Ripple (XRP) Price Today: Analysis of its Support and Resistance Points

2025-01-27

Bittime - Since last December, movement Ripple (XRP) price shows a unique pattern influenced by interactions between large market players (whales) and retail investors. The data revealed aggressive selling pressure in high volume, thought to originate from the activity of whales who started taking profits after XRP strengthened from the $0.300 level. On the other hand, buying interest from retail investors has actually increased, creating a tug-of-war dynamic between massive selling power and consistent small-scale buying.

Whale Sell-Off Pressure for XRP?

This condition has the potential to trigger extreme volatility. Although whale selling risks depressing prices, retail uptake of the asset could provide limited carrying capacity.

If this pattern continues, ownership distribution XRP may become more even, opening up the opportunity for long-term price stabilization.

For investors, this data helps identify liquidity patterns, buying/selling pressure, as well as short-term volatility signals. However, it is recommended to always verify the latest data and consider external factors such as regulatory policies or market sentiment before making an investment decision.

However, the continued dominance of whale transactions risks creating sharp fluctuations, potentially reducing the interest of new investors due to the high risk of sudden movements.

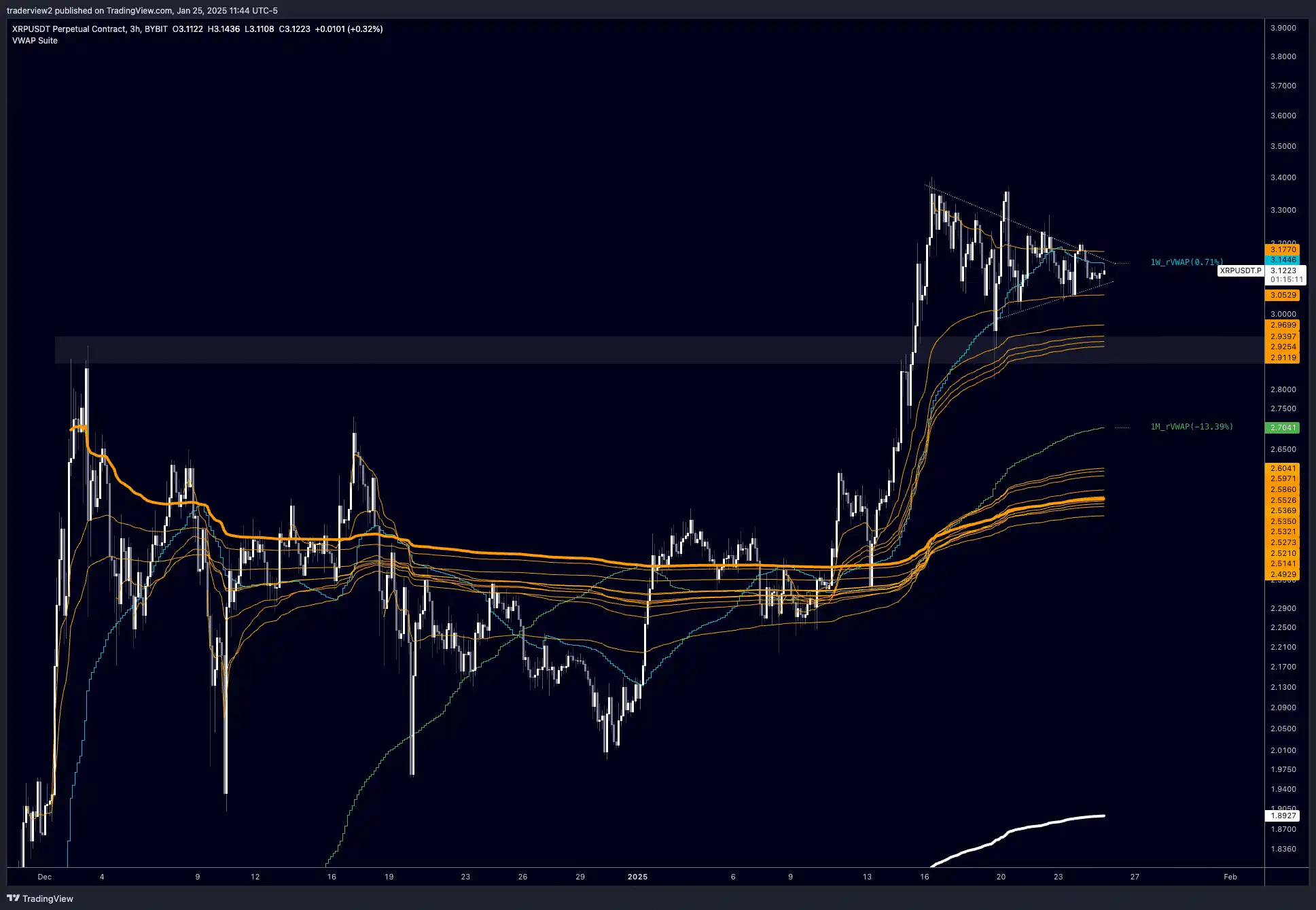

Technical Analysis: The Battle at a Crucial Level

On the XRP/USD pair, compressed volatility over the past 18 days hints at a potential breakout. The critical resistance level is at $3.20, which coincides with the historical Volume Weighted Average Price (VWAP) and relative weekly VWAP. A price close above this zone could trigger a bullish rally, paving the way to explore higher resistance levels.

Meanwhile, area 2.90 became an important resistance as the main support. This level has repeatedly restrained the rate of price weakness, becoming the foundation for recovery in recent weeks.

Also read How to Buy XRP (XRP)

Source: TradingView/Lennox Gitonga

If selling pressure continues and price fails to stay above 2.90, the correction may extend to $2.60—a level reinforced by previous consolidation and the 1-month VWAP.

Read too Can XRP Make You Rich? Listen to this explanation!

US Tax Policy: Opportunities for Local Crypto Assets

The latest policy announced by Eric Trump provides tax incentives for US-based crypto projects. Domestic assets such as XRP will be free of capital gains tax, while overseas projects are subject to a 30% rate.

This policy is expected to increase the attractiveness of XRP to US investors, potentially driving demand and price appreciation.

However, investors need to remain vigilant. Even though fundamental and regulatory factors are supportive, the crypto market remains vulnerable to changes in sentiment, technological developments and macroeconomic dynamics. In-depth analysis and risk management remain key before making investment decisions.

Read too Ripple (XRP) Price $2, Is It Overvalued or Still Cheap?

Conclusion

Today's XRP movement is at a critical crossroads. Breakout above 3.20 or breakdown below 3.20 or breakdown below 2.90 will determine the direction of the short-term trend. The collaboration between technical factors, whale activity and US fiscal policy is a potential catalyst that traders need to monitor closely.

The following is a revised FAQ with appropriate adjustments to the spacing between words:

FAQ on Ripple (XRP) Price

1. What is the cause of high volatility in the XRP price?

XRP volatility is fueled by the interaction between massive selling from *whales* (large-scale asset owners) taking profits and aggressive buying by *retail* investors. This dynamic creates an imbalance between selling pressure and market absorption capacity.

2. What price levels are key for XRP's next move?

The critical levels are $3.20 as the main *resistance* and $2.90 as the important *support*. A *breakout* above $3.20 could potentially trigger a rally, while a *breakout* below $2.90 could lead to a correction towards $2.60.

3. How does US tax policy affect XRP's prospects?

Tax-free *capital gains* policies for US crypto projects like XRP could increase domestic investor interest, potentially boosting demand and prices. However, volatility risks and external factors still need to be watched out for.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Lennox Gitonga, Why XRP needs to flip $3.20 as U.S. waives tax for some cryptos, Retrieved January 27

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.