Bitcoin Prediction & Analysis: Heading to $600K in 2025?

2025-10-27

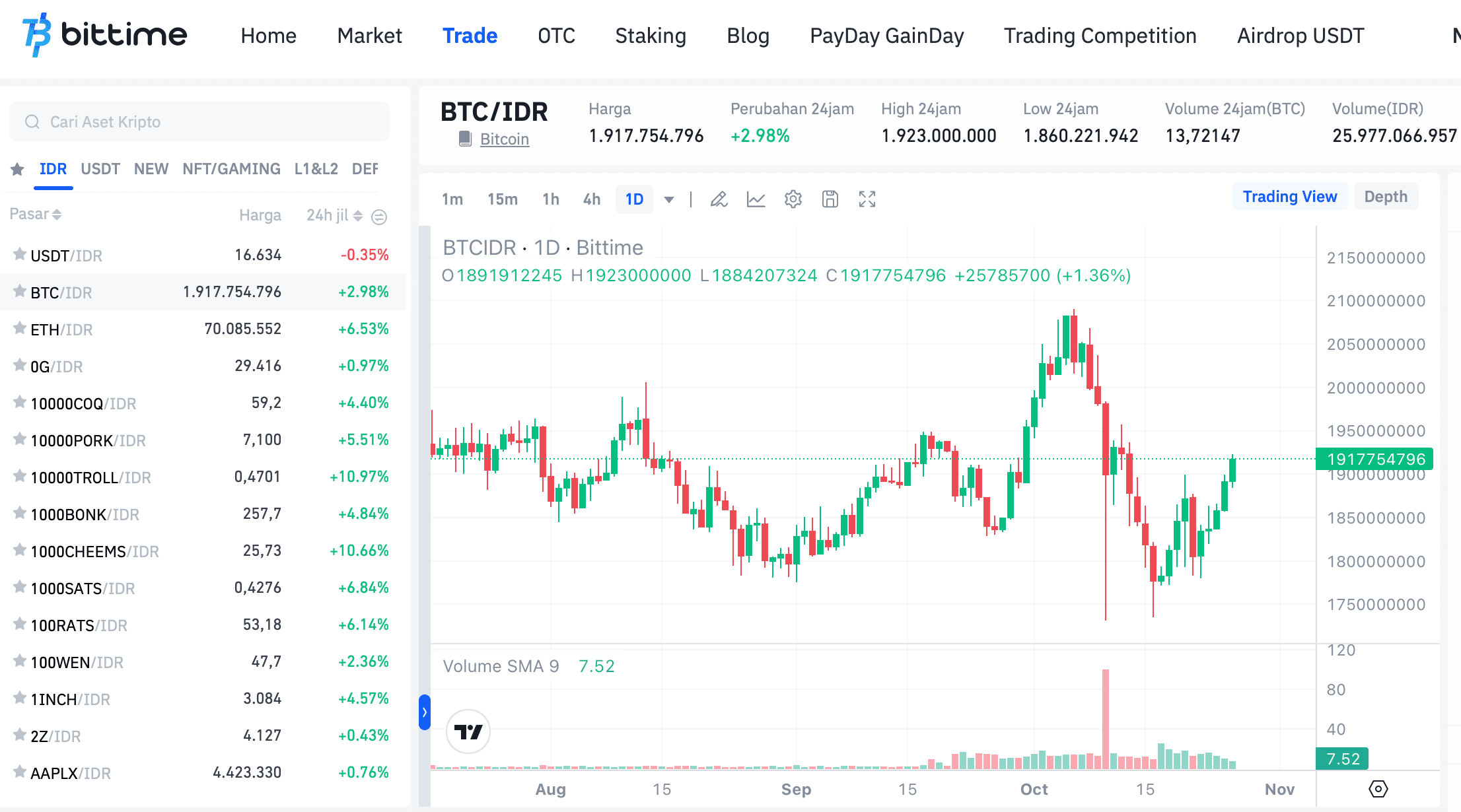

Bitcoin price has once again become the center of attention after showing signs of recovery toward the end of October 2025. On the Bittime platform, the BTC/IDR rate today is around Rp1,917,754,796, up by nearly +2.98% in the past 24 hours. This positive trend raises a big question: is Bitcoin truly on its way to the psychological level of $600,000 this year? Let’s take a deeper look into the predictions, driving factors, and challenges that the global crypto market may face.

Bitcoin Strengthens Again: A Sign of Market Recovery?

After several weeks under pressure, Bitcoin’s recent price increase appears relatively steady. The daily chart on Bittime shows a rebound pattern from the low of around Rp1.86 billion to the Rp1.92 billion area. Although volatility remains high, many analysts see this movement as healthy, indicating renewed buying interest among both retail and institutional investors.

One major reason for this strengthening is the growing confidence in digital assets as a hedge against inflation. As global monetary policy remains uncertain — particularly with The Fed expected to reassess its interest rate direction in the final quarter of the year — Bitcoin is once again emerging as an attractive alternative.

Read also: HBO to Release a Documentary on Satoshi Nakamoto, Creator of Bitcoin!

In addition to macro factors, inflows into crypto-based products like ETFs and stablecoins are also increasing. This reinforces the narrative that Bitcoin is no longer traded solely by speculators but is now included in long-term diversification portfolios.

According to Bittime data, the BTC trading volume in the past 24 hours has exceeded Rp25 trillion, indicating high market activity toward the end of October.

Global Factors That Could Push Bitcoin Toward $600,000

The prediction that Bitcoin could reach $600,000 in 2025 may sound ambitious, but certain macro scenarios provide room for a major rally. Wall Street analyst Fred Krueger believes that imbalances in the U.S. bond market could trigger a significant surge in digital asset prices.

Below are some factors that could potentially drive Bitcoin to that level:

- The Fed’s Policy and the U.S. Dollar

If The Fed decides to cut interest rates or take emergency measures due to economic pressure, global liquidity could increase. This situation typically acts as a positive catalyst for risk assets like Bitcoin. - Institutional Adoption

Major companies such as Tesla, Apple, and even global financial institutions are reportedly considering adding Bitcoin to their balance sheets. This move could create massive demand in the open market. - The Role of BRICS and De-Dollarization

BRICS nations have discussed cross-border payment systems based on gold and Bitcoin to reduce U.S. dollar dominance. If this materializes, it could massively boost market confidence in BTC. - CBDCs and Asset Digitalization

As central banks begin launching Central Bank Digital Currencies (CBDCs), global communities are becoming more familiar with the concept of digital money — further solidifying Bitcoin’s position as the primary reference asset in the crypto world.

If these factors align sequentially, analysts estimate that BTC could surpass $180,000 by mid-year before surging toward $600,000 by the end of 2025.

Crypto Market Trend: The Shift from Gold to Bitcoin

Interestingly, the shift in investor interest from gold to Bitcoin is becoming increasingly evident. Amid dynamic geopolitical situations and fluctuating stock markets, Bitcoin is now viewed as “digital gold”.

Read also: New Documentary Reveals the Figure Behind the Name Satoshi Nakamoto, Creator of Bitcoin

From a technical standpoint, Bitcoin’s chart pattern shows the formation of an ascending triangle, which typically signals medium-term bullish strength. If a breakout occurs above the resistance level of Rp1.93 billion, the potential for a move toward Rp2 billion becomes increasingly likely.

The daily BTC/IDR chart on Bittime (see screenshot above) indicates strengthening buying momentum with steady trading volume.

Conclusion

Bitcoin appears to be building healthy momentum toward the end of 2025. With prices around Rp1.92 billion and nearly a 3% increase in a single day, market sentiment has turned positive again. If global factors such as monetary policy, institutional adoption, and digital innovation align, it’s not impossible for Bitcoin to approach the $600,000 target this year.

However, investors should remain cautious of short-term volatility and macroeconomic risks that could trigger sudden corrections.

Want to start investing or monitor Bitcoin prices in real time?

You can open an account on Bittime.com and enjoy seamless crypto trading with transparent and daily updated price data.

How to Buy Crypto on Bittime

Want to trade and invest in crypto easily? Bittime is here to help! As a crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of Rp10,000. After that, you can immediately purchase your favorite digital assets!

Check conversion rates for BTC to IDR, ETH to IDR, and SOL to IDR, as well as other cryptocurrencies, to monitor today’s crypto market trends in real time on Bittime.

You can also visit the Bittime Blog for exciting updates and educational insights about the crypto world. Discover trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enhance your crypto knowledge.

FAQ

Can Bitcoin really reach $600,000 in 2025?

It’s possible, depending on global conditions and the level of institutional adoption. However, volatility remains high, so a well-planned investment strategy is essential.

What are the biggest factors influencing Bitcoin’s price right now?

The U.S. Federal Reserve’s interest rate policy, large corporate adoption, and U.S. dollar movements remain the main factors.

Is now the right time to buy Bitcoin?

The best timing depends on each investor’s risk profile. However, many analysts see positive momentum heading into late 2025.

Why are investors shifting from gold to Bitcoin?

Because Bitcoin offers higher liquidity, global accessibility, and greater price growth potential compared to gold.

Where can I monitor Bitcoin prices in real time?

You can track them directly on Bittime.com, a local crypto platform featuring complete data displays easily accessible from your phone.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.