Bitcoin's December 2025 Fake Breakout: Why the Surge Hasn't Marked a New Trend

2025-12-05

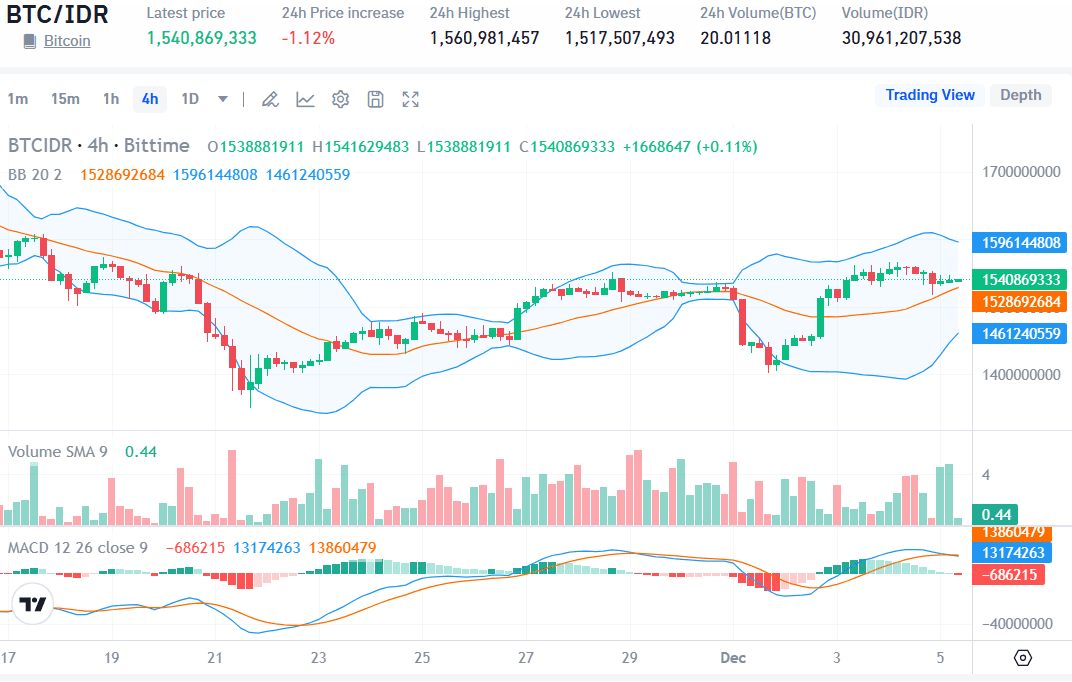

Bittime - Early December 2025 saw a surge in Bitcoin prices, leading some market participants to hope for a new bullish phase. The price briefly moved from around US$86,000 to near US$94,000—and then plummeted again.

Market observers believe that this is fake breakout,When the BTC price appeared to be about to break through resistance, it failed to hold. This article presents a summary of the figures, technical data, and implications for traders and investors.

Price Spike and Drop: from $86,000 to $94,000

The last few days of November to December 2025, Bitcoin traded in a range of aroundUS$86.000–US$87.000as a basic support area. At the peak of the surge, the price reached the rangeUS$93.000–US$94.000, indicating a potential breakout.

However, shortly afterward, the price fell back below the key level, approaching the original support area. This pattern—a rapid rise followed by a correction—has raised doubts about whether this is truly the start of an uptrend or just a temporary rally.

Sign up now on Bittime and start trading crypto assets today. The process is fast, secure, and you can immediately purchase your favorite tokens!

Factors Driving the Surge: Cash Flow, Expectations, and Sentiment

The rise to US$94,000 was driven by a combination of institutional fund flows into Bitcoin-related products, expectations of interest rate easing, and buying interest after the previous decline.

Most of this new money is coming in through ETFs and institutional investment products, not direct retail purchases.

However, analysts warn that a single cash flow is not enough to form the foundation of a long-term trend — especially when the market's dependence on macro sentiment remains high.

Fake Breakout Characteristics December 2025 Version

Several indicators suggest that the last spike was likely a fake breakout:

- Price failed to close at or above the medium-term resistance zone.

- The sudden fluctuations in trading volume and activity reflect speculation rather than a steady rise.

- There was no convincing retest: after heading towards US$94,000, the price did not maintain the level much further.

- Data from derivatives and liquidity markets show weakness after initial volatility, not long-term accumulation.

These factors led many traders and analysts to view the spike as merely a momentary one — not a signal of a trend change.

Impact on Trading and Investment Strategies

For short-term traders, events like these reinforce the importance of a disciplined strategy: tight stop-losses, technical confirmation before opening new positions, or waiting for a valid retest.

Meanwhile, for medium- to long-term investors, the focus should be on fundamentals—not just daily prices. Institutional flows, adoption, regulations, and global macroeconomic conditions are the long-term determinants, not short-term fluctuations.

Conclusion

Bitcoin's price surge from around US$86,000 to around US$94,000 in early December 2025 looked like a potential breakout — but the movement pattern and supporting data suggest it was likely a fake breakout.

Without volume confirmation, retests, and long-term institutional support, the rapid rally resembles a short-lived speculative rally. Market participants are advised to exercise caution, maintain discipline, and avoid relying on momentary spikes as the basis for major decisions.

FAQ

What is a fake breakout in the context of Bitcoin?

A fake breakout is when the price appears to break through a key resistance level — for example, from US$86,000 to US$94,000 — but fails to hold and returns to the previous price area.

How do we know if a breakout is legit or fake?

Signs of a legitimate breakout include a daily candle closing above resistance, stable or increasing volume, a successful retest, and consistent liquidity support and cash flow. If any of these elements are missing, the breakout is suspected to be a fake.

If a fake breakout occurs, what is a safe strategy?

Limit position size, set stop losses, wait for technical confirmation or a valid retest before opening new positions, and pay attention to volume data and broad market correlations.

Should long-term investors be worried?

Not really. Fake breakouts are more relevant to short-term traders. Long-term investors should focus on fundamentals, adoption, and asset value over a longer time horizon.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.