Bitcoin Price Today BTC/USDT: Holding Near $77,000 as Market Tests Key Levels

2026-02-07

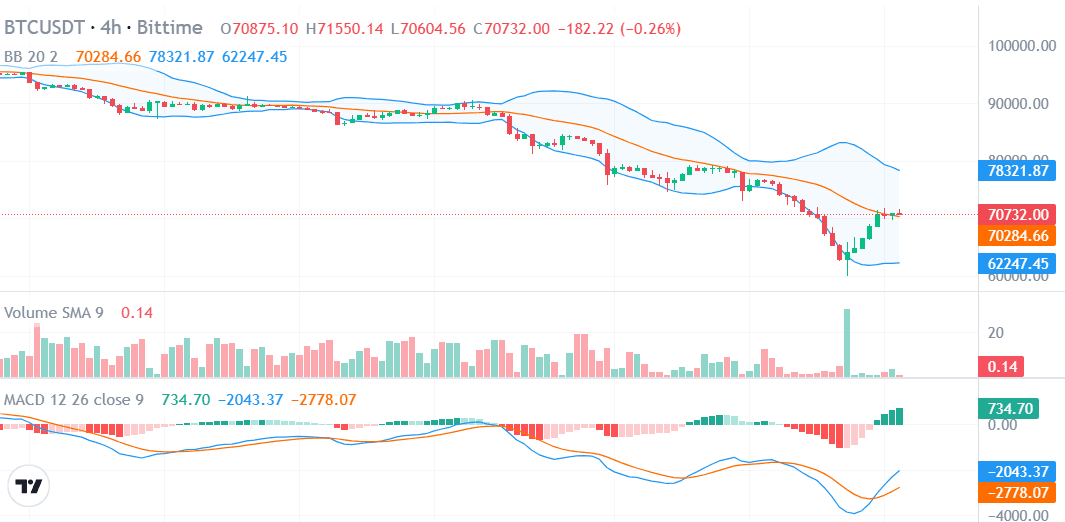

Bittime - Bitcoin’s latest price action is back in focus as BTC/USDT trades around the $77,000 level, recovering from a recent pullback that briefly pushed prices lower earlier this week. The rebound has attracted renewed attention from traders watching whether this move is the start of a broader recovery or simply a technical bounce.

After dipping toward the mid-70,000 area, Bitcoin found buying interest and pushed higher, signaling that demand remains active at discounted levels. As the market approaches 8 February 2026, attention is now firmly on key support and resistance zones that could shape Bitcoin’s next move.

Key Takeaways

- Bitcoin is trading near 77,000 USDT, rebounding from recent lows.

- The 75,000 to 73,000 USDT zone acts as critical support for the short term.

- Resistance between 80,000 and 83,000 USDT may cap upside unless momentum strengthens.

Register at Bittime now and start trading crypto with a fast, secure, and easy process directly from one application.

Bitcoin Price Today: Market Snapshot

At the time of writing, Bitcoin is changing hands around 77,000 USDT, marking a noticeable recovery from recent weakness. Over the past 24 hours, BTC briefly dipped toward the low-70,000 range before buyers stepped in, pushing the price back above key intraday levels.

Trading activity has picked up alongside the rebound, suggesting that market participants are responding quickly to price dips. Despite the recovery, Bitcoin remains below its recent swing highs, keeping the broader short-term structure neutral to slightly cautious.

For global traders, this zone is important. Holding above 76,000 USDT keeps the rebound intact, while failure to do so could invite renewed selling pressure.

Technical Analysis: Key Support and Resistance Levels

From a technical perspective, Bitcoin is currently navigating a decisive range.

Key support levels:

- 76,000 USDT: immediate support where buyers are actively defending price.

- 73,000 USDT: strong support that previously triggered a sharp rebound.

- 70,000 USDT: major psychological support and a critical downside threshold.

As long as BTC holds above 76,000 USDT, the short-term rebound remains valid. A breakdown below 73,000 USDT would significantly weaken the current structure.

Key resistance levels:

- 80,000 USDT: first resistance that must be reclaimed for further upside.

- 83,000 USDT: a heavier resistance zone aligned with recent sell pressure.

- 90,000 USDT: a psychological level that would require strong momentum and volume.

At present, Bitcoin appears to be in a recovery phase rather than a confirmed uptrend.

Read Also: Bitcoin Corrected Again in February 2026, What Happened?

Market Sentiment and Trader Behavior

Market sentiment remains cautious but no longer outright bearish. The bounce from recent lows has eased some downside pressure, encouraging short-term traders to re-enter positions near support zones. However, larger participants appear selective, waiting for clearer confirmation before committing significant capital.

Momentum indicators are improving, yet they do not fully confirm a trend reversal. This reflects a market that is stabilizing rather than accelerating. Volatility remains elevated, and sharp intraday moves are still possible.

Overall, Bitcoin is behaving like a market in transition, where conviction is building slowly rather than aggressively.

Bitcoin Price Outlook Toward 8 February 2026

Looking ahead to 8 February 2026, Bitcoin’s direction will likely depend on how price reacts around current resistance.

If BTC can hold above 76,000 USDT and break cleanly through 80,000 USDT, a push toward 83,000 USDT becomes increasingly plausible. Sustained buying above that level could open the door to a broader recovery phase.

On the downside, losing 73,000 USDT would shift momentum back in favor of sellers, potentially dragging price toward the 70,000 USDT zone. For now, the most likely scenario is continued range trading, with sharp moves triggered by volume spikes or broader market catalysts.

Read Also: Smart Money Concept in Crypto Market Analysis

Conclusion

Bitcoin is currently trading near 77,000 USDT, showing signs of short-term stabilization after a recent pullback. Key support lies between 76,000 and 73,000 USDT, while resistance in the 80,000 to 83,000 USDT range will determine whether the recovery can extend.

As 8 February 2026 approaches, Bitcoin sits at a technical crossroads. The next decisive move will likely set the tone for market sentiment in the days ahead.

FAQ

What is Bitcoin’s current price in USDT?

Bitcoin is trading around 77,000 USDT, following a rebound from recent lows.

Where is the strongest support for BTC right now?

Strong support is located between 73,000 and 76,000 USDT.

What resistance levels should traders watch?

Key resistance zones are 80,000 USDT and 83,000 USDT.

Is Bitcoin turning bullish again?

Bitcoin is recovering, but a full bullish reversal has not yet been confirmed.

Is this article financial advice?

No. This content is for informational purposes only. Always manage risk and do your own research.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.