What is Initial Coin Offering (ICO)? How it Works, Benefits, and Risks

2025-09-29

The crypto industry continues to spawn new projects that require significant funding to grow. However, not all developers have sufficient capital to launch their ideas.

This is the role of Initial Coin Offering (ICO) as a blockchain-based fundraising alternative. This article will thoroughly discuss what an ICO is, how it works, and its advantages and risks for investors. Read on to learn more!

What is Initial Coin Offering (ICO)?

Initial Coin Offering (ICO) is an initial coin offering conducted by blockchain-based startups to raise funds from the public.

In this mechanism, developers mint digital tokens and sell them to early investors. The funds raised are used for project development, while investors receive tokens in return for their contributions.

This concept is similar to traditional crowdfunding, but focuses more on crypto assets. Investors who purchase ICO tokens hope their value will increase as the project succeeds.

Read Also: What is Brilliant Crypto? Key Features and Roadmap

The Difference Between ICO and IPO

While they may sound similar to Initial Public Offering (IPO), there are fundamental differences between them. Here are the differences between an ICO and an IPO:

Initial Public Offering (IPO):Companies raise funds by selling shares to the public. Investors gain ownership of shares that are strictly regulated by government regulators.

Initial Coin Offering (ICO):Blockchain startups raise funds by selling tokens. Investors don't automatically receive shares, and regulations are much looser than for an IPO.

This difference makes ICOs more flexible, but also riskier for investors.

Read Also: What is Falcon Finance (FF)? Key Features, Benefits, and Roadmap

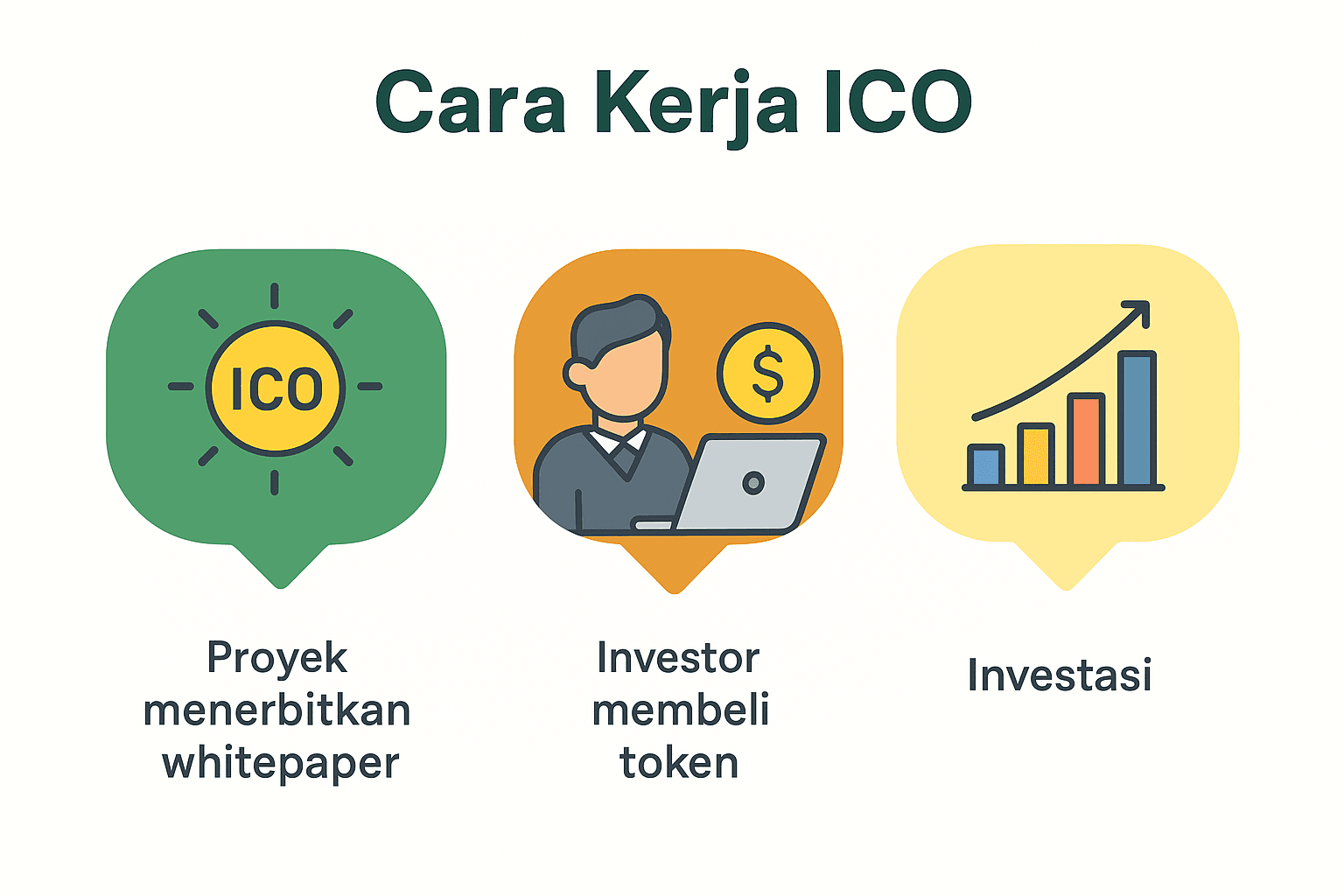

How Initial Coin Offering (ICO) Works

Before an ICO is launched, developers usually release whitepaper which explains the project details, such as:

- Project goal, vision, and mission.

- Development team profile.

- Funds required.

- Rights and obligations of investors and developers.

Interested investors then send crypto assets according to the specified requirements to the project's smart contract address. If the target is met, tokens are distributed to investors. If not, funds are typically returned to investors.

Therefore, it is important to read the whitepaper carefully before deciding to invest in new tokens.

Read Also: What is Monad (MON) Crypto? Technology and Project Advantages

Benefits of Participating in an ICO

ICO have become popular because they offer many benefits, both for developers and investors, namely:

1. Funding Without Losing Equity

Startups can raise funds without selling company shares.

2. Building a Community

Early investors are usually the first users who want the project to succeed, thus creating a solid community.

3. Potential Increase in Token Value

Investors can gain early access to the project's services and potential profits when the token price rises after being listed on an exchange.

A successful example is Ethereum, which raised $15.5 million in 2014. Tokens that initially sold for $0.311 per unit reached prices of thousands of dollars in the following years, providing fantastic returns on investment for early investors.

Read Also: What is Tokenbot (CLANKER)? Price Analysis and Prediction

ICO Risks to Watch Out For

The benefits of ICOs are indeed tempting, but there are also risks that must be taken into account, including the following:

1. The project failed to launch or did not go according to plan.

2. Fraud (scam) by irresponsible developers.

3. Lack of regulation makes investors more vulnerable.

How to Avoid ICO Scams

To reduce the risk of ICO scams, here are the signs of a potential ICO scam that you should know:

- Unclear or unknown projects.

- Vision and mission are vague and without competitive advantage.

- The team has minimal experience and is not transparent.

- No third party escrow wallets.

- Promising unrealistically high profits.

- The website is full of typos and looks hastily put together.

Besides that, you can also do the following steps:

- Review the project team profile, including their experience and credibility.

- Read the whitepaper and roadmap in detail.

- Ensure the project code is audited by a third party.

- Check the reputation of the website and project community on social media.

With a critical attitude, you can distinguish between serious projects and scams.

Read Also: What is Zero Gravity (0G)? Tokenomics and Price Predictions

Conclusion

So, Initial Coin Offering (ICO) is a blockchain-based fundraising method where developers sell digital tokens to early investors.

This mechanism offers great opportunities, but also carries high risks if the project fails or is a scam. Understanding how ICOs work, their advantages, and the risks will help you make wiser investment decisions in the crypto world.

Read Also: What is Bless (BLESS)? Technology, Tokenomics, and Airdrops

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is an ICO?

An ICO is an initial coin offering conducted by a blockchain startup to raise funds by selling digital tokens to investors.

What is the difference between ICO and IPO?

ICOs sell tokens without providing ownership of shares, while IPOs sell shares in companies that are strictly regulated by the government.

How does an ICO work?

Investors send crypto assets to a project's smart contract, then receive tokens in return if the project is successful.

What are the benefits of participating in an ICO?

Investors get early access to project services and potential token price increases if the project is successful.

How to avoid ICO scams?

Review the team, read the whitepaper, ensure there are third-party audits, and avoid projects that promise unrealistic returns.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.