What is the USAT Stablecoin? Features, Tokenomics, Price, and How to Buy USAT

2026-02-19

Tether officially launched the USAT stablecoin on Rumble Wallet. USAT is a digital dollar designed to comply with United States regulations.

USAT is a digital dollar designed to comply with US regulations. With full real asset backing and a federal legal framework, USAT seeks to bridge the crypto world with the traditional financial system.

In this article, we'll cover everything from what the USAT stablecoin is, its key features, tokenomics, recent price performance, and how to buy USAT.

Key Takeaways

- USAT is a stablecoin pegged 1:1 to the USD and fully backed by liquid reserves in the form of U.S. Treasury Bills.

- Operating under the GENIUS Act regulations with an issuance structure through Anchorage Digital Bank.

- The way to buy USAT is through a global exchange that supports USAT trading pairs.

What is USAT Stablecoin?

Image Source: USAT

USAT (USA₮) is a stablecoin designed to always be worth 1 US dollar. Unlike volatile crypto assets like Bitcoin, which are volatile, USAT focuses on value stability.

Each USAT token is 100% backed by liquid reserves in the form of USD cash and short-term U.S. Treasury Bills.

There is no leverage and no rehypothecation of reserves. This means that each token truly represents a claim to an asset held separately off-blockchain.

Read Also:What is Bitway (BTW)? Key Features and Token Utilities

USAT Stablecoin Background

The launch of the USAT stablecoin is inseparable from the huge success of USDT. Throughout 2024, USDT served more than 500 million global users and generated more than $13 billion in profits.

In fact, Tether was once one of the largest holders of the U.S. Treasuries in the world, ranking among the top 20.

However, regulatory pressure in the United States is increasing, especially after the GENIUS Act was officially signed on July 18, 2025. This law is the first federal framework to comprehensively regulate stablecoin issuers.

In response, on September 12, 2025, Tether introduced USAT alongside the appointment of Bo Hines as its new CEO. Thus, Tether maintained USDT's global dominance while introducing a dedicated stablecoin that fully complies with US regulations.

This dual-token strategy allows Tether to maintain global liquidity through USDT, while simultaneously capturing institutional demand in the world's largest financial markets through USAT.

Key Features of USAT Stablecoin

USAT is more than just another stablecoin. It has several features that set it apart:

1. GENIUS Act Compliance Framework

USAT operates under the GENIUS Act which requires:

- 1:1 reserves with liquid assets

- AML/KYC compliance for users and institutions

- Monthly audits and public disclosure

Stablecoins with a capitalization above $10 billion will be under direct federal oversight. This structure makes USAT one of the most transparent stablecoins available in the American market.

2. Hadron Tokenization Platform Technology

USAT uses Tether's Hadron platform which supports:

- Multi-chain implementation

- Smart contract integration

- Programmable money feature

- Tokenization of real-world assets

This technology allows USAT to be used on an institutional scale with high flexibility.

3. Institutional Infrastructure Partnership

The USAT cooperation structure involves:

- Anchorage Digital Bank as a regulated issuer

- Cantor Fitzgerald as backup custodian

Reserves are managed without leverage and without re-borrowing, and are verified through independent audits.

4. Cross-Border Payment Efficiency

USAT enables near-instant settlement of cross-border transactions. Compared to the SWIFT system, which can take 3–5 days, USAT can settle transactions in seconds at a lower cost.

This feature is suitable for:

- Remittance

- Payroll global

- International B2B payments

Read Also: What is Aztec Network (AZTEC)? Ethereum's Privacy-Focused Layer 2

Tokenomics of USAT Stablecoin

Here are the details of the tokenomics of USAT stablecoin:

Reserve Structure

- 100% backed by liquid reserves.

- Consists of USD and short-term U.S. Treasury Bills.

- No leverage.

- Saved by Cantor Fitzgerald.

Publishing Structure

- Anchorage Digital Bank as the official issuer.

- Tokens are created only if reserves are deposited.

- Tokens are burned upon reserve withdrawal.

- There is no maximum supply limit (flexible according to demand).

Transparency and Reporting

- Monthly attestation by a public accounting firm.

- Disclosure of reserve composition.

- Federal regulatory oversight.

- Full compliance with GENIUS Act standards.

Read Also: What is CLAWNCH? A Narrative-Driven Meme Token in the Base Ecosystem

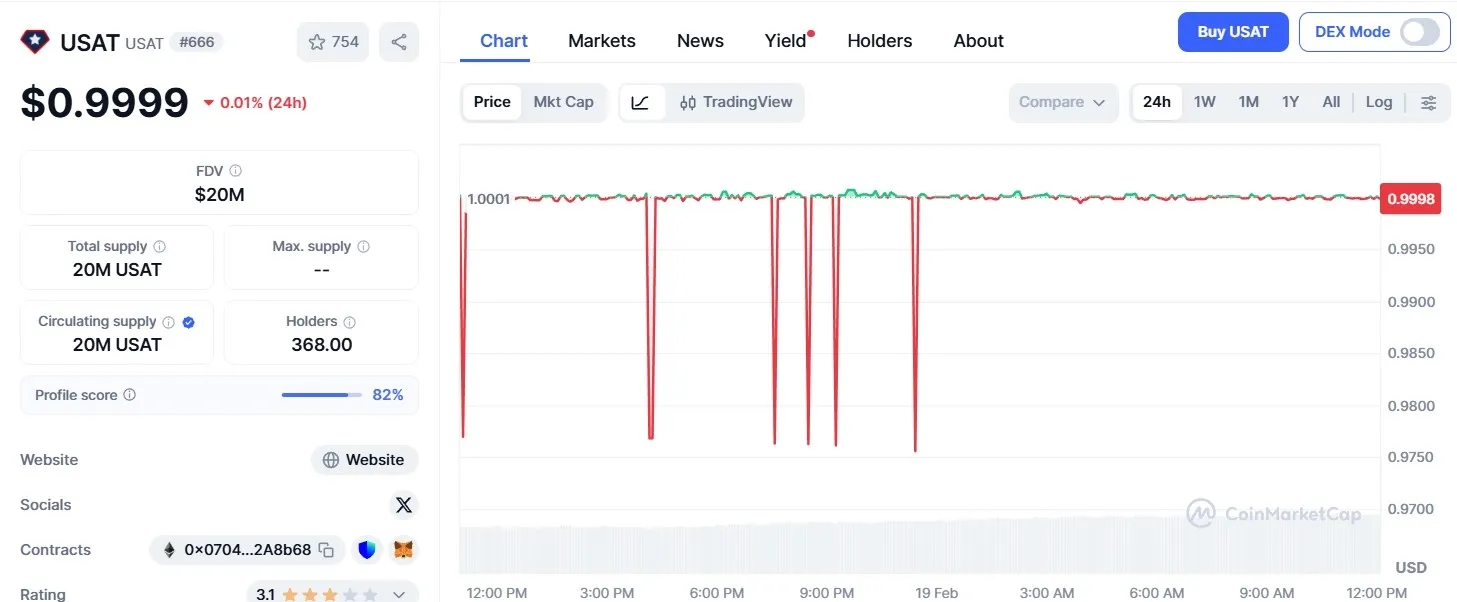

USAT Price Today

Image Source: USAT

Based on the latest market data, USAT price today is hovering around $0.9999. The last 24 hours have been relatively stable, with a change of around -0.01%. This reflects the nature of stablecoins, which are designed to maintain a fixed value.

Current position of USAT price:

All-Time High: $1.00, about 0.25% below ATH.

All-Time Low: $0.9981, about 0.18% above ATL.

With a circulating supply of around 20 million tokens, its market cap is approaching $20 million.

Read Also: What is ZIOWCHAIN (ZIOW)? Concept, Technology, Functions, and Price

How to Buy USAT Stablecoin

Here's how to buy USAT stablecoin:

1. Select the USAT Listed Exchange: Make sure the exchange has a good reputation and supports pairs like USAT/USDT or USAT/USD.

2. Register and Complete KYC: Use an active email and complete identity verification.

3. Deposit Funds: You can deposit USD via bank transfer, stablecoins like USDT, or credit/debit card.

4. Make a Purchase: Select the order type, such as Market Order, Limit Order, or Stop Order. Enter the amount and confirm the transaction.

5. Store in a Secure Wallet: For extra security, move them to a private wallet if needed.

Read Also: What is GoPlus Security (GPS)? How it Works, Features, Tokenomics, and Price

Conclusion

Now you understand what the USAT stablecoin is, its background and regulatory structure, and how to buy USAT.

This stablecoin comes in response to US regulation through the GENIUS Act, with the full support of U.S. Treasury Bills and issuance by Anchorage Digital Bank.

With its stable price, USAT offers a transparent and regulated alternative to a digital dollar. For investors or institutions prioritizing stability and legal compliance, USAT could be an attractive option in the modern crypto ecosystem.

FAQ

What is USAT stablecoin?

USAT is a stablecoin pegged 1:1 to the US dollar and fully backed by liquid reserves in the form of USD and U.S. Treasury Bills.

Why was USAT created separately from USDT?

USAT was specifically designed to comply with United States regulations through the GENIUS Act, while USDT continues to operate globally.

Can I buy USAT in Indonesia?

Currently, purchases are generally made through global exchanges that have listed USAT.

Is USAT safe?

USAT is issued by Anchorage Digital Bank and overseen by US regulators, with regular audits and reporting.

Can USAT increase its price?

As a stablecoin, USAT is designed to remain stable around $1, not for speculation on large price increases.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.