Dropee Question of the Day January 13-14, 2026: Check the Answer!

2026-01-13

Bittime - Dropee’s daily activity is back for January 13–14, 2026. Users who regularly open the app in the morning are greeted right away with one short question. Today’s Dropee Question is about a financial term, a topic that often appears in Dropee’s educational quizzes.

For many users, joining the daily quiz is more than just a routine. There’s a drive to stay consistent, collect points, and of course make sure the answer isn’t wrong. That’s why the Dropee Question of the Day answer keyword is almost always searched for every day as the date changes.

The January 13–14, 2026 edition feels quite straightforward. There aren’t any overly technical terms, but the question does require understanding a concept that often appears in corporate financial statements.

This is where some users can still get tripped up if they read too quickly without understanding the context.

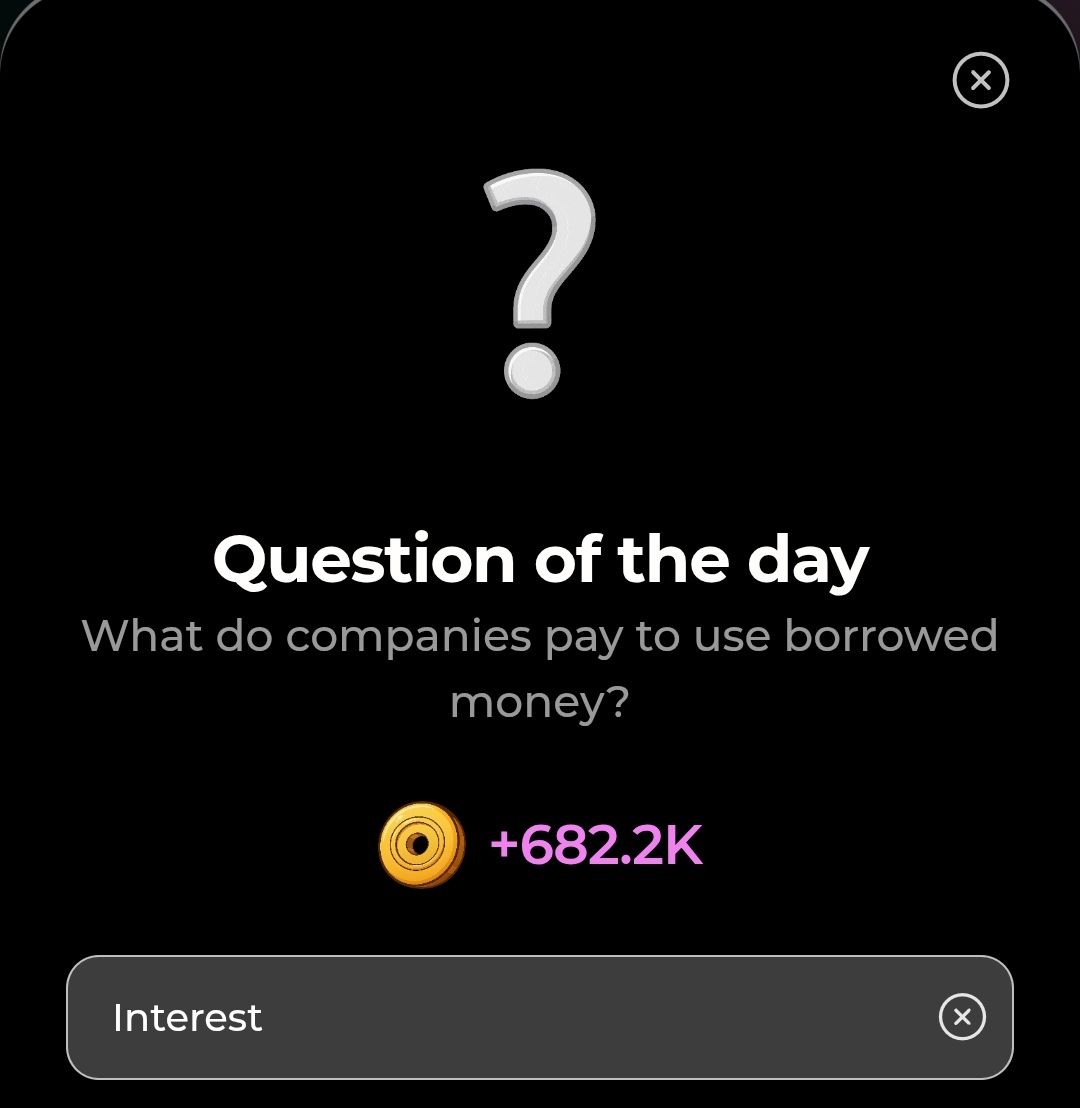

Today’s Dropee Question (January 13–14, 2026)

Based on the references circulating, Dropee Question of the Day today is:

What do we call money a company owes?

This question points directly to a basic term in accounting and finance. Dropee often presents questions that seem light, but are rooted in real concepts commonly used in everyday business practice.

This style of question also aligns with Dropee’s previous pattern. They don’t just test memorization, but understanding of terms commonly found in financial statements, balance sheets, or business discussions.

For users who are used to reading company reports or economic news, the context is actually quite familiar. However, for those who rarely deal with financial terms, carefully reviewing the answer choices is the key to avoiding the wrong selection.

Read Also: Bitcoin Halving: Explanation, Impact, and Estimated Occurrence in 2028

Dropee Question of the Day Answer (January 13–14, 2026)

The correct answer for Dropee Question of the Day (January 13–14, 2026) is:

Liabilities

The term liabilities refers to obligations or debts a company owes to other parties. This can include bank loans, accounts payable, and other obligations that must be paid in the future. That’s why this answer best explains “money a company owes.”

Other answer options that might appear usually point to assets or income, but they clearly don’t match the context of “money a company owes.” By choosing liabilities, users are answering according to the definition commonly used in accounting.

This answer has also been confirmed as the official answer based on available references. So, users don’t need to hesitate when pressing submit on today’s quiz.

Read Also: How to Buy DOGE/USDT on Bittime

Why Is This Answer Correct?

In the structure of financial statements, liabilities are always classified as obligations, not ownership. That means the money isn’t freely owned by the company—it must be repaid according to the agreement. That’s the core of today’s Dropee question.

Dropee seems to be reinforcing this basic concept through a short quiz. Even though it’s simple, understanding liabilities is important—especially for users interested in business, investing, or personal finance management.

By understanding the reasoning behind the answer, users aren’t just guessing—they’re also absorbing knowledge that can be useful later. This kind of educational pattern is what keeps Dropee’s quizzes relevant and not monotonous.

Read Also: How to Buy USDT with ShopeePay

Tips for Answering Dropee Question Every Day

To avoid answering Dropee Question incorrectly, there are a few things to keep in mind. First, read the question slowly and understand the context. Second, connect the question to a commonly accepted definition, not a personal assumption.

Third, don’t rush to choose an answer. Dropee usually gives enough time to think. Lastly, consistently joining the quiz every day helps build a pattern of understanding, so similar questions can be answered faster.

With this approach, your chances of answering correctly will be higher, and the experience of doing Dropee Question of the Day will feel more enjoyable.

Read Also: How to Buy Bitcoin with DANA on Bittime

Conclusion

Dropee Question of the Day (January 13–14, 2026) raises a basic question about a company finance term. The correct answer is liabilities, which refers to money or obligations a company must pay to other parties.

Today’s question is simple, but still relevant and educational. For Dropee users, answering correctly means maintaining daily quiz consistency while also strengthening a basic understanding of finance.

FAQ

What is the answer to Dropee Question of the Day (January 13–14, 2026)?

The correct answer is liabilities.

What is today’s Dropee question?

The question is: What do we call money a company owes?

Has this answer been confirmed?

Yes, the answer matches the official references available.

Is Dropee Question always about finance?

Not always. The topics vary, ranging from finance and business to general knowledge.

Do you have to answer Dropee Question every day?

The quiz runs daily. Answering consistently helps maintain your progress and account consistency.

How to Buy Crypto on Bittime

Want to trade, sell buy Bitcoin and invest in crypto easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then make a minimum deposit of Rp10,000. After that, you can instantly buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see real-time crypto market trends on Bittime.

Also, visit the Bittime Blog to get a variety of interesting updates and educational information about the crypto world. Discover trusted articles about Web3, blockchain technology, and digital asset investing tips designed to expand your knowledge in crypto.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.