How to Identify Undervalued Crypto Projects

2025-10-09

Bittime - Finding undervalued crypto projects is a key strategy for investors aiming to buy before the market fully recognizes their value.

This requires a systematic approach — not just following hype or social media trends. This article outlines the technical and fundamental steps to help you identify crypto assets with strong upside potential.

Deep Fundamental Analysis

The first step is to assess whether a project’s foundation has real value and long-term prospects. Several elements must be analyzed:

1. Market Cap and Revenue

Compare the project’s market capitalization with its generated revenue or transaction fees. If revenue is strong but the market value remains low, it could be a sign of undervaluation.

2. Tokenomics and Unlock Schedule

Review the circulating supply, total supply, and token distribution among the team and investors. A large upcoming token unlock could pressure prices due to potential sell-offs.

3. Team, Roadmap, and Active Community

Transparent teams, realistic roadmaps, and active community discussions are positive indicators that the project is being seriously developed.

4. Token Utility and Economic Model

Ensure the token has a clear function within its ecosystem — such as staking, governance, payments, or incentives. Tokens without strong utility are often purely speculative and carry higher risk.

When all these elements show strength, the project may qualify as an undervalued asset.

On-Chain Analysis and Network Activity

Once the project’s fundamentals are clear, the next step is to assess on-chain data to gauge the health of its network activity. Key metrics include:

- Active addresses and transaction volume: Rising network activity without matching price growth can indicate undervaluation.

- Tokens locked in staking or liquidity pools: A high percentage of locked tokens shows holder confidence in the project.

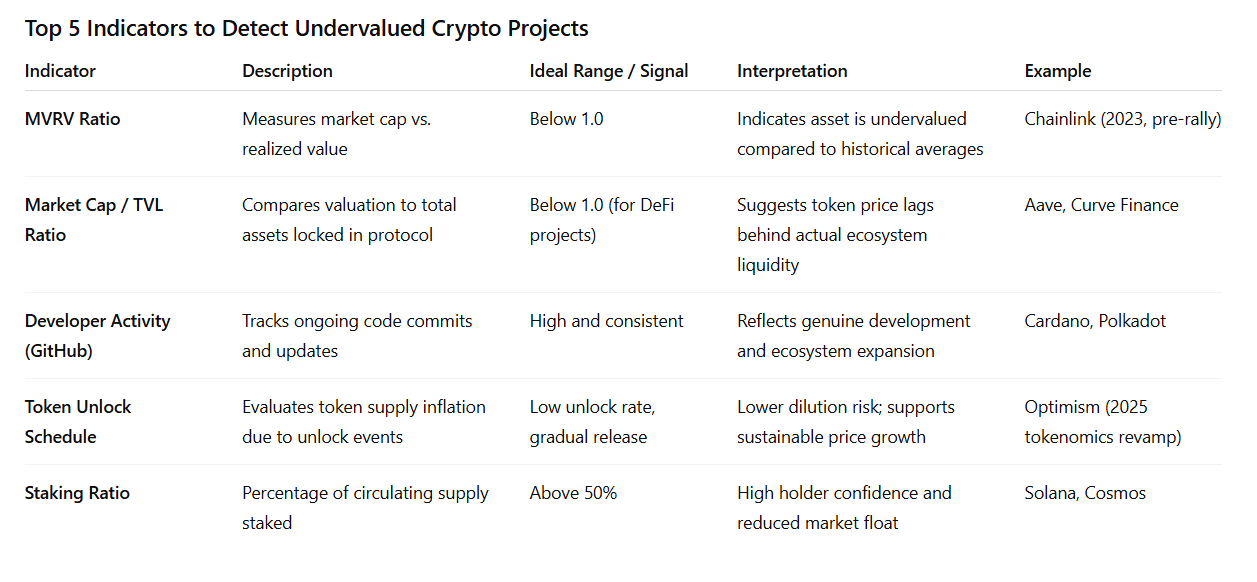

- MVRV and NVT Ratios: An MVRV ratio below 1 suggests the asset is trading below fair value, while a high NVT ratio implies overvaluation relative to network usage.

- Developer activity and code contributions: Frequent GitHub updates indicate ongoing project development rather than abandonment.

When on-chain data shows growth while prices remain stagnant, it often signals a chance to enter before broader market recognition.

Relative Valuation and Sector Comparison

Undervaluation must be assessed within context. Compare projects within the same sector — for example, two DeFi platforms with similar revenue and TVL (Total Value Locked). If one has a much lower market cap, it may be undervalued relative to its peers.

Also, analyze ratios like market cap-to-volume or market cap-to-TVL. A low ratio suggests that the project’s price has not yet caught up with its fundamentals.

However, investors should also note that undervalued projects often have low liquidity, making their prices more volatile when demand increases.

Combining Technical and Sentiment Analysis

Fundamental and on-chain insights should be complemented with technical signals to determine the best entry timing. Important indicators include:

- Price and volume patterns: A breakout accompanied by strong volume often marks the start of a significant move.

- Social sentiment and community activity: Sudden spikes in online discussions about a project can signal early momentum shifts.

- AI and quantitative indicators: Some platforms use AI models to detect unusual activity patterns that may precede strong price movements.

Combining technical, fundamental, and on-chain analysis provides a more comprehensive picture of a project’s true value potential.

Conclusion

Identifying undervalued crypto projects isn’t about luck — it’s the result of thorough research and an understanding of multiple data points. From fundamental health to on-chain data and technical indicators, each element supports a clearer investment decision.

Projects that perform strongly across these aspects but remain overlooked by the market are prime candidates for undervaluation. Still, crypto markets are highly volatile, and every prediction carries risk — which is why proper risk management remains essential.

FAQ

Is an undervalued crypto project the same as a cheap one?

Not necessarily. A low price doesn’t always mean undervalued. Being undervalued means the project’s intrinsic value is higher than its current market price.

Which method is the most reliable for finding undervalued projects?

There’s no single method. The best approach combines fundamental, on-chain, relative valuation, and technical analyses together.

Can on-chain data be manipulated?

Some metrics can be influenced, but monitoring multiple indicators — such as developer activity, MVRV ratios, and community growth — helps reduce manipulation risk.

Do undervalued projects always rise in price?

Not always. Some remain undervalued due to external factors like regulations or poor execution by the team. Comprehensive research and diversification are still crucial.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.