Traders Must Know: How to Overcome the Dopamine Loop and Speculative Behavior

2025-10-09

Bittime - When digital asset charts move up and down within seconds, many crypto traders unconsciously fall into a dopamine loop—a state where the brain constantly seeks instant gratification and emotional highs from market fluctuations.

This mechanism traps traders in speculative patterns: opening positions without proper planning, chasing quick profits, and struggling to stop even after taking losses.

What Is a Dopamine Loop? How Does It Affect Traders?

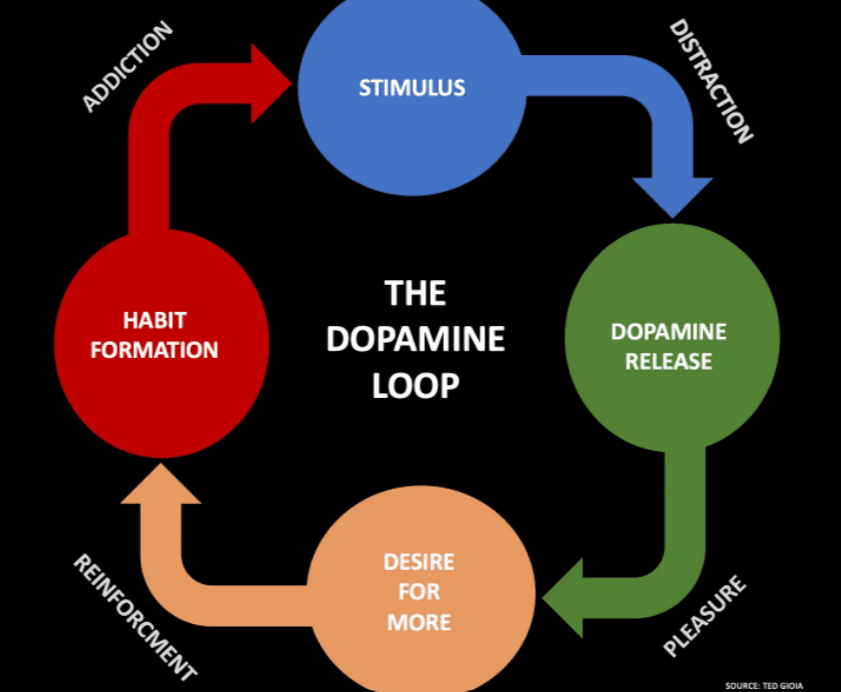

Scientifically, a dopamine loop is a feedback cycle in the brain that arises from the anticipation of a “reward” or positive outcome. Dopamine is released not because of the result itself, but due to the anticipation of that result.

For traders—especially in highly volatile crypto markets—every price spike, profit notification, or minor “pump” can trigger dopamine surges similar to gambling effects. Left unchecked, this leads to compulsive behavior: traders obsessively check charts, make impulsive trades, and lose control over rational strategies.

Behavioral psychologists and neuroeconomists have increasingly studied this phenomenon. According to Psychology Today, dopamine is not just a “pleasure chemical” but also a motivational driver that compels us to keep seeking and anticipating rewards.

In other words, the human brain gets more excited about the feeling of pursuit than about the actual outcome. In trading, this explains why many traders can’t stop even after making a profit—their brains are addicted to the chase, not the result.

How to Break the Dopamine Loop as a Trader

Research from City Traders Imperium shows that high volatility and uncertainty increase dopamine release.

This makes the crypto market a breeding ground for speculative behavior—every quick price swing feels like an opportunity, but it’s often just a psychological trap.

Here are some ways to overcome the Dopamine Loop summarized from Crypto Academy and various other sources that traders should know:

Think Rationally, Not Emotionally

The first step to escaping the dopamine loop is developing emotional awareness. Traders must recognize when decisions are driven by emotion rather than logic.

The difference becomes clear when choices stem from FOMO rather than solid data such as volume, trend confirmation, or market sentiment.

Practice mindfulness microbreaks—short pauses every 30 minutes of trading to assess emotional state. If you feel an urge to “buy in,” wait two minutes and re-evaluate your data.

A study from the Journal of Behavioral Finance found this simple method reduces impulsive trading decisions by up to 40%. Self-awareness restores logical control.

Build a Measurable, Disciplined Trading System

Awareness without structure is just theory. Every trader needs a disciplined, data-based trading plan with clear buying rules, loss limits, and stop points. For instance, set a maximum of three trades per day or stop trading after a 5% drawdown.

Include a trading filter—objective parameters that must align before entering a position (e.g., trend confirmation, volume increase, or momentum indicator alignment).

Also, conduct a weekly strategy review to evaluate performance consistency. Professional traders treat systems not just as profit tools but as psychological protection against dopamine-driven decisions.

Stop Checking PNL Too Often

Dopamine is released due to expectation, not results. Thus, one of the most effective ways to regulate it is by reducing exposure to triggers.

Avoid constantly checking PNL (profit and loss), turn off price alerts, and limit access to chat groups that track market moves every minute.

Use Breathing Techniques to Stay Calm

Apply the 6-2-6 breathing method: inhale for six seconds, hold for two, and exhale for six.

This technique physiologically reduces sympathetic nervous system activity linked to stress and impulsivity.

If the urge persists, use reframing: shift focus from “potential profit” to “potential risk to avoid.”

Start a Daily Trading Journal

Discipline isn’t innate—it’s built through consistent habits. Start a trading journal that logs not only numbers but also emotions before and after each trade. Record your reasoning, market conditions, and mood.

Weekly reviews will reveal recurring behavior patterns, such as panic-buying or euphoric selling. With this insight, you can assess the rationality of your actions.

Some traders even reward themselves with a short market break for each disciplined week—a subtle but effective psychological reinforcement.

Modern Psychological and AI-Based Methods to Control Dopamine

In addition to the four key steps above, behavioral psychologists and AI-based learning systems now recommend advanced dopamine control methods for traders:

1. Dopamine Detox (Digital Stimulation Fast)

Reduce exposure to real-time charts, financial media, and volatility news. Time away from stimulation lowers dopamine thresholds and calms the nervous system.

2. Reward Reframing

Redefine success as discipline and control—not profits. This retrains the brain to find satisfaction in patience and restraint.

3. Pre-Trading Visualization

Before opening charts, imagine a scenario of major loss and mentally train your emotional response.

If you can remain calm in that visualization, you’re more likely to stay rational during actual losses.

4. Pre-Commitment Rule

Create written rules—such as entering trades only when three technical indicators align. This creates a logical barrier against impulsive behavior.

5. Retraining Dopamine Response

Train yourself to resist at least one impulsive urge daily, even small ones. The brain learns that restraint can be rewarding too.

6. Cognitive Defusion Technique

When FOMO arises, don’t fight it—observe it. Say silently, “I’m noticing the urge to chase.” This neutral acknowledgment weakens the emotional power of the impulse.

Conclusion

The dopamine loop in trading isn’t just behavioral—it’s a biological feedback mechanism that must be consciously regulated.

By combining psychological strategies, structured systems, and self-reflective practices, traders can transform the dopamine loop from a trap into a focus tool.

The goal isn’t to eliminate dopamine but to balance emotion and logic. Traders who maintain that balance become more consistent, rational, and sustainable in navigating volatile financial markets.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is a dopamine loop in trading?

It’s a cycle where the brain releases dopamine in anticipation of profits rather than from actual results, leading to compulsive chart-checking and impulsive trading.

Why is the dopamine loop dangerous for crypto traders?

Because crypto markets are highly volatile, triggering emotional responses that fuel impulsive trades without data-based reasoning.

What’s the easiest way to break a dopamine loop?

Start by reducing digital stimulation—turn off price notifications, tighten your trading plan, and practice emotional journaling.

Is a dopamine loop the same as addiction?

In brain chemistry, they’re similar. Both rely on reward anticipation rather than outcome satisfaction, which explains the parallel to gambling behavior.

Can AI or technology help control dopamine loops?

Yes. Advanced trading platforms now use AI behavioral tracking to detect impulsive patterns and warn traders before emotional decisions occur.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.