What is Bedrock (BR) in the Crypto Ecosystem?

2025-11-30

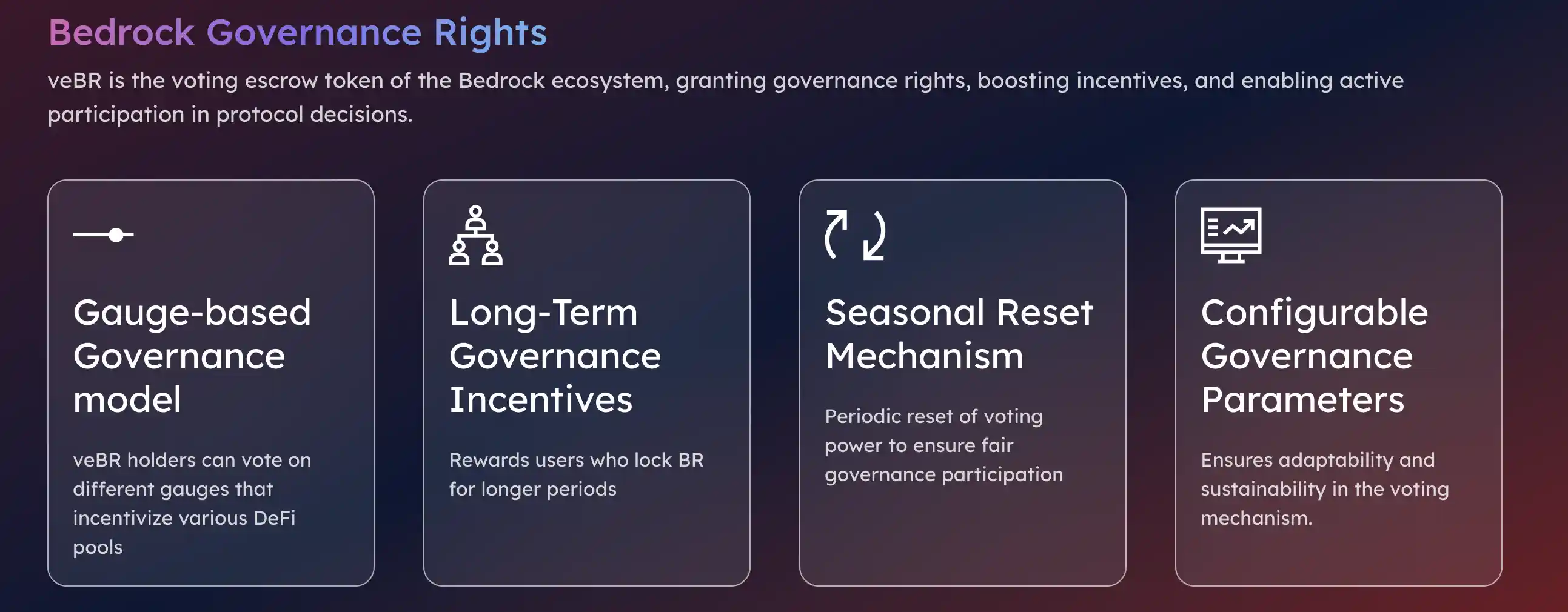

Bittime - The Bedrock ecosystem is starting to attract attention from the crypto community because it offers a governance model designed to be fairer, more transparent, and more long-term oriented.

The system combines two main tokens, BR and veBR, to ensure users have a direct role in protocol decision-making.

This article explains the functions of Bedrock (BR), its governance mechanisms, and how the new BTCFi or Bitcoin DeFi model provides room for innovation.

What is Bedrock (BR)?

Bedrock (BR) is a core asset in the Bedrock ecosystem that serves as both a governance token and an incentive token.

In this model, users can lock BR to generate veBR, which are voting escrow tokens that determine voting power in the DAO.

This structure is similar to popular governance models in the DeFi sector, such as veCRV in the Curve ecosystem, which emphasizes long-term commitment to gain a larger voting share.

Bedrock was introduced as part of the growing wave of Bitcoin DeFi, or BTCFi, a trend that integrates staking, restaking, and liquidity capabilities into Bitcoin-based assets.

In this context, Bedrock seeks to provide stable incentive mechanisms and decentralized governance to encourage community participation.

Read also:The Complete Guide to Crypto Staking: How It Works and Its Mechanisms!

How Governance Works at Bedrock

Bedrock's governance system is based on a 1:1 conversion of BR to veBR. However, voting power increases with the lockup duration.

The longer BR is locked, the more veBR is received. This mechanism encourages users to commit long-term to the protocol.

Read also:Crypto Staking on Bittime: An Easy Way to Earn Passive Income from Crypto Assets

Gauge Voting Mechanism

One of Bedrock's key features is gauge-based governance. In this model, veBR holders can vote on various gauges, which are incentive channels that allocate rewards to specific pools such as staking pools, liquidity pools, or other DeFi integrations.

The gauge voting model was first popularized by Curve Finance and has proven effective in distributing incentives based on community decisions.

Through this voting, Bedrock can determine where BR incentives are allocated each period, so the ecosystem follows the preferences of active users, not the decisions of the core team.

Read also:What is the TAC Protocol? Now Available on Bittime

Sistem Seasonal Reset Voting Power

To prevent long-term dominance by large token holders, Bedrock introduced a seasonal reset mechanism. At the end of each governance season, voting power resets to the base level. This means new users have a fair chance to participate without having to compete with years of accumulated voting power.

This concept adds an element of equality to DAOs, especially for ecosystems that want to remain open to newcomers. Most major DeFi projects haven't implemented such a reset, so Bedrock offers a more balanced alternative model.

Read also:What Is Falcon Finance (FF)? A DeFi Collateral Token on Bittime

Transitioning Toward a Full DAO

In its initial stages, Bedrock remains under the development team's configuration and administrative control. However, the protocol has prepared a transition roadmap to hand over full control to veBR holders.

Once the transition is complete, the community will have the authority to determine protocol parameters, technical updates, incentives, and the strategic direction of the ecosystem.

This gradual approach is similar to the model used by large protocols like Aave and MakerDAO, which started with semi-centralization and then transitioned to fully decentralized governance once their infrastructure stabilized.

Read also:Lista DAO (LISTA): A Growing Stablecoin and Liquid Staking Protocol

Dual Function of BR and veBR in Ecosystem

BR and veBR are not only governance tools but also part of Proof of Staking Liquidity, a reward model that rewards users who stake their assets.

Key benefits of BR and veBR include:

• participation in protocol governance

• incentive income from staking and restaking

• access to BR-based DeFi pools

• additional liquidity for lending, borrowing, and liquidity provision

• the ability to determine the gauge that will receive the reward distribution

With this dual-token model, Bedrock creates a mutually reinforcing internal economic cycle. BR incentivizes users, while veBR votes to determine the direction of ecosystem development.

Bedrock (BR) Latest Prices & Statistics

Currently the price of BR is in the range≈ US$ 0,057–0,074 per token.

In rupiah, based on the latest conversion, 1 BR is equivalent to around Rp. 950–Rp. 960.

The maximum total supply of BR is 1 billion tokens, while the current circulating supply is around 230 million tokens.

Market capitalization (market cap) is in the range US$13–18 million— classified as a crypto with a small to medium market value.

Historically, BR has reached an all-time high (ATH) of around US$0.22. This means the current price of BR is well below its all-time high—a level that some analysts believe indicates upside potential if a positive catalyst emerges.

Bedrock (BR) Tokenomics — How It's Distributed & Its Mechanism

The Bedrock project employs a relatively transparent tokenomics model. Here are the key aspects:

Total Supply & Distribution

Current circulating supply: approx.230–330 million BR, depending on platform data.

The remainder is mostly still locked, awaiting unlock or distribution through the protocol mechanism.

Token Function & veBR Mechanism

BR is not just a speculative token: it is a utility and governance token within the Bedrock ecosystem.

BR holders can “lock” their tokens to earn veBR — a non-transferable escrow token that grants voting rights in governance decisions, including incentive determination, liquidity allocation, and protocol parameters.

The longer the lock-in period, the greater the power of the vote — a mechanism that encourages long-term commitment from the community.

Model “Liquidity Restaking” & Yield

Bedrock is described as a “multi-asset liquidity restaking” protocol. This means the project allows users to stake crypto assets like ETH, BTC, or other assets, then “restake” that liquidity to earn a yield while maintaining liquidity—unlike traditional staking, which locks up assets.

The BR token then becomes an incentive—rewarding both liquidity providers and token holders. This model is expected to support ecosystem sustainability while attracting liquidity.

Potential Risks & Dilution

With a maximum supply of 1 billion tokens and a circulating supply of only a small portion, there is potentialdilutionThis means that if many new BR tokens are released, the value per token could be depressed—unless adoption and demand for the token grow much faster.

This dilution must be taken into account by investors as part of risk management.

Implications for Investors & Users

For active users: if you plan to participate in the ecosystem (liquidity restaking, staking, governance), holding and locking BR for veBR can provide a double benefit — voting rights and potential reward.

For long-term investors: BR's current price is far from its all-time high. If the protocol can attract significant liquidity, widespread adoption, or innovation, there's upside potential. However, dilution and volatility remain the main risks.

For short-term traders: liquidity and trading volume are relatively low compared to major cryptos; price movements can be sharp during news or sentiment events, but they are also prone to slippage and less stable.

Bedrock in the BTCFi 2.0 Trend

Bedrock positions itself within the BTCFi 2.0 framework, a new generation of Bitcoin-based DeFi applications that provide features such as restaking, liquid staking, and sustainable yields.

As Bitcoin is increasingly used on layer-2 or sidechains, projects like Bedrock are capitalizing on this trend by providing active governance and strong incentive mechanisms.

In a competitive market, an ecosystem that combines fair governance, a stable reward model, and integration with various DeFi pools has the potential to attract more users.

Conclusion

Bedrock (BR) offers a veBR-based governance model that emphasizes long-term commitment, gauge-based incentive distribution, and a reset voting mechanism that ensures fairness for new participants.

By integrating with the BTCFi 2.0 model, Bedrock is expanding the potential of Bitcoin-based DeFi through the BR and veBR tokens. The transition to a full DAO demonstrates the ecosystem's commitment to decentralized governance and long-term growth.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Bedrock (BR)?

BR is the primary token of the Bedrock ecosystem used for governance, incentives, and DeFi activities.

What is the function of veBR?

veBR provides additional voting rights and rewards for users who lock BR.

What is seasonal reset?

Seasonal reset is a mechanism that resets voting power to maintain fair governance.

How to follow Bedrock governance?

Users must convert BR to veBR to be able to vote.

What are the advantages of Bedrock over other protocols?

Bedrock offers an adaptive governance model, sustainable staking incentives, and a focus on BTCFi integration.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.