Hot Wallet vs Cold Wallet: Definition, Advantages and Advantages

2025-01-21

Bittime - Are you researching what method is most suitable for storing digital assets? Maybe a term hot wallet And cold wallet You often hear it, but what do these two wallets actually mean and what are the differences between hot wallets and cold wallets?

This article will discuss the differences between the two, including the meaning, advantages, risks, and examples of each, so that you can make the right decision according to your needs.

What are Hot Wallets?

Hot wallets are digital cryptocurrency wallets that are connected to the internet. This connection allows quick and easy access to funds, making it an ideal choice for routine transactions, trading and everyday use.

Examples of hot wallets include software applications on computers or mobile devices, as well as web-based wallets from exchanges.

Advantages of Hot Wallets

1. Ease of Access

Hot wallets allow instant access to your cryptocurrency, facilitating the process of sending and receiving funds quickly. This is especially beneficial for traders who need to respond quickly to market fluctuations.

2. User Friendly Interface

Hot wallets usually have an intuitive interface, making them easy to use by everyone, both beginners and experts.

3. Integration with the Exchange

Many hot wallets connect directly to cryptocurrency exchanges, allowing for smoother trading and asset management without the need to move funds between wallets.

3 Examples of Hot Wallets

1. Trust Wallet

Trust Wallet is a mobile wallet that supports various tokens and cryptocurrencies, with a user-friendly interface for staking and interaction with dApps.

2. MetaMask

MetaMask is eA popular browser extension among traders, it functions as a hot wallet for Ethereum and ERC-20 tokens, enabling interaction with decentralized applications (dApps).

3. Coinbase Wallet

Coinbase Wallet is an easy-to-use mobile wallet that allows users to securely store, send, and receive a variety of cryptocurrencies. Integrates with Coinbase exchange for easy trading.

3 Risk Hot Wallet

1. Limited Storage

Generally, it is not recommended to store large amounts of digital assets in hot wallets due to the risks involved.

2. Phishing Attacks

Users can become victims of cyber fraud, especially if attackers impersonate legitimate services to steal private keys or login credentials.

3. Security Vulnerabilities

Hot wallets are at high risk of cyberattacks and hacking because they are connected to the internet. If hackers manage to access your wallet, they can steal your assets.

What Are Cold Wallets?

In contrast, a cold wallet is a cryptocurrency wallet that is not connected to the internet. This wallet is usually a Paper Wallet or physical device used to store private keys offline, thereby ensuring security from cyber threats.

Cold wallets are perfect for storing cryptocurrency for long periods of time.

Read too Why is Cold Wallet Important to Store Crypto Assets?

3 Advantages of Cold Wallet

1. Long Term Storage

Cold wallets are ideal for users who want to store cryptocurrency for a long period of time without making regular transactions.

2. Protection from Malware

Cold wallets provide protection from viruses and malware, adding an additional layer of security.

3. Enhanced Security

Cold wallets are inaccessible to cyberattacks because they are not connected to the internet, making them a safer option for storing large amounts of cryptocurrency.

3 Examples of Cold Wallets

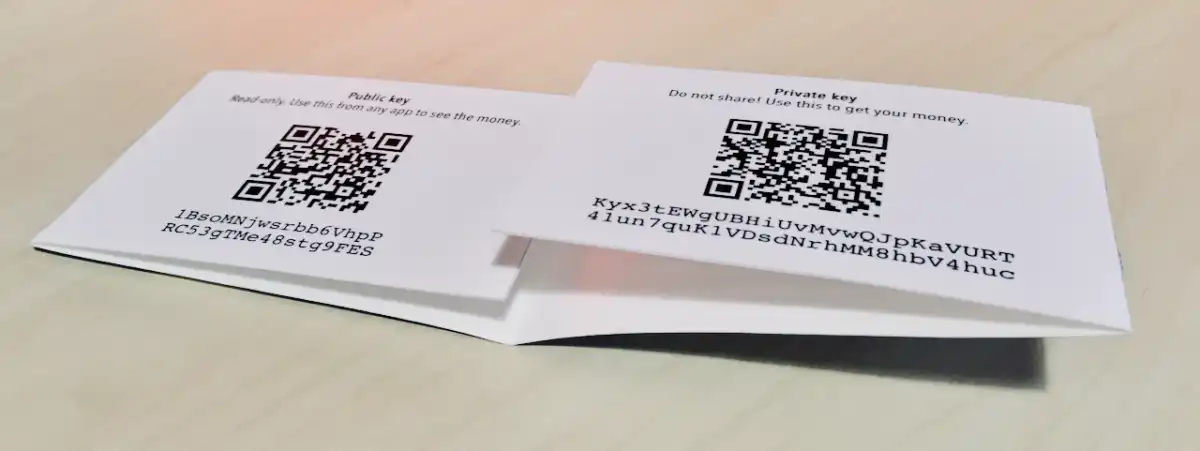

1. Paper Wallet

Paper Wallet is a physical copy of your public and private keys. While it provides strong security if created properly, users must safeguard the paper against damage, loss, or theft.

2. Trezor Model One

Widely used hardware wallet due to its strong security features, supporting various cryptocurrencies with a simple setup process.

3. Ledger Nano S

A popular hardware wallet for safely storing various cryptocurrencies. It can be connected to a computer via USB and offers a user-friendly interface.

Read too 8 Best Crypto Cold Wallets to Safely Store Coins

3 Risk Cold Wallet

1. Complexity for Beginners

Setting up and using a cold wallet may seem more complicated to new users compared to a hot wallet, which may discourage them from choosing this more secure method.

2. Physical Damage or Loss

Hardware wallets can be damaged, lost, or stolen, which can result in permanent loss of funds without proper backup measures.

3. Limited Accessibility

Accessing cryptocurrency from a cold wallet can be difficult for frequent transactions, as users need to connect hardware or access a Paper Wallet every time they make a transaction.

Hot Wallet vs Cold Wallet: Which is Better?

The choice between a hot wallet and a cold wallet depends on your individual preferences and needs. If you frequently make transactions, a hot wallet is the best choice because of its accessibility and ease of use. However, if you want to store cryptocurrency for the long term and need better security options, a cold wallet is a more appropriate choice.

Many users choose to combine both types of wallets. They keep a small portion in hot wallets for routine transactions, and keep the rest in cold wallets for long-term safe storage. This approach provides an effective and safe combination.

Conclusion

Understanding the difference between hot wallets and cold wallets is essential for anyone involved in cryptocurrency. Hot wallets offer fast access and ease of use for routine transactions, while cold wallets provide higher security for long-term storage.

By evaluating your needs and preferences, you can choose the type of wallet that suits your cryptocurrency management strategy, ensuring easy access and security for your virtual assets.

FAQ about Hot Wallet and Cold Wallet

What is a hot wallet and what is it used for?

A hot wallet is a cryptocurrency digital wallet that is connected to the internet, allowing fast and easy access for routine transactions, trading and everyday use.

What are the advantages of using a cold wallet?

Cold wallets offer higher security because they are not connected to the internet, protection from malware, and are ideal for long-term storage of cryptocurrency.

What are the risks associated with hot wallets?

The risks of hot wallets include vulnerability to cyberattacks, phishing attacks, and not being recommended for storing large amounts of digital assets.

How to choose between hot wallets and cold wallets?

The choice depends on individual needs; hot wallets are better for routine transactions, while cold wallets are better suited for long-term storage and better security.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Jane Forget, Hot Wallets vs Cold Wallets: How Are They Different?, Accessed January 21, 2025

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.