What is the Aave Ecosystem? List of Featured Tokens & Their Functions in DeFi

2025-10-03

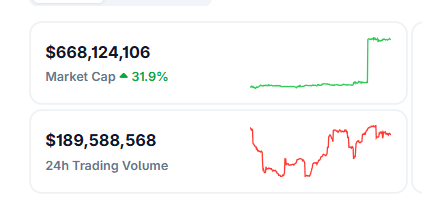

Bittime - The crypto market is again spotlighting the Aave Ecosystem, which now records a market capitalization of over $669 million, up about 32.2% in the last 24 hours.

As one of the pioneers in the DeFi (Decentralized Finance) sector, Aave has successfully built a robust ecosystem that supports lending and borrowing of digital assets without intermediaries.

This article will discuss what the Aave Ecosystem is, the list of tokens within it, and their functions in the DeFi world.

What Is the Aave Ecosystem?

Aave is an Ethereum-based DeFi protocol that enables users to borrow and lend crypto assets in a non-custodial manner.

The system uses smart contracts to ensure the security and transparency of transactions.

The Aave Ecosystem consists of various supporting tokens (Aave Tokens) that represent users' loan or deposit balances in Aave's money markets.

These tokens help maintain stability and provide flexibility for users in managing their digital assets.

Read Also: Analysis Behind the Soaring Aave Project — Read the Explanation!

Featured Tokens in the Aave Ecosystem

Based on CoinGecko data, here are some primary tokens that are part of the Aave Ecosystem:

- AAVE (Native Token)

- Functions as the governance token.

- AAVE holders can vote on protocol decisions.

- Also used for staking and to provide security incentives.

- aTokens

- Representative tokens of assets lent to the Aave protocol.

- Example: If you deposit USDC, you will receive aUSDC as proof of deposit.

- aTokens automatically accrue interest according to the protocol’s interest rates.

- Stablecoins in Aave

- Aave supports various stablecoins such as USDT, USDC, and DAI.

- Enables users to borrow and hold assets with lower volatility.

- Liquidity Pool Tokens

- Tokens issued to liquidity providers.

- Serve as proof of contribution to Aave pools and can be redeemed for assets plus interest.

The Role of Aave Tokens in DeFi

Each token in the Aave Ecosystem has specific functions that support the protocol:

- Proof of Ownership: aTokens serve as proof that a user owns assets stored in the protocol.

- Source of Passive Yield: These tokens automatically generate interest, providing returns for lenders.

- Protocol Governance: AAVE tokens enable community participation in decision-making.

- Liquidity & Stability: Liquidity tokens help keep the ecosystem stable by encouraging provider participation.

Read Also: Aave Releases Mainnet Era — Here’s the Impact on Its Coin Price!

Aave Ecosystem Market Performance

In the last 24 hours, the Aave Ecosystem showed positive performance with market capitalization rising more than 32% to $669 million and trading volume reaching $190 million.

This surge signals high investor interest in the increasingly popular DeFi lending coin sector.

Future Outlook for Aave

Aave is regarded as one of the most solid projects in the DeFi sector. With innovations such as flash loans (instant loans without collateral) and multi-chain support, Aave continues to expand its ecosystem.

If the DeFi trend continues to grow, tokens within the Aave Ecosystem may play a larger role in the global decentralized financial system.

Read Also: Aave V3 Officially Launched on ZKSync Era Mainnet

Conclusion

The Aave Ecosystem is one of the main pillars in the DeFi sector, offering various tokens that support lending and borrowing activities without intermediaries.

With a market capitalization that continues to grow and diverse token functions, Aave offers attractive opportunities for both users and crypto investors.

However, like other digital assets, users should remain cautious of the risks involved.

How to Buy Crypto on Bittime

Want to trade or buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see today’s crypto market trends in real-time on Bittime.

Also, visit Bittime Blog for various interesting updates and educational information about the crypto world. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the crypto space.

FAQ

What is the Aave Ecosystem?

The Aave Ecosystem is a collection of tokens and applications that support the Aave protocol for decentralized borrowing and lending of crypto assets.

Which tokens exist in Aave?

Some main tokens include AAVE (governance token), aTokens (such as aUSDC, aDAI), as well as stablecoins and liquidity pool tokens.

What are the main functions of Aave Tokens?

Their functions include serving as proof of asset ownership, generating passive interest, enabling protocol governance, and maintaining ecosystem liquidity.

Is Aave a DeFi lending coin?

Yes. Aave is one of the most popular DeFi lending coins, allowing users to borrow and lend digital assets securely.

What is Aave’s outlook going forward?

The outlook is fairly positive with broad adoption across DeFi, although price volatility and regulatory risks remain.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.