Latest ChainOpera AI (COAI) Price Analysis: From 1,000% Rally to Sharp Correction, What's Next?

2025-10-16

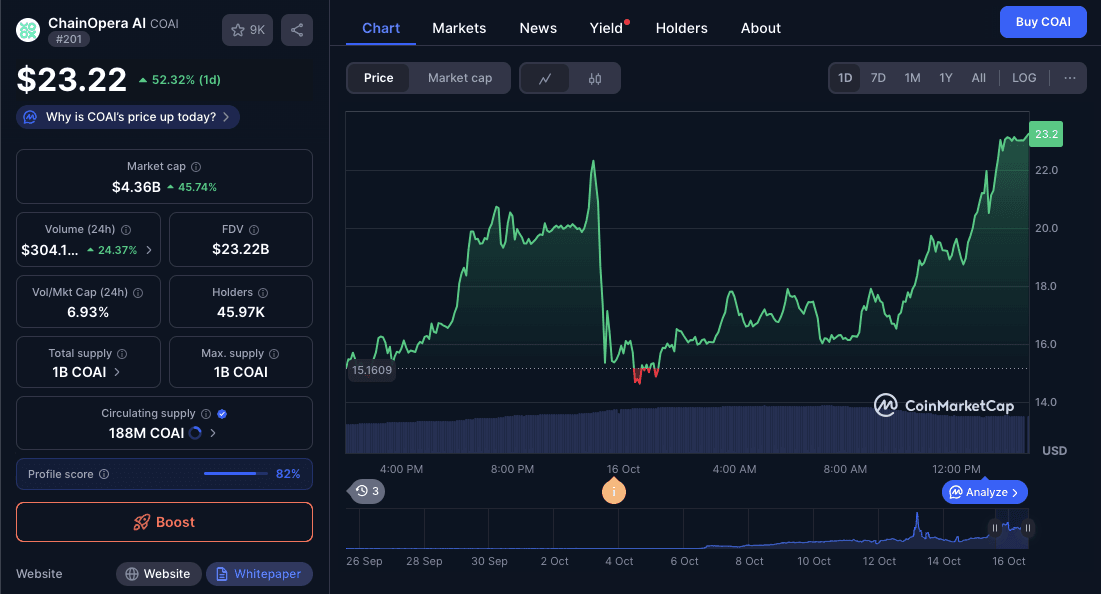

Bittime - After a spectacular surge of over 1,000% in seven days, the ChainOpera AI (COAI) token is now facing a sharp 34.32% correction in the past 24 hours. This extraordinary price surge briefly pushed COAI's market cap above $1.1 billion, before massive profit-taking hit the market.

This article discusses the latest COAI price analysis, including the factors causing the decline, the latest technical signals, and the volatility risks due to whale ownership concentration.

READ ALSO:Palapa (PLPA) Price Prediction 2025: Is Local Token Bittime Poised for a New Rise?

Taking Profits After Extreme Rally

Sumber: CoinMarketCap

COAI's surge over the past week, reaching over 1,700%, has been one of the largest rallies in the crypto AI sector this year. Following its listing on DEXs and CEXs, many retail and institutional traders have jumped in to catch the momentum.

However, this rapid rise also triggered profit-taking. COAI trading volume decreased by around 15% compared to the previous day, indicating that buying pressure is starting to weaken. The 34% drop in a single day is a natural reaction after a period of market euphoria, similar to historical corrections in previous AI tokens.

Technical Signals Indicate Overbought Conditions

According to CoinMarketCap data, the COAI (Relative Strength Index) RSI indicator reached 99.73, a very high level that rarely lasts long in the cryptocurrency market. This figure indicates a highly overbought market.

Additionally, the price is currently moving below the 7-day exponential moving average (EMA-7) at around $4.08, while the market price is around $4.58.

This condition signals the potential for further correction if selling pressure persists. If the RSI doesn't quickly fall back into the neutral zone, the COAI market risks a deeper retracement towards the $3.43 SMA area.

Volatility Due to Whale Concentration

One of the most significant aspects of COAI price analysis is the high concentration of ownership. Approximately 96% of the total COAI supply is held by the 10 largest wallets, with the majority of tokens locked until the end of 2026 (Phemex data).

This situation creates high volatility, as small sales from whales can immediately have a large impact on market prices due to limited liquidity (19.6% of circulating supply).

Investors are advised to monitor whale activity on the blockchain, especially inflows to large exchanges, as this can be an early signal of a change in price direction.

AI ChainOpera’s Outlook Amid Crypto AI Trends

Despite facing a short-term correction, the fundamentals of the AI sector remain strong. ChainOpera AI occupies a prominent position among artificial intelligence-based crypto projects, combining machine learning, data governance, and advanced tokenomics.

As long as the COAI price remains above the $4.08 EMA support, a technical rebound remains possible. However, if selling pressure increases, investors should prepare for a decline to the psychological level of $3.4–$3.5 before further consolidation occurs.

READ ALSO:MegaETH Prepares Public ICO on Cobie's Sonar Platform: A New Era for Layer 2 Ethereum?

Conclusion

COAI's current sharp correction reflects a natural cooling phase after a large, unsustainable rally. Overbought technical signals, whale selling, and declining volume combined to drive price pressure. Despite this, investor interest in AI projects remains high, opening up opportunities for a medium-term recovery.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the main cause of COAI price decline?

Massive profit taking action after the extreme rally over the past week.

Does COAI still have the potential to rise again?

Yes, if the price stays above the $4.08 EMA support level and selling pressure starts to subside.

What is the current RSI COAI?

The RSI is around 99.48 — indicating that the market is still overbought.

Do whales affect COAI price?

Yes, because 96% of the token supply is held by a handful of large wallets.

Is COAI worth monitoring in the medium term?

Worth it, especially if the crypto AI market returns to bullish and COAI is able to break through its key resistance.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.