List of 5 Altcoins That Could Rise After BTC All-Time High

2025-10-06

Bittime - The rise in bitcoin prices that broke through the all-time high (ATH) level is usually the main trigger for altcoin movements.

When BTC stabilizes after a major rally, investors often shift part of their portfolio to alternative assets with faster growth potential.

Due to the historical correlation between Bitcoin and altcoins, investors are beginning to pay attention to the potential surge in several tokens other than BTC.

Here are five altcoins that are seen as having a high chance of rising after Bitcoin reaches its peak.

The Relationship Between BTC All-Time High and Altcoins

When bitcoin sets a new record, investors often move some of their capital from BTC to altcoins in an attempt to seek higher returns.

This trend is driven by the expectation that positive sentiment will spread to projects with good liquidity and network exposure.

Historical analysis shows that altcoins with strong fundamentals and sufficient liquidity often enjoy rallies after Bitcoin breakouts.

However, this is not a guarantee — altseason (the period when altcoins dominate gains) also depends on external factors such as global monetary policy, foreign capital flows, and crypto regulations.

Criteria for Altcoins Worth Considering

To select altcoins with potential for growth after BTC's all-time high, here are some commonly used criteria: high liquidity capacity and transaction volume, technical track record and ecosystem adoption, active development team, and integration into real-world applications (DeFi, NFTs, cross-chain bridging).

Additionally, altcoins that are not too far from their historical price levels have more realistic upside potential compared to those that have already surged significantly.

Here is a List of Five Altcoins that Could Rise After BTC Hits an All-Time High

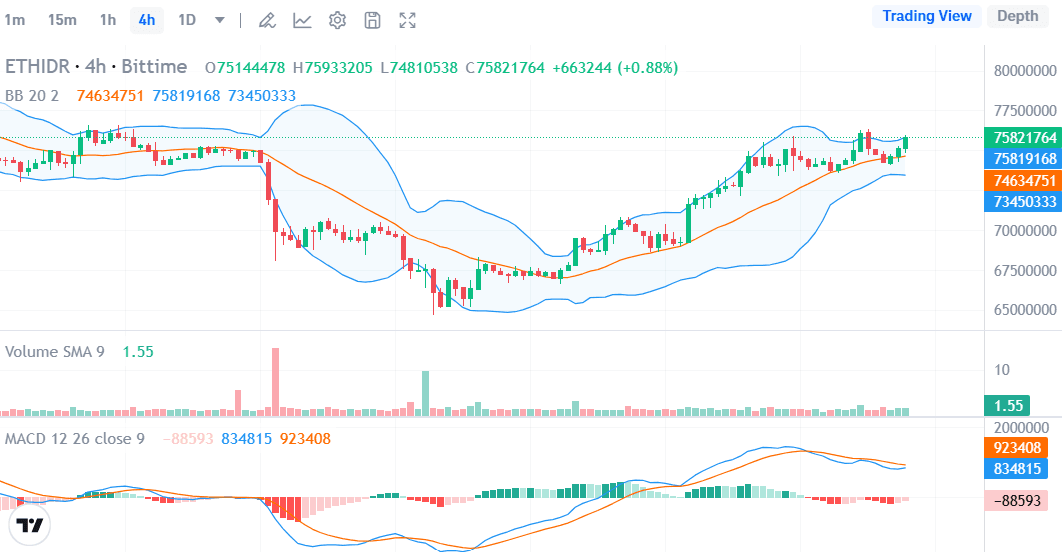

1. Ethereum (ETH)

Ethereum remains the main driver of the altcoin ecosystem. With the support of smart contracts and thousands of decentralized applications (dApps), ETH is almost always the first altcoin to get a boost when bitcoin starts to consolidate.

Increased activity in the DeFi sector, NFTs, and real asset tokenization (RWA) projects are driving demand for ETH to continue to increase.

Additionally, the full transition to Ethereum 2.0 with its proof-of-stake system adds further appeal due to its energy efficiency and stable staking opportunities.

Many analysts predict ETH could see significant growth following Bitcoin's rally, with the psychological levels of US$4,500 to US$5,000 as medium-term targets.

2. Binance Coin (BNB)

BNB is the primary asset of the Binance ecosystem, the world's largest crypto exchange. Its value is driven not only by trading activity on the exchange but also by its extensive integration into the DeFi and NFT ecosystems, as well as its use to pay transaction fees on the Binance Smart Chain (BSC).

As the crypto market enters an optimistic phase, the number of new projects on the BSC network tends to increase, potentially driving demand for BNB.

History also shows that BNB often experiences strong surges after BTC reaches its peak, as investors seek alternatives with solid fundamentals.

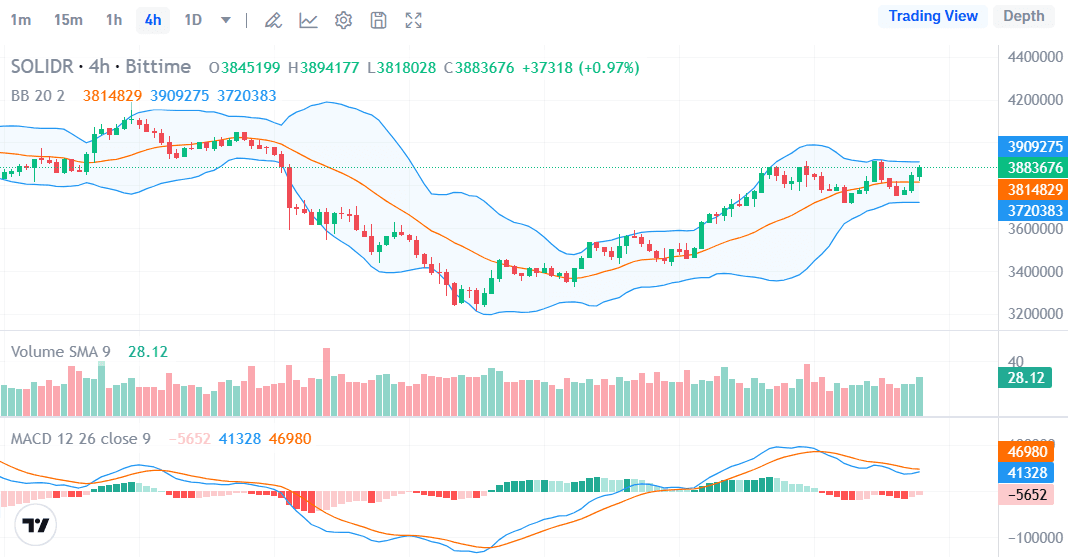

3. Solana (SOL)

Solana has attracted global attention thanks to its scalability and high transaction speed. The network is used by various DeFi applications, NFT marketplaces, and blockchain-based games.

The popularity of memecoins in the Solana ecosystem has also strengthened its position as one of the altcoins with a rapidly growing community. In the previous bullish period, SOL was one of the coins with the fastest price surges.

With increased network stability and institutional investor support, Solana has the potential to once again become one of the best-performing altcoins after Bitcoin hits its ATH.

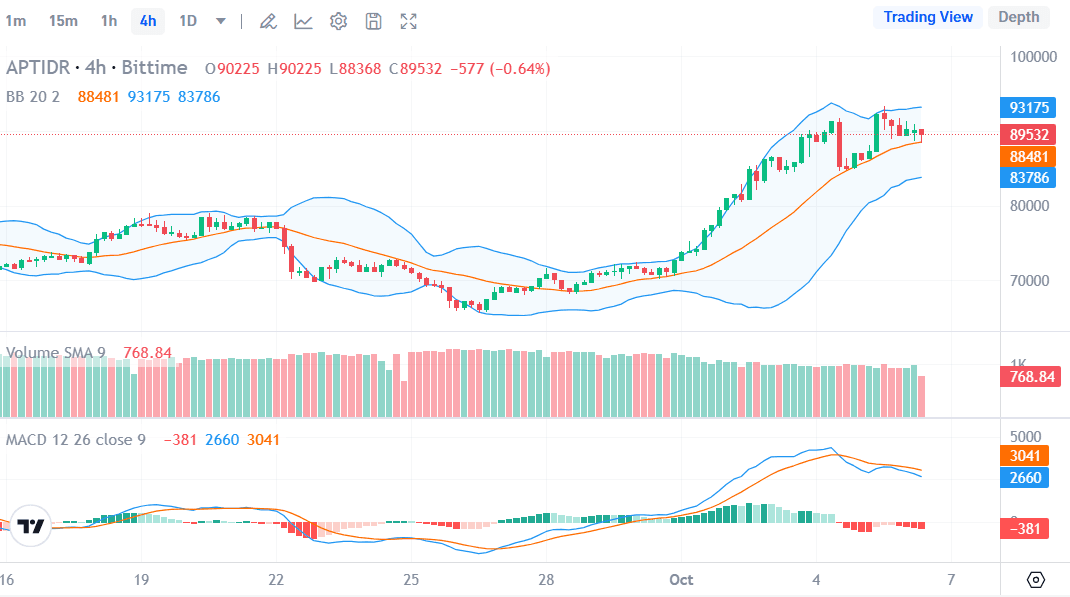

4. Aptos (APT)

Aptos is a newcomer bringing innovation in terms of blockchain security and scalability. With its unique consensus technology, Aptos aims to offer faster and more efficient transaction experiences for Web3 application developers.

Despite being relatively new, the Aptos ecosystem shows significant growth with an increasing number of projects choosing to build on it.

If the adoption trend continues, APT has the potential to become one of the most aggressively growing altcoins in the post-Bitcoin rally phase. Investors view APT as a strong candidate for a major rally due to a combination of technical factors and support from major venture capital firms.

5. Ripple (XRP)

XRP remains one of the assets with real utility in the financial world, particularly in cross-border transfers. Ripple's technology enables cross-border transactions to be conducted at low cost, quickly, and efficiently.

These advantages have enabled XRP to continue gaining traction among global financial institutions. Increasingly clear regulatory support in a number of countries has also reinforced positive sentiment toward XRP.

Many analysts predict that if bitcoin reaches a new ATH, XRP could get an additional boost from increased global digital payment adoption.

With its large market capitalization and institutional user base, XRP is seen as one of the safest and most promising altcoins in the next phase.

Conclusion

After bitcoin sets a new record, the altcoin market usually enters a much more volatile but opportunity-filled expansion phase.

Ethereum and BNB are top choices due to their solid ecosystem foundations, Solana and Aptos offer aggressive growth thanks to innovative technology, while Ripple (XRP) brings real utility to the global financial sector.

The combination of technical factors, user adoption, and market sentiment makes these five altcoins worth monitoring as the strongest candidates in the next rally.

FAQ

Which altcoins have the most potential to rise after BTC's all-time high?

Ethereum (ETH) is often considered the most promising altcoin due to its large ecosystem and widespread adoption across various blockchain sectors.

Can XRP join the rally alongside Bitcoin?

Yes. XRP has significant potential, particularly due to its role in the growing cross-border payments sector and clearer regulatory support in some regions.

Why do altcoins tend to rise after Bitcoin's ATH?

Typically, after BTC reaches its peak, investors seek other assets with faster growth potential. This capital flow often leads to major altcoins or innovative new projects.

Will all altcoins rise when Bitcoin rallies?

No. Only altcoins with strong fundamentals, community support, or real-world adoption have the potential for significant gains. Altcoins without clear utility tend to experience only short-term spikes.

How do you choose the right altcoin?

Factors to consider include market capitalization, liquidity, the development team, the asset's utility, and global market sentiment. Investors are advised to conduct thorough research before purchasing.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.