Today's Crypto News: Latest BTC Liquidation Heatmap

2025-11-15

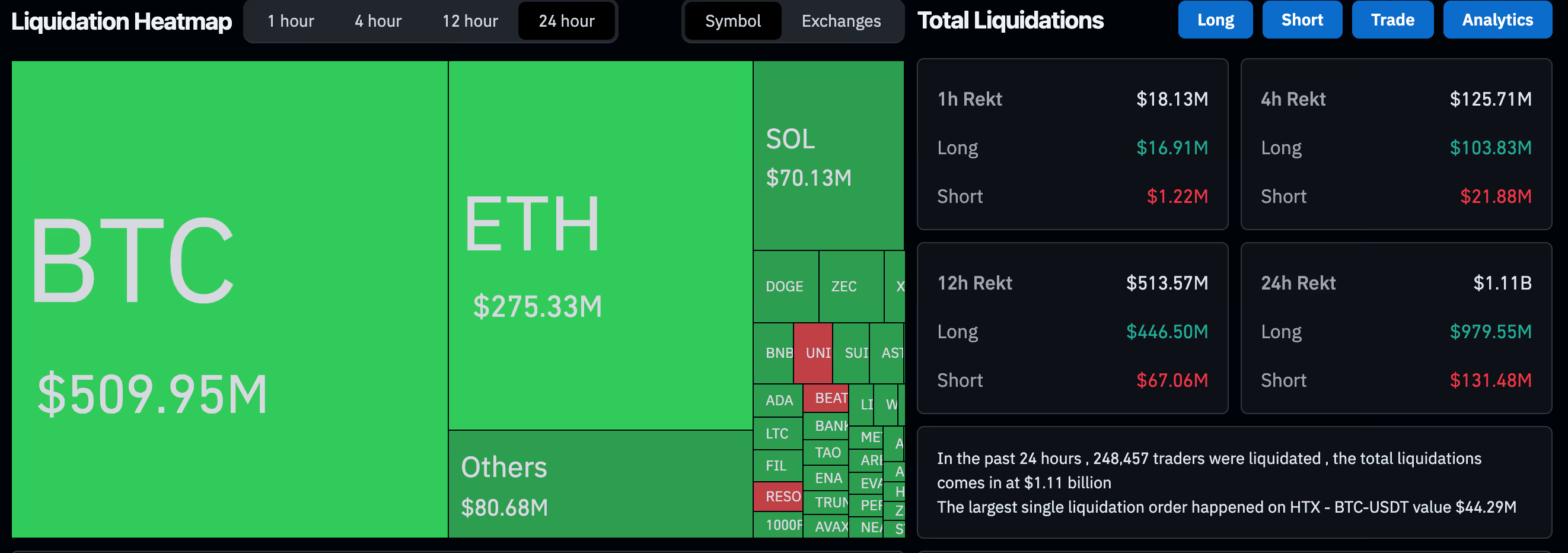

Bittime - The crypto market is again facing sharp pressure with massive liquidations dragging down prices.Bitcoin (BTC) and altcoins have fallen significantly. Recently, over $1 billion worth of liquidations occurred, with approximately half of them coming from Bitcoin positions, in response to selling pressure amid low liquidity.

On the other hand, a number of altcoins including Ethereum (ETH), AAVE, Jup, And SUI recorded double-digit declines, most hitting their lowest levels in recent months.

However, the privacy coin sector such as Zcash (ZEC) And Monero (XMR) shows different performance with significant increase.

Bitcoin Drops Below Its Support Level at $98,000

Bitcoin's price drop below the key support level around $98,000 signaled an early sign of a potential market reversal, causing concern among traders. This decline also triggered the liquidation of over $1.1 billion in derivatives positions, of which approximately $510 million came from Bitcoin trading pairs, according to CoinGlass data.

Coinglass

At the same time, Ethereum fell more than 9% in 24 hours, with other altcoins experiencing declines of more than 10%. The CoinDesk 20 Index, which tracks 20 major crypto assets, also fell 8%, indicating widespread selling pressure.

Latest BTC Liquidation and Its Impact on the Market

The latest BTC liquidation marks one of the most significant moments in recent memory, indicating intense market pressure. Open long positions were forced to close due to this sharp decline, forcing approximately 235,000 traders out of their positions, including the largest liquidation of $44 million in BTC longs on the HTX platform.

This situation is exacerbated by continued high volatility, even though BTC's 30-day implied volatility index (BVIV) has declined slightly to around 47.8%, indicating that despite the price drop, there is caution in options buying, leading the market to respond more measuredly.

Thin liquidity makes the market more vulnerable to excessive selling pressure, triggering a large wave of liquidations. Open interest (OI) in the futures market for tokens other than BTC, such as ETH, SOL, XRP, And ADA, reportedly decreased by more than 5%, indicating capital outflow from these assets.

At the same time, the Ether futures premium on the CME fell to 4.26%, its lowest since April, while BTC maintained a premium above 5%, signaling a divergence in demand between the two major assets.

BTC Heatmap and Derivatives Position Analysis

CoinGlass' liquidation heatmap shows a fairly even distribution of liquidations between Bitcoin and altcoins, with the greatest pressure on long Bitcoin positions and some highly leveraged altcoins.

This heatmap is very useful for showing areas of concentration of liquidated positions so that traders can understand the active market risk areas.

Other on-chain data, such as the Glassnode Cost Basis Distribution Heatmap, confirms that the technical support level around $98,000 is a crucial area for Bitcoin to maintain.

A drop below this area could signal a trend reversal from a bullish market to a medium-term bearish condition, which could extend the downward pressure on prices.

Read also: XRP ETF News Is Getting Hotter, Is a Launch Near?

Latest BTC News and Market Outlook

Despite the intense pressures, several macroeconomic factors could aid the crypto market's recovery, such as the potential end of the Quantitative Tightening (QT) policy in the United States in early December 2025, which would add approximately $100 billion in liquidity per month to the global banking system.

Fiscal stimulus from countries like China and Japan is also expected to increase capital flows into risky assets, including crypto.

This data creates room for optimism for investors who see the potential for a BTC price recovery later in the year.

The significant rebound in the performance of privacy coins like Zcash and Monero is also interesting news.

Zcash has even recorded a gain of over 1,000% since August, signaling a shift in market interest that is again prioritizing the narrative of privacy and political freedom over pure speculation.

Read also:Telecoin (TEL) Listing on Bittime: Price Soars and How to Buy It?

The conclusion

BTC and the crypto market are currently at a critical juncture. The massive liquidation not only indicates intense selling pressure but also opens up the possibility of a reversal if Bitcoin can hold its ground and rise back above key support levels.

Traders and investors need to monitor the latest liquidation heatmaps and macroeconomic developments to make more strategic decisions in the face of this still-high market volatility.

In this situation, the latest BTC news and liquidation heatmaps become important tools for understanding market sentiment and potential Bitcoin price movements in the coming days.

Comprehensive analysis of liquidation data and market depth enables market participants to identify both the opportunities and risks currently underway in the global crypto market.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the latest BTC Liquidation?

The latest BTC Liquidation is the process of automatically closing Bitcoin (BTC) trading positions that have experienced losses exceeding the available margin, usually due to a significant price drop, which causes large liquidations in the crypto market.

What is the function of BTC heatmap in trading?

A BTC heatmap is a data visualization that shows areas of concentrated liquidation of Bitcoin trading positions, helping traders identify risk levels and potential key support or resistance areas in the market.

How does the Latest BTC News affect Bitcoin price?

The latest BTC news, particularly regarding liquidations and market trends, can trigger Bitcoin price volatility by influencing trader sentiment and capital flows in the crypto market.

Why do large liquidations impact the crypto market?

Massive liquidations force open positions to be forcibly closed, which accelerates price declines and increases crypto market volatility in the short term.

How to monitor liquidation developments in the Bitcoin market?

Liquidation progress can be monitored through liquidation heatmaps and open interest data on derivatives platforms such as CoinGlass and CME, which provide real-time information on liquidated positions and market volatility.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.