How to Pay Taxes at Coretax DJP 2026: A Complete Guide

2025-12-15

The 2026 Coretax tax payment method, now serves as the sole primary reference for tax payments in Indonesia. Coretax no longer functions as a supplementary system, but rather as a central control center for all tax administration.

All tax payments, both from SPT and independent deposits, now depart from the same digital portal.

This change has a direct impact on taxpayers. The payment process is streamlined, transparent, and well-documented.

Each tax transaction has a clear identity, linked to the NPWP or NIK, and is validated directly by the state through the State Revenue Transaction Number.

This article provides a guide on how to pay taxes through Coretax DJP 2026 using an aggressive SEO approach. It's based on official DJP practices, presented in a straightforward manner, and designed to be both easy to understand and easy to find on search engines.

Register now at Bittime and start trading crypto assets today. The process is fast, secure, and you can buy your favorite tokens instantly!

How to Pay Taxes at Coretax DJP 2026 in 3 Main Steps

In practice, the entire tax payment process in Coretax DJP 2026 can be summarized into the following three core steps.

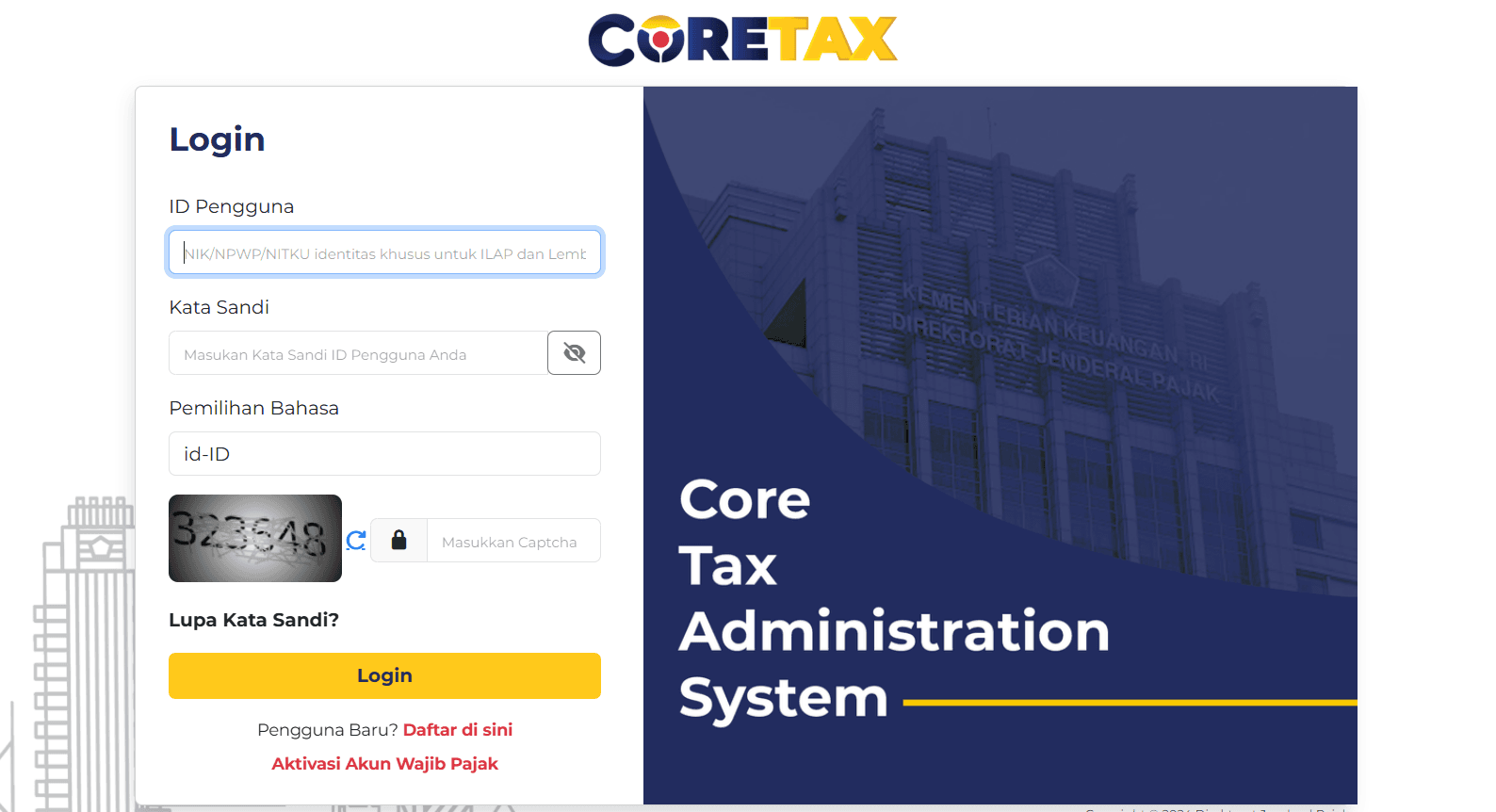

- Log in to the Coretax portal using your registered NPWP or NIK.

- Create billing codes according to the type of tax obligation.

- Pay the billing code until you get the State Revenue Transaction Number.

These three steps apply universally to both individual and corporate taxpayers. As long as the payment results in a NTPN, the tax obligation is considered fully paid and legally valid.

How to Create a Coretax Billing Code from an Underpaid Tax Return

Billing codes are most often created when a tax return indicates an underpayment. In 2026, Coretax will automatically process this step to reduce input errors.

Practical sequence for creating billing codes from SPT in Coretax DJP 2026:

- Prepare the draft SPT on the Coretax portal until the calculation is complete.

- Make sure the SPT status shows Underpayment.

- Select the billing code creation option on the SPT page.

- The system automatically fills in the tax type, tax period, tax year, and nominal amount.

- The billing code is stored in the active billing code dashboard and is ready to be paid.

A single billing code can cover one or more tax obligations as long as they are related to the same draft SPT. This speeds up the payment process and minimizes the risk of incorrect payments.

How to Create a Mandiri Billing Code in Coretax DJP 2026

Not all tax payments originate from the SPT. For certain obligations, Coretax DJP 2026 provides for the creation of independent billing codes.

Payments that generally use the Mandiri billing code:

- Income Tax Article 25 installments.

- Final PPh paid by yourself.

- Tax deposit payment.

- Certain tax payments that do not require an SPT.

Quick steps to create a Mandiri billing code:

- Go to the Payment menu in Coretax.

- Select the independent billing code creation service.

- Specify the Tax Account Code and Deposit Type Code.

- Select the tax period and enter the payment amount.

- Confirm until the billing code is issued.

Mandiri billing codes have a validity period of seven days. If the validity period is exceeded, the code cannot be used and must be regenerated.

How to Pay Coretax Billing Code to Get NTPN

All unpaid billing codes can be accessed via the active billing code dashboard in Coretax DJP 2026.

Stages of billing code payment in Coretax:

- Open the list of active unpaid billing codes.

- Select the billing code to be paid.

- Press the pay button to be directed to the perception bank.

- Complete the payment through the bank's official channels.

- Wait for validation until the NTPN is issued.

The NTPN is official proof of state revenue. This number is automatically recorded in Coretax and used as a reference for reporting, audits, and other tax administration.

Conclusion

The 2026 tax payment method via Coretax by the Directorate General of Taxes (DGT) reflects Indonesia's fully integrated digital tax system. The process is streamlined, data is consistent, and every transaction is clearly traceable.

By understanding the billing code creation process and ensuring that payments generate a NTPN, taxpayers can fulfill their tax obligations without administrative hurdles. Coretax makes paying taxes a measurable process, not a source of confusion.

FAQ

Are all tax payments in 2026 required to be made through Coretax?

Yes. Coretax will become the DGT's primary system for all tax payments by 2026.

Is a billing code mandatory for every tax payment?

Yes. Every tax payment at Coretax must use a billing code.

How long is the Coretax billing code valid for?

The billing code is valid for seven days from the date of creation.

When is tax payment declared valid?

Tax payments are valid after the issuance of the State Revenue Transaction Number.

Is it possible to pay taxes without an SPT at Coretax?

Yes. Coretax provides independent billing code creation for certain tax payments.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.