What is Aster (ASTER)? Tokenomics and Price Prediction

2025-09-22The newly launched Aster (ASTER) experienced significant price movements and attracted the attention of traders.

However, before participating in it, it is important to understand more about what Aster is, how tokenomics or token allocation works, and the reasons for the recent decline in ASTER prices.

What is Aster (ASTER)?

Aster (ASTER) is a new generation DEX platform that offers Perpetual and Spot trading in one ecosystem.

The platform is designed as an on-chain trading hub for global traders.Aster's advantage lies in its featuresMEV-free one-click execution in "Simple Mode" which is user friendly.

For experienced traders, there is a “Pro Mode” which brings features such as 24/7 stock perpetuals, Hidden Orders, dan grid trading, as well as cross-network support such asBNB Chain, Ethereum, Solana, Dan Arbitrum.

What makes Aster unique is its ability to offer liquid-staking tokens such as BNB and yield-generating stablecoins like USDF as collateral, thus opening up unprecedented opportunities for capital efficiency.

Additionally, Aster is powered by Aster Chain, a high-performance, privacy-focused L1, built by YZi Labs with a “fast, flexible, and community-first” vision.

Read Also: What is Kamino Finance (KMNO)? Features, Tokenomics, and Pricing

Aster (ASTER) Tokenomics

At the core of the Aster ecosystem there is token $ASTER. This token serves to decentralize governance, support platform growth, reward user participation, and ensure long-term sustainability.

Based on the latest data, here is the tokenomics or distribution of ASTER tokens:

Airdrop: 53,50%

Ecosystem & Community: 30%

Treasury (locked until used through governance): 7%

Team: 5%

Liquidity & Listing: 4,50%

This distribution model demonstrates Aster's focus on the community and ecosystem with the largest portion for airdrops, so early user participation is highly valued.

Read Also: What is MemeCore ($M)? Key Features and Price Prediction

Aster (ASTER) Price Today

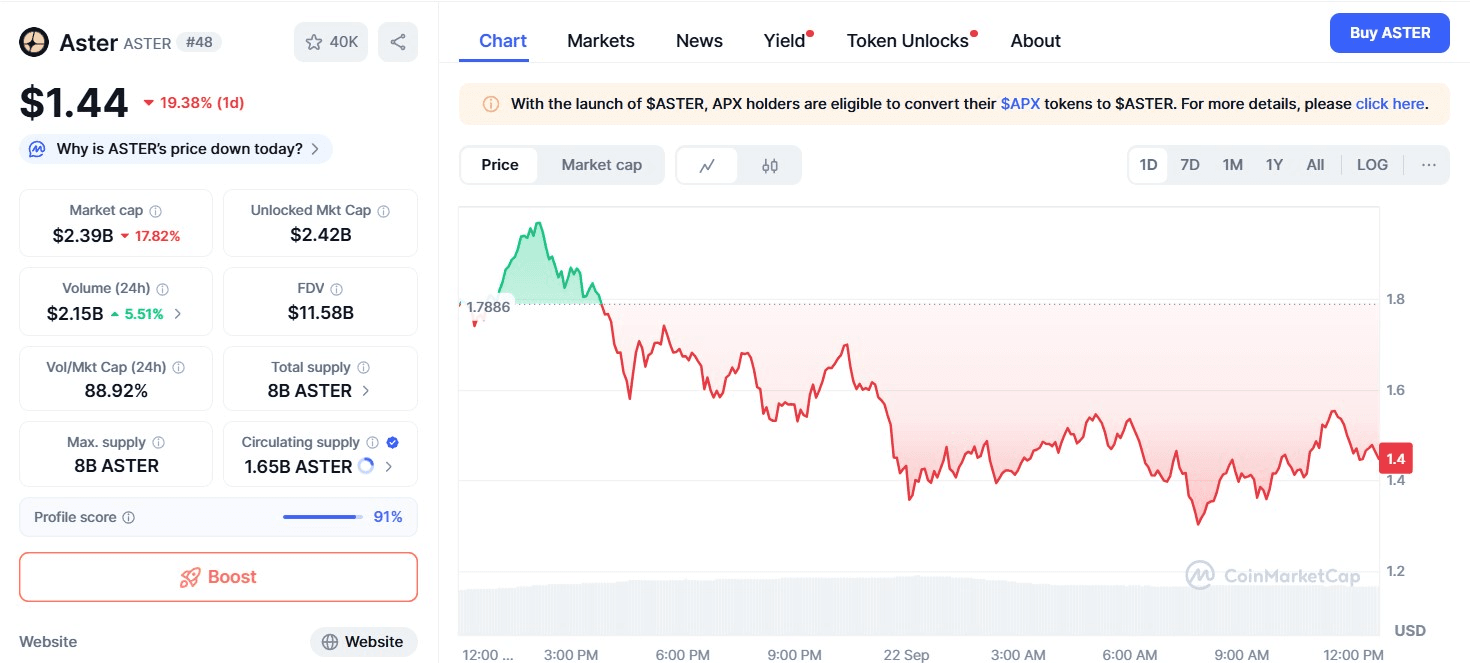

Sumber: Coinmarketcap

Referring to the latest chart, ASTER price today is around $1.44, down about 19% in the last 24 hours. This decline comes after ASTER experienced a significant price spike in the past few days.

Meanwhile, the current market capitalization is around $2.39 billion, with daily trading volume above $2.15 billion, which indicates very high market activity.

Read Also: What is CUDIS Token? Roadmap, Allocation, and Price Prediction

Causes of ASTER Price Down Today

Some of the factors causing the price of ASTER to fall today are as follows:

1. Profit-Taking After a Big Rally: In the last 7 days, ASTER has surged sharply, so it is natural for investors to take profits after the significant increase.

2. APX token migration to ASTER: The ongoing APX to ASTER token conversion program could trigger selling pressure from airdrop recipients or early holders looking to secure profits before the unlock period ends.

3. Uncertainty ahead of the opening of withdrawals: Several rumors on social media suggest that new token withdrawals will open on a specific date. This uncertainty often triggers panic selling or FUD (fear, uncertainty, and doubt).

4. Technical resistance at the $1.57 pivot level: Technically, ASTER's price is stuck at a resistance level of around $1.57, triggering selling from traders who see short-term opportunities.

5. Competition with DEXlain: The emergence of new competitors such as Hyperliquid is also a factor that could reduce demand for ASTER tokens.

Read Also: What is CrazyGames? Play Various Games on One Platform

Aster (ASTER) Price Prediction

With the current conditions, which are around $1.44, if selling pressure eases and positive sentiment returns, ASTER has the potential to test the next resistance level in the range $1,70-$1,80 in the short term.

However, if selling pressure continues, strong support is around $1,20-$1,30. For long-term investors, focusing on Aster's strong fundamentals and platform innovation could justify maintaining exposure despite high volatility.

Conclusion

So, what is Aster (ASTER)? This platform is a next-generation DEX that combines flexibility, capital efficiency, and a community focus. The ASTER token is at the heart of its ecosystem, with distribution favoring early adopters.

Meanwhile, ASTER's recent price decline is largely due to profit-taking, token migration, and short-term market uncertainty. However, fundamentally, Aster still has the potential to grow as a major player in the DeFi space.

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Aster (ASTER)?

Aster (ASTER) is a next-generation decentralized exchange offering Perpetual and Spot trading across multiple blockchains with advanced and user-friendly features.

What is the function of the ASTER token?

ASTER tokens are used for governance, supporting ecosystem growth, rewarding participation, and ensuring platform sustainability.

Why is the ASTER price down today?

The decline was caused by profit-taking after a major rally, selling pressure from the migration of APX tokens to ASTER, and market uncertainty.

How are ASTER tokens allocated?

Most of it is allocated to airdrops (53.5%), ecosystem and community (30%), and the rest to treasury, team, and liquidity.

What is the predicted price of ASTER in the near future?

If positive sentiment returns, ASTER could potentially rise to $1.70-$1.80. However, if selling pressure persists, the price could fall to support around $1.20-$1.30.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.