from shorters or breakout longs

- Sell Side Liquidity (SSL): liquidity positions at support from longers or breakdown shorts

Market Structure & Break of Structure (BOS)

Market structure (trend, swing high / swing low) remains important. Smart Money watches when structure is updated (broken) as a signal that trend dominance may shift.

Change of Character (CHoCH)

CHoCH describes a change in the market’s “character” — e.g., a market previously bullish begins showing bearish signals, or vice versa. This is a moment when Smart Money may already have taken control.

Order Block & Fair Value Gap (FVG)

- Order Block: area where large institutions place significant orders (often called “institutional money zones”)

- Fair Value Gap: price gap resulting from rapid movement — an area likely to be “filled” (retested) as a signal

Practical Strategies Using Smart Money in Crypto Trading

Here are steps you can try:

- Use higher timeframes first (H4, Daily) to determine the dominant trend direction.

- Identify market structure and BOS points.

- Look for BSL / SSL areas around swing highs / lows, previous highs / lows from the higher timeframe.

- Monitor order block / FVG in those areas — they can be potential entry zones.

- Confirm with change of character (CHoCH) and additional signals (e.g., retest, rejection) before entry.

- Place stop loss slightly away from liquidity zones to avoid being caught by institutional “suction”.

- Manage risk-reward at least 1:2 or higher.

For example, if on the Daily timeframe you see an uptrend, and on H4 there is a BOS upward + a fair value gap above the previous structure — that could be a long entry point, but still wait for retest + confirmation.

Read Also: 7 Effective Crypto Trading Methods for Beginners, Complete with Tips & Tricks

Benefits, Challenges & Limitations

Benefits

- Gives a more realistic perspective on the market (not only ideal patterns)

- Helps “shadow” institutional moves so you don’t become a liquidity victim

- Can provide sharper entry/exit points when combined with market structure

Challenges / Limitations

- Requires deep understanding & time to learn — not an instant concept

- Not all assets are suitable — more effective on liquid assets (BTC, ETH) and less relevant for small illiquid coins

- False signals / market noise still exist — strong confirmation is required

- Requires disciplined risk management to avoid institutional liquidity “suction”

Simple Case Example

For example:

- Daily timeframe: BTC rises and forms higher highs / higher lows

- On H4: price breaks the old swing high (BOS), then retests to an area of FVG + order block

- Then CHoCH appears — the market shows a new bullish character

- Entry may be considered at the retest of the order block with targets to the resistance area above, and stop loss below the liquidity zone

This way, we follow Smart Money’s steps, not fight them.

Read also:How to Trade Crypto in Indonesia for Beginners: Comprehensive & Easy Guide

Conclusion

The Smart Money concept helps traders understand that markets are not only driven by ordinary technical patterns, but by large strategies based on liquidity.

By learning to think like Smart Money, traders can increase profit opportunities and avoid traps that often hit retail traders.

Akademi Crypto emphasizes that learning Smart Money is not just about a new strategy, but about understanding the real dynamics of market power.

How to Buy Crypto on Bittime

Want to trade or buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures transactions are safe and fast.

Start by registering and verifying your identity, then deposit a minimum of Rp10,000. After that you can immediately buy your favorite digital assets!

Check rates for BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to follow real-time market trends on Bittime.

Also visit Bittime Blog for updates and educational content on crypto. Find trusted articles on Web3, blockchain technology, and investing tips designed to expand your crypto knowledge.

FAQ

How is crypto smart money different from conventional trading?

Conventional trading often focuses on patterns, indicators, and support-resistance lines. Smart Money focuses on liquidity, market structure, and institutional actions.

Is Akademi Crypto’s Smart Money concept suitable for beginners?

It can be, but it requires study time because there are many terms (order block, FVG, CHoCH). It's strongly recommended to understand technical basics first.

How to spot Smart Money traces in crypto markets?

Use on-chain analysis, volume analysis, look for sudden liquidity grabs, order block areas, and tools that can track whales’ transactions.

Is Smart Money always accurate?

No. Institutions can be wrong too. The concept is an analytical aid — still use risk management and additional confirmations.

Which coins are suitable for applying Smart Money?

Ideally highly liquid coins (e.g., BTC, ETH) so liquidity areas are clear and institutional action is more visible — while small low-liquidity coins tend to have high noise.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.