7 Best Investments of 2026 Worth Considering Now

2025-12-12

Bittime - Finding the answer to the question of what the best investments will be in 2026 requires looking at market data and sentiment, not just expectations. The phrases "7 best investments in 2026" and "best investments in 2026" have emerged in many forums due to significant macroeconomic shifts and technological changes.

Next year has the potential to be a period where company quality, inflation protection, and access to liquidity become the main differentiators in investment returns.

This article compiles seven options that research and analyst projections suggest deserve attention, along with risk context and how to incorporate them into a portfolio. Each option is presented with concise analysis and practical advice to help readers make informed decisions based on their risk profile.

1. Quality stocks and artificial intelligence themes

Stocks remain a key asset for capital growth, but 2026 likely places a premium on companies with strong cash flow, clean balance sheets, and competitive dominance.

Furthermore, the artificial intelligence (AI) sector still attracts significant capital, so companies that truly generate revenue from AI and operational efficiency have the opportunity to excel. Choose stocks with reasonable valuations and competitive advantages that can maintain margins in an era of technological competition.

For retail investors, a sensible strategy is to use quality ETFs or thematic AI ETFs to gain exposure without taking on the risk of a single stock. Check the ETF's geographic exposure and expense ratio before purchasing. Investing in quality stocks doesn't guarantee a lack of volatility, but it does offer a better chance of recovery when sentiment shifts.

2. Bonds and debt securities of emerging markets in rupiah

After a period of interest rate tightening, many analysts expect a gradual decline in interest rates, opening up opportunities for bonds.

For investors in Indonesia, rupiah-denominated government bonds and sound corporate bonds offer attractive coupons and protection from market fluctuations when purchased at a reasonable yield.

Additionally, global banks and asset managers see the potential returns on emerging market bonds as a source of diversification and income.

Allocation should be selective: prioritize credit rating and liquidity, and consider laddering to manage interest rate risk. Bond investments are suitable for investors seeking stable income with more controlled volatility than stocks.

Read Also:Top 5 Airdrops for December 2025: Token Distribution List to Watch

3. Selected properties: rental and logistics assets

Rental residential properties and the logistics sector are worth considering in 2026. Demand for affordable housing in city centers and the need for warehouse space for e-commerce and supply chains remain drivers of rental income.

Retail investors can gain exposure through REITs or property mutual funds to maintain liquidity. Key to success are location, tenant quality, and realistic rental cash flow projections.

Risks include rising interest rates that suppress demand for financing and macroeconomic conditions that reduce population mobility. However, carefully selected properties can provide cash flow and medium-term inflation protection.

Read Also:BTC Price Prediction According to Suli Crypto: Analysis of Instagram Discussions

4. Gold and commodities as inflation protection

Gold remains a widely used asset as a hedge against inflation and uncertainty. Investment demand through ETFs and physical demand show strong buying trends, and analysts at several major banks see gold's prospects as remaining solid should inflationary pressures or geopolitical turmoil arise.

In addition to gold, a basket of commodities can help diversify and provide input price protection for a company's portfolio. A moderate allocation to gold and commodities can enhance a portfolio's resilience to macroeconomic risks without creating a reliance on a single asset class.

5. Index ETFs and passive mutual funds for cost stability

Investment costs will be a significant factor in 2026. Index ETFs and passive mutual funds offer broad market exposure at low costs, making them suitable for investors who want to stay on top of benchmarks while reducing the drag of management fees.

Use a combination of global stock ETFs, bond ETFs, and sector ETFs to tailor your risk profile. Another advantage is intraday liquidity compared to traditional mutual funds, allowing investors to manage execution.

Passive doesn't mean passively watching; regular rebalancing and understanding index composition are important for long-term results.

Read Also:Free Crypto Mining Apps 2026: The Best Choice to Make Profit from Crypto

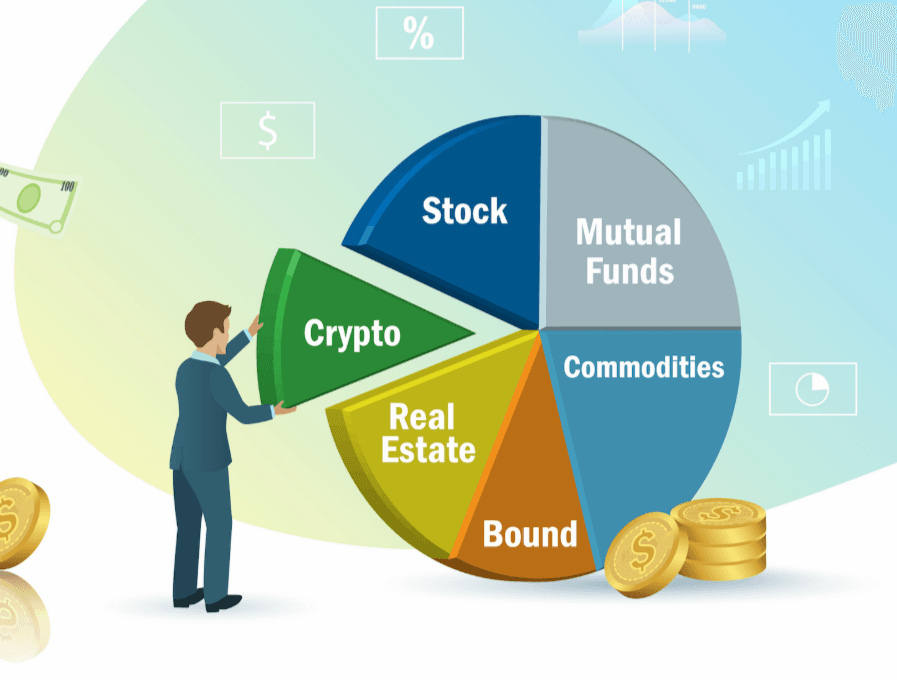

6. Selected crypto assets for small allocations and long time

Crypto assets remain controversial but will likely continue to be a small portfolio asset for investors willing to tolerate high volatility. Choose projects with real adoption, adequate liquidity, and clear regulatory compliance.

Bitcoin is still often seen as a digital store of value while some layer one and rollup solutions offer a utility narrative.

Risk management is essential: limit your crypto allocation to a small amount below your tolerance threshold, use the safest storage available, and avoid leverage. Crypto assets can provide non-correlated diversification but should not be the backbone of a portfolio.

7. Startups and private equity for experienced investors

Investing in startups and private equity offers the potential for high returns but carries a significant risk of failure. For 2026, the technology sector, which integrates AI, enterprise software, and healthcare, presents numerous private investment opportunities.

Interested investors should consider robust due diligence, a fair valuation structure, and a realistic exit plan. Alternatively, access through a fund of funds or a regulated crowdfunding platform can lower the entry threshold.

Allocation to this asset class should only be a small part of the portfolio and is suitable for investors with a long investment horizon and limited liquidity.

Conclusion

There's no single answer to the best investments for next year. The seven best investments for 2026 outlined feature a combination of growth, inflation protection, and income. The keys to management are diversification, honest risk assessment, and selecting instruments that align with your financial horizon and goals.

Start with a basic allocation using ETFs and bonds, consider quality stocks and gold as complementary options, then add a small portion of higher-risk assets like crypto and startups only when appropriate. Discipline and regular adjustments will determine your results more than trying to guess the market.

FAQ

Should I move my entire portfolio to one of these seven options?

No. Moving an entire portfolio to a single asset class increases risk. Diversifying across options relevant to your goals is a more appropriate approach.

What is the appropriate portion of crypto assets in a 2026 portfolio?

For conservative retail investors, a small portion, such as 1 to 5 percent, is more realistic. More aggressive investors might consider 5 to 10 percent, but with the preparation for significant volatility.

How to choose the right ETF for AI theme?

Examine the stock composition, expense ratio, asset size, and correlation to the benchmark index. Ensure the ETF truly emphasizes AI-generating companies, not just their names.

Is property still worth it amid expectations of falling interest rates?

Selected properties with stable tenants and strategic locations still offer cash flow. Lower interest rates help financing, but location and asset quality analysis remain crucial.

When do I need to review my investment allocation for 2026?

Conduct reviews at least quarterly and recalculate after major macro events such as interest rate policy changes or geopolitical shocks.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.