What Is StakeStone (STO)? A Complete Guide to Liquid Staking DeFi and Its Ecosystem

2025-12-10

Bittime - StakeStone (STO) is getting more and more buzz in the crypto world as it brings a new approach to liquid staking and liquidity distribution in the ecosystem.DeFiMany users are looking for information about StakeStone (STO) and the concept of liquid staking in DeFi, especially since the protocol offers yield-bearing assets like STONE, SBTC, and STONEBTC that can be used across networks without sacrificing user flexibility.

This article discusses the concept, benefits, products, and tokenomics of StakeStone in full.

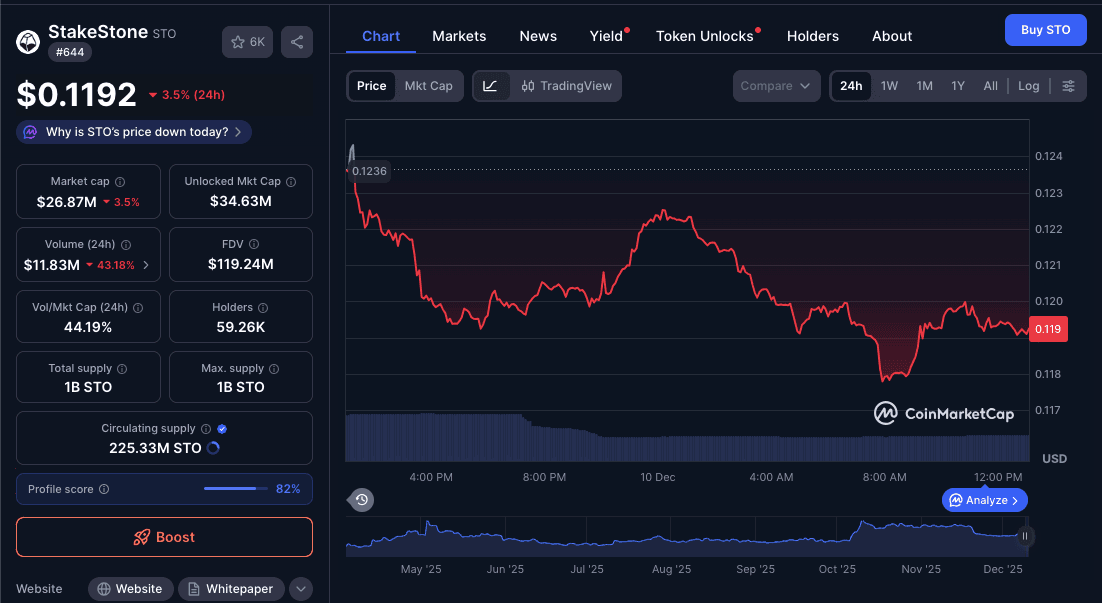

StakeStone (STO) Price Today

Source: CoinMarketCap

Rank: #644

STO Price: $0.1191

24 hour changes: 2.98%

Market Cap: $26.84 million

Unlocked Market Cap: $34.6 million

Volume 24 jam: $11.96 million(up 41.68%)

FDV: $119.14 million

Vol/Market Cap: 44.55%

Holders: 59.26K

Total Supply: 1 billion STO

Max Supply: 1 billion STO

Circulating Supply: 225.33 jute STO

Why is STO’s price down today?

Market volatility, selling pressure, and ecosystem liquidity fluctuations are typically the main factors driving STO price declines in the short term.

READ ALSO:What Is a Securitize Airdrop? Learn How to Participate!

What is StakeStone (STO)?

StakeStone is a decentralized liquidity infrastructure protocol aimed at optimizing yield generation and liquidity distribution across multiple blockchain networks. Through a suite of innovative products, StakeStone enables users to maximize returns on their assets while supporting the liquidity needs of the DeFi, CeDeFi, and Crypto ecosystems.RWA.

StakeStone also provides an omnichain solution, allowing liquidity to move efficiently between blockchains. This is why many users consider STOs an attractive asset in the world of liquid staking.

The Concept of Liquid Staking in DeFi

Liquid staking is a mechanism that allows users to stake assets such asETH or BTCbut still maintains its liquidity through derivative tokens. In other words, users can get:

Reward staking

Derivative assets that can be used in DeFi, such as lending, farming, or trading

Complete flexibility without having to lock up funds for months

StakeStone expands on this concept by creating yield-bearing assets like STONE and STONEBTC, which are not only liquid but also generate optimal returns through adaptive on-chain strategies.

StakeStone's Main Products

STONE: Liquid ETH Ber-Yield Stabil

STONE is a liquid ETH asset that generates stable returns. Powered by an adaptive staking network with multiple consensus layers, STONE:

Maximizing yield opportunities through the on-chain “OPAP” strategy

Providing liquidity across ecosystems

Supporting the growth of DeFi protocols that require ETH as the underlying capital

STONE is perfect for users who want to stake ETH but still want their assets to be liquid and usable across multiple protocols.

SBTC & STONEBTC: Yielding BTC Derivatives

StakeStone offers two types of BTC assets:

SBTC

Index-based liquid form of BTC

Optimizingutilities BTC wrapped

Leveraging redemption liquidity for omnichain liquidity

STONEBTC

High Yield BTC Derivatives

Combining BTC yield strategies across DeFi, CeDeFi, and RWA

Delivering sustainable yields without sacrificing flexibility

Both of them transform BTC from a passive asset into a productive asset with high earning potential.

LiquidityPad: Platform Fundraising Omnichain

LiquidityPad is a platform designed to help blockchains and protocols efficiently pool liquidity. The platform:

Connecting Ethereum liquidity with other ecosystems

Optimizing capital allocation for network growth

Becoming a cross-chain liquidity distribution center

LiquidityPad makes StakeStone not just a liquid staking protocol, but also a global liquidity bridge.

READ ALSO:Privacy Token Narrative 2026: Which Assets Will Rise?

StakeStone (STO) Advantages

Supports ETH and BTC based assets

Omnichain liquidity

Competitive yields through adaptive strategies

Liquid staking without lock-up restrictions

A growing ecosystem for DeFi and CeDeFi

Fundraising solutions for new blockchains

With these features, StakeStone is attractive to both investors and users looking to maximize the potential of their digital assets.

READ ALSO:USDT to Rupiah Conversion Calculator: How Much is 1 USDT in Rupiah?

Conclusion

StakeStone (STO) presents a new way of understandingWhat is StakeStone (STO) and the concept of liquid staking in DeFi?, offering yield-bearing assets, cross-chain liquidity, and an efficient liquidity infrastructure. With products like STONE, STONEBTC, SBTC, and LiquidityPad, StakeStone is a noteworthy protocol in the growing DeFi ecosystem.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What are the main functions of StakeStone?

To provide liquid staking infrastructure and omnichain liquidity.

Is STONE the same as ETH?

STONE is a liquid ETH derivative that generates yield.

Is StakeStone's official STO token?

Yes, STO is the StakeStone ecosystem token.

Can BTC be staked on StakeStone?

Can be through SBTC and STONEBTC.

Is StakeStone suitable for beginners?

Yes, especially for those who want yield without locking up assets.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.