Bitcoin Is Predicted To Be Overbought, This Means For The Crypto Market

2024-12-09

Bittime - In recent times, the price of Bitcoin has experienced a significant spike. However, now predictions have emerged that Bitcoin may have entered a phase called "overbought".

What exactly is meant by overbought, and how can this condition affect the crypto market as a whole? This article will discuss in more depth the overbought conditions on Bitcoin and what to expect from the next price movement.

What is Overbought?

In the world of investment, the term overbought refers to a situation where the price of an asset, in this case Bitcoin, rises excessively without strong fundamental support.

This phenomenon occurs when many investors buy these assets excessively. Thus, this activity causes prices to soar high.

However, these price increases are not always driven by underlying factors or favorable market conditions, such as continued increases in demand or new innovations in technology.

Overbought can usually be identified through technical analysis tools, such as Relative Strength Index (RSI), which measures whether an asset has been overbought.

Usually, an RSI value above 70 is considered an indication that the asset is already in the overbought zone. Apart from RSI, other indicators such as Stochastic And Williams %R It is also often used to assess whether a crypto asset has entered this zone.

Basically, overbought is a sign that the asset price may have passed its fair value, and there could be a correction or price drop in the near future. It is very important for investors to be careful, because price movements that are not supported by basic factors can cause high volatility.

Read also: Bitcoin and Crypto Heatmap: Understanding and Everything You Need to Know

Bitcoin is predicted to be overbought

In early December 2024, the price of Bitcoin reached a new high in numbers $103.620. This was accompanied by a surge in unrealized profits for many investors.

This price spike triggered warnings that Bitcoin had reached a state overbought. Typically, periods like these are associated with rapid and sharp price increases, potentially leading to price declines in a relatively short period of time.

Source: CCN

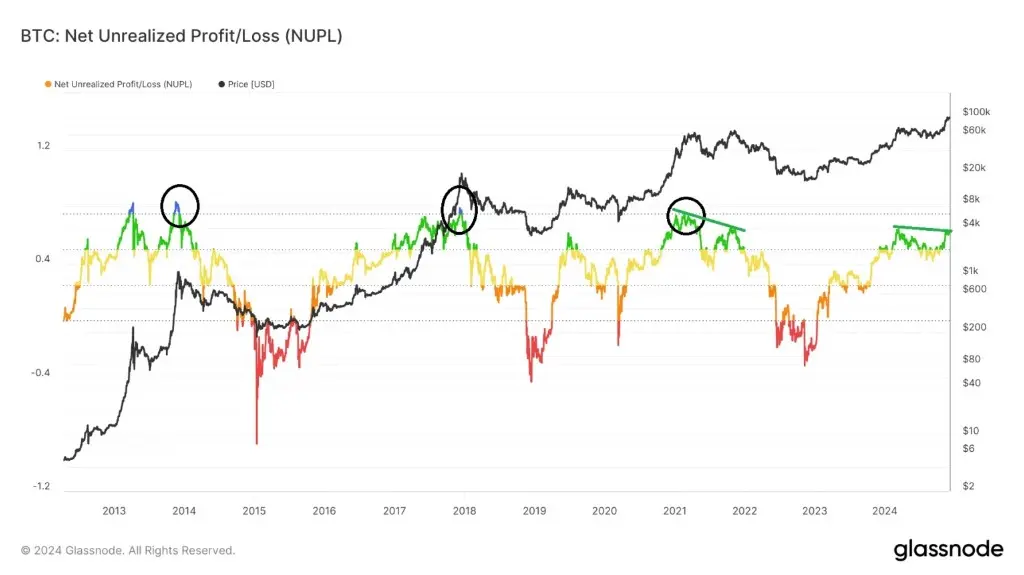

One of the important indicators used to assess whether Bitcoin is in an overbought condition is Net Unrealized Profit/Loss (NUPL). This indicator measures the size of unrealized profits or losses, which is calculated as a percentage of market capitalization.

Read also: Bitcoin Crash: Understanding and Impact on Traders

A high NUPL value often indicates that the market is in euphoria, and this usually occurs at the peak of the Bitcoin market cycle. Currently, Bitcoin's NUPL is at numbers 0.62, which although lower than euphoric levels 0,75, indicating that the market is still in a high-risk zone.

Source: CCN

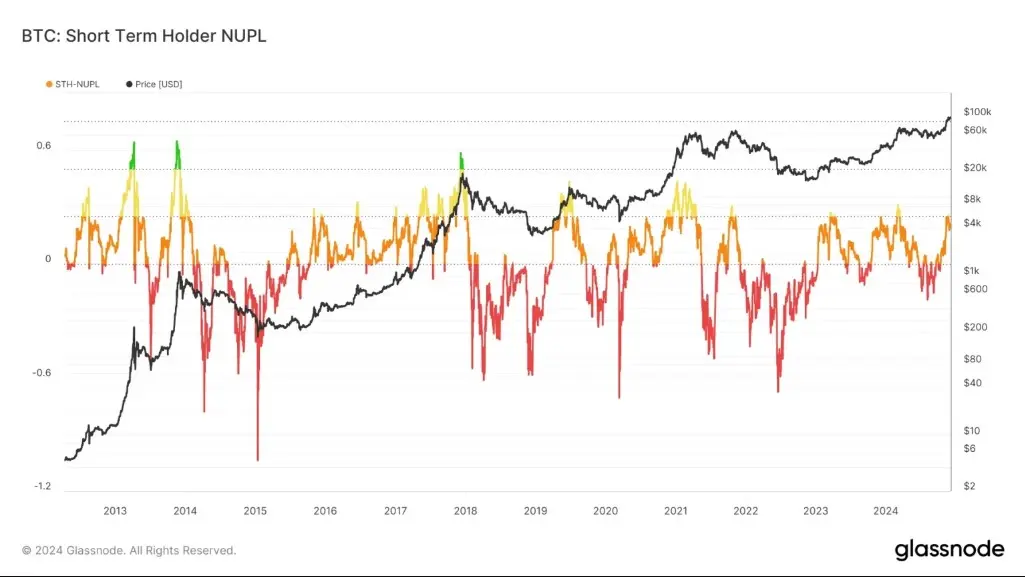

However, despite overbought signals, the data suggests that Bitcoin may still have room to grow further. Analysis of short-term holder (STH) cohort shows that many short-term investors have not pocketed significant profits.

This means there is still potential for further price increases. In this case, even though there are overbought indicators, the possibility of price correction in the short term could be lower, with more stable price movements over the next few months.

The Effect of Overbought Bitcoin on the Crypto Market

When Bitcoin is deemed overbought, the impact can be far-reaching for the entire crypto market. Bitcoin, as the dominant asset in the crypto market, is often a leading indicator for price movements of other crypto assets.

If Bitcoin's price experiences a correction due to overbought conditions, it is likely that altcoins and other crypto assets will also be affected. A decline in the price of Bitcoin could trigger a decline in the prices of other digital assets, causing the overall crypto market to experience a correction.

However, this could also be an opportunity for more cautious investors. Price corrections that occur after an overbought period can open up opportunities to buy assets at lower prices.

On the other hand, for those who are not prepared to face the risk, a correction can cause huge losses, especially for investors who bought at the peak price.

Read also: XRP and Bitcoin are targeted by large companies, one of which is Worksport

Conclusion

Bitcoin is currently in a state that can be considered overbought, based on several technical indicators such as RSI and NUPL.

However, other indicators show that the Bitcoin market still has the potential to continue growing, with the possibility of more stable price movements in the coming months.

This means, even though a price correction could occur, it is likely that the market will still experience further increases, at least until 2025.

FAQs About Bitcoin

When will Bitcoin hit $1?

Debuting in January 2009, the price of Bitcoin broke the $1 mark for the first time in February 2011. Fast forward to 2024 when Bitcoin soared to several record highs, even breaking the $100,000 mark on December 4.

How many people own 1 Bitcoin?

How Many People Own At Least One Bitcoin? As of October 2024, there are approximately 1 million Bitcoin addresses with at least one bitcoin in them.

Who has the most Bitcoins?

The largest bitcoin holders include Satoshi Nakamoto, public companies such as MicroStrategy and Tesla, institutional investment products such as BlackRock, individuals known as “Bitcoin whales”, and even some governments through legal confiscation and strategic purchases such as the United States and El Salvador.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

CCN, Bitcoin on-Chain Data Gives Overbought Signal — What This Means for the Bull Market, accessed December 9, 2024.

coinmarketcap, Overbought, accessed December 9, 2024.

Author: Y

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.