Hedera (HBAR) vs Cardano (ADA): Which Has More Potential in the 2026 Market Cycle?

2026-02-17

As the 2026 market cycle approaches, many investors are starting to compare two equally “veteran” altcoins: Hedera (HBAR) and Cardano (ADA). Both have large communities, but their approaches are different.

Hedera is known to be closer to enterprise needs, while Cardano is strong in research and the community ecosystem. The problem is that when the crypto cycle shifts, the winner isn’t just the most popular one, but the one with real usage and the right capital flows.

The solution is simple: use a clear comparison framework. We’ll break down Hedera vs Cardano in a light, practical way through adoption narratives, upside potential, and risks—so you can build a calmer, more structured altcoin strategy for 2026.

Key Takeaways

- HBAR vs ADA isn’t about “which one is cooler,” but which one fits the 2026 crypto-cycle theme best.

- Hedera tends to stand out if the market rewards institutional adoption and business integration.

- Cardano tends to stand out if the market is driven by ecosystem growth, community strength, and retail participation.

Hedera vs Cardano: Different Focus, Different Ways to Win

If you’re looking for a quick answer, think of it this way: Hedera and Cardano both have potential, but their paths to winning are different. This matters because altcoins in 2026 often move along with big narratives. When the narrative changes, the spotlight can shift to different assets.

Hedera (HBAR): Enterprise Narrative and Stable Fees

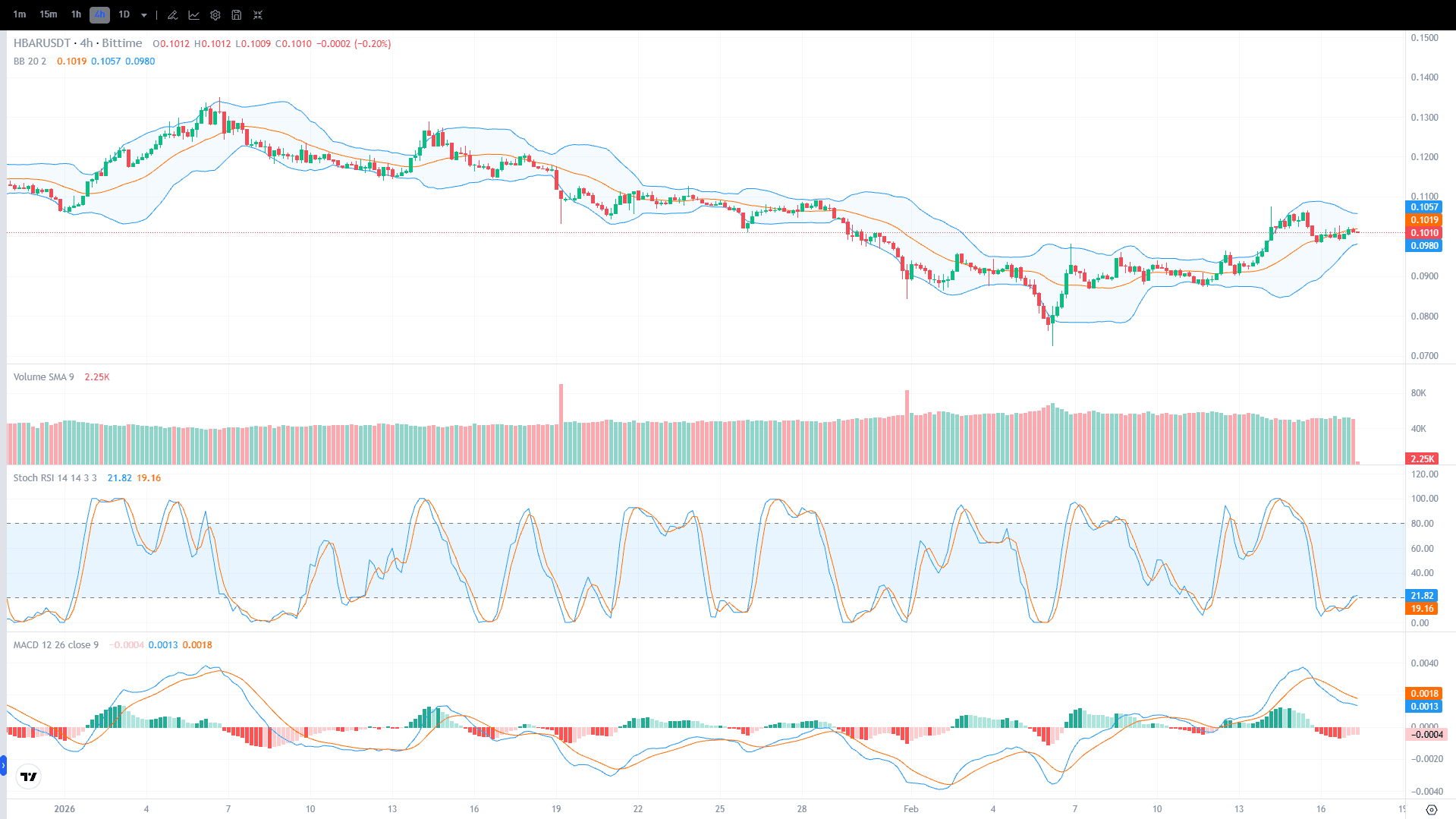

In Hedera analysis, HBAR’s appeal usually lies in its more “serious” use-case focus for business needs.

Many investors like it because it’s seen as having room to grow through integration and system needs that require more stable costs and high performance. If the cycle’s big theme is institutional adoption, Hedera could get more attention.

What often matters when assessing HBAR:

- Network activity and consistent growth in real usage

- Collaborations and partnerships that deliver real products

- The increasingly busy narrative around asset tokenization and payment infrastructure

Read Also: Crypto Trading Strategies for Beginners: Don’t Do This!

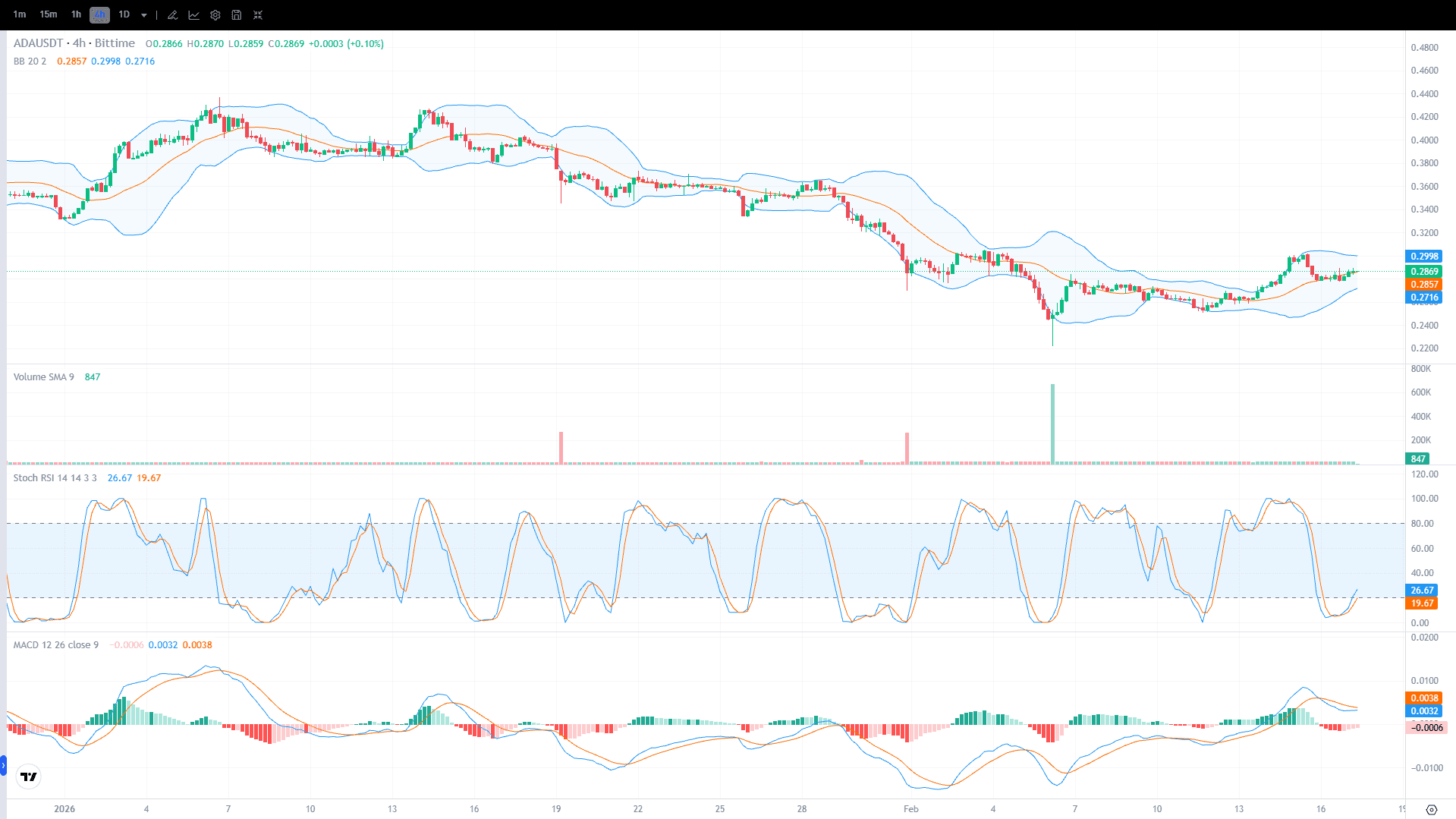

Cardano (ADA): Ecosystem, Research, and Community Strength

In Cardano analysis, ADA is usually seen as strong because of its more disciplined research-and-development approach, even if it can sometimes feel slow. However, a large community can be an important fuel source when the market enters an active retail phase.

In a cycle driven by sentiment and application adoption, Cardano (ADA) can be more attractive. What often matters when assessing ADA:

- Developer activity and improvements in the application ecosystem

- Growth in network utility and community engagement

- Staking appeal and long-established brand support

Read Also: 7 Smart Crypto Trading Methods for Beginners, Complete with Tips and Tricks

Market Cycle 2026: Which Has More Potential—HBAR or ADA?

To assess HBAR vs ADA fairly, use a scenario approach. This helps you avoid getting locked into a single prediction. Because in reality, the 2026 crypto cycle can be influenced by many factors such as liquidity, regulation, and Bitcoin’s movement.

Scenario 1: Liquidity Returns and Institutions Become More Active

If institutional capital flows return strongly and the market focuses on business use cases, Hedera is often seen as having a better chance to perform more strongly. But the condition is clear: there must be evidence of increasing usage—not just headlines.

Read Also: Join the Bittime Futures Public Beta Waitlist and Get Trial Funds Rewards up to 1500 USDT

Scenario 2: Retail Altseason—Ecosystems Become the Magnet

If the 2026 altseason is driven more by retail participation and application growth, Cardano can “light up” more easily thanks to its community and brand. However, ADA also needs proof in terms of ecosystem growth and user-facing innovation.

A Simple Checklist to Help You Decide

- If you lean toward institutional themes and business integration, monitor HBAR

- If you lean toward community themes and app ecosystems, monitor ADA

- Whatever you choose, keep watching trend structure and risk management

Conclusion

So, between Hedera (HBAR) vs Cardano (ADA), which has more potential in the 2026 market cycle? The most realistic answer is: it depends on which narrative wins in the 2026 crypto cycle and how strongly each network proves real-world usage.

Hedera can outperform when institutional themes and business integration dominate. Cardano can outperform when ecosystems and retail communities become the main engine. To keep your 2026 altcoin strategy cleaner, use scenarios and track indicators you can check regularly—not bold guesses.

If you want to start building a more practical trading strategy, you can explore the market via Bittime Exchange . For light daily insights and news updates, also stop by Bittime Blog .

FAQ

What’s the main difference between Hedera and Cardano?

Hedera tends to focus on enterprise needs, while Cardano is stronger in its community ecosystem and research-driven approach.

HBAR vs ADA: which is more suitable for beginners?

Beginners should start by understanding risk and using a gradual strategy, then choose the asset whose narrative they understand best.

Will altcoins in 2026 definitely rise during a bull market?

Not always. Altcoins depend heavily on liquidity and narrative. Choose projects with real usage and disciplined risk management.

What simple indicators should you monitor for the 2026 market cycle?

Track price trends, volume, Bitcoin dominance, and ecosystem developments for each network.

How can you follow Hedera and Cardano news easily?

You can regularly check market updates and crypto news via the Bittime Blog so you don’t miss important information.

How to Buy Crypto on Bittime?

Want to trade, buy, and sell Bitcoin and invest in crypto easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check exchange rates for BTC to IDR , ETH to IDR , SOL to IDR and other crypto assets to see today’s crypto market trends in real time on Bittime.

Also, visit the Bittime Blog to get various interesting updates and educational information about the crypto world. Find trusted articles on Web3, blockchain technology, and digital-asset investment tips designed to deepen your knowledge of crypto.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.