November 2025 Token Unlocks List: Comprehensive and Rational Guide

2025-11-03

Token unlocks often change market mood as new supply hits the order book. Spreads widen, funding can flip, and fuzzy plans get swept away. The solution isn’t complicated.

Understand Token Unlocks, keep a clean calendar, then execute a plan that matches event size with position size.

We present the November 2025 Token Unlocks List and How to Maximize Profits during Token Unlocks in plain language, with steps you can use today. Read calmly, note the key points, and let data guide decisions—not euphoria.

Read also: Smarter Crypto Day Trading with Gemini AI: A Complete 2025 Guide

What Are Token Unlocks?

Token unlocks are scheduled releases of previously locked coins into circulation. Teams and investors receive tokens according to a vesting plan so incentives align with long-term building.

When an unlock happens, circulating supply rises. If demand is flat, price can soften. If demand is strong and liquidity deepens, price can hold or even rise. The event is neutral. The edge comes from preparation.

Two ideas give you the map. Every project has a total supply and a release plan. Impact isn’t just about the date, but how large the tranche is compared with daily trading activity. Small unlocks on liquid pairs are usually smooth.

A large cliff on a thin pair can rattle the chart. Read the schedule, size the impact, decide your move before the date.

Key terms with brief descriptions

- Circulating supply — tokens already tradeable. Helps gauge how large the next tranche is.

- Vesting — the release timetable for team, investors, community, and ecosystem. Shows the forward supply path.

- Cliff — a one-off large release on a specific date. Often triggers brief volatility around the event window.

- Linear vesting — small daily or monthly emissions. Risks are subtler but still matter when volume is low.

- FDV vs market cap — FDV uses total supply; market cap uses circulating supply. A wide gap signals dilution risk.

- Release percentage — the proportion of total supply already liquid. Higher figures usually mean fewer surprises.

- Next unlock value — dollar estimate of the nearest tranche. Compare with 24-hour or 30-day volume to gauge potential shocks.

- Recipients — who gets tokens at unlock. Team or investor tranches tend to realize profits. Ecosystem grants often recycle into growth.

Practical ways to use unlock data

- Mark all unlock dates on your calendar so supply shifts don’t catch you off guard.

- Compare unlock value with average volume to gauge market absorption capacity.

- Monitor team or treasury wallets on-chain after the release.

- Consider entries after a cliff if selling pressure eases and momentum recovers.

- Hedge spot positions with perps or options when event size is large.

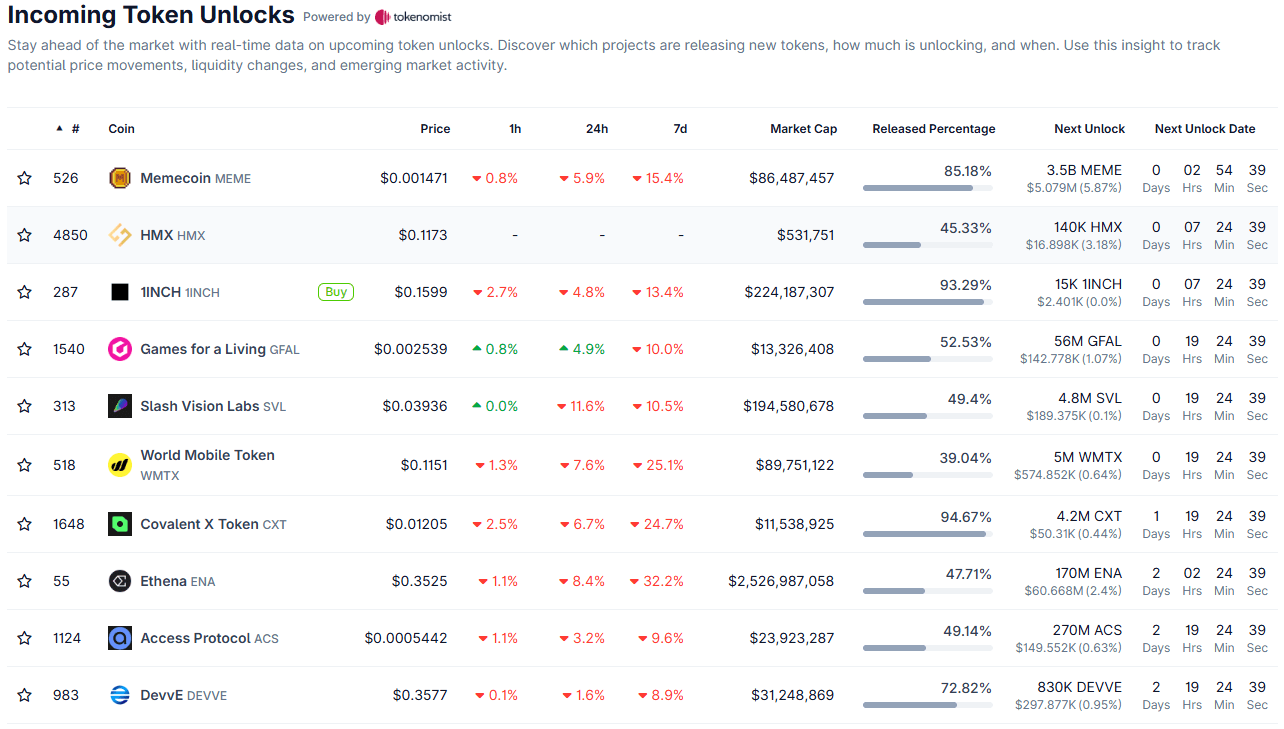

November 2025 Token Unlocks List

This section is a beginner-friendly watchlist for November 2025. Treat it as a research map. Schedules can change with official announcements, so verify before you execute. The goal isn’t to guess direction but to understand when supply shifts and how it affects liquidity and spreads.

First, understand the table structure on unlock dashboards. Columns typically show price, short-term performance, market cap, release percentage, and the countdown to the “next unlock.”

The most useful number is the next unlock’s value relative to trading volume and the thickness of order books on major exchanges.

If the tranche is small versus daily volume, the impact is often calm. If it’s large—equal to several days of volume—watch for wider spreads and sharp wicks. Let’s check the token unlock list below:

1. Memecoin (MEME)

Memecoin is fueled by community power and internet-culture narratives, so news flow and marketing campaigns often accelerate sentiment shifts. At unlock, focus on who receives the tokens (team, investors, or community incentives) because each bucket trades differently.

Compare the upcoming tranche value with the 30-day volume to judge the market’s ability to absorb new supply without excessive slippage.

Because MEME volatility is usually high, use a staged plan: set a clear invalidation level, scale entries and exits, and watch for cross-exchange liquidity shifts that can trigger sharp wicks. Also confirm on-chain wallet flows to exchanges as an early signal for short-term selling pressure.

2. HMX (HMX)

HMX focuses on a derivatives ecosystem, so metrics like funding rate, open interest, and perps basis become key indicators ahead of unlocks. Emissions aimed at liquidity incentives can deepen books, but large tranches on thin pairs still risk sudden moves.

Build a simple impact matrix: unlock value vs. volume, order-book depth, and the presence of active market makers. For spot holders, consider temporary hedges via futures if you don’t want to sit through the unlock window unprotected.

Re-evaluate positions after the event because derivatives market behavior can change quickly once new supply circulates.

3. 1inch (1INCH)

As a DEX aggregator, 1INCH relies on liquidity across AMMs and efficient swap routing; unlocks allocated to ecosystem grants can expand incentive programs and partnerships.

Price impact typically tracks tranche size relative to volume and on-chain activity on networks most used by its users.

Check whether the unlocked tokens enter liquidity pools or move to centralized exchanges, because these two paths signal different selling pressures. Also inspect the market-cap vs. FDV gap to assess medium-term dilution room.

A common strategy is to wait for post-event stabilization before adding medium-term exposure at proven support levels.

4. Games for a Living (GFAL)

GFAL serves a gaming ecosystem, so product calendars, player incentive seasons, and IP partnerships often influence token demand beyond unlock factors. When tranches go to user incentives, volatility may ease if new supply is absorbed by in-game activity right away.

But if early investors are the primary recipients, prepare contingency scenarios on thin books. Track participation metrics like MAU and in-game transactions to evaluate whether token flows support organic growth.

Use staggered entries and the 30-day volume data as guardrails so position size stays proportional.

5. Slash Vision Labs (SVL)

SVL is tooling-oriented, so developer adoption and project collaborations underpin utility. Gradual unlocks tend to spread pressure more evenly, but you still need to size them against daily liquidity to avoid slippage traps.

A healthy sign before the event is thick order books and active market makers across exchanges. Watch recipient wallets; if tokens flow into staking contracts or grant programs, selling pressure may be reduced.

Also note feature or SDK release news that might balance supply with demand.

6. World Mobile Token (WMTX)

WMTX is tied to connectivity infrastructure, so operational vesting and partner grants can add supply steadily. The key analysis is on-chain distribution: do tokens move to operational wallets, liquidity pools, or exchanges?

Because network-utility narratives are often long term, short-term price reactions will be heavily influenced by book depth and day-to-day trader activity.

Mark network events like new node launches or regional expansions that can offset unlock effects. Use disciplined stops because liquidity can thin out outside peak market hours.

7. Covalent X Token (CXT)

CXT incentives data indexing and network contributors, so unlocked supply often flows to active participants. Their behavior can vary: some sell immediately to cover operating costs, others restake.

Track the ratio of unlock value to volume and monitor recipient addresses to see whether tokens go to exchanges or staking contracts. If data shows flows back into the ecosystem, selling pressure may be lighter. For entries, consider timing when volatility tapers after the initial distribution phase.

8. Ethena (ENA)

ENA sits on a synthetic-liquidity stack, so core-mechanism stability and peg health are crucial into unlocks. Emissions directed to liquidity providers can deepen markets, but large tranches during fragile sentiment can still accelerate moves.

Watch funding rates, TVL changes, and treasury wallet flows as indicators of market readiness to absorb supply.

If you must hold spot through the event, partial hedging can mute tail risk. Many participants wait for confirmation of volume recovery and normalized spreads before sizing up.

9. Access Protocol (ACS)

ACS supports the creator economy, so distributions to partners and creators can broaden the user base while introducing new supply. Liquidity isn’t always even across exchanges, so check book depth and pair coverage before execution.

Unlocks flowing into content-incentive programs tend to be more constructive, whereas investor tranches can raise short-term selling pressure. Use a simple mapping: unlock size, distribution purpose, and near-term project roadmap. Staged entries and realistic exits help avoid slippage during peak hours.

10. DevvE (DEVVE)

DEVVE is an infrastructure token with roadmap-based vesting, so technical progress and new listings can offset supply additions. Make sure the main pairs have sufficiently deep books because niche infrastructure can trade on limited venues.

Watch token flows from recipient wallets; rapid transfers to exchanges are a caution signal for short-term traders.

If liquidity thins into the event, reduce position size and prioritize risk management. Afterward, assess whether volatility has eased and volume has returned to average before planning follow-up positions.

How to read an unlock calendar in seconds

- Release percentage — the higher it is, the smaller the relative shock tends to be.

- Unlock value vs. 30-day volume — quick impact gauge. If equal to several days of volume, volatility tends to rise.

- Market cap vs. FDV — a wide gap flags long-term dilution risks.

- Recipient analysis — team and investor tranches can lean more sell-oriented; community tranches often add adoption.

- Order-book depth — thick books reduce slippage; thin books around events invite sharp wicks.

Read also: How to Take Profit from Crypto Trading Without Taking a Loss

How to Maximize Profits during Token Unlocks

Profit in unlock season comes from simple preparation. No fortune-telling needed. Just a clear checklist, sensible position sizes, and patience. The tidier the plan, the calmer the execution. Start with research, define your action path, then place orders. If unsure, downsize and let the event pass.

Two rules protect capital. Position size should reflect event size and pair liquidity. Then define exit levels from the start. Many losses aren’t from bad ideas, but from having no plan. Write it, follow it, review it.

A setup checklist you can copy

- Confirm the schedule — match date, time, tranche size, and recipients on official announcements and project dashboards.

- Size the impact — compare unlock value with daily and weekly volume. Label high, medium, or low.

- Note catalysts — check product releases, listings, audits, or partnerships near the date.

- Choose scenarios — avoid, fade, or buy the dip after supply is absorbed. Sketch a simple decision tree.

- Set alerts — price, volume, funding, and OI alerts to detect early moves.

Risk rules that protect capital

- Sizing — shrink for thin pairs or large unlocks. Increase only if the tranche is small and books are deep.

- Stops and invalidation — place them where the idea is wrong, not just painful.

- Hedge — if you must hold spot through a big event, protect with perps.

- Avoid thin venues — choose main pairs with thick books around the event time.

- Post-trade review — log premise, size, outcome, then refine the checklist for next month.

Simple tools that help

- Calendar — archive dates and tranche sizes with your team.

- On-chain explorers — monitor recipient wallets and flows to exchanges after claims.

- Volume trackers — compare unlock value with 30-day volume for a quick impact score.

- Order practice — ladder entries and exits to avoid going all-in at one price.

- Mental notes — brief pre- and post-event summaries keep emotions cool and lessons captured.

Conclusion

November 2025 mixes small linear releases with a few cliffs on popular projects. Preparation is the best edge. Read the calendar, size unlock value against volume, then pick a plan that fits your risk profile.

Keep position sizes in check, trade on deep books, and let data decide when to act. Consistency beats drama.

Ready to apply your plan with comfortable liquidity and friendly tools? Explore Bittime Exchange for trading various pairs, or dive into market insights on the Bittime Blog. Stay calm, log your process, and review monthly to lift your win rate.

How to Buy Crypto on Bittime

Want to trade buy Bitcoin and invest in crypto with ease? Bittime has your back! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of Rp10,000. After that, you can immediately buy your favorite digital assets!

Check rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see today’s crypto-market trends in real time on Bittime.

In addition, visit the Bittime Blog for a stream of helpful updates and educational information about crypto. Find trusted articles on Web3, blockchain technology, and digital-asset investing tips designed to enrich your crypto knowledge.

FAQ

What is a token unlock?

A planned release of locked tokens into circulation based on a vesting schedule. It changes supply and can affect price and spreads.

Do unlocks always push prices down?

Not always. Impact depends on tranche size relative to volume, market sentiment, and positive catalysts like listings or product releases.

How do I verify unlock dates and amounts?

Check the official website, project announcements, and vesting dashboards. If available, confirm on-chain via the vesting contract or claim transactions.

Is it better to buy before or after the event?

It depends on impact size. Many traders wait until selling pressure eases after a large cliff, then enter when volume stabilizes.

Which metrics matter most?

Release percentage, next unlock value, 24-hour and 30-day volumes, the market-cap vs. FDV gap, recipient wallets, and exchange liquidity depth.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.