What is Mira Network? Getting to Know the MIRA Token and Stablecoins in the MIRA Ecosystem

2025-09-26

Bittime - In the Web3 ecosystem that combines artificial intelligence (AI) and blockchain, Mira Network has emerged as an ambitious project that aims to build a trust layer for AI output.

With the MIRA token and the Lumira stablecoin, Mira aims to enable the tokenization of real assets, one-time AI verification, and a transparent community economy.

This article will outline what Mira Network is, the functionality of the MIRA token, the Lumira stablecoin, their tokenomics, as well as price predictions and potential risks.

What is Mira Network?

Mira Networkis a blockchain protocol that focuses on decentralized verification of AI output.

The goal: to reduce the errors (hallucinations) that often occur in single AI models by using a consensus method among multiple models. In the process, AI output is broken down into verified claims, distributed to independent nodes, and agreed upon through consensus.

The Mira whitepaper states that the network of nodes operates a verification model and stakes tokens. Nodes that deviate from the consensus may have their stakes slashed.

In addition to its AI verification function, Mira Network also aims to become a real-world asset (RWA) tokenization ecosystem.

This project will enable users to become tokenized shareholders of real companies through tokenized events and airdrops.

Mira uses a hybrid consensus (PoW + PoS) in its verifier network to maintain the system's economic security and honesty incentives.

Read Also: How to Get the $MIRA Airdrop: Complete Guide & Tokenomics Predictions

MIRA Token: Functions & Tokenomics

MIRA Token Function

MIRA Token is the native token of the MIRA-20 Blockchain network that serves several functions:

- As a utility token (gas) to run transactions and smart contract calls on the network.

- As a staking tool for verification nodes to participate in the AI output verification process.

- As a reward token for nodes or ecosystem participants who contribute (verifiers, data providers).

- As part of the internal economic mechanism of the tokenization ecosystem and distribution of benefits to the community.

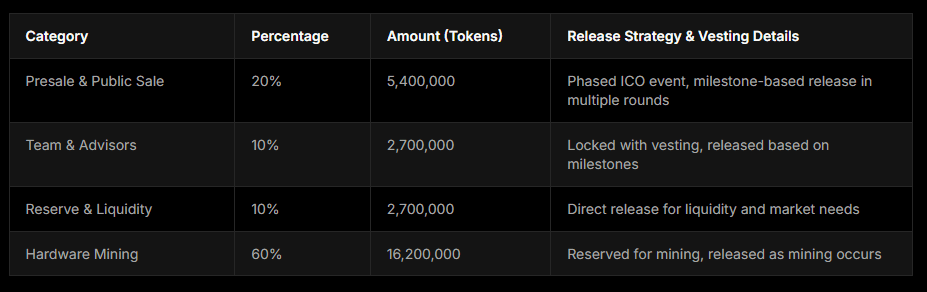

Tokenomics MIRA

Here are the details of MIRA Network's tokenomics:

With a milestone-based vesting mechanism, the supply of tokens entering the market can be more controlled, thereby helping maintain long-term price stability.

Additionally, audits from CertiK provide security assurance for investors and early adopters.

Additionally, the project also introduced Lumira, a community stablecoin within the Mira ecosystem.

Lumira Stablecoin: What It Is & What It's Used For

Lumirais a stablecoin in the Mira ecosystem designed to bring stability and utility to activities on the network.

Some points about Lumira:

- LUmira will have a fixed supply of 250,000,000 LUM (250 million).

- The Lumira value is linked to the Swiss Franc (CHF) currency as a starting point, providing value stability.

- Mira users can mine Lumira for free through the Mira Network app as part of a community engagement mechanism.

- Lumira will be a stablecoin unit used in transactions within the ecosystem, as a “stable currency” within the asset tokenization platform.

Thus, MIRA and Lumira function differently: MIRA for utility, staking, verification, while Lumira is a more stable stablecoin and is used in the ecosystem's economic activities.

Read Also: Lumira Coin (LUM): Swiss Franc Stablecoin in the Mira Network Ecosystem

MIRA Price Prediction & Future Potential

Here are some projections and factors that could potentially influence MIRA's price:

Price Determining Factors

- Utility and staking demand on the Mira network

- AI output verification activity (verification service request)

- Real asset tokenization (RWA) adoption and community participation

- MIRA token listing on crypto exchanges

- Regulatory clarity & legal compliance (whitepaper under legal review)

MIRA Price Prediction

With the ecosystem just developing, price predictions should be heavily factored in as scenarios:

- In an optimistic scenario: if adoption is high and the network grows, the price of MIRA could grow significantly from the pre-listing value to the rangeUS$0,50 – US$1,00+depending on liquidity & demand.

- In a moderate scenario: the increase may be limited to the rangeUS$0,10 – US$0,30if adoption is slow and token distribution is gradual.

- In a pessimistic scenario: if education, listing, or the use of AI verification do not go according to plan, the price could stagnate or fall.

Since MIRA's current circulation is still zero, the price on the public market is highly dependent on how and when the tokens begin to circulate.

Challenges & Risks

Some challenges to be aware of when investing in Mira Network & Lumira:

- Mira's whitepaper is still in progresslegal review to ensure compliance with Swiss and other country regulations.

- The risk of token distribution being too slow or limited, resulting in low liquidity in the initial term.

- The success of the AI verification system and adoption by third-party applications are critical factors: if not many applications use Mira's verification service, demand for MIRA tokens could be low.

- Regulatory challenges: as a project that combines AI + finance + real asset tokenization, state regulations can be a barrier.

- Competition from similar projects in the domain of AI verification and asset tokenization (Web3 + AI) could suppress Mira's market potential.

Read Also: How to Buy ASTER on DEX: A Complete Beginner's Guide & Safety Tips

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Mira Network in simple terms?

Mira Network is a decentralized protocol that serves as a “trust layer” for AI — verifying AI output using multiple models by consensus, and also enabling the tokenization of real assets.

What is the function of the MIRA token?

MIRA is used as a utility token for gas, staking, node verification, and incentives within the Mira ecosystem.

What is Lumira stablecoin?

Lumira (LUM) is the Mira ecosystem's stablecoin with a fixed supply of 250 million, pegged to the Swiss Franc, and used in internal transactions within the ecosystem.

What is the total supply of MIRA & Lumira?

The total supply of MIRA is27 million MIRA. Lumira has 250 million LUM.

Can MIRA prices rise high?

Yes, there's significant upside potential if the Mira ecosystem grows rapidly and tokens begin circulating. However, there are risks of low liquidity and adoption challenges to consider.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.