The 10 Stablecoins with the Largest Volume in the World

2025-12-15

Bittime - Stablecoins are now the backbone of fund movement in the crypto market. Amidst the volatility of digital assets, stablecoins serve as a safe and fast way for market participants to shift positions.

Stablecoin trading volumes often exceed the total transactions of non-stablecoin crypto assets, confirming their role as a major source of liquidity.

In practice, stablecoins are not only used as a temporary hedge. Many exchanges and DeFi platforms use them as primary trading pairs, for both spot and derivatives trading. This makes stablecoin volume an important indicator of global capital flows in the crypto market.

This article presentsThe 10 most traded stablecoins in the world, ranked by trading activity and liquidity dominance. This list provides a snapshot of who truly drives daily crypto trading traffic.

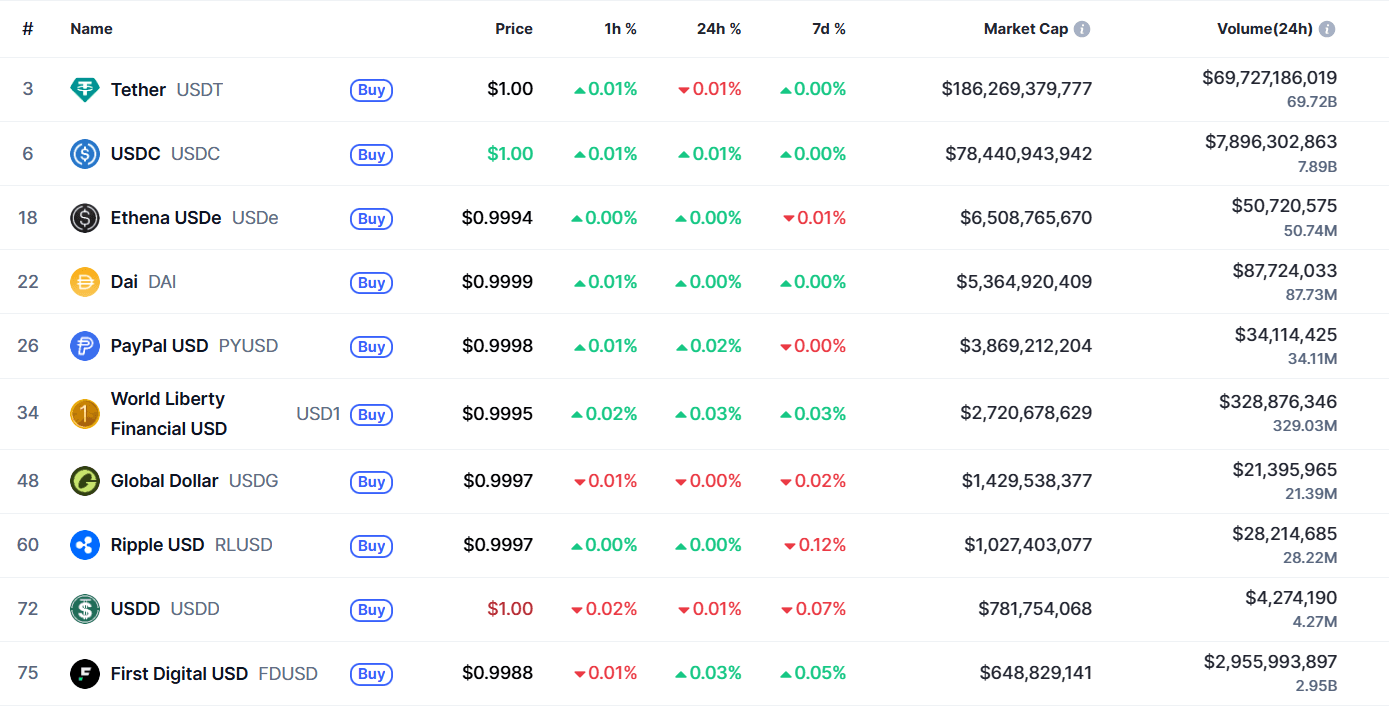

List of the 10 Stablecoins with the Largest Volume in the World

- Tether (USDT)

USDT remains the world's most traded stablecoin, with liquidity spread across nearly all major exchanges and major blockchain networks. - USD Coin (USDC)

USDC ranks second with high volume, especially in the DeFi ecosystem and global exchanges that emphasize reserve transparency. - Athena USDe (USDe)

Despite being relatively new, USDe has recorded significant volumes due to aggressive trading activity and rapid adoption in the derivatives market. - Dai (DAI)

As a decentralized stablecoin, DAI maintains strong volume thanks to its role in DeFi protocols and crypto lending and borrowing. - PayPal USD (PYUSD)

Support from the digital payment ecosystem has led to PYUSD immediately recording stable trading activity since its launch. - World Liberty Financial USD (USD1)

This stablecoin records large volumes even though it does not yet have a market capitalization as large as other major players. - First Digital USD (FDUSD)

FDUSD shows consistent volume growth, especially on international exchanges with an active user base. - Ripple USD (RLUSD)

This stablecoin, which is connected to the Ripple ecosystem, is starting to attract attention through increased trading activity. - TrueUSD (TUSD)

TUSD remains relevant with stable trading volume and widespread usage across multiple platforms. - USDD

This TRON ecosystem-based stablecoin still records significant volume despite being under the dominance of major players.

This list reflects the stablecoins most frequently used as short-term transaction and value storage tools in the global crypto market.

Read Also:One Attempt Remaining: A Film Review of a Couple Who Lose Crypto

Why Stablecoin Volume Is an Important Indicator

Stablecoin volume reflects the level of market confidence and demand for stable assets. As market participants prepare for uncertainty, funds often shift to stablecoins before returning to riskier assets.

High-volume stablecoins typically have deep liquidity and tight spreads, making them ideal for large transactions. This is why USDT and USDC continue to dominate, as they are able to absorb large-scale capital flows without disrupting prices.

Furthermore, spikes in stablecoin volume are often an early sign of a shift in market sentiment. When volume increases sharply, the market is usually preparing for the next phase of volatility.

Read Also:How to Get Candy Canes in 99 Nights in the Forest

The Relationship Between Stablecoin Volume and Crypto Market Direction

Stablecoin volume is also closely linked to the crypto market cycle. During the accumulation phase, capital flows tend to be concentrated in stablecoins. When momentum increases, stablecoins become the primary fuel for investment into other crypto assets.

This makes stablecoins not just a tool, but a strategic element of the ecosystem. The dominance of stablecoin volume indicates a maturing crypto market, with maintained liquidity even when other asset prices fluctuate sharply.

For traders and investors, monitoring the stablecoins with the highest volumes can help them read market dynamics more objectively.

Read Also:Tether's $1 Billion Acquisition of Juventus: Crypto's Bold Step into the Number 1 Sports Industry

Conclusion

The ten stablecoins with the largest volumes in the world show how liquidity is key in crypto trading.

From the dominant USDT and USDC to the alternative stablecoins that are starting to steal the show, all play a role in maintaining the smooth flow of global capital.

High volume isn't just a number, but a reflection of market confidence. In a constantly evolving ecosystem, stablecoins will remain the foundation of transactions and a key driver of crypto trading activity.

FAQ

What is meant by stablecoin?

Stablecoins are crypto assets whose value is pegged to a stable asset, typically the US dollar, to maintain price stability.

Why stablecoin volume is bigger than other cryptos?

Because stablecoins are used as the primary means of transaction and temporary store of value in the crypto market.

Are stablecoins with large volumes always safe?

High volume indicates liquidity, but the safety factor still depends on governance and asset reserves.

Which stablecoin is most frequently used?

USDT remains the stablecoin with the highest volume and usage globally.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.