Ark of Panda (AOP): What It Is, Tokenomics, How to Buy & Price Analysis

2025-10-17

Bittime - Ark of Panda (AOP) is a Web3 project combining AI, user-generated 3D content (UGC), and asset tokenization.

The platform runs on BNB Chain, with the AOP token serving as utility and governance — enabling node staking, voting, 3D asset minting, and ecosystem revenue sharing.

After achieving listings (including support at Binance Alpha events), many eyes turned to AOP's price potential.

This article will fully explain: what Ark of Panda is, its tokenomics, how to buy, and price predictions and analysis.

What Is Ark of Panda (AOP)?

Ark of Panda works as a bridge between Web2 & Web3. The project leverages 3D models — notably Unity-based — that can be converted into digital assets on the blockchain. Core features include:

- AI Agent for UGC: AI tools assist users in creating assets, scenes, and 3D avatars.

- 3D asset tokenization: Unity models are encoded into resource packs that can be traded.

- Rewards & shared ecosystem: users, nodes, and creators earn rewards through on-chain activity, staking, and commissions.

- Cross-domain interoperability: GameFi, NFT, social, DePIN, RWA, and Web2-to-Web3 transitions.

The project has partnered with more than 20 projects for infrastructure, tokenomics, and cross-domain interoperability.

Also read: Getting to Know DUSD Token: Function, How to Buy, and Official Address

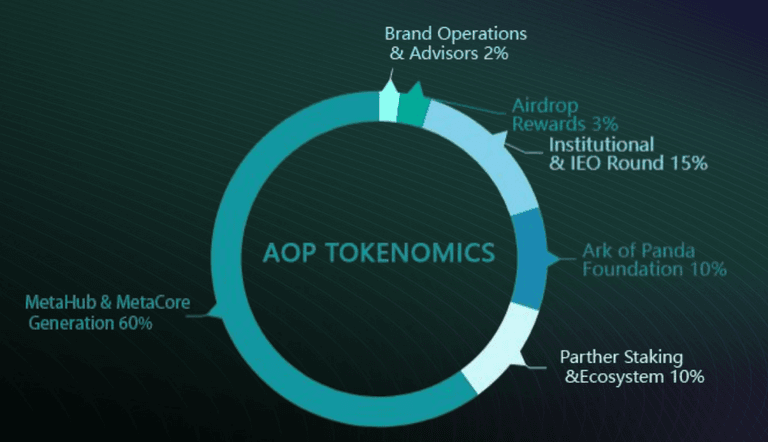

AOP Tokenomics

- The AOP token is the native utility and governance token in the Ark of Panda ecosystem.

- Token allocation includes: 60% for MetaHub/MetaCore generation, 15% institutional/IEO, 10% stakeholders & ecosystem, 10% foundation, 3% airdrop, and 2% brand & advisors.

- Nodes produce 1 million AOP per day, with distribution 50% evenly shared and 50% based on ecosystem contribution.

- A halving mechanism applies after the first year and every two years thereafter to control inflation.

- Utility use cases include: minting 3D assets, paying in-game fees, marketplace commissions, staking, and DAO voting rights.

How to Buy AOP

Here are the general steps to buy AOP:

- Prepare a BNB Chain–compatible wallet (MetaMask/Trust Wallet) and fund it with BNB for gas.

- Add the official AOP contract address to your wallet (obtainable from the Dex listing page or the project website).

- Visit a DEX that supports AOP or a CEX that lists AOP.

- Connect your wallet & choose a pair (AOP/BNB or AOP/USDT) → perform the swap.

- Confirm the transaction and verify success via BscScan.

- If you want to stake/run a node, follow the official guide for registration and daily allocation minting.

Always verify the contract from official sources to avoid fake tokens.

Want to start your investment safely? Buy USDT on Bittime might be your best option. Trading is easier and safer with Bittime.

Also read: Palapa Coin (PLPA) Price Breaks 2,000 IDR: A Bullish Sign for Bittime Ecosystem Tokens

Price Analysis & AOP Forecast

Below are price predictions & analysis for AOP based on market conditions, tokenomics, and community behavior:

Current Sentiment & Market Dynamics

- After listing, AOP experienced a significant price spike followed by an adjustment. Very active trading volume indicates strong community interest.

- On Dex listing platforms (e.g., CoinMarketCap Dex for BSC), AOP shows reasonable liquidity and active pools.

- Because the project is in an early expansion phase, AOP price is highly sensitive to news, new listings, and community hype.

Medium – Long-Term Price Projection

Assumptions in the optimistic scenario include: community growth, solid minting & staking feature rollouts, cross-domain integrations, and wider CEX listings.

Upward Catalysts

- Listings on major exchanges and marketing campaigns.

- Launch of 3D asset minting features and real use in apps/games.

- Active node participation and staking.

- Partnerships with Web2 projects transitioning to Web3 driving adoption.

Risks & Obstacles

- If adoption is slow or the community is inactive, price may stagnate or correct sharply.

- Liquidity may shrink; spreads can be large in early markets.

- Overly aggressive tokenomics or imbalanced distribution could cause selling pressure.

- General crypto market volatility and global sentiment can drag AOP down.

Also read: Complete Guide: How to Buy RECALL Token — Safe, Easy, and Ready for New Investors

Conclusion

Ark of Panda (AOP) is an ambitious AI + 3D UGC Web3 project, with AOP as the core utility and governance token.

Price analysis shows potential for significant upside if the ecosystem grows and real adoption occurs, but significant risk exists — especially in the early phase.

Investors should balance a long-term perspective, understand staking/node mechanics, and monitor project news and market volume.

How to Buy Crypto on Bittime

Want to trade or buy buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then deposit a minimum of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check exchange rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see real-time market trends on Bittime.

Also visit Bittime Blog for various interesting updates and educational information about crypto. Find trusted articles on Web3, blockchain technology, and investment tips designed to enrich your knowledge in the crypto world.

FAQ

What is AOP (Ark of Panda)?

AOP is the native utility and governance token for the Ark of Panda ecosystem, an AI & 3D UGC platform on BNB Chain.

How does AOP get its utility value?

Its utility includes minting 3D assets, paying fees, staking/node rewards, DAO governance rights, and use within cross-domain applications.

Can AOP price surge sharply?

Yes, there is potential for sharp gains if the project attracts large adoption, but there is also a risk of strong corrections in the early phase.

How do I stake or run an AOP node?

You must register a node via the official portal, provide collateral tokens if required, and mint daily allocations following project rules.

How do I verify the AOP contract address?

Obtain the contract from the official project site or the Dex listing page (CoinMarketCap / Dex), then check validity on BscScan and ensure the contract is verified.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.