What is Crypto Staking: Definition, Advantages and Risks

2025-01-13

Bittime - Have you been holding cryptocurrency for a long time and want to get more benefits than just capital gains or selling it? If yes, you might be interested in staking, which is a way to generate income from your crypto holdings. Staking involves using your assets to generate returns, instead of leaving them sitting unused in your wallet.

Crypto staking is quite busy, around 10% of assets are staked

The concept of crypto staking has opened up more opportunities for investors and attracted attention from both institutional and retail investors. A recent report from Staked, a crypto staking company, stated that almost 10% of digital assets are currently staked. Some ecosystems, such as BNB Chain, have a staking ratio of 96.8%, according to Staking Rewards.

Read too Optimizing USDT Staking: Choose the Right and Secure Platform

Ethereum's Transition to Proof-of-Stake Also Driving Staking Growth?

Additionally, Ethereum's switch to a more energy efficient Proof-of-Stake (PoS) mechanism following the Ethereum Merge, is sure to attract more investors and capital into staking. To stake ETH, users can choose to solo stake as validator or join a staking pool. Liquid staking options have also emerged, allowing users to access liquidity from staked ETH, so that it can be used in DeFi activities such as providing liquidity, borrowing, or as collateral.

This article will go into detail about crypto staking, its benefits and risks, as well as three centralized staking platforms to consider.

Read too Learn How to Stake Ethereum (ETH)

What Is Crypto Staking?

Crypto staking is the process of locking up your crypto holdings to support blockchain security, integrity, and efficiency. This is similar to the concept of earning interest on a savings account. The difference is, with staking, you get rewarded for helping secure the blockchain network.

Simple Principles of How Blockchain Works

To understand how staking works, it is important to understand how the blockchain functions. Blockchain is a decentralized distributed ledger, which records and stores transactions transparently and securely. Blockchain consists of a series of blocks containing records of various transactions. In order for new blocks to be added to the chain, they must be validated by network participants known as validators.

The Role of Validators in Blockchain Network Security

Validators have an important role in the security of blockchain networks. They are responsible for ensuring the integrity of the network by verifying transactions and preventing fraud using their stakes. In exchange for their services, validators earn a portion of transaction fees and/or newly minted coins. However, if the validator acts dishonestly, the staked crypto may be subject to garnishment.

Read too Complete Guide to Crypto Staking: How it Works and Mechanisms!

Minimum Crypto Asset Ownership Requirements for Staking

To participate in staking, you must own a minimum amount of a particular cryptocurrency and run a node on the network. Nodes are software that communicate with other nodes on the network to validate transactions and add new blocks to the chain. The bigger your stake, the bigger your influence on the network, and the bigger the rewards you can earn.

Different Types of Proof-of-Stake

There are different types of staking, including Proof-of-Stake (PoS) And delegated PoS (DPoS). In a PoS system, the network selects validators based on the amount of cryptocurrency they own and stake. The more you stake, the higher the chance of you being selected to validate a new block. In a DPoS system, validators are elected by the community and represent the interests of shareholders.

Advantages of Cryptocurrency Staking

Staking cryptocurrency has several advantages, including:

1. It is easier to earn interest on unused crypto holdings compared to other investment strategies, such as yield farming, because you only need to deposit and lock your cryptocurrency according to the staking agreement. Even if you don't have enough crypto to operate as a solo staker, you can join a staking pool and still earn a share of the staking rewards.

2. You no need to purchase expensive mining equipment to participate in crypto staking as required in crypto mining.

3. You helps maintain the security and efficiency of the PoS blockchain you love.

4. With liquid staking, you can even unlock liquidity from staked assets, which can then be used for other DeFi activities.

Read too 4 TON Staking Platforms on The Open Network

5 Risk of Crypto Staking

While staking offers good rewards for crypto ownership and allows you to participate in the security of your favorite blockchain, there are some risks you need to be aware of when locking cryptocurrency on any platform. Here are some of the risks associated with staking crypto:

1. Market Risk

The biggest risk that you must be aware of when staking crypto is the possibility of negative price movements in the cryptocurrency you stake.

For example, if you staked 1 ETH on January 5, 2022, when the price was around $3,500 with an Annual Percentage Yield (APY) of 12%, and a lockup period of one year, you might withdraw your stake on January 5, 2023 at an average price of $1,200.

Even though you get rewards, you will still experience significant losses.

Locking and Staking Waiting Period

While there are some staking opportunities that do not enforce a lockup period, most existing staking platforms have a lockup period. This means your stake will be locked and cannot be used or withdrawn during that period.

If you decide to cash out before the specified time, you may have to wait almost three weeks for your assets to be reopened.

2. Third Party Risks

Third party risk refers to the risk that another party to a financial transaction may fail to fulfill its obligations. In crypto staking, there are several sources of third party risk that you need to be aware of, including risks from the exchange or platform where you are staking. If the platform does not secure your assets properly or goes bankrupt, you could lose your staked crypto.

Read too What is Liquid Staking? Complete Guide for Beginners & Benefits Offered

3. Custody Risk

Custody risk refers to the loss of access or control over digital assets due to the failure or incompetence of a third party. This could be caused by hacking, bankruptcy, or loss of private keys. One way to reduce this risk is to do solo staking, where you maintain control of your assets.

4. Validator Fees for Staking

If you plan to become a solo staker or validator, you should consider validator fees. These costs sometimes exceed the rewards you earn. Therefore, it is important to calculate your expenses and income when registering as a validator.

5. Loss or Theft

Losses due to hacks and exploits remain a major problem in the crypto world. Therefore, it is important to do careful research about the platform you choose and store your private keys safely.

Read too How Staking BTC Works: Great Opportunity for Passive Income!

A number of Platform Staking di Centralized Exchange (CEX)

Centralized Exchange (CEX) staking platforms offer a simple and convenient way for users to start staking cryptocurrency. Here are four centralized staking platforms you can consider:

1. Coinbase

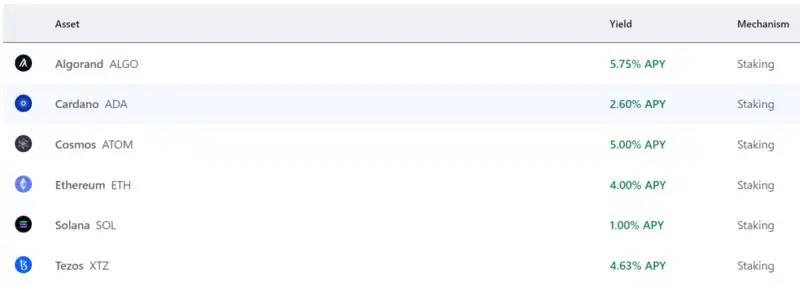

With Coinbase, you can earn up to 5.75% APY on your crypto holdings. You need to register and buy the assets you want to stake. Coinbase will transfer the rewards to you after deducting fees.

2. Binance

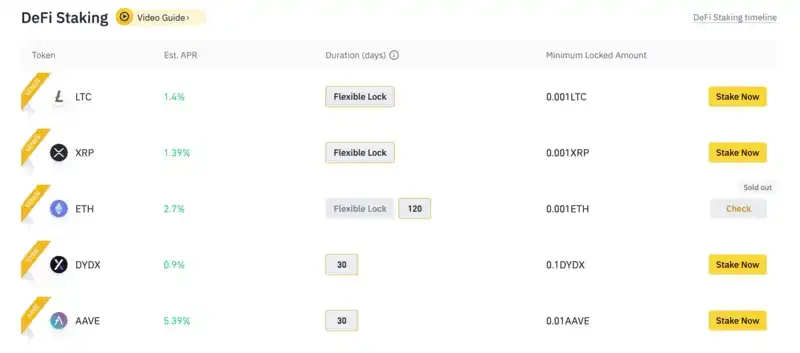

Binance offers up to 5.39% APY for crypto staking. They manage your staking and take protective measures to reduce staking risks.

3. Kraken

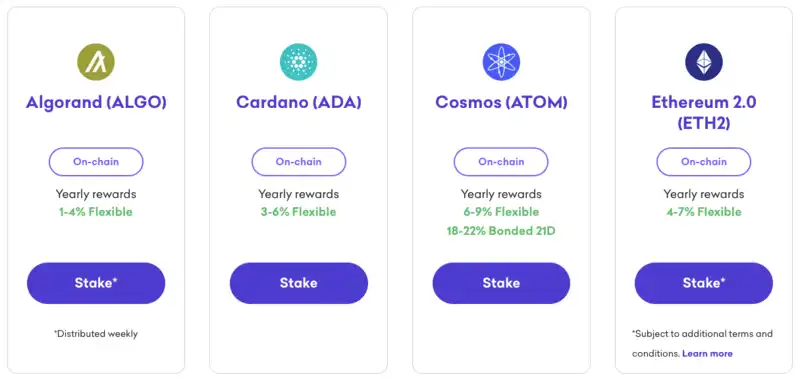

Kraken allows you to earn up to 24% APY on your crypto holdings. You can choose from a variety of assets available for staking and earn rewards twice a week.

4. Bittime

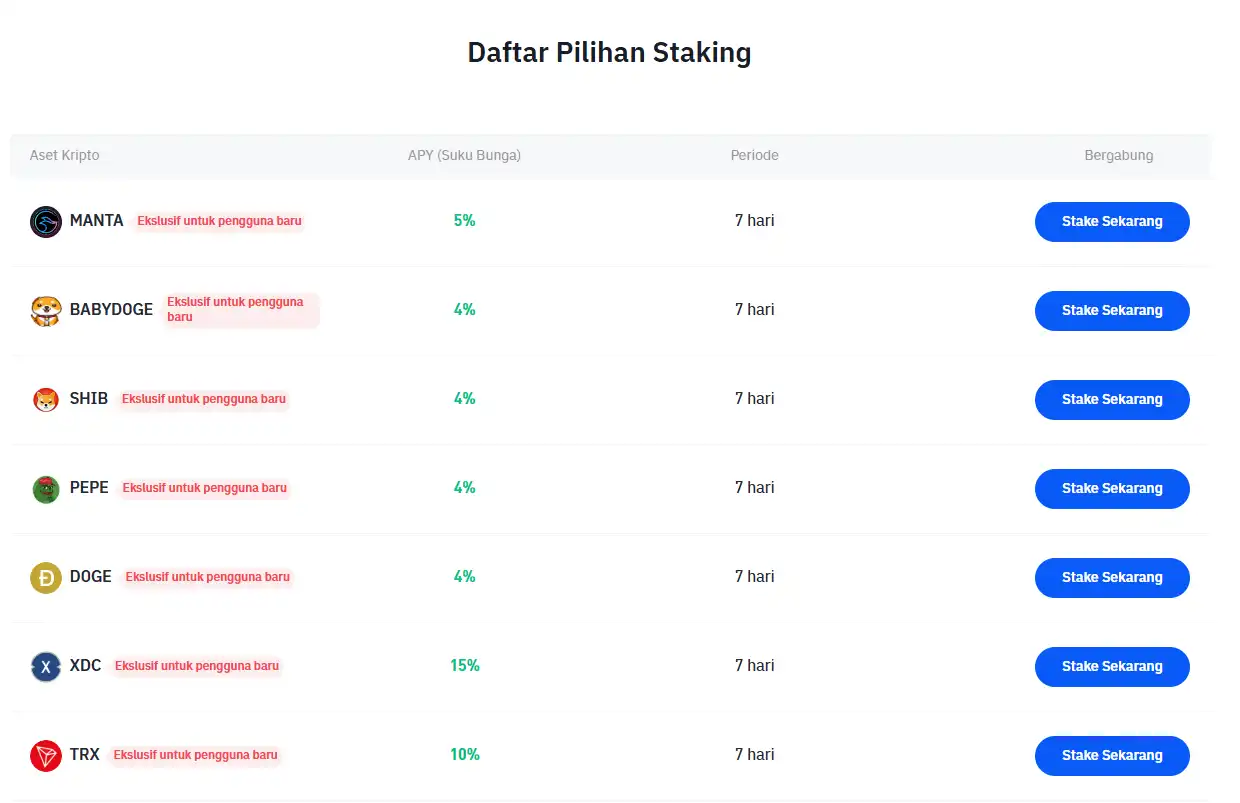

Staking crypto on Bittime allows users to lock digital assets to earn passive returns of up to 15% per year on various assets such as Ethereum, Solana, DOGE, and SHIB. The process is flexible, allowing deposits and withdrawals at any time without additional fees, and staking proceeds are immediately received in the user's wallet.

Conclusion

Cryptocurrency staking provides a way for users to leverage their crypto and earn rewards, while retaining ownership of the asset. While there are many ways to stake, it is important to understand the risks involved and conduct thorough research before participating. Ensuring that the platform or validator you choose is reputable and safe is a very important step.

FAQ

What is crypto staking and how does it work?

Crypto staking is a process in which cryptocurrency owners lock up their assets to support the security and efficiency of a blockchain network, similar to earning interest on a savings account. By staking, users contribute to transaction validation and network security, and in return, they receive returns in the form of additional cryptocurrency.

What are the advantages of staking crypto?

The advantages of crypto staking include the ability to generate returns on unused assets, without the need to purchase expensive mining equipment. Additionally, staking helps maintain the security of the chosen blockchain network, and with the liquid staking option, users can keep access to liquidity from staked assets for use in other DeFi activities.

What are the risks associated with staking crypto?

The risks of crypto staking include the possibility of negative price movements in the staked cryptocurrency, which may result in losses even if returns are earned. Additionally, there are third party risks if the staking platform is not secure, risks of losing access to assets due to hacking or bankruptcy, as well as fees that may exceed the rewards earned from becoming a validator.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Josiah Makori, Crypto Staking: What Is It and What Are The Risks Involved?, Accessed January 13, 2025

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.