Buy Limit vs. Buy Stop: This Difference Often Traps Traders, Don't Make the Wrong Entry!

2026-01-19

Bittime - MomentIn trading, one click can determine profit or loss. Therefore, understandingbuy limit vs buy stopnot just theory, but a basic need. Many traders, especially beginners, often confusebuy limit isbuy order at lower price andbuy stop isbuy order at a higher price.

This mistake often results in entries that go against the original plan. In practice, these two types of orders have different logic, are used in different market conditions, and serve different purposes.

This article dissectsWhat is buy stop and buy limit?, complete with the context of its use, so that entry decisions are no longer based on guesswork, but rather on measured strategies.

Key Points

• Buy limit is used to buy at a price lower than the market price.

• Buy stop is used to buy above the market price when the trend is strengthening

• Mistakes in selecting orders often trigger entries that do not go according to plan.

• Buy stop limit combines a price trigger and an execution limit

• Understanding the market context determines the effectiveness of each type of order.

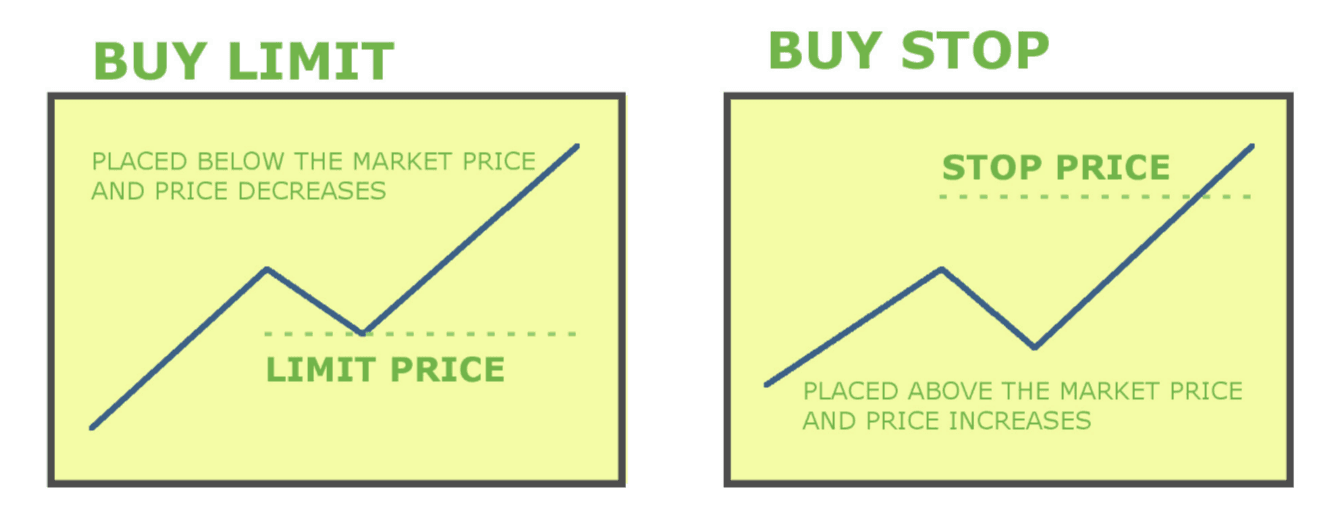

Understanding Buy Limit and Buy Stop

Simply, buy limitA buy order is placed below the current market price. Traders use it when they expect the price to fall first before turning up.

In the context of forex or crypto, buy limits are often placed at support areas, in the hope that the price will bounce.

On the contrary,buy stopis a buy order placed above the market price. Its purpose is not to chase high prices, but rather to capture momentum.

When the price breaks through a certain resistance level, the buy stop will be activated and the order will be executed, signaling a potential continuation of the uptrend. Here's whybuy stop functionclosely related to the breakout strategy.

This difference in logic is key. Buy limits operate in discounted areas, while buy stops operate on confirmation of market strength.

Read Also:Apa Itu Midnight (NIGHT)? The Architecture of Freedom is Rational Privacy

The Difference Between Buy Stop and Buy Limit in Trading Practice

The main differencebuy stop vs buy limitIt depends on how traders read the market. Buy limits are used when the market is expected to correct.

Traders don't rush into a trade, waiting for the price to fall to a level they deem ideal. The main risk is that the order won't be filled if the price rises immediately.

A buy stop order is the opposite. This order is used when a trader is ready to enter after a strengthening signal appears. When the price breaks through a key level, the buy stop is activated, leading the trader to follow the trend. The risk is that if a false breakout occurs, the position could quickly turn into a loss.

Therefore, the difference between buy stop and buy limit orders isn't about which is better, but rather when to use them. Both are tools, not guarantees of results.

Read Also:Timothy Ronald's Case Is Trending, Here's What You Need to Know

Buy Stop Limit and Its Relationship to Sell Limit and Sell Stop

In addition to the two basic orders, there arebuy stop limit, a combination of a buy stop and a buy limit. This order provides tighter control. The trader determines the trigger price and the maximum execution price. If the market moves too quickly, the order may not be executed, but slippage can be avoided.

On the sell side, the concept is similar.Sell limitused to sell at a higher price than the market, usually in the resistance area.

Sell stopused to sell below market price, often used as part of risk management or a downward breakout strategy. Understandmeaning of sell limit and sell stophelps traders see orders symmetrically, both when buying and selling.

Read Also:5 Viral Chinese Coin Memes on BSC That Must Be on Trader's Radar

Conclusion

UnderstandWhat is a forex buy limit? And buy stopIt's not just about memorizing definitions. Both reflect how traders read the market. Buy limit is suitable for strategies like waiting for corrections, while buy stop is for capturing momentum.

Mistakes in choosing order types are often not caused by the market, but by incorrect assumptions. By understanding the differences and the context in which they are used, traders can formulate more disciplined entries that align with their trading plans.

Read Also:Venezuela Has $1,000 Trillion in Bitcoin Reserves: Potential Impact on the Global Crypto Market

FAQ

What is a buy limit?

Buy limit is a buy order below the current market price, used to enter at a lower price area.

What is a buy stop?

A buy stop is a buy order placed above the market price, usually to ride the momentum after a breakout.

When is it best to use buy limit?

Buy limit is used when a trader expects the price to fall to a certain level before rising again.

What is the difference between buy stop and buy limit?

Buy limit waits for the price to fall, buy stop waits for the price to rise above a certain level.

What is a buy stop limit?

Buy stop limit is a combination order that limits the execution price after the trigger price is reached.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.