DeAgentAI (AIA): The Future of AI Agents on Blockchain and Token Price Predictions

2025-10-06

Bittime - DeAgentAI (AIA) is a blockchain-based artificial intelligence (AI) infrastructure project that aims to deliver autonomous agents for the Web3 ecosystem.

Launched in September 2022, DeAgentAI has grown rapidly thanks to a global team with backgrounds in AI, blockchain systems, and quantitative finance.

This article discusses the project’s functions, technology, tokenomics, and the outlook for the AIA token price.

What is DeAgentAI?

DeAgentAI provides a modular framework to build AI agents that can:

- Interact with users

- Execute strategies

- Coordinate across decentralized applications

Key features include agent identity, memory, lifecycle control, and tool integration, allowing agents to make autonomous decisions.

By employing Mixture-of-Experts (MoE) models and Reinforcement Learning from Human Feedback (RLHF), DeAgentAI agents adapt to context and use resources more efficiently.

Their first product is AlphaX, an AI signal platform for crypto price trend prediction.

Launched on Sui, BNB Chain, and Bitlayer, AlphaX now reportedly has over 400,000 daily active users and 17 million total users.

Read also: Ozak AI: An AI-Driven Blockchain Project Predicted as the Next 100x Crypto

DeAgentAI Product Ecosystem

Beyond AlphaX, the DeAgentAI ecosystem includes:

- CorrAI: a no-code quantitative strategy engine for DeFi users.

- Truesights: an InfoFi financial information platform that incentivizes accurate market insights.

- Enterprise Solutions: custom AI agent solutions for retail, telecom, and agriculture sectors.

With backing from major investors such as Momentum, Valkyrie Fund, Cointelegraph, and Vertex Ventures, DeAgentAI is building foundations to become a key player in AI-driven automation for Web3.

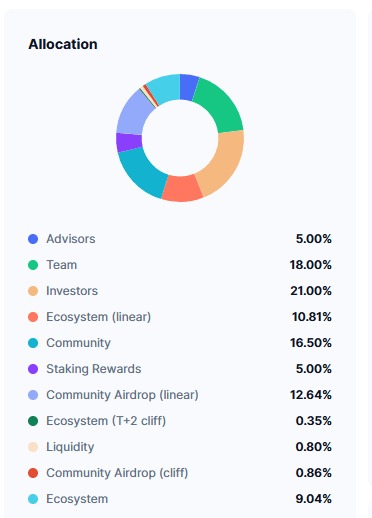

AIA Tokenomics

The AIA token is the native ecosystem token with functions including:

- Access to agent services

- Unlock premium features

- Staking for rewards

- Governance participation

AIA token distribution is as follows:

- Investors: 21%

- Team: 18%

- Community: 16.5%

- Ecosystem: approx. 20% (linear & cliff)

- Advisors & Rewards: 10%

- Liquidity & Airdrop: the remainder

Currently, about 107 million AIA (10.7%) are circulating, while 893 million AIA (89.3%) remain locked.

A large unlock is scheduled to occur after 2026, primarily affecting investor and team allocations. This creates risk of future selling pressure.

Read also: What Is a DeSci Meme Coin? When Science Meets Meme in Web3

AIA Price Prediction

Bullish Factors:

- Buyback & Staking → deflationary mechanism from protocol revenue.

- Product Adoption → AlphaX and CorrAI could boost token demand.

- Exchange Ecosystem → AIA is already traded on large exchanges with high volume.

Bearish Factors:

- Unlock Supply 2026–2028 → risk of significant selling pressure from investors & team.

- Futures Volatility → leverage up to 50x on Binance can trigger extreme swings.

Outlook:

In the short term, AIA price is expected to trade around support at $1.20 and resistance at $2.00.

If the Q4 2025 roadmap (Truesights launch) succeeds, AIA could break resistance toward psychological levels of $2.50–$3.00. However, correction risk remains high ahead of the major unlock period in 2026.

Read also: Big 4 Green Crypto Projects September 2025: Eco-friendly Innovations

Conclusion

DeAgentAI (AIA) presents a new paradigm by combining autonomous AI agents with blockchain transparency.

With products already serving hundreds of thousands of active users and tokenomics based on utility and deflationary mechanisms, AIA has potential to become an important asset in the AI × Web3 ecosystem.

However, investors should be wary of the large unlock schedule, which could affect long-term price performance.

How to Buy Crypto on Bittime

Want to trade or buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then deposit a minimum of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check rates for BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to follow real-time market trends on Bittime.

Also visit the Bittime Blog for updates and educational content about crypto. Find trusted articles on Web3, blockchain technology, and investment tips designed to enhance your crypto knowledge.

FAQ

What is DeAgentAI (AIA)?

DeAgentAI is a blockchain-based AI infrastructure that enables AI agents to operate autonomously on decentralized networks.

What is the function of the AIA token?

The AIA token is used for access to agent services, staking, governance, and unlocking premium features.

What is the total supply of AIA?

The total supply of AIA is approximately 1 billion tokens, with roughly 107 million already circulating.

What is the price outlook for AIA?

If product adoption increases, AIA could potentially rise to $2.50–$3.00. However, the 2026 supply unlock may put downward pressure on price.

Where can I buy AIA token?

AIA tokens can be purchased on several major exchanges that support spot and futures trading.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.