Global AI Market Soars vs Crypto AI Sector: Trends & Projections for 2026

2026-02-04

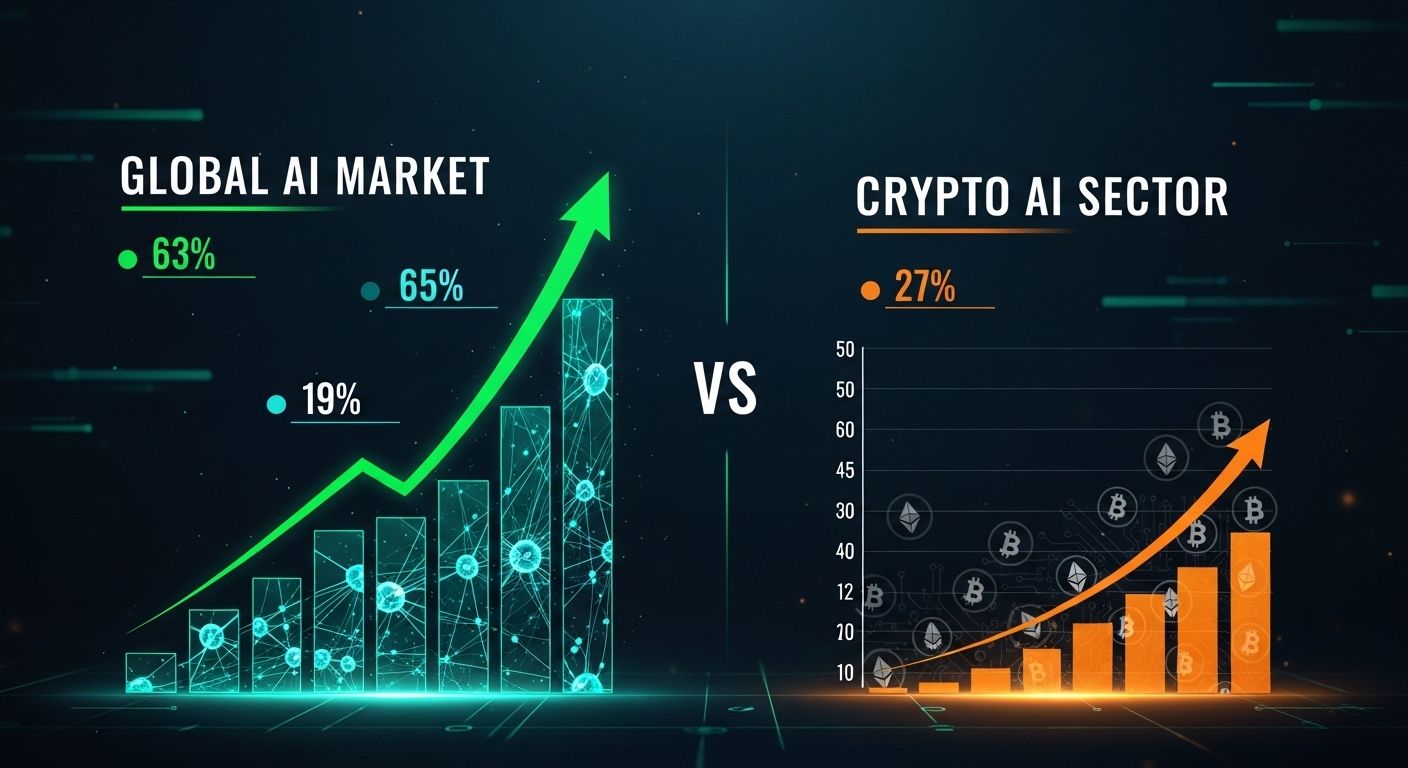

The global artificial intelligence (AI) market is expected to experience a massive surge in 2026, with rapid growth across various technology sectors. On the other hand, the crypto AI sector seems to lag behind, with many crypto AI tokens failing to meet market expectations.

We will discuss the trends and growth projections for the AI market in 2026, comparisons between mainstream AI and crypto AI, and the factors affecting the performance of these sectors.

Let us explore further the performance differences between the two and what can be expected in the future.

Key Takeaways

- The global AI market in 2026 is expected to grow rapidly, with projections reaching $376 billion as technology adoption continues to expand.

- The crypto AI sector lags behind mainstream AI, with many crypto AI tokens such as Chainlink, Bittensor, and Near Protocol experiencing a decline in value.

- Investors prefer the mainstream AI sector, driven by institutional funding, while the crypto AI sector is hindered by liquidity issues and market uncertainty.

Global AI Market Development in 2026

The global AI market is expected to reach $376 billion by the end of 2026, with significant annual growth. Emerging technologies such as machine learning, data analytics, and automation are key drivers behind this growth.

Additionally, the sector is also receiving strong support from governments and businesses, who are investing in AI research and development to strengthen their competitiveness and national security.

AI Global Growth Projections

According to data from Fortune Business Insights, the global AI market is projected to grow at a Compound Annual Growth Rate (CAGR) of 26.6%, bringing the market value to $2.48 trillion by 2034.

The sector continues to attract attention from major investors like Nvidia, Alphabet, and Microsoft, who are leveraging AI technology to accelerate innovation and growth across various industries.

One of the key factors behind this growth is the adoption of AI in industry and government sectors, which are increasingly relying on AI to enhance operational efficiency and data-driven decision-making.

Read Also: 7 Crypto Trading Strategies for Beginners, Complete with Tips and Tricks

Comparison of Mainstream AI vs Crypto AI

While the mainstream AI market continues to surge, the crypto AI sector is experiencing poor performance. Projects like Chainlink, Bittensor, and Near Protocol have fallen behind amidst liquidity challenges and market uncertainty.

Many crypto AI tokens have been unable to address funding issues and still rely on market speculation, whereas mainstream AI is supported by more stable institutional funding models.

Read Also: Join the Bittime Futures Public Beta Waitlist and Get Trial Funds Up to 1500 USDT

Crypto AI Tokens Underperform

Crypto AI tokens, such as Chainlink, Bittensor, and Near Protocol, have seen a significant decline in value in 2025, with most still struggling to find a solid revenue model.

Although some crypto AI projects have experienced short-term price spikes, overall, their performance lags far behind leading AI company stocks that have posted stable profits.

- Chainlink (LINK): Although it reached a high of $52.70 in 2021, Chainlink is now stuck in a downward trend with a price drop of more than 80% over the past year.

- Bittensor (TAO): This project, which develops a decentralized machine learning network, has experienced a price decline of around 51% in the past year.

- Near Protocol (NEAR): With a negative performance of up to 68%, Near Protocol is also lagging, despite being designed to support decentralized applications and AI agents.

Mainstream AI Dominates Investor Preference

Large companies like Nvidia and Alphabet continue to attract major investors, while the crypto AI sector remains hindered by liquidity issues and concerns over market volatility.

Mainstream AI, supported by institutional backing, stronger infrastructure, and more mature revenue models, continues to lead the market.

In contrast, the crypto AI sector needs more time to prove its long-term potential, especially in terms of market acceptance and clearer business models.

Read Also: Crypto Trading Strategies for Beginners, Don't Do This!

Impact of Technology Sector on AI Performance

The technology sector overall has a significant impact on the performance of both mainstream AI and crypto AI markets.

Companies that dominate technology infrastructure, such as Nvidia with their AI GPUs and Alphabet with AI integration across their products, have a major advantage in leading the market.

Meanwhile, the crypto AI sector is still constrained by adoption issues and regulatory uncertainty that continues to affect the performance of tokens in this sector.

Conclusion

The global AI sector continues to experience significant growth, with highly positive growth projections through 2026. While the crypto AI sector has potential, many crypto AI tokens have performed poorly due to liquidity issues and market uncertainty.

For investors interested in AI, the mainstream sector offers more stable and profitable opportunities.

However, over time, if the crypto AI sector can overcome these challenges, it is likely to follow the path of the mainstream AI sector in the long term.

If you want to start your crypto trading journey or learn more about the AI market's development, visit Bittime Exchange or read interesting articles on Bittime Blog.

FAQ

What is the difference between mainstream AI and crypto AI?

Mainstream AI is more dominant in terms of investment and institutional adoption, while crypto AI still faces challenges in liquidity and a clear business model.

Why are crypto AI tokens experiencing poor performance?

The poor performance of crypto AI is driven by liquidity issues, market uncertainty, and reliance on speculation rather than a proven revenue model.

Is the mainstream AI sector more stable than crypto AI?

Yes, the mainstream AI sector is more stable due to institutional investment, stronger infrastructure, and more mature revenue models.

What are the main factors affecting the global AI market's performance?

The main factors influencing the global AI market are technology adoption by industrial and government sectors, as well as funding and support from major investors.

What is the future outlook for the crypto AI sector?

The crypto AI sector has potential but needs to overcome challenges such as liquidity, market adoption, and the development of a clearer business model to compete with the mainstream AI sector.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.